Make use of this motorcycle loan calculator to determine what your monthly payments may be before sending your application. Additionally, it’s essential to compare motorcycle loan rates and lenders to find the most suitable motorcycle financing option for your purchase. The lending companies that offer bad credit motorcycle loans can assist weak credit customers and provide motorbike loans with the Lowest rates on the initial.

Consumers Credit Union offers used and new motorcycle loans for terms that extend to 60 months (five years), and the APR starts at 4.90 percent. To become a member of this credit institution, you must make a one-time payment to the Consumers Cooperative Association and keep at least five USD in your bank account with the bank. They provide traditional motorcycle loan options, but finding personal motorcycle loans from other lenders is possible.

USAA is an organization that offers loans to military personnel. To be eligible for a loan to purchase your motorcycle through USAA, the applicant must also be a U.S. military member, pre-commissioned officer, veteran, spouse, child, or child of one. USAA motorcycle loans begin at 5.49 APR for 72 months (six months).

Online motorcycle loans have become more popular with the increasing demand for convenience and speedy transactions. These loans typically involve less paperwork and faster credit approval. However, paying attention to credit checks motorcycle loans require is essential, as they can impact your credit history.

Consider various financing rates and deals when searching for the most cost-effective way to finance your motorcycle. With proper research, you can find the most suitable motorcycle financing option and enjoy the benefits of financing motorcycles without creating a financial burden.

PenFed Credit Union. They are among the credit motorcycle financing companies that cater to various credit ratings. Pentagon Federal Credit Union provides secured motorcycle loans starting at 5.99 APR. The loan is available with the option of 60 or 60 months. It’s among the most flexible and convenient membership requirements since it’s an open-charter company. To be a member, you must possess at least the Social Security or Tax Identification Number and at least five dollars in your account with PenFed.

Motorcycle Lender. A company that offers online finance specifically focused on bad credit motorcycle loans, the Motorcycle Lender could help you locate a lender who will collaborate with you. They also provide motorcycle title loans and work with those who need better credit.

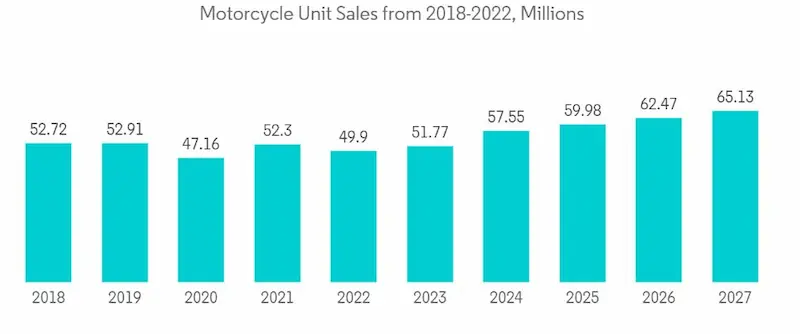

Here are some statistics on motorcycle loans

| Statistic | Value |

|---|---|

| Average motorcycle loan interest rate | 10% |

| Average motorcycle loan term | 60 months |

| Average motorcycle loan amount | $10,000 |

| Percentage of motorcycle loans with a down payment of 20% or more | 25% |

| Percentage of motorcycle loans with a down payment of less than 20% | 75% |

| Growth of motorcycle loan market in 2021 | 15% |

| Factors driving growth of motorcycle loan market | Increasing popularity of motorcycles, rising cost of motorcycles, and availability of online lenders |

| Convenience and affordability of motorcycle loans | Motorcycle loans can be a convenient and affordable way to finance the purchase of a motorcycle. However, it is important to carefully consider your options before taking out a motorcycle loan. |

Different Types of Bad Credit Motorcycle Loans

Understanding the process for motorcycle financing is crucial, especially for those with a bad credit score. There are various financing options available for people with different credit ratings. Some companies may have minimum credit score requirements, while others provide more flexible terms. The loan application and application process may vary between lenders, particularly for applicants with a bad credit history. Therefore, researching the right secured motorcycle loan and credit motorcycle financing companies is essential for successful loan approval.

Suppose you prefer to be connected with an online lender like a bank, credit union, or dealer. In that case, it is possible to take loan offers for individual Loan Amounts to compare offers from various lenders, regardless of whether your credit score is one of the lowest scores.

THE BEST

Credit unions

The National Credit Union Administration (NCUA) states that credit unions typically have lower average APRs than banks on all kinds of loans. The average rate for national credit institutions that customers needed personal loans was almost one percentage point less than banks. Credit unions are not-for-profit entities that tend to help those with bad credit ratings. They often provide favorable loan terms and consider those with less-than-perfect credit. Sometimes, Consumers CU only requires an initial deposit to become an active member.

Lender online

Online lenders usually offer competitive rates and a variety of loan options. They allow applicants to complete the entire loan process online, making it convenient and quick. Online lenders often require an excellent credit score and may impose Minimum loan amounts. However, they are known for fast funding times and making quick loan decisions.

When applying for a loan, it’s essential to read the loan agreement carefully to understand the conditions, including any potential late payment penalties. You can choose the best loan option to suit your needs and financial situation by comparing different lenders.

If you avoid taking out a loan through an institution, such as a credit union or bank, online lending is an alternative. They don’t have the costs as bricks mortar businesses, and their services are accessible online or by phone. Loan funding options like these are helpful for bad-credit borrowers during financial emergencies and often provide favorable terms.

At GreenDayOnline, we understand that bad credit shouldn’t hinder your dreams of owning a motorcycle. That’s why we’re proud to offer our services in several states nationwide. Our commitment to providing accessible financing options means that individuals with less-than-perfect credit can still enjoy the thrill of hitting the open road on their motorcycle. Below, you’ll find a comprehensive list of the American states where our company is active, giving you the opportunity to explore our bad credit motorcycle loans and start your journey toward motorcycle ownership.

| Alabama | Alaska | Arizona | Arkansas |

| California | Colorado | Connecticut | Delaware |

| District Of Columbia | Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana | Iowa |

| Kansas | Kentucky | Louisiana | Maine |

| Maryland | Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana | Nebraska |

| Nevada | New Hampshire | New Jersey | New Mexico |

| New York | North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania | Rhode Island |

| South Carolina | South Dakota | Tennessee | Texas |

| Utah | Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

THE MIDDLE GROUND

Banks

Banks need help to take on borrowers with credit issues. Certain banks don’t offer loans for people looking for motorcycles. If you’re using a standard financial institution to handle your financial requirements and would like to secure a loan on your vehicle to ease the process, take your time looking at the alternatives. With various credit scores to consider, banks often have varying approval rates and repayment terms depending on the borrower’s credit profile.

Dealership financing

Dealerships don’t lend money; however, they could assist you in locating a lender for those with lower credit. Find the perfect vehicle through a dealer. Make sure to bring any pre-approvals and pre-approval agreements, and ask the dealer if they have any partner lenders in their network that can beat the price you’re currently paying. Dealerships may also have different repayment options for their clients.

Manufacturing Finance

Manufacturing finance can offer quick funding to those who need it. They may have maximum loan amounts higher than traditional banks offer, making them a suitable option for those needing larger loans. Like other loan companies, manufacturing finance companies want to ensure that borrowers can repay the loan so that they may consider factors such as income and employment status in addition to credit scores. Good customer service is crucial for manufacturing finance providers, as they aim to build strong relationships with borrowers to earn their trust and loyalty.

Manufacturers of motorcycles offer low-interest loans and discounts to the financing firms they work with. For instance, Harley-Davidson has Eaglemark Savings Bank, and Yamaha offers Yamaha Motor Finance. These types of loans for motorcycles are only available for those with credit scores in the top levels. It’s not easy to find a bad credit motorcycle loan with one.

THE BAD

Internal financing

Sometimes, it is referred to as “pay-here or buy-here” companies. This financing type is generally costly and could be the most lucrative source for legally enforceable interest. Take care when you encounter it.

You could have alternative alternatives if your motorbike credit cannot be secured. Flexible options may be available if you pay your bills on time and maintain a good repayment history. Remember that each lender may have requirements regarding the minimum or exact credit score needed.

OTHER TYPES OF FINANCING

Personal Loan

These loans can be a good choice for people with fair credit or those needing to meet the average borrower score required by some motorcycle lenders. Although they typically have higher interest rates, they provide a more flexible option for financing. It’s essential to note that personal loan providers may use different credit scoring models to determine your eligibility. Consider your financial history, credit history applications, and whether your credit score falls within the poor rating range or excellent user rating before applying. Lenders may also provide a loan amount range based on your payment method and repayment history.

You can get a bad credit personal loan instead of the ones who apply for a bad credit motorcycle loan. But you’ll be charged additional interest and charges. For example, you can get a LendingClub personal loan with an origination fee of 1% to 6% of the loan’s amount. Meanwhile, the majority of motorcycle loans don’t have charges for origination.

HELOC

The line of equity credit (HELOC) could be the perfect option for those who plan to buy many large objects within the next few years. However, be aware that you are borrowing against the property you own as collateral. If you can’t repay the loan, the lender may be able to seize your house to pay the loan.

What should you do when you cannot get bad credit motorcycle financing?

Make a cash payment.

If you have money in the bank, consider buying an affordable, used bike. Based on where you reside, you can purchase a quality bicycle for less than $2,000.

Enhance the quality of your credit initially.

Taking time to improve your credit utilization and paying off existing debts can help you secure better loan examples with lower interest rates. Remember that most lenders follow business day processing, and applications are typically reviewed during Eastern business hours. Once you approve the loan, you can expect the loan fund to be disbursed the day after approval.

Review the loan documents carefully, as they provide essential information about your 24-month loan term and the actual loan terms associated with your financing. The minimum loan rate can vary significantly; lenders often determine rates by credit score. To save money, consider setting up automatic payments, using the lender’s direct payment function, and choosing custom payment dates that accommodate your financial situation. Ensure each payment is made within the necessary timeframe, as not doing so might affect your overall credit score and financial standing, ultimately delaying establishing better credit.

Always manage the loan responsibly and make timely payments to ensure you can enhance your credit over time, helping you qualify for better loan options.

If your credit score differs from the standard needed to be eligible for a motorbike loan and is based on bad credit, you may have to tidy it up to a certain extent. Aim for perfect credit scores and look for excellent customer reviews to improve your eligibility.

Examine your credit report thoroughly, dispute any incorrect details, and start building the base for credit. Consider your current expenses and plan to utilize the loan proceeds within the loan duration.

Get a co-signer.

If you require cash quickly, consider asking someone with excellent credit to secure the loan you need to purchase your motorbike. Opting for a 36-month loan term might be ideal for some borrowers.

The co-signer is legally accountable in the event of a loan. If you make the loan being paid late, it can affect both your and your credit scores. Actual rates may vary, and securing loans might offer better rates.

You’re currently accepting credit debit cards.

A member of the National Foundation for Credit Counseling can help develop the right plan of action to pay off your debts and create an adequate budget for your requirements. They may advise you on shorter loan terms or connect you with experienced loan officers.

Do you require a bad credit motorcycle loan worth it?

Consider factors like your income ratio, average income, and funding preferences while evaluating if a motorcycle loan is worth it. Lenders may require annual and verifiable income proof to approve your loan application.

Bad credit is one of many obstacles to owning a bike. Pre-approvals could be a solution if you want the lowest-cost guaranteed loan approval and no credit check for motorcycles. With our business day decision, you can have your current loan approved quickly. There is a wide range of options, and you’ll be sure you’re getting the most affordable on the brand-new vehicle you’re searching for.

At Greenday Online, we have helped numerous customers with bad credit secure loans for their motorcycles. Our Customer experience is exceptional, as we prioritize the needs of everyday people like you. With tons of customer reviews and a perfect user rating, we offer five-year loan terms that cater to various financial situations.

Frequently Asked Questions

Can I get a motorcycle loan with bad credit?

Yes, you can get a motorcycle loan with bad credit through specialty lenders like RoadLoans and Ride Time that work with lower credit borrowers. You’ll need steady income, significant down payment, proof of insurance, and may require a cosigner or higher interest rates. Building credit history by making payments on time helps increase future approval odds.

What are the typical interest rates for bad credit motorcycle loans?

For borrowers with bad credit seeking a motorcycle loan, typical interest rates can range between 10-30% APR depending on your specific credit situation. Applicants at the lower end of that range will need credit scores of at least 600. Anything below can expect rates in the upper 20% APR range from most lenders.

How can I improve my chances of getting approved for a motorcycle loan with bad credit?

Tips to improve approval odds for a bad credit motorcycle loan include making a sizable down payment, providing proof of income greater than the required monthly payments, showing significant motorcycle equity if refinancing, including a creditworthy cosigner, highlighting timely bill payments, avoiding new credit applications, and applying with specialty lenders that offer programs for poor credit.

Are there specific lenders or financial institutions that specialize in bad credit motorcycle loans?

Yes, lenders specializing in motorcycle loans for poor credit borrowers include EagleRider, Motofinancial, Harley-Davidson Financial Services, RoadLoans, Twisted Road, and MotoLease. They cater to applicants with credit challenges by offering motorcycle-specific lending products with flexible underwriting and terms to accommodate bad credit situations.

What are the consequences of defaulting on a bad credit motorcycle loan?

Defaulting on a bad credit motorcycle loan can lead to the motorcycle being repossessed and sold, wage garnishment, bank account levies, severe damage to credit making future borrowing difficult, debt collection calls and legal action, deficiency balance remaining after motorcycle sale, and potentially having to continue making payments even after repossession.