A personal loan is an installment loan from a bank or credit union. A credit card is also a loan because these products are paid back monthly. Installment loans are the most common but are known under different names or used in various methods.

The duration of installment loans can be months or sometimes years.

Fixed monthly payments help you plan based on your monthly income. The beauty of installment loans is that you can easily plan your repayments.

They are also good for larger purchases or for consolidating other high-interest loans into lower payments. Below, Greendayonline will explain these common types of loans, how to use one wisely, and how to get a loan with bad credit, even for those with poor credit scores.

What Is An Online Installment Loan For Bad Credit?

An installment loan for bad credit is a loan in which a customer is lent money for a fixed amount of time. The loan is then paid off in monthly installments, making it a viable option for those with poor credit scores seeking to rebuild their credit.

The monthly installments are set out in advance for six months, 12 months, 24 months, and up to 60 months. These loans are advantageous as the interest rate (APR) is set during the loan contract and helps you manage unexpected expenses.

Instead of having variable interest rates, the interest rates are fixed in advance. The fixed rate allows you to anticipate your monthly payment each month to avoid the variable rate that some loan types have, making it easier to handle unexpected expenses.

When you repay an installment loan each month, you will repay some of the principal plus some interest. The origination fee on your loan application will be stated along with the repayment plan before signing, ensuring transparency when dealing with potential unexpected expenses.

Advantages of Instant Approval Installment Loans From GreenDayOnline

Instant approval online installment loans are a terrific way to boost your finances, even with bad credit, and offer better control over unexpected expenses.

- Greendayonline’s fast loans have a simple application process and no hidden costs. Get quick funding for your needs.

- Once authorized for an installment loan, users obtain a set interest rate and pay predetermined amounts over time. Our flexible repayment terms make it easier for you.

- Always know how much to pay each month, so you can manage your finances to repay debt.

- You can get a loan even with bad or poor credit. We understand that having less-than-perfect credit doesn’t define your capabilities.

- 5-minute application process

- Greendayonline lenders offer unsecured personal loans with no hidden costs and flexible terms.

- We can assist with credit card debt or unforeseen expenses.

- No prepayment penalties

We proudly provide accessible financial solutions to individuals across the United States who may face credit challenges. Our company offers a wide range of options, including bad credit installment loans, designed to assist individuals in managing their financial needs. To ensure our services reach as many people as possible, we have expanded our operations to various states nationwide. The table below shows a comprehensive list of the American states where our company actively provides bad credit installment loans. We strive to offer reliable support and assistance to individuals in need, regardless of their credit history, and are committed to helping them navigate their financial journey.

| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) |

| California (CA) | Colorado (CO) | Connecticut (CT) | Delaware (DE) |

| District Of Columbia (DC) | Florida (FL) | Georgia (GA) | Hawaii (HI) |

| Idaho (ID) | Illinois (IL) | Indiana (IN) | Iowa (IA) |

| Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) |

| Mississippi (MS) | Missouri (MO) | Montana (MT) | Nebraska (NE) |

| Nevada (NV) | New Hampshire (NH) | New Jersey (NJ) | New Mexico (NM) |

| New York (NY) | North Carolina (NC) | North Dakota (ND) | Ohio (OH) |

| Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) |

| Utah (UT) | Vermont (VT) | Virginia (VA) | Washington (WA) |

| West Virginia (WV) | Wisconsin (WI) | Wyoming (WY) |

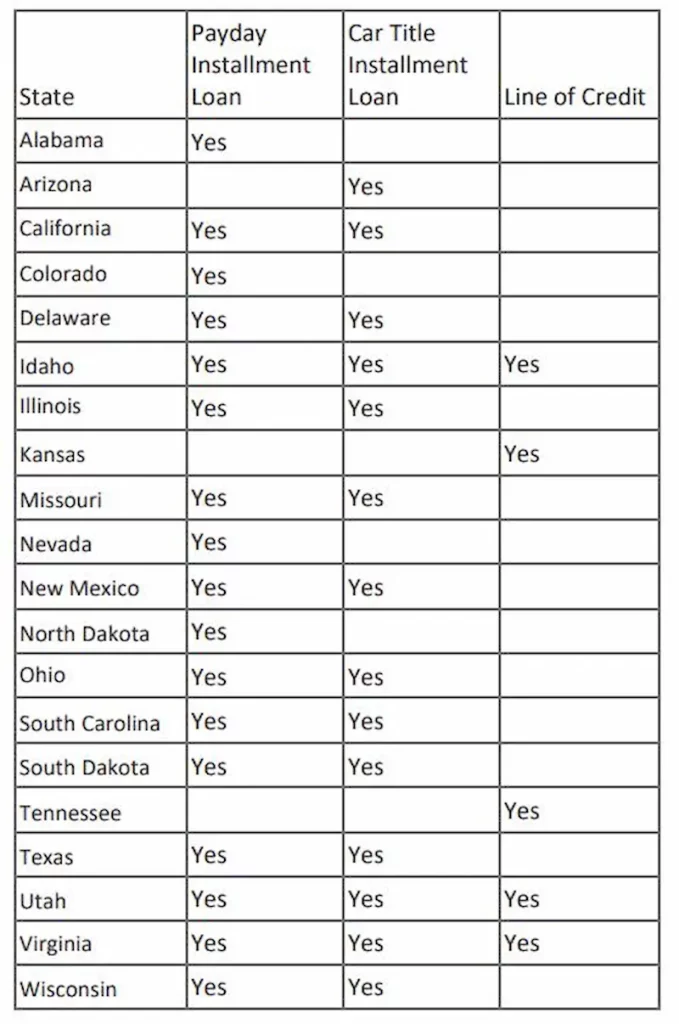

We also offer payday and title loans. In most situations, you can get your emergency loan in one business day, so apply online today to discover what we can offer you. Our loan process features an instant decision, enabling a quick decision on your application. You can check out additional installment loan articles here.

How Do I Apply For A Direct Lender Loan?

It is easy to apply for a direct lender installment loan. At the top of the page is a request form to start your application. Input your information accurately to get a swift reply from the lenders.

You may apply any time of day as our ping-tree software is always on and connected to lenders 24/7, 365 days a year. The loan process is completed in a few minutes, offering an instant decision, and is entirely online.

Can I get Guaranteed Approval for installment loans?

Credit bureaus such as Equifax®, Experian®, and TransUnion® exist to judge borrowers’ creditworthiness for a reason. No lender can guarantee any loan. Any lender who would approve every loan requested would soon go broke. The lowest rates and guaranteed approval loans go to those most can afford them. That is consumers with good credit.

Having defaulted on a loan previously does not help, but there is still hope, even if you have a bad credit score. If you meet the minimum credit score requirements, you can get an online installment loan with Greendayonline’s lenders. This is particularly helpful for bad credit borrowers.

It would help if you had a steady income to show you can repay the lender. Still, our installment loans have much higher approval rates than traditional lenders like banks and credit unions.

How Can I Get Installment Loans Near Me With Bad Credit?

You can get a bad personal credit installment loan “near me” from Greendayonline. We have up to 80% approval rates for borrowers who apply and are in full-time employment. Our lenders do not only look at your credit history when applying, and because there is no hard credit check, you have a good chance of being eligible for a loan.

Our online loans are one of the most popular options for personal loans, with monthly payments and varying loan amounts. Customers should note that installment loans are unsecured bad credit loans with sums up to $5000. Because of your bad credit history, your interest rates will be higher.

Installment loans can improve credit scores or fund mid-to-high needs like home repairs or rent. You should only apply if you can meet the repayment schedule and the eligibility criteria, and we encourage lenders to borrow responsibly.

Do Installment Loans Have No Credit Checks?

Our lenders only do a soft credit check when you apply for $1,500, $2000, or $5000 installment loans. This basic check on your details is less rigorous than a bank’s or other financial institution’s hard credit check. They will not do a hard credit check on you for smaller amounts. The lack of checks can help, as too many queries on your credit score could damage your credit rating even further if you have less-than-perfect credit scores.

So think carefully about how much you need to borrow. The higher the amount, the more likely your credit score will be checked. However, our lenders have a minimum credit score requirement that is more lenient than traditional banks, allowing you to qualify for quick cash even with a low credit score.

No credit check is not honest, and it is advertised by many websites online. Before a loan is distributed, there is always some form of analysis of your credit history, no matter how small.

Before approving any online application, lenders need to assess credit scores. Lenders will want proof of income or bank statements if you have poor credit. It also allows for more competitive interest rates for those with better credit and can secure loans, an important aspect of making a financial decision.

How Do I Qualify for A No Credit Check Loan With Same Day Approval?

To qualify for a no-credit-check loan with same-day approval, the basic eligibility requirements are:

- Be a US resident citizen.

- Be over eighteen

- Have A Social Security Number

- Earn at least $1000 a month

- Have a bank account

- Email address

- A Fixed or cell phone number

Why Should I take out installment loans for bad credit?

You should take out an installment loan for bad credit if you need it. Suppose you need cash badly and have an emergency. In that case, installment loans are one of the cheapest ways for bad-credit consumers to borrow money. The borrowing process becomes much more manageable with flexible repayment options and various loan options.

Here are four reasons how installment loans can help you

- Installment loans may be available to consumers with bad credit

- You can receive online installment loans with nearly fast approval.

- Depending on the lending company, your loan can take one to a few business days to approve.

- Unsecured online installment loans involve fewer fees than payday loans.

How Much Will The Installment Loans “Guaranteed Approval” Cost?

The following are examples of installment loans guaranteed approval taken out for 36 months. The first one has an interest rate of 11% for a borrower with good credit

- Total principal: $5,000

- Loan Term: 36 months

- Monthly payments: $163.69

- Total interest paid: $892.97

Here is an example of a loan taken out for 36 months at an interest rate of 98% for a borrower with bad credit

- Total principal paid: $5,000

- Loan Term: 36 months

- Monthly payments: $434.05

- Total interest paid: $10,625.71

Bad credit installment loans have a higher interest rate than good and fair credit loans. Installment loans are cheaper and more reliable than payday loans.

Online payday loans may be more likely to be approved if you need better credit. If you’re in financial trouble, payday loans can be dangerous and should be used wisely.

How Much Money Can I Get When Using Direct Lenders Only?

Our direct lenders only have Installment loans up to a maximum loan amount of $5000. You can pay $1000 or $2,500, depending on your needs. The loan proceeds can be used for various purposes, including debt consolidation or as financial assistance in times of need.

Our lenders offer flexible loan terms and a range of loan amounts, providing a convenient solution for cash into your checking account as soon as the same business day.

We can offer smaller loans of $100 or a $500 loan with monthly payments. Typically people take out a payday loan for these small amounts, but it is more convenient to pay the loan back over a few months rather than in one lump sum with our flexible loan terms.

What Amounts Are Installment Loans Available In?

Even with bad credit, an installment loan of $500 to $5000 is achievable. GreendayOnline features a streamlined application process designed to cater to any loan size. Our platform is infused with flexibility and adaptability, enabling us to address individual lending needs. Sometimes you don’t need thousands, but only a small loan. Consequently, by acknowledging such a fact, GreendayOnline contributes to narrowing the financial gap that usually comes with emergencies and unforeseen expenditures.

From car repairs to urgent medical bills or even minor home improvements, a $500 or $400 installment loan is an invaluable tool. The principle of our platform at GreendayOnline is based on the notion that each request carries its unique story and importance. We treat each application with the same dedication and urgency, regardless of the loan amount.

Can I Use $1000-$3000 Installment Loans For Debt Consolidation?

A $3,000 installment loan can be good for consolidating your debt if the interest rate is lower than the one you are paying. A good example would be if you had multiple payday loans with high interest. An installment loan with a lower rate and flexible loan terms will reduce your monthly payments and be a convenient solution for managing your debt.

We can consolidate your loans also if you have too much debt already. You can also see all about the pros on cons of this article from Pewtrusts.

Is A Direct Lender Or Broker Cheaper When Borrowing 5000 Dollars?

You may think the direct payday lender is cheaper when borrowing 5,000 dollars, but be aware that is only sometimes the case with online installment loans. You can get your money from a direct online lender or a broker. You should check several lenders to compare loan amount options and fees before deciding where to get a loan. At the same time, look for excellent customer service to ensure a smooth borrowing experience. Explore various financial solutions to find the best fit for your needs.

Some direct lenders need collateral to ensure customers can repay the loan. Most internet lenders want a consistent monthly income to ensure repayment is met, considering major expenses and loan funds.

Payday Loans Versus Installment Loans

You should settle Online payday loans on your next payday. 800-dollar payday loans are short-term products and should be repaid quickly, considering your payment history. They range from $100 to $1000 in most states, although there are some exceptions, like $255 if you reside in California. Payday lenders require a one-time payment at the end of the month, and the loan is terminated.

However, long-term installment loans can last years if you take out a mortgage. Many Americans are looking for personal loans with repayment periods over several months. Monthly payments mean you can plan your outgoings, including medical expenses and other financial commitments.

If you are ready for a payday loan for bad credit or an installment loan with a competitive acceptance rate and a decision in minutes, call our customer service now at (800) 233-9435

What Are Other Types Of Installment Loans?

Examples of installment loans include title loans, mortgages, secured and unsecured personal loans, and car loans.

Title Loans

Title loans are secured on your vehicle’s title papers. The lender enables you to drive your car while the lender has security on your vehicle. By using the collateral in your car, the lender can give you better interest rates. Title loans can be 12-24 months, depending on the lender.

Car Loans

Monthly installments are typically paid over 24, 36, 48, 60, and 72 months. However, not all lenders offer these ranges.

If you don’t keep up with payments, a lender may seize your new car.

Make sure lenders disclose payments and hidden fees. Dealerships, banks, and credit unions sell them. Credit unions offer the best rates.

Mortgages

Monthly payments are made for 10 to 30 years. If you don’t pay, your property works as collateral, like vehicle loans.

Home mortgage loans have lower interest rates because they’re secured; some have set payment rates that don’t alter.

Irrespective of the amount borrowed and monthly payments, always communicate with the lender. Mortgage lenders evaluate credit, income, and employment to ensure on-time loan repayment.

Personal Loans

These can be utilized for debt restructuring or unforeseen medical needs. Personal loans don’t need collateral like a car or house.

The duration can be 12 to 60 months.

Installment loans, in general, provide cheaper fees than payday loans.

Online Installment Loan Lender Considerations For Instant Funding

It would help to look for decent monthly interest rates when taking out an installment loan for instant funding. Online lenders consider various factors while evaluating loan applications. The factors below determine your interest rate and APR.

- Your credit rating

- Earnings

- Liabilities

- Debt-to-income ratio

- Employment length

Before depositing installment loans, lenders must be confident that customers can repay. Before applying for an installment loan, borrowers can try and improve their credit. Increasing your credit score could cut your rates.

Can I get installment loans with no credit check near me?

You can get a loan agreement with no credit check in your location that requires in-store applications. The reality is, though, these days, you will get a much faster answer online using the internet.

Your request will be sent to many lenders with Greendayonline based on your information and location, such as California, Florida, and Texas.

The lender may be based in a different state, but the conditions could be better.

By shopping around for online loans, you have a great advantage over storefront locations, which may reject you individually.

Here are some statistics on installment loans

| Statistic | Value |

|---|---|

| Average installment loan amount | $10,000 |

| Average interest rate for an installment loan | 10% |

| The average borrower will pay | 36 months |

| The installment loan market is growing rapidly | $1,200 in interest over the life of an installment loan |

| Number of installment loans outstanding in the United States | $2.5 trillion |

| Installment loan market is growing rapidly | Average of 10% per year |

| Growth of the installment loan market is being driven by | Increasing availability of online lenders, growing popularity of buy now, pay later (BNPL) programs, and rising cost of living |

Frequently Asked Questions

How do bad credit installment loans from direct lenders work?

Bad credit installment loans from direct lenders provide access to fixed-amount loans repaid in installments over a set repayment term. Payments are the same each period. Interest rates are often high for bad credit borrowers.

What is the process for applying for an online bad credit installment loan with guaranteed approval?

The application process is simple and can be completed online. You’ll provide personal information and documents to prove income and identity. Approval can be instant if you meet the lender’s qualifications.

What are the typical eligibility requirements for getting approved for a bad credit installment loan?

You’ll need government-issued ID, proof of income, a checking account, to be 18+ years old, and have a minimum credit score around 500-550, depending on the lender.

Are there any alternatives to bad credit installment loans for people with poor credit?

Secured credit cards, credit-builder loans, borrowing from family/friends, p2p lending, and federal assistance programs are some alternatives to high-interest installment loans.

What should borrowers consider before taking out a bad credit installment loan online?

Consider repayment ability, all fees, interest charges, lender reputation, impact on credit, and alternative options before accepting a bad credit installment loan.