Title loans in Houston, Texas, are a popular type of secured lending where borrowers use their car title as collateral to obtain a loan. Auto title loans appeal to individuals who require immediate funds but do not qualify for traditional bank loans due to a poor credit score or irregular income. In such cases, bad credit title loans can be a viable option for borrowers with less-than-perfect credit.

Borrowers must understand the potential benefits and drawbacks of title loans before applying. The following blog post discusses what borrowers need to know about bad credit title loans in Houston, Texas.

Summary

- Title loans in Houston use a vehicle title as collateral to obtain a loan. They are popular for people who need immediate funds and have poor credit scores or low income.

- Benefits include easy application, larger loan amounts, and flexible repayment terms.

- Risks include high-interest rates and the potential of losing one’s vehicle for defaulting on payments.

- Borrowers must own a vehicle with a clear title, provide proof of income and insurance, and be 18 years old to qualify for a title loan.

- Online title loans are also available, where borrowers must review the loan terms and interest rates before accepting a title loan to guarantee they can repay the loan on time and avoid risking the loss of their vehicle.

Understanding The Basics Of Title Loans

Title loans are a type of secured lending where borrowers use their vehicle title as collateral to obtain a loan. They are popular among individuals who require immediate funds but need help accessing traditional bank loans due to poor credit scores or irregular income. Online title loans provide a convenient option for those who prefer a faster and more accessible application process.

Title loans are short-term loans that carry high-interest rates. The lender holds the title of the borrower’s car until the loan is repaid. The borrower retains the use of their car during the repayment period, but the lender has the right to repossess it if the borrower fails to repay the loan on time. The amount of money borrowed through a title loan application depends on the value of the borrower’s car.

Benefits Of Title Loans Houston

Multiple individuals need help to get approved for traditional bank loans due to poor credit scores, low income, or limited credit history. Many turn to alternative lending options like title loans to access funds quickly. Title lenders are particularly attractive to people who need immediate cash and more time to wait for the lengthy approval process that traditional bank loans require. Here are the benefits of using title loans.

- No credit checks or extensive documentation is required, making the application process fast and easy. This makes it possible for individuals with Less-than-perfect credit to access title loan funding.

- It is helpful for individuals with poor credit scores or borrowers who have been denied traditional bank loans due to their financial history.

- Larger loan amounts compared to other short-term lending options like payday loans. Borrowers receive up to 50% of the value of their vehicle as determined by the lender. This can benefit those seeking title loan funding even with Less-than-perfect credit.

- Flexible repayment terms allow borrowers to repay the loan over time in smaller installments rather than all at once.

- Title loans provide a convenient solution for people needing emergency funds in Houston, Texas, especially those with less-than-perfect credit.

Here are some statistics on title loans in Houston, Texas:

| Statistic | Value |

|---|---|

| Number of title loan stores in Houston | 200 |

| Average interest rate for a title loan in Houston | 250% |

| Average term for a title loan in Houston | 30 days |

| Average borrower pays in interest over the life of a title loan in Houston | $1,250 |

| Number of Houstonians who have taken out a title loan | 100,000 |

| Amount of money lent in title loans each year in Houston | $100 million |

| Risk of default on a title loan in Houston | 25% |

| Chance of losing your car if you default on a title loan in Houston | 90% |

Risks Of Title Loans Houston

Title loans in Houston are similar to other types of loans. They still have risks despite their benefits. For example, title loans carry the risk of high-interest rates, which puts borrowers in a difficult financial position. Defaulting on title loan payments has serious consequences, such as repossession of the vehicle and potential legal action. In addition to title loans, it’s essential to consider other loan options that may provide better terms and conditions.

High-Interest Rates

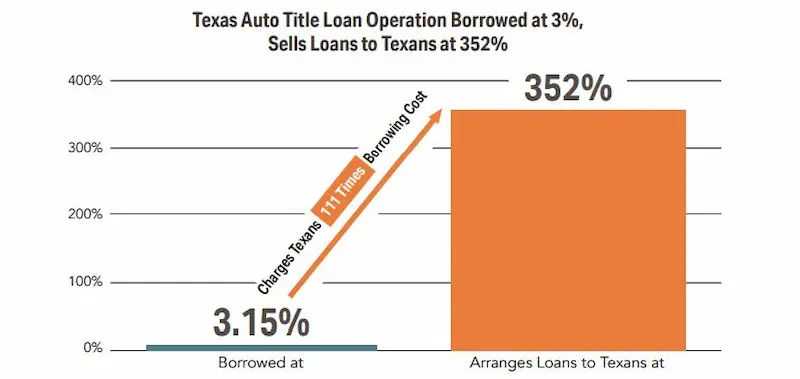

Obtaining quick cash through title loans in Houston is tempting, especially during financial emergencies. But borrowers must carefully assess potential risks before committing to a loan. One particular risk is the high-interest rates associated with title loans, which exceed 100% APR, according to Business Insider. Such exorbitant interest rates result in long-term debt and financial instability for individuals and families. It means that certain borrowers pay significantly more than they borrowed in the first place. Therefore, exploring different loan options can be a prudent choice for borrowers in need of financial assistance.

Defaulting On Payments

Another significant risk associated with title loans in Houston is the chance of defaulting on payments. It occurs when a borrower fails to make timely repayments, as agreed upon in their loan contract. Lenders can seize and sell the borrower’s vehicle to recover their money. Defaulting on payments not only results in losing one’s car but lead to legal action against the borrower, further exacerbating their financial situation.

Qualifying For Title Loans Houston

Title loans are relatively easier to obtain than traditional bank loans as they have fewer strict requirements. Borrowers must meet certain qualifications To qualify for a title loan in Houston. Note that some lenders also offer a credit check title loan option for those with less-than-perfect credit scores, making it possible for more people to access these loans. Here’s how to qualify for a credit check title loan in Houston, Texas.

- Borrowers must own a vehicle with a clear title in their name. The vehicle must be in good condition and have a certain minimum value.

- Provide identification documents such as a driver’s license, passport, or state-issued ID.

- Have a steady income source, although not all lenders require this. Borrowers must provide pay stubs, bank statements, or other proof of income if needed.

- Provide proof of insurance for the vehicle being used as collateral.

- Be at least 18 years of age.

Borrowers can obtain a title loan quickly and with little hassle if they meet the requirements. The loan process involves evaluating the vehicle’s value and determining the lending amounts based on a percentage of that value. It’s best for borrowers to carefully review the loan terms and interest rates before accepting the loan to guarantee they can repay the loan on time to avoid risking the loss of their vehicle.

Repaying Title Loans Houston

Understanding the repayment process for title loans is necessary for borrowers to avoid falling into a cycle of debt and potentially losing their vehicle. It’s best to carefully review the loan terms, including the interest rates, repayment plans, and any fees associated with the loan.

Interest Rates

Interest rates for title loans in Houston vary widely depending on the lender and the borrower’s credit history. Title loan interest rates are higher than traditional bank loans because they are short-term loans and carry a higher level of risk for the lender.

According to Bankrate, title loans include an average monthly finance fee of 25%, which translates to an APR of 300%. It’s best for borrowers to carefully review the loan terms and conditions, including the interest rate, before accepting a title loan to guarantee they can repay the loan on time and avoid the potential consequences of defaulting.

| Scenario | Loan Amount | Monthly Finance Fee | APR | Total Cost |

|---|---|---|---|---|

| A | $1,000 | 25% | 300% | $3,000 |

| B | $5,000 | 25% | 300% | $15,000 |

| C | $10,000 | 25% | 300% | $30,000 |

Explanation of scenarios:

A lending decision is made in each scenario based on specific credit criteria. The loan amount, monthly finance fee, APR, and total cost are determined according to these criteria.

- Scenario A – A title loan of $1,000 with a monthly finance fee of 25% results in an APR of 300% and a total cost of $3,000. It demonstrates the high cost of interest associated with small title loans, especially for borrowers with bad credit scores.

- Scenario B – A title loan of $5,000 with a monthly finance fee of 25% results in an APR of 300% and a total cost of $15,000. It shows the impact of a larger loan amount on the total loan cost and the difficulty of meeting long-term financial needs.

- Scenario C – A title loan of $10,000 with a monthly finance fee of 25% results in an APR of 300% and a total cost of $30,000. It highlights that even larger title loans still have extremely high-interest rates and total costs, affecting long-term financial needs and those with bad credit scores.

Repayment Plans

Creating a budget and sticking to it helps borrowers manage their finances effectively, making the repayment process smoother and less stressful. A repayment plan outlines the borrower’s payment schedule and helps them stay on track, especially when catering to their long-term financial needs and improving their bad credit score.

Lenders offer different repayment plans depending on the loan amount and duration, such as weekly or monthly installments. But borrowers must carefully review the plans and guarantee they meet the payment deadlines without defaulting on their loans. To ensure quick approval, it is advised to fill out a loan request form accurately. Listed below are the steps on how to pick the right payment plan.

- Assess the financial situation. Borrowers must review their income and expenses to determine how much they can pay each month toward the loan. An online application can streamline this process and provide a more accurate assessment.

- Review the loan terms. Carefully review the loan terms, including the interest rate, access to money, and repayment options. Doing so helps determine the total amount borrowers need to repay and how long they must repay the loan.

- Examine the payment options. Certain lenders offer flexible payment options, including bi-weekly or monthly payments. Borrowers must choose a payment plan that fits their budget and income level to avoid defaulting on the loan.

- Check for prepayment penalties. Title loan lenders charge prepayment penalties if borrowers pay off the loan early. Review the loan terms to determine if there are any fees associated with paying off the loan before the due date.

Conclusion

Title loans in Houston, Texas, appeal to individuals who require quick cash but cannot qualify for traditional bank loans. The loan amount that borrowers receive is based on the value of their car, and flexible repayment terms make it easier for borrowers to repay the loan.

Title loans carry risks, including high-interest rates that lead to financial instability and defaulting on payments that result in the loss of the borrower’s car and legal action. Borrowers must meet certain qualifications to obtain a title loan, and it’s best to carefully review the loan terms, including interest rates and repayment plans, to avoid falling into a cycle of debt.

Frequently Asked Questions

How can I apply for car title loans online in Houston with bad credit?

You can apply for car title loans online in Houston by providing details on your vehicle and income to lenders who offer loans for bad credit borrowers.

What are the eligibility requirements for car title loans in Houston, especially if I have no credit or a poor credit history?

Houston car title lenders require a car, clear title, ID, and income verification – credit checks are rarely needed.

What is the typical interest rate for online car title loans in Houston, Texas?

Interest rates for Houston online car title loans typically range from 100% to 500% APR.

How do I ensure I’m not falling into a predatory lending trap when seeking car title loans with bad credit in Houston?

Avoid lenders with rollovers or balloon payments and compare rates and fees from multiple lenders.