An installment loan is one in which you borrow money for a set time and repay it in installments. The phrase “installment” refers to monthly payments. Borrowers who can only repay small amounts of money at once like to take out installment loans with various repayment options. You must present proof of income for your type of loan request to get accepted.

What is a no-credit-check installment loan?

A no-credit-check installment loan is a long-term loan in which borrowers are not required to disclose any information about their credit history. The borrowed money can be used for various things, like car repairs and home improvements. These loans are easier to get and have more ways to pay them back than traditional ones. Many lenders additionally provide cheaper interest rates than those available for standard applications. The installment loan fund is deposited directly to the borrower’s bank account within the next business day.

How do installment loans with “guaranteed approval: work?

An installment loan with “guaranteed approval” works like any other type of personal loan. The distinction is that it is a secured loan for a set amount of money you must borrow in a single transaction. The amount borrowed is usually larger than other personal loans, such as unsecured credit cards and personal lines of credit. Installment loans typically involve payments spread out over several months. When applying for an installment loan, lenders evaluate various factors, including income, employment history, assets, debt levels, and current financial obligations. Depending on these variables, borrowers may qualify for different terms and rates.

How do no credit check installment loans work?

No credit check installment loans work like traditional payday advances; lenders will grant you a loan without checking your credit. The only difference between installment loans and conventional payday advances is their higher interest rates. Suppose you want to restore your credit and prove yourself as a responsible borrower. In that case, you should apply for one of these loans. Remember that installment loans and payday advances need collateral. You’ll need to put up something of value, like a car, a home equity line of credit, or a savings account, to show that you can repay the loan. Additionally, knowing the repayment schedule is essential as it can impact your financial planning.

How long do no credit check installment loans take to pay back?

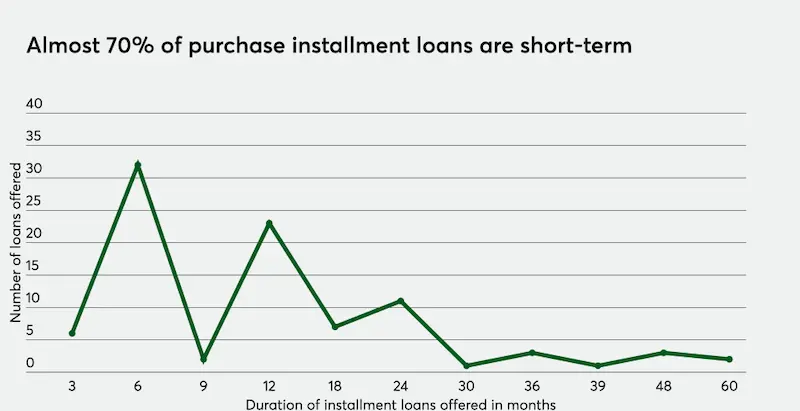

Online installment loans in Texas are a popular option for those seeking a flexible and convenient way to borrow money. Usually, no-credit-check installment loans are paid back in 12 to 60 months, depending on the loan. Repaying an installment loan in Texas depends on the amount borrowed and the type of online loan chosen.

The loan amount, length, and interest rate determine the amount of each scheduled payment for online installment loans in Texas. If you placed $1,000 down for 30 days, you would owe around $1,030. Yet, if you borrowed half that amount for one month, you’d only be out $500. So it pays to browse around for the best deals.

Can I borrow more than $1,000 loan from a direct lender without a credit check?

Yes, you can get more than a $ 1,000 loan from a direct lender without checking your credit. Yet, the APR is likely to be high. Even if you can get a loan without a credit check, choosing a lender who performs at least a mild credit check is still better. In this manner, you can get competitive loan offers even with a low credit score. $1,000 personal loans are available to most types of customers. Because this is a smaller loan, you may not need perfect credit to qualify. If you need more than $1,000 for a few weeks, you can charge it on a credit card and pay off the balance before your next statement. GreenDayOnline offers installment loan amounts from $500 up to $5,000+. Complete the online loan application form accurately so your online loan is approved quickly. This option can also be suitable for those with bad credit scores.

Can you repay your installment loan early?

Yes, you can repay your loan early. The borrower can repay their loans earlier than agreed, saving them money on interest and fees. Unsecured installment loans are usually compensated with fixed, regular installments. Installment loans include both personal loans and commercial types of loans. Financial institutions often assist with the loan process, and mortgages, personal, and auto loans are the most common.

Do loans for bad credit with no credit check have variable rates?

Yes, loans for bad credit with no credit check have variable rates, meaning that the interest rate changes during the life of the loan. With most installment loans, the scheduled monthly installment and the monthly payment stay the same throughout the whole period of the loan. That makes it easier for borrowers to calculate their budgets in advance and make payments every month.

No matter what kind of loan you want, there is always a chance that your lender will give you a low interest rate based on your credit history. Consider all your options when getting a new line of credit or refinancing.

What is a tribal installment loan?

A tribal installment loan is a word used to describe loans made available by Native American tribes in the United States. Tribal funding for various amounts has been going on since Native Americans traded money with each other. Tribal funding was also referred to as “tribal capitalism.” A tribal lender is a lender that offers loans on specific sovereign land and is run by a singular or group of Native American tribes. Tribal lenders are helpful over normal online lenders as the same laws do not bind them. Tribal lenders can, in some cases, be better for a no-credit-check loan due to these exemptions. If you fail to get the money, having a second chance with a tribal lender is good.

Who is eligible for an installment loan from direct lenders only?

Anyone is eligible for installment loans from direct lenders only. But, several factors influence eligibility for an installment loan. The first step in determining if you can get an installment loan is looking at your income, job, and assets. Next, you must decide how long you intend to fund using an installment loan. A personal unsecured loan is a good choice if you want to repay the whole amount. Suppose you will use only some of your resources to finance the money. In that case, you can invest some of the debt with equity from other sources. When deciding which installment loan is best for you, consider any fees you might have to pay if you pay it off early.

How much will a No Credit Check installment loan cost?

The cost for a no-credit check installment loan varies depending on the length of the loan agreement and whether fees are paid ahead. An installment loan instead of a payday advance can save you hundreds of dollars in late fees and other expenses.

What are the types of installment loans near me?

There are three types of installment loan options available today when you are searching for loans near me. These are unsecured personal loans, secured installments, and cash advance loans. These loan products are designed to cater to different financial needs, with lenders making careful lending decisions based on various factors.

1. Unsecured Personal Loans

An unsecured personal loan is a credit product in which the borrower does not commit assets to secure the loan. Borrowers should be able to approve these loans as long as they complete their payments on schedule. However, This form of financing comes with its own set of hazards. If a borrower fails to make payments, he may lose the property or assets used as collateral.

2. Secured Installment Loans

To qualify for a secured installment loan, the borrower must present proof of ownership of the object used as collateral. The borrower must pledge an asset as security for this loan. Once accepted, the lender will keep the asset until the borrower has paid off the loan amount plus interest. Secured installment loans frequently have higher interest rates than unsecured loans.

3. Cash Advance Loans

A cash advance is the ultimate sort of installment loan. Cash advances are short-term loans that allow borrowers to borrow money without collateral. While these loans may appear appealing to many, they come with significant fees and interest rates. Before acquiring a cash advance, a borrower must meet certain standards. Applicants must typically have good credit and consistent income. Their employment status and financial situation are crucial to their eligibility.

What are the eligibility criteria for applying for an installment loan with same-day approval?

The criteria for eligibility for an installment loan with same-day approval are:

- A steady income.

- A valid government-issued ID.

- A bank account to be eligible for an installment loan.

You will also typically need to be at least 18 years of age and legally able to enter into financial agreements in the jurisdiction where you live. Lenders may also check your credit report before approving your application. Additionally, some lenders may have different requirements or restrictions depending on the amount of loan or the state laws of the area you reside in.

What are the advantages and disadvantages of installment loans online?

During the application process, it’s essential to weigh the advantages and disadvantages of installment loans online. This will help you decide whether an installment loan is the right financial solution for you.

The advantages of installment loans include reasonable interest rates, flexible loan amounts, loose repayment term options, quicker approval, and no collateral requirements. No upfront payment is required, and there are no long-term commitments. Personal Installment loans are flexible, which makes them a good choice for big purchases like cars, houses, and furniture. Additionally, they aid in avoiding bankruptcy in unforeseen financial problems. The disadvantage of an installment loan is that you must repay the full debt over a set period, which can range from months to years. If you borrow $1,000 for 30 days at 18% APR, you’ll repay the lender $1,827 during those four weeks. Because you will know how much money you’ll need once you’ve completed everything, the lender may want more installments.

Here are some statistics on no-credit-check installment loans:

| Statistic | Value |

|---|---|

| Loan amount | $500 – $5,000 |

| Interest rate | 36% – 400% |

| Repayment period | 12 – 60 months |

| Availability | Borrowers with fair to bad credit |

| Regulation | Regulated by the Consumer Financial Protection Bureau (CFPB) |

| Pros | Shop around for the best interest rate and fees, make sure you understand all of the terms and conditions of the loan, be prepared to repay the loan on time, and consider other options, such as a personal loan or credit card, if you can |

| Cons | Available to borrowers with fair to bad credit, longer repayment period than payday loans, fixed interest rates, and monthly payments, can be used to cover larger expenses |

| Tips | Shop around for the best interest rate and fees, make sure you understand all of the terms and conditions of the loan, be prepared to repay the loan on time, consider other options, such as a personal loan or credit card, if you can |

What is a credit score when applying for a quick loan?

A credit score is a number from 300 to 850 that shows a person’s creditworthiness when applying for a quick loan. A credit score is a summary of a person’s credit history, which includes the number of open accounts, the amount of debt owed, and how the loan was repaid. Credit ratings help lenders figure out how likely it is that borrowers will pay back loans on time.

What is a good credit score for a $1500 installment loan?

A credit score of 720 or higher is considered good when applying for a $1500 loan. Positive payment history is the most effective approach to raising your credit score.

What is a poor credit score when obtaining a high-risk loan?

A credit score below 620 is considered a poor credit score when you need a high-risk loan. The higher your score, the better your rate.

How does a credit score affect an online loan application?

A credit inquiry is conducted by lenders when evaluating a loan applicant. The credit score is crucial in determining the terms and conditions of the online loan offered to the applicant, playing a significant role in the loan approval process. A good credit score can increase the chances of loan approval. In contrast, a poor credit score may result in a rejected application or a higher interest rate.

The higher your credit score, the greater your chances of approval. But if you apply for a personal loan, you should expect to be turned down because some lenders don’t want to give loans to people who won’t pay them back. Bad credit borrowers with lower credit scores than 620 are not approved. Yet, those with 720+ have a far better chance of being approved for loans.

Can I get an installment loan near me without a credit check?

Yes, you can get an installment loan without a credit check when you search for “installment loans near me.” To qualify for such loans, you must show proof of income and assets through work or other sources. You must also be willing to make lesser payments earlier and let them go unpaid until the primary sum is repaid.

What credit score is needed to get an online loan for bad credit?

You can get credit online with a FICO credit score of at least 600. Yet, applying for a secured credit card that demands verification of monthly income or assets may be beneficial. Some lenders may also ask for a 20% deposit, which is repaid immediately upon acceptance. Online loans for bad credit do not require borrowers to have a good credit score to qualify.

What is the most accessible high-risk loan to get approved?

Here you are putting something valuable up in exchange for money. The most accessible high-risk loan to get approved is a secured loan. Personal loans, signature loans, and car title loans are other types of loans that people with bad credit loans can get from online lenders or credit unions.

What Are the Installment Loan Benefits With Same Day Approval From GreenDayOnline?

Listed below are the following benefits associated with installment loans from GreenDayOnline with same-day approval:

- Easy to repay: An installment loan is easy to repay. Borrowers need to pay off the amount borrowed each month. There are no penalties for paying early.

- Flexible repayment terms: Unlike payday loans, which need to be repaid within two weeks, installment loans allow borrowers to choose the length of the payment period.

- Lower interest rate: Installment loans are usually paid over a more extended period, so installment loans’ interest rates tend to be lower than payday loans.

- Cheaper than payday loans: Installment loans are less expensive and more affordable than traditional bank loans.

- No hidden charges: Installment loans have no application fees or other hidden acquisition charges. In addition, there are no prepayment penalties.

- No Service Fee: There is no service fee for requesting a loan at GreenDayOnline.

We are delighted to present our comprehensive reach throughout the United States, where our company actively operates to provide reliable financial solutions. With a commitment to serving customers from coast to coast, we proudly offer our services in various American states. Our dedication to accessibility and inclusivity drives us to extend our support to as many individuals as possible, ensuring that financial assistance is readily available when needed. Below, you will find a table highlighting all the states we are currently active, enabling you to locate and access our services conveniently. Discover the extent of our presence and find out how we can assist you in achieving your financial goals with our no-credit-check installment loans.

| Alabama – AL | Alaska – AK | Arizona – AZ | Arkansas – AR |

| California – CA | Colorado – CO | Connecticut – CT | Delaware – DE |

| District Of Columbia – DC | Florida – FL | Georgia – GA | Hawaii – HI |

| Idaho – ID | Illinois – IL | Indiana – IN | Iowa – IA |

| Kansas – KS | Kentucky – KY | Louisiana – LA | Maine – ME |

| Maryland – MD | Massachusetts – MA | Michigan – MI | Minnesota – MN |

| Mississippi – MS | Missouri – MO | Montana – MT | Nebraska – NE |

| Nevada – NV | New Hampshire – NH | New Jersey – NJ | New Mexico – NM |

| New York – NY | North Carolina – NC | North Dakota – ND | Ohio – OH |

| Oklahoma – OK | Oregon – OR | Pennsylvania – PA | Rhode Island – RI |

| South Carolina – SC | South Dakota – SD | Tennessee – TN | Texas – TX |

| Utah – UT | Vermont – VT | Virginia – VA | Washington – WA |

| West Virginia – WV | Wisconsin – WI | Wyoming – WY |

How to Choose a “no-credit-check” lender for high-risk loans?

In choosing no-credit-checking lenders for high-risk loans, borrowers must research before choosing a direct lender to get an installment loan and choose one that complies with all state laws. It should also provide full disclosure of information on rates and lending practices. A loan contract should be carefully reviewed before making a decision. Selecting the right installment loan lending company is essential if you take out an installment loan and require financial assistance.

What is a bad credit installment loan online?

A bad credit installment loan online is when someone with a poor credit history takes a loan from a lender. The borrower uses money borrowed from the lender to cover his debts which he cannot repay at the end of the month. He may be pressured into taking up such loans because he needs more options, including more traditional financial assistance. Such loans come with high interest rates and usually require collateral, making the loan contract particularly important to review.

Conclusion

A personal installment loan is one in which the principal is paid back over a certain number of monthly installments rather than all at once. There is a subset of installment loans known as “no-credit-check installment loans” that do not require a borrower’s credit history for approval. These loans’ interest rates and collateral requirements are often greater than those of more conventional loan types.

The exact sum of each installment is based on several variables, including the principal, interest rate, and loan length. If you need a loan for more than $1,000, you can get one without checking your credit, but the interest rate will be sky-high. Premature loan payoff might reduce interest and fees owed. Some no-credit-check loans include interest rates that fluctuate over the life of the loan.

Frequently Asked Questions

How do I qualify for a no credit check installment loan from a direct lender with guaranteed approval?

You’ll need proof of steady income, a valid ID, active checking account, and contact info. Age and residency requirements must be met. No formal credit check is done.

What are the typical interest rates and repayment terms for online installment loans with no credit check?

Interest rates typically range from 200-400% APR. Repayment terms are usually 3-12 months. Shorter terms have higher monthly payments.

Are there any hidden fees or charges associated with these guaranteed approval installment loans?

Read the fine print carefully as some lenders charge origination fees, late fees, early repayment penalties, or insufficient funds fees. Ask for full details.

Can I apply for these loans online, and what documents or information will I need to provide during the application process?

You can apply online. Documents needed typically include ID, paystubs, bank statements, contact information, and e-signature for the loan agreement.

What are the risks associated with borrowing from direct lenders offering no credit check installment loans?

Risks include very high interest, potential debt traps, lowered credit score if you default, and aggressive collections practices for past due accounts.