Can I Get a Personal Loan With Bad Credit Without Credit Checks?

How can you cross the financial minefield to apply for a personal loan? According to your bank and all the online advertising, it sounds really easy.

Security gives you a better chance, as the bank can remove your pledged asset. Many people have no assets or do not want to risk it, so they would rather pay higher interest because they have a poor credit history. The average interest per state is in this article.

What Is a No-Credit Check Personal Loan?

A no-credit-check loan is a personal loan in which a lender will look at your eligibility for credit. They do this without a hard credit check.

This loan is a boon to people worried they will not qualify due to bad credit. The lender advertises a “no credit check personal loan.” Still, they check some basic details that do not affect your credit score.

These loans are great when you have an emergency that needs fast cash.

What Questions Should I Consider Before Requesting a Loan?

- How much do I need to borrow?

- Do I have enough collateral?

- What’s my loan limit?

- Can I repay the loan on time?

- How much interest is there?

- Are there any late fees?

Are Bad Personal Loans Secured or Unsecured?

A secured personal loan will often be tied to your property or other collateral (things you own). The advantage will be that the interest rates will be much smaller than an unsecured loan.

In this case, you must be completely certain you can meet the payments comfortably. If you don’t, you could risk losing your property.

An unsecured personal loan ( bad credit) will not be secured on any collateral you have, which is great. The downside will be that you must make up the lender’s risk with additional interest.

What Assets Can I Use to Secure the Loan?

You can use real estate and even a car or a boat. You might also have financial investments. Banks, in general, like hard assets like a car or home. The more immovable for them, the better.

In certain cases, you may be able to use the item you purchase from the loan proceeds – but be aware you could get into even deeper trouble if it all goes wrong. It’s called ‘Double Jeopardy.’

Many lenders will take investments such as stocks and bonds as collateral. This can work well as you can continue earning money on them while the lender holds them as collateral.

What Should I Do if I Have Too Many Bad Credit Loans Already?

If you have too many personal loans and need help, try our payday loan consolidation to help you get back on your feet.

If you find yourself with too many bad credit loans, it’s important to take action to address the situation. First, create a comprehensive list of all your existing loans, including their interest rates, repayment terms, and outstanding balances. Evaluate your monthly budget to determine how much you can allocate towards loan repayments. Consider reaching out to your creditors and explaining your financial difficulties. They may be willing to negotiate new repayment terms or provide alternative solutions.

Additionally, explore debt consolidation options that can help combine multiple loans into a single, more manageable payment. Seek professional advice from credit counseling agencies or financial advisors who can provide guidance tailored to your situation. Implementing a disciplined approach to managing your finances, prioritizing debt repayment, and avoiding taking on additional loans will be crucial in gradually improving your credit situation. Remember that it may take time and patience. Still, with determination and responsible financial habits, you can work towards improving your credit and regaining financial stability.

What Documents Will I Need to Get a Bad Credit Loan Online?

You will need proof of your monthly income, address, phone number, email address, SSN, and bank account details. The lender will need these documents for a soft credit check on you.

When applying for a bad credit loan online, you must provide several documents to complete the application process. The requirements may vary depending on the lender and the loan type. However, commonly requested documents include proof of identity, such as a valid government-issued ID or passport. You may also be asked to provide proof of income, which can be demonstrated through recent pay stubs, bank statements, or tax returns.

Lenders may also require proof of residence, such as utility bills or a lease agreement. Other documents that may be needed include your Social Security number, employment history, and contact information. It’s important to note that different lenders may have different document requirements, so checking with the specific lender or reviewing their website for accurate and up-to-date information is advisable.

What Are the Types of Personal Loans With Bad Credit?

These types of loans come in a few forms. Examples are:

Installment loans, credit cards, bank loans, vehicle title loans, and online payday loans. A higher interest rate usually dictates the bad credit part.

When it comes to personal loans, having bad credit can make it more challenging to obtain favorable terms or secure a loan from traditional lenders. However, several types of personal loans are still available for individuals with bad credit. Here are some common options:

- Payday Loans – Payday loans are short-term loans typically due on your next payday. They are known for their high-interest rates and fees, making them a costly option. While they are relatively easy to obtain with bad credit, they should be cautiously approached due to their high costs.

- Installment Loans – Installment loans allow you to borrow a specific amount of money and repay it over a set period through fixed monthly installments. Some lenders specialize in installment loans for individuals with bad credit. However, be prepared for higher interest rates than loans for borrowers with good credit.

- Secured Loans – Secured loans require collateral, such as a car or a savings account, to secure the loan. By providing collateral, you reduce the lender’s risk, making it easier to obtain a loan even with bad credit. However, the lender can seize the collateral if you fail to repay the loan.

- Co-Signed Loans – If you have a trusted friend or family member with good credit, they can co-sign the loan with you. The co-signers’ good credit can increase your chances of approval. They may even help you secure a loan with more favorable terms. However, remember that if you default on the loan, the co-signer is responsible for repayment.

- Online Lenders – Online lenders, including peer-to-peer lending platforms, may have more flexible lending criteria and be willing to work with individuals with bad credit. When evaluating your application, these lenders often consider other factors beyond your credit score.

- Credit Union Loans – Credit unions are nonprofit financial institutions that can be more lenient in lending than traditional banks. They may offer personal loans to members with bad credit at more reasonable interest rates and fees.

It’s important to note that while these options are available, individuals with bad credit are generally considered higher-risk borrowers, resulting in higher interest rates and stricter terms. It’s crucial to carefully evaluate the terms and consider the long-term financial implications before committing to any loan. Additionally, improving your credit score over time can open up more favorable loan options.

What Expenses Can I Use Bad Credit Personal Loan For?

If we all could have some backup money, then life would be great, but most Americans have very little put aside. To compound the misery, many also have poor credit. This is defined by a FICO score of 610 or less.

Here are some examples of emergency expenses that our borrowers tend to use a personal loan for:

- Car Repair

- Heating Repair

- Rent arrears

- Utility bills

- Food bills

- and many more

What Is the Difference Between a Direct Lender and a Broker?

The difference between a direct no-credit-check personal loan lender and a broker is that the direct lender is assumed to have better rates.

That could be so, but when it comes to bad credit, all interest is much higher than a bank. It does not matter if it is a direct lender or a broker. The ultimate deciding factor will be the interest rates and fees that the lender charges.

Check in the footer of the lender’s website to see the APR charged before deciding. This should be there by law. It would help if you always understood what you were signing.

What Is a Bad Credit Score?

The scale of credit goes from 300 to 850. Most online lenders will determine anything below 660 as bad. Generally, a credit score from around 570 to 670 is considered OK. Anything below 570 and as low as 300 is considered bad, and you will need help to get credit.

Here is a summary:

| 300 – 580 | Bad |

| 570 – 670 | Reasonable |

| 660 – 740 | Good |

| 740 – 800 | Very Good |

| 800+ | Amazing |

Where Else Can I Look for a No-Credit Check Personal Loan?

The most sensible place to start would be at your bank – you’ll probably get the best terms here as a regular customer. Having a no-obligation chat won’t do any harm. Look at the other options available as your ban’s terms may not be to your liking – in short, it pays to shop around.

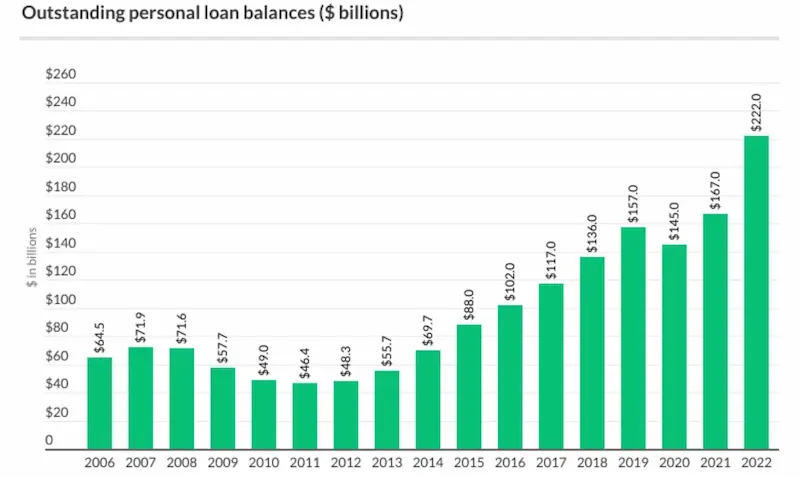

Below are some statistics about personal loans with bad credit:

| Statistic | Value |

|---|---|

| Percentage of personal loan borrowers with bad credit | 20% |

| Average interest rate for personal loans with bad credit | 18% |

| Average personal loan amount for borrowers with bad credit | $5,000 |

| Delinquency rate for personal loans with bad credit | 6% |

Why Can My Bank Give Me Better Interest Rates?

The annual percentage rate, or APR, is the most important thing. The shorter the term you can get, the better it will be in the long run.

You must ensure you understand all of the terms and the small print. There could be fees attached for things like late or missed monthly payments.

At GreenDayOnline, we understand that financial setbacks can happen to anyone, regardless of their credit history. That’s why we are dedicated to providing accessible solutions for individuals with bad credit without the hassle of traditional credit checks. We are proud to offer our personal loans online across a wide range of states in the United States. Whether you need financial assistance to cover unexpected expenses or consolidate debts, our services are available to residents in the following American states:

| AL – Alabama | AK – Alaska | AZ – Arizona |

| AR – Arkansas | CA – California | CO – Colorado |

| CT – Connecticut | DE – Delaware | DC – District Of Columbia |

| FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana |

| IA – Iowa | KS – Kansas | KY – Kentucky |

| LA – Louisiana | ME – Maine | MD – Maryland |

| MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana |

| NE – Nebraska | NV – Nevada | NH – New Hampshire |

| NJ – New Jersey | NM – New Mexico | NY – New York |

| NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania |

| RI – Rhode Island | SC – South Carolina | SD – South Dakota |

| TN – Tennessee | TX – Texas | UT – Utah |

| VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Conclusion

In conclusion, applying for a personal loan, especially with bad credit, requires careful consideration and understanding of various factors. While banks and online lenders may advertise easy loan processes, assessing your needs, collateral options, loan limits, repayment capability, interest rates, and potential fees is important. Secured loans can offer lower interest rates but come with the risk of losing pledged assets. Unsecured loans have higher interest rates but don’t require collateral. Exploring options like payday loan consolidation can be helpful if you already have multiple bad credit loans. When applying for a bad credit loan online, be prepared to provide necessary documents such as proof of income, address, and identification.

Different types of personal loans with bad credit include payday loans, installment loans, secured loans, co-signed loans, online lenders, and credit union loans. Such loans can be used for emergency expenses like car repairs, heating repairs, rent arrears, and utility bills. Differentiating between direct lenders and brokers primarily comes down to the interest rates and fees they charge. Bad credit scores typically range from 300 to 670, with scores below 570 considered bad. While banks may offer better interest rates for personal loans, exploring other options and comparing terms is essential to find the most suitable loan for your needs. Understanding the APR, loan terms, and potential fees is crucial before committing to any loan.

Frequently Asked Questions

What are the typical interest rates associated with personal loans for bad credit, especially those that don’t require credit checks?

Personal loans for bad credit typically have higher interest rates from 10% to 35% APR compared to 3% to 18% for good credit, but those that don’t check credit at all may charge even higher rates.

Are there any specific eligibility criteria or requirements for obtaining a personal loan online with bad credit and no credit checks?

Typical eligibility includes being 18+ years old, having an income of at least $1,000 per month, having a valid ID, and a checking account. Proof of income and direct deposit may be required.

What is the maximum loan amount that can be obtained through online lenders specializing in bad credit personal loans?

The maximum loan amount available for bad credit personal loans online is typically $15,000 to $20,000, but many lenders cap loans in the range of $1,000 to $5,000 for applicants with poor credit.

What are the potential risks or pitfalls associated with taking out a personal loan for bad credit online, especially if no credit checks are involved?

Risks include very high interest rates, predatory lending practices, loan stacking with multiple back-to-back loans, and endless debt cycles or bankruptcy if unable to repay the loan as scheduled.