A bad credit holiday loan with bad credit at Christmas is a credit made available to those with less-than-perfect credit. These loans cover Christmas presents, vacations, decorations, and other expenses. Alternative lenders, such as online lender payday lending organizations, are the most common providers. These loans are costly due to high-interest rates and fees. Credit scores are better if paying the loan on time.

Budgeting, utilizing a low-interest credit card, or asking family and friends for aid must be considered before applying for a Christmas loan for poor credit. Improve credit scores to get better loan conditions in the future and become more attractive to creditworthy borrowers. Read the loan terms and conditions to understand fees, interest rates, and payback schedule. Compare loan options to get the best one with a competitive interest rate.

Check your minimum credit score before applying and opt for loans with flexible repayment terms to minimize the financial burden during repayment.

Main Points:

A Christmas loan is a short-term personal loan to help with holiday expenses.

Important Factors to Consider Before Applying for an Online Christmas Loan With No Credit Check

Borrowers must consider their interest rate, repayment terms, charges, credit score, intended use, payback ability, and alternatives before applying for an online Christmas loan with no credit checks. The application process and the loan agreement should be thoroughly reviewed to understand the terms and conditions.

Creditworthiness and Loan Amounts For Bad Credit Christmas Loans Near Me

The creditworthiness of borrowers, including their financial history, plays a significant role in determining the loan amount for bad credit Christmas loans near me. High fees and interest rates, such as those seen in Christmas loans for poor credit, are the norm for these loans.

Repayment Consequences For Small Christmas Loans From a Direct Lender

The borrower’s credit rating takes a hit if the loan needs to be repaid on time. Several variables, including income, credit history, and loan provider policy, determine how much of a Christmas loan from a direct lender one may get.

Alternatives to Christmas Cash Loans That Allow You To Pay Weekly

One can save money for the holidays in several ways besides obtaining Christmas cash loans, including setting aside money each month, utilizing a credit card with a low-interest rate, borrowing from family and friends, and planning. Access to funds through these alternatives can greatly reduce borrowing costs.

Debt-Free Vacation Tips With Christmas Payday Loans

Planning, using a debit or cash card, and paying off credit card debt before traveling help individuals enjoy a vacation free of debt. Christmas payday loans are personal loans promoted to meet financial needs associated with the Christmas season. Lenders can advertise these loans with attractive interest rates and other terms to encourage holiday shoppers during the winter vacations. However, weighing the costs, interest rates, and loan decision involved is crucial before agreeing to a Christmas loan. Avoiding debt requires careful financial planning and taking on no more obligation than one comfortably repays. For those who need extra cash, looking into online applications for financial products might be a sensible option.

Factors to consider when applying for Christmas Advance Loans

There are several variables to think about while applying for Christmas advance loans, including:

- Flexible loan options to cater to your specific needs

- Eligibility requirements set by the lender to qualify for the loan

- Interest rate: Christmas loans for poor credit often have high-interest rates, so shopping around and choosing the most reasonable option is crucial. Consider different credit types when searching for the best terms.

- Repayment terms: Pay attention to the repayment conditions, especially the monthly payment amount and timing.

- Costs: The loan may include extra fees, such as origination fees or penalties for late payments.

- Credit Score: Be aware of the credit score and how it affects the loan application since it plays a significant part in establishing the loan conditions.

- Purpose: Make sure the borrower and the lender are on the same page about why one needs the loan and how one intends to put the money to use.

- Repayment Capacity: Only take out a loan if one is not certain to make the monthly installments; doing so won’t burden your finances. Evaluate your repayment capacity for different credit types before choosing a loan.

- Alternatives: Consider choices such as saving enough, using a credit card with a low-interest rate, or borrowing from family and friends before applying for a Christmas loan. These alternatives may provide more suitable credit types to meet your needs.

At GreenDayOnline, we take pride in serving individuals with diverse financial backgrounds, including those with bad credit, during the festive season. As a trusted financial institution, we understand that the holiday season can bring about unexpected expenses, making it challenging for individuals with less-than-perfect credit scores to secure the necessary funds. However, our mission is to empower our customers to embrace the season’s joy by offering Christmas loans tailored specifically for those with bad credit. We are pleased to announce that our services extend throughout various states nationwide, ensuring that individuals nationwide can access the financial support they need. To provide a comprehensive overview of our reach, we present the following table, highlighting all the American states where our company is actively offering Christmas loans for bad credit.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) | AR (Arkansas) |

| CA (California) | CO (Colorado) | CT (Connecticut) | DE (Delaware) |

| DC (District Of Columbia) | FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) | IA (Iowa) |

| KS (Kansas) | KY (Kentucky) | LA (Louisiana) | ME (Maine) |

| MD (Maryland) | MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) | NE (Nebraska) |

| NV (Nevada) | NH (New Hampshire) | NJ (New Jersey) | NM (New Mexico) |

| NY (New York) | NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) | RI (Rhode Island) |

| SC (South Carolina) | SD (South Dakota) | TN (Tennessee) | TX (Texas) |

| UT (Utah) | VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Below are some statistics about important factors to consider before applying for a Christmas loan:

| Factor | Importance | Average |

|---|---|---|

| Interest rate | High | 25% |

| Fees | Can be high | 5% – 10% of the loan amount |

| Repayment terms | Short | 30 – 60 days |

| Ability to repay | Important | Must be able to afford the monthly payments |

Drawbacks Of Taking Out A Christmas Loan Near Me

Here are some disadvantages to consider before applying for a Christmas loan near me.

- Fees: Lenders impose an origination fee or a penalty if borrowers pay off the loan early. These charges pile up quickly. Completing an application form for multiple lenders may also lead to additional fees.

- Negative impact on credit score: Late payments and loan defaults harm the credit score. Keep an eye out for the expected monthly payment amount. It assists the borrower in determining whether or not monthly payments are feasible. Compare holiday loan costs, rates, and amounts. Not paying back the Christmas loan on time may worsen the financial condition due to high-interest rates and short payback periods. Compare lenders and loans for the best options within the network of lenders.

- Loan approvals and credit approval: The promotional period many lenders offer when taking out a Christmas loan may lead to increased interest rates after the promotion ends. Loan and credit approval may take longer during the holiday season as lenders tend to be busier.

How much money does a person get for a Christmas Loan?

- Holiday gifts and financing for holiday expenses: Remember that while a Christmas loan can help with purchasing holiday gifts and providing financing for holiday expenses, it’s essential to choose a loan amount you can afford, as Christmas loans can accumulate interest and ultimately affect your financial health.

The amount of money a person is eligible to get from a loan for cash, specifically a Christmas loan, is determined by several variables, including the individual’s income, credit history, and the regulations of the loan provider. Lenders often provide loans to borrowers ranging from a few hundred to several thousand dollars, with the average being in the middle. Investigating the favorable loan conditions and the lowest rates is in the best interest before agreeing to take out the loan as a suitable option for borrowers.

What Are Holiday Funding Options That Provide Maximum Benefits?

Budgeting and preparing for regular expenses like your holiday shopping list is the most excellent way to enjoy the maximum benefits of the Christmas season without financial worry. However, it’s only sometimes doable. Necessities sometimes are satisfied on a tighter holiday budget.

Listed Below are Holiday Funding Options.

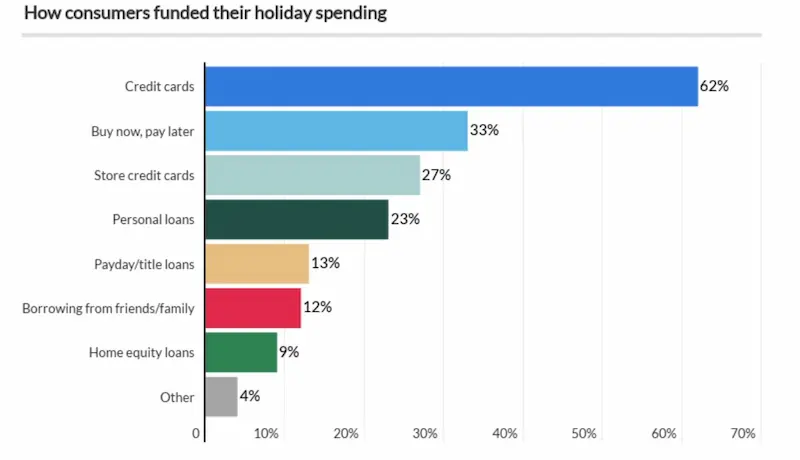

- Using a Credit Card: Credit cards are a revolving line of credit issued by a financial institution (often a bank) to individuals who have shown their creditworthiness by making regular, timely payments. The borrower may use the card to make purchases or withdraw cash and then pay back the loan, plus interest and fees, throughout a certain period. Cardholders must familiarize themselves with the credit card’s terms and conditions, including the interest rate, fees, and payment due dates, to prevent making expensive financial errors. They risk accumulating large amounts of debt if not utilized sparingly, while credit cards provide easy access to money.

- Cash Advance: A cash advance is a short-term loan a person repays with a credit card. Although cash advances might be a quick and straightforward method to get money, credit card issuers only consider regular transactions. Business days and an online form may be required to process the cash advance. Credit card companies charge cash advance fees. Cash advance costs range from 3% to 5% of the total amount borrowed, with minimum loan amounts of $10. The cash distribution amount is subjected to an annual percentage rate (APR). Cash distribution APRs are often more significant than those for routine purchases. Credit unions offer cash loans with no credit checks on holidays.

- Loans from friends and relatives: Family and friends often lend money for vacations and other costs. It’s a loan that does not need a credit check and comes with flexible terms, such as cheaper interest rates or longer repayment periods. Borrowing from friends and relatives may strain relationships if the loan is not returned or there are arguments about the conditions. Be sure all parties understand and agree to the loan conditions before borrowing from a friend or family. Providing proof of income and discussing favorable repayment terms can help maintain a healthy relationship. Also, consider discussing the impact of the loan on each party’s credit inquiry before finalizing the agreement.

Best Way to Have a Credit Card Debt-Free Vacation Near Me

Follow these methods available “near me” to avoid a deficit on the next trip.

- Prepare in advance: Create and follow a spending plan, shop around and compare prices, and put away as much money as possible. Consider automatic repayments to manage your credit card debt efficiently.

- Pay for things using cash or a debit card: Make incentives or unexpected purchases credit card’s only purpose. Stick to a monthly loan payment to stay on top of your finances.

- Pay with cash or a debit card: Only make unforeseen purchases or use a credit card for rewards. Be mindful of the borrower in trouble situations and seek help if needed.

- Pay down the bill monthly to avoid excessive interest rates. Look for flexible repayment options to manage your credit card payments better.

- Credit card transactions made abroad may incur foreign transaction fees. Ensure you meet the Minimum income requirements before signing up for a new credit card.

- Travel insurance helps individuals recoup expenses if sickness, theft, or other occurrences ruin their vacation. Always read the borrower agreement for any hidden terms and conditions.

- Avoid credit card cash advances: They have hefty interest rates and costs. Opt for a reputable lender to avoid unnecessary financial issues.

Bottom Line

A Christmas loan is a specific unsecured personal loan made available by some financial institutions and other loan providers during the holiday season. A Christmas loan is intended to provide financial assistance for people throughout the holiday season. The assistance covers holiday-related costs such as travel, gift-giving, or other expenditures. The amount of money an individual is eligible to get as a Christmas loan is determined by several variables, including the individual’s credit score, income, and debt-to-income ratio.

To apply for a Christmas loan, borrowers can fill out loan forms provided by the lender. These forms will gather detailed information about the borrower’s financial situation to help determine the appropriate loan sizes. Some loan providers offer a funding process that can be quick and efficient, which makes these loans more attractive for those seeking immediate financial assistance.

One advantage of Christmas loans is their flexible eligibility criteria, meaning that people with various credit situations may be able to qualify. However, before taking out a loan, an individual has to consider the terms and circumstances of the loan since the loan may come with a high-interest rate and have long-term repercussions for the borrower’s financial situation.

Ultimately, weighing the pros and cons of a Christmas loan is essential to determine whether it is the right option for your financial situation during the holiday season. For more information on Christmas loans and how to submit loan forms, potential borrowers can refer to a detailed guide provided by the loan provider. This guide can help explain the range of products for borrowers and aid in making informed decisions.

Frequently Asked Questions

Can I get a Christmas loan with bad credit in 2024?

It’s possible but approval odds are lower. Some lenders offer Christmas loans to borrowers with credit scores around 580-620 or below if you have income. Expect high interest rates.

What are the eligibility criteria for Christmas loans for people with bad credit in 2024?

You’ll need steady employment, government-issued ID, Social Security number, checking account, and proof of income. Lenders may check ChexSystems records.

Are there any lenders offering no-credit-check Christmas loans for 2024?

Very few legitimate lenders offer Christmas loans with no credit checks at all due to risk. Most will check your credit history even with bad scores.

What is the typical interest rate for Christmas loans for individuals with poor credit in 2024?

Expect interest rates from 25-36% APR for a Christmas loan with bad credit. Some lenders cap rates at 36% per state laws.

How can I improve my chances of getting approved for a Christmas loan with bad credit in 2024?

Having steady income, limiting loan requests, providing collateral, applying with a creditworthy cosigner, or taking steps to improve your credit can help.