Private lenders, such as mortgage companies or banks, offer VA loans. They have the support of the United States Department of Veterans Affairs (VA) through the VA-backed home loan program. A VA-backed loan requires no down payment and is available to service members, veterans, and qualified spouses of military personnel.

The United States Department of Veterans Affairs created the VA home loan in 1944 to assist returning veterans in purchasing homes without needing a down payment or excellent credit. Over 25 million VA loans have been guaranteed under this crucial program, assisting veterans, active service military personnel, and families in purchasing or refinancing houses. Read more about a VA home loan benefit below.

VA loans in 2023

We now live in a period when it is clear that the VA loan is more important than ever. Following the Great Recession, many Veteran or military house purchasers have found it challenging to acquire mortgage financing for their homes. Many lenders have tightened their lending requirements in preparation for the 2020 worldwide pandemic, especially regarding loan type and credit score requirements.

VA loans have given an option for Veterans and active Military homeowners who have a lower credit score or are required to put down a smaller down payment in the last ten years. Each of the VA loan benefits is worth your time.

How VA loans work

The VA loan from the United States Department of Veterans Affairs is a one-of-a-kind financing choice, but other forms of house loans are simple and manageable. This VA loan guide will provide the information you need to complete your VA loan refinance or purchase and maximize your benefits, including details about the credit score requirements.

If you are ready to get started on your VA loan, double-check your VA loan eligibility. Speak with a Veterans United Home Loans professional now if you have particular questions about your VA loan.

Traditional Mortgages Compared VA Loans

Veterans and military personnel can take advantage of some of the most innovative and effective financing schemes backed by the federal government. Learn how the VA-backed purchase loans compare to a traditional mortgage for a home:

Conventional Loans vs. VA Loans, supported by the federal government

Conventional loans typically require a down payment of up to 20% to secure a mortgage, which puts them out of reach for most buyers.

PMI is not required

This is one of the main VA loan benefits. VA loans do not require you to acquire Private Mortgage Insurance because the federal government guarantees them.

For conventional loans, mortgage insurance is a must. Private Mortgage Insurance is usually necessary for those who finance more than 80% of their home’s worth and can afford to pay an extra monthly charge in mortgage payments.

Competitive Interest Rates

According to Ellie Mae’s data, VA loans have had the lowest average fixed interest rate as a mortgage payment for over five years.

Low-Interest Rates at a Price

Buyers need top-of-the-line credit scores to qualify for the highest traditional mortgage rate. Veterans can get reduced rates with VA loans because they do not have to have a perfect credit history.

It is a lot easier to qualify now.

The VA Loan is a work benefit meant to increase the chances of Veterans and military members becoming homeowners. The cornerstone of the advantage is the more flexible and forgiving credit standards for underwriting, including a lower minimum credit score requirement.

Procedures for Standard Qualification

Compared to VA loans, conventional mortgages often have higher credit scores, lesser down payments, and stricter underwriting standards in some cases.

Get a VA home loan quote from a regional loan center or a Native American direct loan provider.

VA Loans Come in a Variety of Shapes and Sizes

The VA loan program provides qualifying Veterans with various home loan options at an affordable interest rate.

Purchase Loan from the Veterans Administration

VA loans for service members and veterans are available to veterans and service members. You can use a VA loan to purchase an existing or new house with no money down. Veterans can use a VA loan to purchase loans to buy single-family homes, condos, mobile homes, condominiums, multi-unit residences (duplexes), and new construction. Regional loan centers can also provide support and guidance for these loans.

Depending on the lender, guidelines and policies may differ. Some lenders may only provide some of these types of VA loan options.

IRRRL VA

The VA Interest Rate Reduction Refinance Loan is among the two options for refinancing available under the VA loan program. It is the one that the majority of Veteran homeowners choose.

They are low-cost, straightforward refinance loans that do not need income verification, credit underwriting, or an appraisal. On the other hand, Cash-out refinances loans are also offered, which allow veterans to access cash by refinancing their existing mortgage. Both of these options often come with favorable terms for eligible borrowers.

Only individuals with a current VA home loan are eligible for VA IRRRL. Only Veterans currently engaged in a VA loan are eligible for VA IRRRL. You will need to make sure your new rate is lower than the old one, and you will need to set a deadline for paying back the VA funding fee. This will assist Veterans in getting the most out of their financial plans, especially when considering investment properties and obtaining credit approval.

Cash-Out Refinance with the VA

A VA Cash-Out refinance enables active duty service members to refinance their VA mortgage and cash out their home equity, which can be helpful for those interested in investment properties. Veterans with current VA loans are eligible for the loans with an affordable VA funding fee.

Lenders may have different VA loan eligibility criteria and requirements for a VA home loan. Because this VA home loan program does not require homeowners to cash out, those with non-VA mortgages can use them to refinance at a conventional rate and term.

Read more about debt to income ratio and VA home loans.

Mortgage Guaranteed by the Veterans Administration (VA) that is Energy Efficient

The VA home loan allows veterans to acquire additional funding to finance energy-efficiency renovations to their houses. This loan is available to qualified borrowers with a specific duty status or those with a service-related disability.

Veterans can borrow a VA mortgage of up to $6,000 to cover the expenses of qualified renovations such as thermal and stormproof windows, heat pumps, and solar cooling and heating systems. There is no down payment requirement in the VA loan process. Homeowners cannot access appliances, windows, air conditioning systems, and other non-permanent objects.

Check Your Eligibility for a $0 Down Payment mortgage loan Right Now!

Examining the Veterans Administration Loan

This program has aided generations of Veterans, service members, and military families to achieve their dream of buying a home. The promise made due to their selfless service to our country is that veterans can access an inexpensive home loan program with flexible guidelines and considerable financial incentives, including the ability to purchase a home without putting down any VA home loan as a down payment.

Let us look at how a VA loan works and what you will need to do to get started with the VA loan process, including working with a loan officer and understanding the different types of loan options available.

What does the VA guarantee entail?

While the VA Loan is a federally financed program, the government rarely provides direct loans to veterans. On the other hand, private lenders such as Veterans United Home Loans invest in the VA home loan and give a guarantee. The Department of Veterans Affairs provides the guarantee. A loan officer specializing in VA loans can help navigate the process and ensure a smooth application.

The guarantee protects the lender from ultimate loss in the case of a buyer default, encouraging private lenders to offer the VA loan at a cheaper rate than other mortgage options, such as Jumbo loans or other mortgage loans.

What are the restrictions on VA loans?

Qualified veterans with full VA loan rights can borrow as much as the mortgage servicer company will allow them to without putting down any money. There is no VA loan limit on how much money you can borrow. However, there might be a county loan limit that applies. Buyers who are not eligible for the entire entitlement, have multiple active VA loans or have already lost one to foreclosure are eligible for VA loan limits from a mortgage lender. Please call us to learn how VA and county loan limits may affect you.

What is the cost of VA funding?

The VA Funding Fee and monthly payments go directly to VA to ensure that the program continues to operate for future generations of borrowers in the military service and military homebuyers. This helps maintain a balance in the market among different types of mortgage loans, including Jumbo and conventional mortgages.

The amount charged as a VA funding fee by a mortgage lender on a VA home loan varies depending on the borrower’s conditions. Regardless of how many times you have used the advantage, the Interest Rate Reduction Refinance Loan closing costs 0.5 percent.

The funding charge might be added to the total loan amount for VA borrowers. The VA will also impose a cap on closing expenses for veterans, allowing sellers to bear most of the VA funding fees. Many of our borrowers in the military service purchase homes with no money down until closing, but each buyer’s situation is unique.

The VA exempts certain eligible Native American Veterans and their spouses who survive them from getting the loan amount. Veterans who get benefits due to a service-connected disability are the most common recipients of an exemption. Survivors’ spouses with VA loan status are likewise exempt.

Is the VA loan a viable option?

VA loans are among the most cost-effective option with affordable closing costs. A VA-approved lender provides several significant advantages, including:

- the possibility of making a zero-down payment

- no mortgage insurance

- a high loan amount and flexible monthly payment

- flexible and forgiving credit requirements

- the industry’s lowest fixed loan rates

Each Veteran’s situation is unique. So speaking with a home loan expert about your VA home loan options will ensure you make the best financial decision possible. Additionally, checking your credit report can help you identify any issues affecting your eligibility for a VA loan.

What is the procedure for applying for a VA loan?

Speak with a reliable mortgage company familiar with VA loans and how to maximize this advantage. The pre-approval letter will show you exactly how much money you can spend. It will help demonstrate to sellers and listing agents that you have the qualifications to close. VA loans are guaranteed by a government agency, which helps reduce the risk for lenders and encourages them to offer better terms to veterans.

Begin my VA loan application with Veterans United Home Loans, the United States government-leading VA, by a lender.

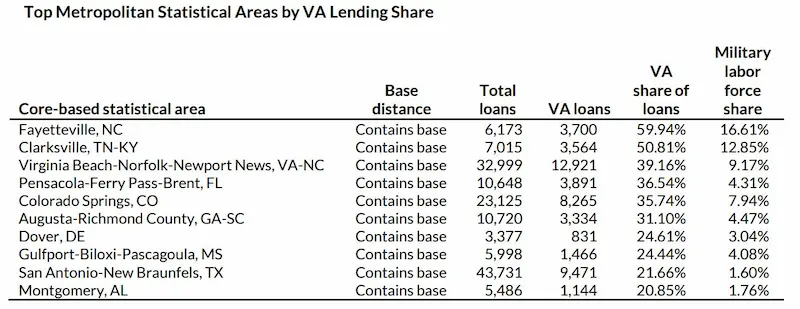

Below are some statistics on VA loans:

| Statistic | Value |

|---|---|

| Number of VA loans originated in 2021 | 2.3 million |

| Average VA loan amount in 2021 | $330,000 |

| Percentage of VA loans with no down payment | 92% |

| Percentage of VA loans with no PMI | 100% |

| Average interest rate on VA loans in 2021 | 3.25% |

| VA loan approval rate in 2021 | 95% |

Is reapplying for a VA loan feasible if I have already taken advantage of it?

This is not a one-time deal. Once you have earned a VA credit, you can use it for the rest of your life. You can use the VA loan as often as you want, even if you consider a non-VA loan in between. You can also be a part of many VA loans simultaneously as long as you meet the service commitment requirements and hold a valid certificate of eligibility.

Frequently Asked Questions

What is a VA loan, and who is eligible to apply for it?

A VA loan is a mortgage backed by the Department of Veterans Affairs available to eligible military members and veterans. Qualified applicants can receive 100% financing.

What are the key benefits of obtaining a VA loan compared to other types of mortgages?

Key VA loan benefits include no down payment, no monthly mortgage insurance, low interest rates, and no maximum or income limits. There are also more flexible credit and debt guidelines.

How does the VA loan approval process differ from traditional mortgage applications?

VA loans require a Certificate of Eligibility showing length of service, discharge status, and VA underwriting versus traditional income and credit score standards.

Are there any specific property requirements or restrictions when using a VA loan?

The VA has minimum property requirements and won’t finance fixer uppers. Properties must meet VA minimum standards and have the full VA appraisal amount.

Can a veteran or active-duty service member use their VA loan benefit more than once?

Yes, there is no limit on how often eligible borrowers can use a VA loan, provided they have enough entitlement to cover the purchase price or refinance amount.