A payday loan is a short-term, unsecured loan that offers debtors a way out of a financial emergency. People who can’t pay their monthly bills because of unexpected expenses like medical bills, car repairs, and job loss can borrow extra cash for a set amount of time through San Antonio Payday Loans. You may repay the borrowed emergency cash amount within the repayment term. The interest rate fluctuates based on the borrower’s repayment capacity and their short-term financial needs.

What Are Payday Loans in San Antonio, Texas?

Payday loans in San Antonio, Texas, are short-term loans with high-interest rates that allow consumers to borrow money for up to one month. These loans can help individuals manage unexpected bills and other short-term cash needs. Depending on the lender, the maximum loan amount in San Antonio ranges from $100 to $255. Borrowers have to show that they have a steady monthly income.

What Is a Same-Day Payday Loan?

Payday loans online same day are short-term loans enabling customers to borrow money from lenders for up to one month on the same day. The borrower will repay the loan amount plus costs in the next paycheck. Payday advances are another name for these types of loans. A single payday loan can quickly solve a borrower’s financial needs.

How Long Does Applying for Easy Loans in San Antonio Take?

It takes as little as 5 minutes to apply for payday loans. The loan application is online, so forget about lengthy paperwork, faxing, or phone calls. As an Online lender, unlike in-store payday loan lenders in San Antonio, you don’t have to worry about long queues or waiting days to process your online application. You do not need to worry about hard credit checks, either. With a high approval rate, loan approval can be fast, and you might even get an instant payday loan. If you apply today and get approved, you will receive the funds in 1-2 business days.

What Are the Loan Application Processes to Get a Payday Loan At GreenDayOnline?

Below is the simple application process for getting a payday loan at GreenDayOnline.

To get a cash loans instant at GreenDayOnline, First is to fill out the loan request form. It includes personal details such as name, address, contact information, and financial service information. Second, wait for the instant loan decision. GreenDayOnline reviews the information and decides whether to approve the loan. The third step involves the lender giving the borrower a loan agreement. The agreement outlines the loan terms, including the payday cash advance repayment schedule. The borrower signs the deal and makes a down payment. Finally, the borrower makes monthly or weekly loan payments per the loan agreement.

Why Is GreenDayOnline the Best Payday Loan Provider in San Antonio?

Listed below are the reasons why GreenDayOnline is the best payday loan provider:

- GreenDayOnline offers a quick loan application process, allowing borrowers to access funds within a short period.

- They have a network of reputable loan lending companies that provide competitive interest rates and flexible repayment terms.

- GreenDayOnline’s user-friendly platform makes it easy for borrowers to apply for an online payday loan in San Antonio.

- They maintain a high level of customer service and support throughout the entire loan application process.

- Instant decision. As soon as we receive your loan request, it will take seconds to get the application decision. GreenDayOnline approves loans faster compared to in-store payday loans. It makes it an ideal loan product for those needing quick access to funds.

- Safe to apply. If you have never applied for online payday loans in San Antonio, you may wonder whether the process is safe. At GreendayOnline, your application is safe and confidential, ensuring applicants with a bad credit history can apply without fear.

- Everything, from funding application, is safe and secure. It helps those facing financial hardship comfortably apply for a loan. All the personal and financial details shared with us are confidential. We don’t share customer information with third parties.

- Accessibility. Customers who apply for payday loans with us have 24/7 access their loan accounts. It ensures continuous stable income for borrowers, giving them peace of mind.

- Better rates. Applying for payday loans in San Antonio, Texas can be costly. GreenDayOnline is a group of lenders that offers personal loans online bad credit at better rates. We don’t have hidden charges, making our loans a reliable option during financial stress.

Is It Legal to Get a Payday Loan in San Antonio, Texas?

Yes, obtaining a Payday Loan or a payday loan in San Antonio, TX, is legal. People often only take out Payday Loans and Cash loans to cover short-term expenses. Other types of alternative lenders in San Antonio may be able to offer better deals with less hassle.

What Are the Types of Loans Can I Get in San Antonio?

Listed below are the different types of Loan Type payday loans, including their eligibility requirements and lending requirements:

- Cash advance loan. Cash advances, known as convenient cash advances, are often available from banks or credit unions with no fees. They allow users to put extra money toward simple requirements without fear of incurring overdraft fees. To qualify for this loan, you must provide proof of income.

- Check advance loan. Check advances are meant to offer emergency funding for people who use checks to pay for daily requirements. A check is frequently used to secure this loan, and identification is required. If you do not repay the entire amount of the loan on time, the lender may levy penalties and costs.

- Unsecured personal loan. Unsecured personal loans offer consumers affordable borrowing at competitive rates. This loan does not require collateral to be accepted. Repayment periods, however, vary depending on the lender and your circumstances.

- Payday loan. A payday loan is a short-term loan for $100-$1000, which you must repay when your next paycheck comes around. The lender deposits the money into your checking account immediately after instant approval.

What are the Payday Loan Requirements in San Antonio?

Listed below are the requirements to qualify for a payday loan in San Antonio from Quik Cash or other loan companies offering the Fastest Payday Loans:

- Valid identification. Valid identification includes a valid driver’s license or state-issued identification card. Most lenders need a recently issued ID with a current address and a clear photograph. Bring or upload a birth certificate, Social Security card, and proof of citizenship.

- Social Security Number. The borrower must provide a personal nine-digit Social Security Number. Lenders get proper credit and background information using the borrower’s Social Security Number.

- Income and employment verification. Borrowers must provide information about payment and employer to verify employment and source of income.

- Financial accounts and assets. Borrowers must submit a bank statement from an active bank account. A valid checking or online banking account helps borrowers achieve routing and account numbers.

- Complete the online form. To apply for the Fastest Payday Loans, complete the required online form accurately and submit it to the loan provider, such as Quik Cash or other loan companies available.

- Be aware of annual percentage rates. When comparing various payday loans, consider the annual percentage rates (APRs) to understand and compare the borrowing costs.

What Are the Alternatives to Payday Loans?

Listed below are the payday loan alternatives, which include hour paycheck loan lenders, loans lenders, assistance on cash expenses, Bad Credit Loans, and other options in the loan lending business.

- Savings. Savings should always be the first choice when looking for an alternative to a payday loan. Begin by putting a few dollars aside each paycheck into a designated savings account and working toward funding an emergency fund or paying off debts. It can help you meet your long-term financial needs and avoid relying on short-term credit in the case of an unexpected expense.

- Credit unions. Credit unions are nonprofit organizations that offer lower interest rates and reasonable repayment terms as alternatives to payday loans. They provide a professional service through cost-effective small-borrowing options and clear repayment terms that cater to your monthly installments. Joining one can be a great solution in the long run.

- Personal loans from banks. Personal loans from banks often come with lower interest rates than payday loans and more reasonable repayment terms, making them one of the most affordable alternatives. To qualify, you must provide evidence of your ability to repay the real cash money, such as proof of employment or asset information.

- Cash advances from your employer. If your employer is willing to provide an advance on wages, this could be a great alternative for you—especially if you pay any associated fees directly back to yourself through automated payroll deductions. Ensure that any agreement is in writing so that both parties have something to refer to if there are any disagreements or conflicts about payment commitments later. This option can help you avoid taking additional loans from other sources.

- Borrowing from family and friends. This option may not always be available depending on your relationships. Still, if possible, this may prove a less costly alternative than a payday loan since there won’t be any additional interest or penalties associated with late payments—which don’t necessarily exist with private loans either! Of course, there’s still a potential fallout risk if agreements aren’t honored, so ensure everyone involved understands what they’re committing to before entering into such an arrangement.

- Government assistance programs. State and federal governments may be able to provide much-needed assistance in times of financial stress through various relief programs such as welfare benefits, unemployment insurance, etc. Contact your local government office for more information on what is available if this becomes necessary during your financial journey.

- Low-income lending products. Some low-income lending products are designed specifically for individuals who don’t meet traditional lending criteria, which can serve as suitable (and potentially cheaper) alternatives compared to payday lenders. Several non-profits offer these types of services across various countries. Preapproved amounts are available at lower than usual market rates, with terms often linked to social impact programs managed by these organizations.

What Is Payday Loan, Direct Lender?

A payday loan direct lender is a company that lends money directly to people struggling to make ends meet. Payday lenders, on the other hand, give short-term financial assistance when customers require emergency funds but cannot obtain a regular loan from a bank. They usually offer day approval for loans, which can be helpful for those in immediate need of cash.

Is Credit History Necessary in Applying for a Payday Loan in San Antonio?

Yes, some lenders consider current credit history significant when applying for a payday loan in San Antonio. You should start creating one if you have no credit history. It entails having at least two active accounts with different banks, such as an active checking account, a savings account, and a debit card. A prepaid debit card is an excellent way to establish a credit history.

Prepaid cards allow you to earn interest and build your credit history, giving you better prospects for future loans and other finance. A valid phone number may also be required for lenders to contact you. Be prepared for lenders to charge a finance charge on a loan, which you should consider before applying.

Here are some statistics on payday loans in San Antonio, Texas:

| Statistic | Value |

|---|---|

| Average Payday Loan Amount | $500 |

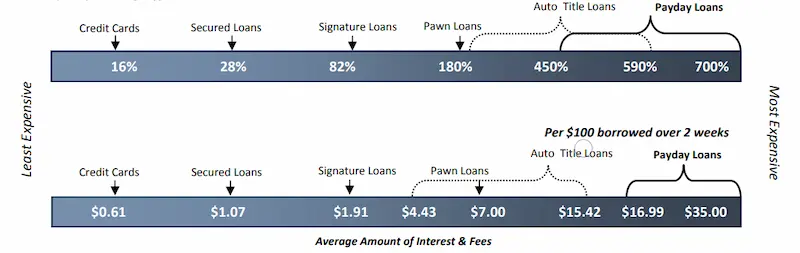

| Average Payday Loan APR | 521% |

| Average Payday Loan Term | 14 days |

| Percentage of Payday Loan Borrowers Who Roll Over Loans | 45% |

| Payday Loan Debt as a Problem | Yes |

| Number of Alternative Lending Options Available | Many |

Conclusion

A payday loan direct lender can be extremely helpful for those needing emergency funds for a short time. However, it’s essential to understand the importance of a good credit history when applying for these loans. Establishing credit through prepaid debit cards can be useful in building your credit history, making it easier to get approved for a payday loan in the future.

In San Antonio, Texas, a payday loan is a short-term, high-interest loan that allows consumers to borrow money for up to one month. The maximum amount varies between $100 and $255, and borrowers must have a steady monthly income. The application process for payday loans is quick and easy, taking as little as 5 minutes, and you can do it online.

GreenDayOnline is a reputable payday loan provider in San Antonio that offers instant decisions, safe and secure applications, 24/7 accessibility, and better rates than other providers. Obtaining a payday loan in San Antonio is legal. Still, other types of alternative lenders may be able to offer better deals with less hassle. Other types of loans available in San Antonio include cash advances, installment personal, and lines of credit.

Frequently Asked Questions

How do online payday loans in San Antonio, TX work, and are they available with no credit checks?

Payday lenders in San Antonio offer high-cost, short-term loans marketed as no credit check. However, most still check earnings, ID, and banking history. Interest and fees can exceed 400% APR.

What are the eligibility requirements for obtaining a same-day payday loan in San Antonio?

Same-day payday loans in San Antonio require proof of income, residence, ID, and an open checking account. However, approval is not guaranteed even when marketing no credit checks.

Are there any alternative financial options besides payday loans for San Antonio residents with poor credit?

Instead of payday loans, San Antonians with poor credit could explore local charity assistance, borrowing from family/friends, low-interest credit union loans, credit counseling, or negotiating bills.

What is the typical repayment period for payday loans in San Antonio, TX?

Payday loans in San Antonio usually must be repaid in full on the borrower’s next paydate, typically in 14 days or less. This short timeframe can create debt cycles.

What are the potential risks and fees associated with online payday loans in San Antonio?

Payday loans in San Antonio carry risks like steep fees, triple-digit APRs, short repayment windows, rolled over balances, defaults, and potential damage to credit scores.