Unsecured personal loans without credit checks are an effortless solution for those with bad credit scores. Online lenders do not require collateral for their loan offers, making it easier for individuals to secure funds despite a poor credit score. This type of loan is called a Credit Check Loan or bad credit loan.

The versatility of unsecured personal loans makes them a favored option. Borrowers can use the funds for any purpose, from covering unforeseen expenses to consolidating debt or financing a major purchase. Unsecured personal loans are readily accessible as they are available online, offering comfort to those seeking quick access to funds.

What Are Personal Unsecured Loans For Bad Credit With No Credit Check?

Personal unsecured loans for bad credit with no credit check are a financial solution made available by personal loan lenders that do not need security, such as a car or a house. It is based on the creditworthiness and financial situation of the borrower. Lenders differ in terms of minimum loan amounts and flexible terms, with some Internet lenders offering lower minimum loan amounts and more flexible terms than traditional banks. Types of loans such as these can be affected by a borrower’s credit reports and are an important factor in loan approval.

These loans cover high costs like credit card debt, house repairs, medical bills, or emergency expenses. Applying for a personal unsecured loan online is possible, and many online lenders provide the best rates and a simple online application process.

Online Personal Loan Rates and Repayment Terms For Low Credit Borrowers

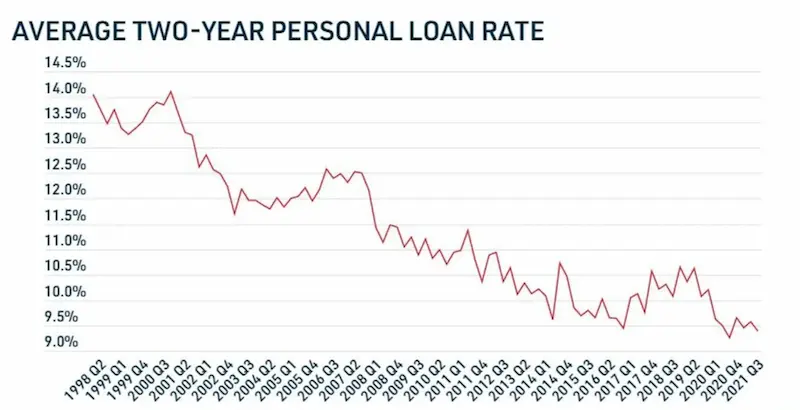

Online personal loan rates and repayment terms for low-credit borrowers vary, but they generally have a minimum credit score requirement and offer competitive interest rates. Many lenders perform a soft credit inquiry to determine a borrower’s creditworthiness and annual income, taking into account their financial history.

Loan terms and credit ratings play a significant role in deciding the interest rates and repayment periods. The competitive rates on personal loans vary, with some lenders offering rates that are lower than others. The terms of the personal or installment loan are sometimes different. Some lenders offer repayment terms as short as a business day or as long as several years.

What are the Unsecured Personal Loan Requirements For Borrowers With Fair Credit?

Applicants must meet the eligibility requirements to get approval for an unsecured personal loan with fair credit. Credit scores are among the most important requirements since lenders evaluate them to gauge a borrower’s creditworthiness and ability to make timely monthly income payments. A credit score of at least 600 is required for personal loan offers. The borrower’s income and debt-to-income ratio are other crucial considerations in the personal loan application procedure.

Financial institutions and lenders check the borrower’s annual income and compare it to their monthly installments to see if they can afford the loan. However, income ratio criteria for online lenders are sometimes lower than those for traditional banks.

Where can I apply for an unsecured personal loan for good credit?

Unsecured easy online loans for good credit are available from various lenders, including no-credit-check loan providers and direct lenders. Borrowers can apply for the loan through online banking or in-store. It is advisable to compare options from different lenders before applying, especially if considering traditional loans. Researching options and filling out an online form make it easy to find a lender who offers loans at convenient terms and rates within a network of lenders.

Listed below are the types of lenders who offer unsecured personal loans.

- Banks: Traditional banks are one of the options when looking for unsecured personal loans. Borrowers can talk to someone face to face here and have all their questions answered before applying.

- Credit unions: These non-profit organizations provide unsecured personal loans to their members. The loans come with reasonable terms and rates.

- Online lenders: Online lenders offer unsecured personal loans to borrowers who live in any state. The loans come with reasonable terms and rates, and borrowers can apply from the comfort of their homes.

- Peer-to-peer lenders: These websites match investors with borrowers based on their credit profiles. They generally offer lower interest rates than traditional banks or credit unions but charge higher fees.

At GreenDayOnline, we take pride in our extensive presence and commitment to serving customers across the United States. Our dedication to providing accessible financial solutions has allowed us to establish operations in several states, ensuring individuals can access unsecured personal loans when needed. Whether you reside in the vibrant cityscapes of the East Coast, the Midwest’s picturesque landscapes, or the West’s sun-drenched coastlines, we are here to offer you reliable and flexible loan options. Below, we present a comprehensive table listing all the American states where our company is actively operating, showcasing our commitment to nationwide coverage. Explore the table to discover the breadth of our reach, and allow us to assist you in realizing your financial goals.

| AL / Alabama | AK / Alaska | AZ / Arizona |

| AR / Arkansas | CA / California | CO / Colorado |

| CT / Connecticut | DE / Delaware | DC / District Of Columbia |

| FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana |

| IA / Iowa | KS / Kansas | KY / Kentucky |

| LA / Louisiana | ME / Maine | MD / Maryland |

| MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana |

| NE / Nebraska | NV / Nevada | NH / New Hampshire |

| NJ / New Jersey | NM / New Mexico | NY / New York |

| NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania |

| RI / Rhode Island | SC / South Carolina | SD / South Dakota |

| TN / Tennessee | TX / Texas | UT / Utah |

| VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

Benefits of Taking Out Unsecured Personal Loans Near Me With Guaranteed Approval

Unsecured personal loans “near me” with guaranteed approval are popular for several reasons. Listed below are the benefits of taking out unsecured personal loans.

- An unsecured personal loan has no constraints on how the borrower uses it, which makes it great for debt consolidation loans, student loans, or even managing unexpected expenses.

- Most unsecured personal loans have a fixed interest rate. The amount the borrowers pay monthly is fixed, making budgeting for loan repayments easier, especially for those with a regular income.

- Lenders for unsecured loans typically offer them with a flexible repayment period. The loan period varies from one to five years, allowing borrowers to plan according to their financial needs.

- Unsecured personal loans are available for large initiatives such as launching a company, making substantial home improvements, and tackling student loans. The loans are offered in large amounts. Borrowers can take a loan of up to $50,000 or even more.

- There are no prepayment fees. Paying off the loan early doesn’t incur any additional costs. Some lenders offer discounted rates with autopay arrangements, reducing interest repayments. This can benefit borrowers with proof of income and can efficiently manage repayments.

- Those with excellent credit scores can secure larger loans, allowing them to finance large purchases or pay off a debt, such as unexpected expenses or debt consolidation loans. These loans usually come with a fixed interest rate and a repayment period.

Below are statistics on Unsecured Personal Loans:

| Statistic | Value |

|---|---|

| Average interest rate | 10% |

| Average term | 36 months |

| Average loan amount | $10,000 |

| Most common use | Unexpected expenses |

| Other common uses | Debt consolidation, home improvement, and car repairs |

| Risks | High interest rates, long terms, and easy to qualify for |

| Alternatives | Secured personal loans, credit cards, and government assistance programs |

Things to watch out for When Obtaining A Personal Loan With No Credit History

Unsecured personal loans with no credit history are one of the most practical solutions to financial emergencies. However, there are some things that borrowers need to be aware of when applying for a personal credit loan. Some of these are listed below:

- Interest rate: Lenders offer these loans based on the borrower’s creditworthiness, so expect the interest rate to be higher. To get the lowest rates, consider performing a soft credit check before applying to know your eligibility.

- Fees: Borrowers need to know the fees associated with unsecured personal loans. These include origination fees, late payment fees, application fees, and prepayment penalties. It’s best to read the terms and conditions carefully before signing any agreement.

- Repayment period: The repayment period for unsecured personal loans is usually shorter than for secured loans. Shorter repayment periods mean higher monthly payments. Consider asking for flexible repayment terms or exploring a family loan for better management.

Unsecured personal loan borrowers must understand how much they must pay each month before applying. It’s best to have a solid budget in place to avoid getting into financial troubles later on.

When Is an Unsecured Personal Loan With Same Day Approval a Good Option for You?

An Unsecured loan with same day approval is a good option if the borrower needs money for emergencies, such as unexpected medical expenses and car repairs. Apart from that, it’s a good option for the following situations:

- Unsecured personal loans can be ideal when you need a short-term loan for a particular purpose.

- Unsecured personal loans might be the better choice for those needing a wide range of loan amounts and flexible repayment terms.

- An unsecured personal loan might suit your needs when considering an alternative option other than traditional bank loans.

- Unsecured personal installment loans are viable when you require a fixed-rate loan and want predictable monthly payments.

- Making large-time payments: Unsecured loan options are a good option for making large-time payments, such as buying a house or paying bills. Most loan agreements offer repayment flexibility and allow borrowers to repay monthly, quarterly, or annual. Alternative loans can also be considered in such scenarios, as they offer various borrowing options.

- Need quick funding: Unsecured personal loans are often easier to get approved for than other types of financial products, and they provide people with quick funding. Borrowers often get approved and receive the loan proceeds in hours rather than waiting weeks or months. This can be especially beneficial when needing Same-Day Funding for urgent expenses.

- Consolidate debt: Consolidating debt through an unsecured loan for debt consolidation is a good option since it’s easy to acquire and doesn’t require a credit check. Lenders often offer unsecured loans with flexible monthly payments, which are useful when paying off debt. By consolidating multiple debts into a single loan, borrowers can break free from the cycle of debt and better manage their finances.

Conclusion

With careful consideration and research, an unsecured personal loan fund is a great tool to help borrowers manage their finances. Generally, unsecured personal loans are a great option for those who need quick access to loan funds or want to consolidate debt. However, shopping around and comparing rates and terms from different lenders is important before committing to an approved loan. Ensure you understand the full cost of the loan, including any prepayment penalties.

Frequently Asked Questions

My loan request for home improvements needs to be approved. What should I do?

Many factors influence the approved loan decision when you need a loan for home improvements. They include credit score, income, and debt-to-income ratio. Most lenders provide feedback when they reject a loan application. Work on improving them and then reapply for the loan funds after discovering the reasons behind the rejection.

Do direct lenders only perform a hard credit inquiry?

Some direct lenders only use a hard credit check to assess the applicant’s credit profile and yearly income, like federal credit union institutions. However, the editorial staff of many financial outlets has noted that they sometimes perform credit checks and instead use other ways to identify the applicant’s eligibility.

What if I Default On A Bad Credit Direct Lender Unsecured Personal Loan?

In case you default on a bad credit direct lender unsecured personal loan, the lender reports the borrower to one of the credit bureaus. Defaulting on a loan negatively impacts the credit score, sometimes even dropping it by triple digits. This makes it harder for a person to get approved for future unsecured personal loans or other types of credit, such as auto loans.