How to Choose an Online Loan Provider For Your $1000 Loan

When you need to borrow money, selecting a reputable lender is essential to ensure a smooth and fair lending experience. This guide will discuss choosing the best online loan provider near me for your needs.

Understand Your Financial Situation and Eligibility Criteria For $1,000 Bad Credit Loans And Get Same Day Approval

Before applying for a loan a bad credit loan with same-day approval, it’s crucial to understand your current financial situation, including your minimum credit score requirement. Knowing your credit score will help determine which lender and loan product may work best for your unique circumstances.

You must also understand the eligibility criteria for the loans you are interested in. This may include income requirements, employment status, and residency requirements.

Research Different Direct Lenders For $1000 Loans With Poor Credit

Before choosing a specific direct lender for $1,000 loans with poor credit, you will want to compare various lenders, including banks, credit unions, online lenders, and payday lenders. Look for lenders with a broad network of lenders and competitive rates for your needs.

Read the Payday Loan Online Contract

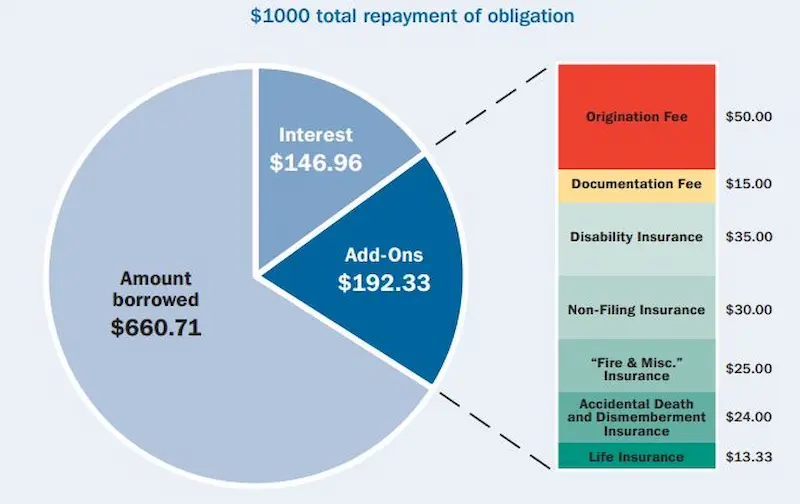

Always read and understand the terms and conditions of the loan contract carefully. Be aware of any fees, penalties, and interest rates associated with the payday loan online to avoid unexpected financial difficulties.

How Much Would a $1,000 Payday Loan Cost?

If you borrow $1,000 from a payday lender, how much will you owe them after a month? The annual percentage rate (APR) of a payday loan depends on the state where you live, but it is usually between $10 and $30 for every $100 you borrow. So, to repay a $1,000 loan, you will have to give back from $1,100 to $1,300 at the end of the month.

Quick Funding On No Credit Check “Direct Lender Loans” With A Same Day Direct Deposit

For those who require quick funding, choosing a lender with a streamlined application process and quick approval is essential. Many online lenders offer an online application process, which can significantly speed up the loan process. Requirements for instant approval when obtaining no credit check direct lender loans with direct deposit may include lending institutions requiring a pre-approval credit check or submitting the loan request form. Be sure to understand the requirements before proceeding.

Factor in Support for Poor Credit Histories When Applying For $1,000 Loans For Unemployed People

Suppose you have a less-than-perfect credit score and are looking for a loan for unemployed people. In that case, you may consider lenders specializing in poor credit loans and poor credit histories. These lenders are more likely to look beyond your credit score and might offer options to improve your chances of approval.

Make Payments on Time And Apply For Another Loan!

Finally, once you have secured a loan, make your payments on time to allow you to obtain another loan today. This can help you avoid late fees, damage to your credit score, and future financial difficulties.

By following these steps and carefully considering your options, you can find a lender that provides fair loan terms, easy access to funds, and the support necessary to help you navigate the loan process.

Guaranteed Approval No Credit Check Loans?

A $1,000 loan with “guaranteed approval” is a simple application loan that does not need a credit check. It includes proof of income and a valid ID. The approval of the loan is subject to the borrower meeting the lender’s criteria. Borrowers use these loans to cover any financial emergency.

$1000 Loans For Bad Credit?

A $1,000 loan for bad credit is available for individuals with a low credit score. However, the terms and interest rates are higher than those with good credit. Borrowers must read the loan agreement before signing. They must ensure they understand the repayment terms and potential fees. A bad credit loan company offen offers this type of loan.

$1000 Payday Loans Are Unsecured

An unsecured $1000 loan is not backed by collateral. The approval is based on the borrower’s creditworthiness and monthly income. Late payments sometimes negatively affect the borrower’s credit score and incur additional fees. Borrowers must ensure to repay the loan on time before applying. All they have to do is complete an online form with Greendayonline. Once done, they get their funds the next business day or even the same day if they apply in the morning.

At Greendayonline, we are committed to providing quick and convenient financial solutions to individuals across the United States, regardless of their credit history. Our services are available in several states, where we have established a strong presence and built trustworthy relationships with our customers. Whether you are facing unexpected expenses or need extra cash to cover urgent bills, our instant $1,000 loans with guaranteed approval are designed to assist you in times of financial need. To help you better understand our reach, we have compiled a comprehensive list of the American states where we are actively operating. Please refer to the table below to find your state and learn how we can promptly assist you in securing the funds you require.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

What Types Of $1,000 Loans Are There?

There are types of funding available; personal, payday, and installment loans. Bad credit payday loans and loans for persons with less-than-perfect financial histories are also an option for people.

Here are some statistics on $1,000 loans

| Feature | Value |

|---|---|

| Interest rates | 20% – 30% |

| APR | Varies |

| Repayment period | 12 – 24 months |

| Loan approval | Most likely |

| Risks | Short repayment period, high fees, default |

| Alternatives | Credit card, personal loan, family or friends |

Online payday loans up to $1,000 are legal in most states. Borrowers must repay payday loans on their next payday. They are short-term for up to 31 days. These loans provide instant decision and instant approval decisions, allowing borrowers with a bad credit history or limited credit history to have access to cash.

Installment loans are from $1000 to $5000, with monthly payments. Installment loans often have a repayment term of anything up to 60 months. Borrowers repay the money in equal monthly installments. These loans are suitable for those who want extra cash without the pressure of immediate repayment.

Personal loans: A personal loan is an unsecured loan used for various purposes. These include debt consolidation, home improvement, or unexpected expenses. Personal loans typically have a fixed interest rate, fixed repayment term, and fixed monthly payments. Personal loans differ from other loans, such as auto or mortgage loans, secured by a specific asset. These assets include a car or a house. Personal loans are unsecured, meaning they are not backed by collateral. Bad credit loans, known as personal loans for bad credit scores, are available for individuals with poor credit scores, provided they meet the requirements set by the bad credit lender. The loan decision is primarily based on the borrower’s ability to repay the loan, and these loans often come with higher interest rates and fees. However, they provide a wide range of possibilities for borrowers with different financial backgrounds and needs.

Both payday and installment loans are suitable for getting a 60-minute loan of $1,000.

Why are Americans unable to cover an unexpected $1,000 bill with savings?

| Scenario | Percentage |

|---|---|

| U.S. adults with fewer savings or no savings | 49% |

| U.S. adults who would pay for an emergency expense from their savings | 43% |

| U.S. adults with more emergency savings than credit card debt | 51% |

| U.S. adults with more credit card debt than emergency savings | 36% |

| U.S. adults with no credit card debt and no savings | 13% |

| People who would accrue credit card debt to pay for a $1,000 emergency expense and pay it off over time | 25% |

| People who say inflation is causing them to save less | 68% |

| People who are worried they wouldn’t be able to cover their living expenses for just one month if they lost their primary source of income | 68% |

| Millennials with more credit card debt than emergency savings | 45% |

| Gen Xers with more credit card debt than emergency savings | 44% |

| Baby boomers with more credit card debt than emergency savings | 25% |

According to Bankrate, the table from 2023 above shows the percentage of U.S. adults who have fewer savings, no savings, and more credit card debt than emergency savings. It also shows the percentage of U.S. adults who would pay for emergency expenses from their savings, have more emergency savings than credit card debt and have no credit card debt. These scenarios were chosen to highlight the current state of Americans’ emergency savings and credit card debt and their willingness to use their savings for unexpected expenses.

Can I Get A $1,000 Loan With No Denials And Guaranteed Approval?

No lender guarantees a loan completely. The likelihood of acceptance increases when applying for cash advances online. The lender does not examine the credit history using the major credit bureaus. GreenDayOnline’s lenders use no hard credit checks, which helps them approve most applications. Their statistics show that 80% of applicants are accepted. Due to their high approval rates, $1,000 loans are called “1000 dollar loans with guaranteed approval”

Frequently Asked Questions

How can I obtain a quick $1000 loan with bad credit and the promise of guaranteed approval, and what should I be cautious about when considering such offers?

Lenders promising guaranteed approvals on $1000 loans despite bad credit should be examined carefully, as approval is never fully guaranteed. Ensure lenders are reputable and fully understand loan terms.

Are there reputable lenders that provide instant approval for $1000 loans, even for individuals with poor credit, and what factors should I consider when choosing a lender?

Yes, some lenders provide quick approvals on $1000 loans for bad credit borrowers, but compare costs, terms, lender reviews, and regulatory compliance when selecting one.

What are the typical eligibility requirements for these types of loans, and do they truly involve no credit checks?

Instant approval $1000 loans typically only require ID, income verification, and a bank account. However, some soft credit checks may be done to confirm applicant details.

What should borrowers be aware of in terms of fees, interest rates, and repayment terms when seeking quick $1000 loans with bad credit?

High interest rates, origination fees, and short repayment timelines are common with these loans. Borrowers should understand the costs and have a repayment plan.

Are there any specific regulations or laws that govern these types of loans, and how can borrowers ensure they are dealing with legitimate lenders while avoiding potential scams?

Laws vary by state. Borrowers should research lenders, verify licensing, avoid upfront fees, and read the fine print to ensure legitimacy.