Payday loans in Maryland are short-term, high-interest loans that provide quick cash. They are excellent for individuals in need of funds before their next payday. They are generally intended for unexpected expenses or unexpected bills. In Maryland, payday loans are regulated by state law. They have specific requirements, such as maximum loan amount and maximum loan term.

GreenDayOnline is here to help people looking for payday loans in Maryland. The company is dedicated to helping people in similar situations. It offers them online payday loans in Maryland and personal loans, which are easy and quick to apply, with same-day approval and no credit checks. GreenDayOnline also provides information on payday loan alternatives for those seeking other options. There comes a time when people need quick money to care for an emergency. It is a common issue that is likely to happen to anyone, whether they have a steady monthly income. Online loans from GreenDayOnline can be a viable solution for those needing fast cash.

All they need is a quick cash loan to help them fix the situation and help them move on with their life during such times. It means they rule out getting help from a conventional bank loan since their loan processing is long. Thus, it won’t be able to help them deal with emergencies. They receive the payday loan online within the shortest time possible once borrowers submit their applications. They get the money without considering their credit score rating, making it easier during their financial distress.

Why Obtain a Maryland Online Payday Loan For Bad Credit With No Credit Check?

Borrowers need an online payday loan in Maryland for bad credit with no credit check for countless reasons. However, ensuring they only take a payday loan is important to help them handle unforeseen emergencies. They must not use them as a long-term financial solution but rather to manage monthly payments when needed.

Below are some things that require borrowers to take a payday loan in Maryland.

- Their bank declined the loan application: Sometimes, borrowers seek a traditional bank loan to help them pay a certain cost. Their loan application is declined or delayed, and their deadline is approaching soon due to one reason or another. They opt for a payday loan to help them deal with the situation as they try to sort things out with their traditional loan provider. This can be a crucial loan decision for those with limited time to manage their financial needs.

- They do not cover their monthly bills or buy groceries: These are some main reasons for considering a cash advance loan in Maryland. Some things are necessary for life, and people cannot do without them. Therefore, borrowers are short on cash and need to take care of any of these emergencies. A speedy payday loan helps in ensuring that they achieve this. In this case, managing one’s monthly expenses becomes an important factor for considering a payday loan.

- They want to avoid borrowing from their friends and relatives: Most people feel uncomfortable asking for financial help from their relatives or friends. Suppose they are one of those people. They must consider taking a cash advance loan to help them handle any financial emergencies. This choice can sometimes be influenced by the need to manage their monthly expenses while maintaining privacy.

- They need to take care of a debt likely to cost them: They risk losing some of their possessions and incur heavy penalties if a borrower has a debt with other payday loan borrowers approaching or past its due date. Therefore, to avoid such, consider taking a payday loan. It helps them cover some of these debts to avoid the inconvenience of delay in repaying such debts. This can also be a part of their overall loan decision process to prevent further financial issues.

Why Choose Greendayonline For Your Emergency Loans With Same Day Deposit?

Greendayonline provides an excellent alternative for those seeking emergency loans with same day deposit in Maryland. Our platform offers a variety of loan offers that cater to the unique needs of our clients. In addition, our repayment options are also flexible and easy to manage, minimizing the stress that can sometimes accompany loan commitments.

One of the many benefits of choosing Greendayonline is our Same-day funding option. This allows you to access the cash you need quickly, making it easier to address any urgent financial challenges you may be facing. By choosing Greendayonline for your payday loans in Maryland, you can rest assured that you’re making a smart decision backed by exceptional customer service and competitive terms.

- Clear terms and conditions: The company ensures that all its terms and conditions are clear during the application process. It helps to understand everything expected from them and the company. The company keeps the borrowers’ details safe. These include email address, credit card number, and phone number.

- Streamlined application process: The company offers a streamlined application process that allows applicants to quickly and easily apply for Maryland short-term loans. This simplified process makes it more convenient for borrowers to receive financial assistance when needed.

- Apply from anywhere: The good thing about their Maryland short-term loans is that borrowers apply for them on the go. They don’t need to leave their house or office to apply for a loan. All they have to do is complete the online application process and sign the loan agreement. They get approval within minutes of applying once done.

- Instant decision and quick approval process: The company reviews the application details once done once borrowers submit their online application form. Borrowers get feedback almost instantly on whether the loan has been approved or not and the approved amount. This instant decision allows borrowers to know the outcome of their application quickly. Borrowers expect the cash into their account within 24 hours if approved. Some get them on the same day in certain circumstances.

- Convenient application forms: Loans direct lenders provide large forms that take a long time to complete during the application process. However, it is different from Greendayonline’s network of lenders. Their application forms are simplified and completed quickly. They help borrowers quickly get instant cash advances online and handle financial emergencies.

We take great pride in serving individuals and communities across Maryland with our reliable and accessible payday loan services. Understanding the importance of local presence and convenience, we have strategically established our operations in key cities throughout the state. Below, you will find a comprehensive table highlighting the most significant cities where our company is actively engaged in providing payday loans. Whether you reside in a bustling metropolitan area or a charming suburban neighborhood, our dedicated team is committed to meeting your financial needs promptly and efficiently. Explore the table below to discover the cities where we are ready to assist you with our trusted payday loan services.

| Baltimore | Frederick | Gaithersburg |

| Rockville | Bowie | Hagerstown |

| Annapolis | College Park | Salisbury |

What Are The Legal Requirements To Qualify For Payday Loans Offered in Maryland

The following are the legal requirements. to qualify for payday loans offered in Maryland.

- Eligibility requirements include borrowers must not be a debtor in bankruptcy.

- Borrowers need to have a valid phone number and email address.

- Those on government benefits such as social security qualify as bad credit borrowers. Their bad credit histories do not matter when applying for a payday loan in Maryland. However, the company needs borrowers to provide proof of a steady source of income. It helps the company develop a suitable loan package.

- Borrowers must be Maryland residents to qualify for a short-term loan in MD.

- They must be above the age of 18.

What are the laws for MD payday loans with no denial?

The Maryland Office of the Commissioner of Financial Regulation regulates payday loans with noi denial in MD. Listed are some of the main rules and laws that apply to payday lending in Maryland, including repayment terms and other provisions:

- Maximum loan amount. The most payday loan amount that borrowers obtain in Maryland is $1,000.

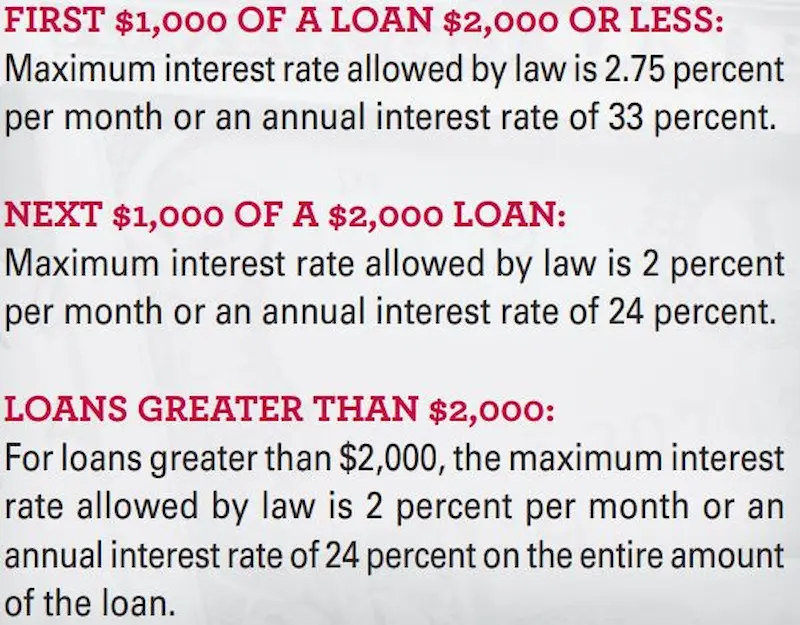

- The maximum finance charge. The maximum finance charge for a payday loan in Maryland is 2.75% per month, or 33% per year, on the unpaid principal balance.

- Maximum term. The maximum period for a payday loan in Maryland is 31 days.

- Rollovers. Rollovers or renewing a payday loan multiple times are not allowed in Maryland.

- Cooling-off period. Maryland law requires a one-business-day cooling-off period after a borrower has received two payday loans. The borrower must wait at least one business day before taking out a third payday loan.

- Business day funding. With payday loans, borrowers often experience faster access to funds than traditional loans. This access to loans can be crucial for those who need urgent financing.

- Repayment period. Payday loans usually have shorter repayment periods, and borrowers must ensure they can repay them on time to avoid additional charges or fees.

It’s important to note that these are some of the rules and regulations that apply to payday loans in Maryland. It’s always a good idea to carefully read and understand the loan terms and conditions of any loan before agreeing to it.

Are legit and safe payday loans different from installment loans near me with guaranteed approval?

Yes, legit and safe payday loans and installment loans near me with guaranteed approval are two different types of loans. These bad credit loans are small, short-term loans designed to be repaid in a single payment. Borrowers with poor credit scores repay them on their next payday. They come with high-interest rates and fees and are not intended for long-term borrowing. Installment loans are longer-term financial services repaid in fixed, equal payments over a set period. These payments are called installments, hence the name “installment loan.”

Borrowers use installment loans for a variety of purposes. These include home renovations, car purchases, or consolidating debt. Payday and installment loans are useful in certain situations, such as financial hardships. They have lower interest rates and fees than payday loans and are generally intended for longer-term borrowing. However, they come with risks and potential downsides.

Borrowers must consider their financial needs and options before choosing any loan. Suppose borrowers are considering a payday loan or an installment loan. They must understand the terms and conditions of the loan and ensure they can afford to make the required payments. When dealing with loan requests, it’s essential to be cautious and thoroughly assess the borrower’s ability to repay the loan.

Maryland residents looking for alternatives to payday loans may want to consider installment loans. Installment loans allow borrowers to repay over several scheduled payments. This can provide more flexibility than a single payday loan payment. To learn more about installment loans and how they work for borrowers in Maryland, check out our overview of Installment Loans in Maryland.

Where do Maryland residents obtain the best $200 payday loans from direct lenders only?

Payday lenders and credit unions are places where Maryland residents obtain the best $200 payday loans from direct lenders only, even with bad credit scores. Payday lenders are direct lending companies that specialize in offering small-dollar loans. These loans are generally designed to be repaid in a single payment on the borrower’s next payday. They help borrowers obtain extra cash for emergencies. The Maryland Office of the Commissioner of Financial Regulation must license payday lenders in Maryland. Licensed lenders are subject to certain rules and regulations designed to protect consumers. Credit unions are not-for-profit financial institutions owned and controlled by their members. Many credit unions offer short-term, payday alternative loans (PALs). It is a type of loan that is an alternative to traditional payday loans. Their maximum interest rates and fees are lower than payday loans. They are designed to be more affordable and flexible for borrowers.

What is the cost of $100-$500 same day loans approved immediately?

The cost of same-day loans of $100 – $500, approved immediately, vary depending on the interest rate applied. It’s a common misconception that such loans have high costs. The interest rate ranges from 5% to 35%, which is quite competitive compared to other market options. Suppose a borrower takes a $500 loan at an average interest rate of 20%. They repay around $600. It’s a fast and smooth way to handle sudden financial needs, particularly if you use it wisely and make timely repayments.

What is the difference between payday installment loans and title loans with instant approval and fast deposit?

Payday installment loans with instant approval and fast deposit and title loans are both types of short-term, high-interest loans. They are designed to provide people with quick cash in emergencies. However, there are some key differences between the two types of loans.

Small lending institutions or online lenders issue payday loans. They are based on the borrower’s income and employment history. The lender reviews the borrower’s information. They send an email message to the borrower with the loan terms and conditions once approved. People must provide proof of active email, a current pay stub, and a bank statement to apply for a payday loan.

Title loans are secured loans issued using a borrower’s vehicle as collateral. The lender can take possession of the vehicle if the borrower cannot repay the loan. Borrowers must provide the lender with a clear title for their vehicle and proof of active email to apply for a title loan. The lender reviews the borrower’s details and, if approved, sends an email message to the borrower with the loan terms and conditions. To initiate this process, one needs to submit a formal application.

The payday and title loans are both issued through GreenDayOnline’s lender network. They are obtained quickly but come with a high-interest rate and short-term duration. They are best used as a last resort, and borrowers must consider the terms and conditions before applying. A primary step in deciding whether or not to proceed is to explore various funding options available and compare their pros and cons.

What are the requirements for $300 Payday Loans From Online Companies Approved in 1 Hour?

The basic requirements for $300 payday loans from online companies in Maryland vary depending on the lender. However, some common requirements must be met to get a 1 hour loan. It’s essential to understand how the loan proceeds will be disbursed clearly and any additional charges or fees that may apply during the loan term.

- Proof of income: Borrowers must provide proof of income through pay stubs or bank statements. They help to ensure that the borrower can repay the loan.

- Identification: Borrowers must provide a valid government-issued ID. These include a driver’s license or passport to verify their identity.

- Active bank account: Borrowers must provide proof of an active bank account to receive the loan funds and set up automatic loan repayment.

- Other paper or electronic documents: Borrowers must provide either paper or electronic documents such as proof of income, ID, and active bank account.

- Internet access: Borrowers must have internet access to apply for the loan online. Online lenders need borrowers to complete the application process and submit the required documents electronically.

Here are some statistics on payday loans in Maryland:

| Statistic | Value |

|---|---|

| Legal Status | Legal |

| Number of Lenders | Over 100 |

| Average Interest Rate | 450% APR |

| Average Repayment Term | 14 days |

| Total Amount Taken Out Annually | $100 million |

| Risks | High interest rates, short repayment terms, risk of default |

| Alternatives | Personal loans, credit cards, government assistance programs |

Maryland lenders must follow state laws that regulate the safety of users. They must protect them from predatory lending practices. Payday loan lenders must disclose all the costs associated with the loan. These include interest rates and fees to borrowers before they agree to the loan. They must understand these costs and read and understand the loan terms before accepting them. Borrowers need to be aware of bills on time and various payment methods they can use to avoid late payments. Also, lenders must provide clear information about any origination fees associated with the loan.

Conclusion

Maryland enacted rate caps to legalize payday lending, unlike the banned Pennsylvania, Virginia, West Virginia, and Washington D.C., which prohibit the practice entirely. Maryland allowed access by capping rates at around 200% APR but with oversight curtailing the worst 500% APR abuses seen in some states. Maryland lawmakers continue working on solutions to balance access and affordability more effectively than outright bans in neighboring jurisdictions that reform groups argue are misguided and restrict consumer credit options. For now, Maryland’s approach promotes pricing transparency and supervision, although advocates argue lower rate caps should align with North Carolina, Delaware, and other nearby states.

Frequently Asked Questions

How do payday loans work in Maryland?

Payday loans in Maryland involve borrowing against your next paycheck and paying back the loan, plus fees and interest, all at once on your next pay date. Loans are available in stores and online.

What are the eligibility requirements for obtaining a payday loan in Maryland?

To get a payday loan in Maryland you’ll need government ID, proof of income, an active bank account, to be 18 years old, and contact details. No minimum credit score is required.

What is the maximum loan amount I can get from a payday lender in Maryland?

Maryland limits payday loan amounts to $1,000 or 35% of the borrower’s gross monthly income, whichever is less. First-time loans are capped at $500.

What are the fees and interest rates associated with payday loans in Maryland?

Maryland caps payday loan interest rates at 33% APR. Lenders can charge an origination fee up to $30 for first $500 borrowed. Renewals and unpaid fees are prohibited.

Are there any alternatives to payday loans for quick cash in Maryland?

Alternatives include credit cards, credit union loans, borrowing from family/friends, employer cash advances, pawn shops, bank personal loans, or assistance programs.