Instant Payday Loans Near Me in Wisconsin (WI) For Bad Credit From Direct Lenders Only

Wisconsin Instant Payday Loan services near me are available for those with small and short-term financial needs, and they are offered by bad credit direct lenders only. These loans are usually due on the borrower’s next paycheck. They are secured with post-dated checks or digital access to the person’s bank account. Payday loans in Wisconsin are straightforward compared to other loans from physical locations or online loan vendors. Before taking out a WI Payday Loan, it is essential to inspect all of the options and understand the terms and conditions of the loan. Borrowers must compare lenders’ fees and interest rates to secure the best possible deal.

SUMMARY

- Examples of payday loans in Wisconsin are small and short-term loans offered for emergency expenses or to bridge the gap until the next paycheck. These loans can be helpful for those facing unexpected expenses.

- Payday loans and no credit checks near me are available, but they come with high-risk, high-interest rates and must be cautiously approached.

- To be eligible for a payday loan in Wisconsin, one must be at least 18 years old, a resident of Wisconsin, have a steady income, and provide personal details such as name, address, and social security number.

- The finance charges for payday loans in Wisconsin can be at most 2.75% per month, and the outstanding debt can be at most $1,500 or 35% of the borrower’s monthly income.

- Reasons for taking out a payday loan include denied bank loans, difficulty paying Rent, needing to pay credit card debt, avoiding borrowing from family and friends, and paying off debt. These loans can be especially useful when dealing with unexpected expenses.

- To qualify for a payday loan, one must have valid identification and a steady source of income.

What Is a Legit Payday Loan With Guaranteed Approval & Same Day Deposit?

Legit payday loans with guaranteed approval and same-day deposit are typically paid back on a borrower’s following payday and are of small size. Their purpose is to give immediate money to people to utilize for unexpected expenditures or to bridge the time until their next salary. These loans are often advertised as an effortless way to gain access to money quickly. Significantly, borrowers comprehend how these loans function and the charges and interest rates connected with them if looking into taking out a payday loan.

What Is a Small Direct Lender Payday Cash Advance Loan With No Credit Check & No Denial?

A small direct lender payday cash advance loan with no credit check and no denial is a type of payday loan that does not necessitate the lender to inspect the borrower’s credit history before granting the loan. These loans are often promoted as an alternative for people with bad credit scores or no credit who need help to get accepted for other sorts of loans. These high-risk loans must be approached warily, although they appear beneficial for people with inadequate credit or bad credit scores. They frequently have extreme expenses and interest rates, meaning borrowers eventually land in economic difficulty if unable to repay the debt timely. Borrowers must consider all their choices thoroughly and be certain they know precisely the terms and conditions of the loan agreement before taking out a payday loan.

What Are the Eligibility Criteria for a Payday Loan in Wisconsin?

The following are the eligibility criteria for a payday loan in Wisconsin.

- Must be at least 18 years old. In the United States, lending money to anyone under 18 is illegal.

- Must be a resident of Wisconsin. Proof of legal residency must be provided to qualify for a payday loan in Wisconsin.

- Bad credit history is not a problem, but a steady source of income and proof of income with a monthly income of at least $1000 must be demonstrated to ensure loan repayment capability.

- A phone number and email address are required for cash advances online same day.

- Debtors in bankruptcy cannot apply.

GreenDayOnline only needs personal details, including the borrower’s social security number, name, address, and loan amount.

What Are the Payday Loan Rates On Wisconsin Loans Approved in 1 Hour?

The licensee charges interest at a rate of 2.75% per month on both the subsequent loan and the licensee if the licensee makes a subsequent 1 hour payday loan to the customer. A licensee won’t charge consumers a fee, database access fee, or use fee if the customer does not repay the subsequent loan in full on or before the subsequent loan’s maturity date. No licensee makes a payday loan to a customer that results in the client having an outstanding aggregate liability of more than $1,500 or 35% of the customer’s gross monthly income, whichever is less, to all licensees who have provided payday loans to the customer. A licensee depends on a consumer report to verify a customer’s income and review poor credit histories to determine approvable loan amounts.

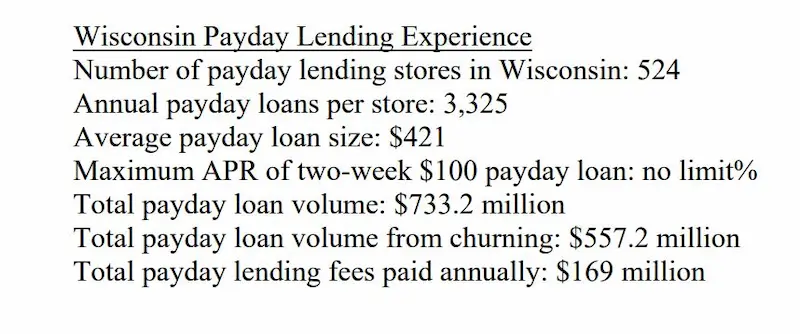

Here are some statistics on Payday Loans in Wisconsin:

| Statistic | Value |

|---|---|

| Legal Status | Legal |

| Number of Lenders | Over 100 |

| Average Interest Rate | 360% APR |

| Average Repayment Term | 14 days |

| Total Amount Taken Out Annually | $100 million |

| Risks | High-interest rates, short repayment terms, risk of default |

| Alternatives | Personal loans, credit cards, government assistance programs |

What Are the Reasons To Get $200 Payday Installment Loans Approved Immediately?

Below are the reasons to get $200 payday installment loans approved immediately.

- Denied Bank Loan and Need for Extra Cash

There is no way to safeguard oneself from financial ruin. Obtaining a bank loan or modifying a home loan takes time and effort. Sometimes it takes up to a year or more to convince a lender. Getting a short-term loan for borrowers to cover rent or mortgage payments is significantly simpler. Small financial advances are used by 70% of Americans for daily purposes or to cover consumer bills. Many debtors are perpetually short on cash and must borrow money to fulfill their debts. In such cases, having extra cash could help them overcome this obstacle. - It Is Difficult to Pay the Rent

Many folks have significant difficulties when it comes to paying their Rent. Finding the money to pay the Rent is a challenge for some people when other essential expenses need to be paid, such the electricity, groceries, car payments, and so on. Having enough money to pay the entire sum is even more challenging because most landlords need the first and last month’s Rent to be paid before move-in day. People with high Rent or whose income fluctuates frequently need help gathering sufficient resources to pay the due amount each month. Those who need assistance with their rent payments can access various services, including loan for borrowers. - Need to Pay Credit Card Debt

Credit card companies typically employ aggressive debt collection tactics, including frequent phone calls, threatening letters, and harassment. GreenDayOnline protects borrowers from harassing collection methods, including repeated phone calls and intimidating letters. It can be a helpful solution for those who need extra cash to pay off their credit card debt. - It Is Not a Good Idea to Borrow Money From Family and Friends

Sometimes, people can’t overcome their financial problems and turn to their families for financial help. Payday loans Online in Wisconsin are happy to guide borrowers with money troubles without asking relatives. This option makes it easier for people needing to access a loan for borrowers without involving their loved ones. - Debt Needs to Be Paid

Failure to pay a debt results in serious financial difficulties. Non-payment results in substantial fines and potential loss of assets based on the terms of agreements with lenders. The loan interest owed becomes secondary compared to the larger debt issue. Addressing the issue immediately may require finding extra cash to settle the debts and avoid further complications.

Guide on The Requirements for The Easiest Payday Loan With a Prepaid Debit Card

Listed below are the requirements to qualify for the easiest payday loan with a prepaid debit card:

- Valid identification. Valid identification includes a valid driver’s license or state-issued identification card. Most lenders need a recently issued ID with a current address and a clear photograph. Bring or upload a birth certificate, Social Security card, and proof of citizenship.

- Social Security Number. The borrower must provide a personal nine-digit Social Security Number. Lenders get proper credit and background information using the borrower’s Social Security Number.

- Income and employment verification. Borrowers must provide information about payment and employer to verify employment and income.

- Financial accounts and assets. A checking or online banking account helps borrowers achieve routing and account numbers. Borrowers must submit a bank statement from an active checking account.

How Can I Apply For $300 Payday Advance Loans From The Best Companies For Online Loans?

Listed below is the application process for $300 payday advance loans from the best companies for online loans.

- First, fill out the online form. Includes personal details such as name, address, contact information, and financial information.

- Second, wait for approval. GreenDayOnline’s lending partners review the information and decide whether to approve the loan.

- The third step involves the lender giving the borrower a loan agreement. The agreement outlines the loan terms including the repayment schedule and terms.

- Lastly, the borrower makes monthly or weekly loan payments per the loan agreement and repayment terms.

What Are the Advantages and Disadvantages of A $100-$500 Good Payday Loan?

Listed below are the advantages of a $100-$500 good payday loan.

- Quick access to funds – Borrowers can quickly access funds through payday loans.

- Guaranteed approval with no credit check – Since payday loans are not usually contingent upon a credit check, and they provide a viable option for those with weak credit who have been denied traditional loans due to credit score requirements.

- Quickly meet the requirements – Due to the relaxed conditions for approval, some borrowers find it simpler to get approved for a payday loan than a traditional bank loan.

- Convenient – Payday loans are obtained online and in traditional brick-and-mortar lending establishments, making them a potential credit lifeline for those without other options.

- Loans to customers with various credit profiles – Payday loans can extend loans to customers who may not be eligible for traditional lending options due to their credit history.

Listed below are the disadvantages of a payday loan.

- Predators are suspected – Some say payday lenders prey on the financially weak. Payday loan customers need help, but not lenders. People get aid with Rent, insurance, food, and other requirements till payday.

- The cost is high – The biggest disadvantage of fast payday loans is that they are expensive in terms of charges. For every $100 borrowed from a payday loan service, costs range from $10 to $30.

- Access to Bank Account Details – Some lenders request bank account information. Access to the bank account is given to the lender for security purposes when obtaining a payday loan.

- Debt Cycle Traps – Falling into debt cycles is frequent when periodically taking out payday loans. Payday loans are helpful in emergencies, but acquiring financial knowledge to minimize dependence on borrowing money is beneficial. It is important to utilize payday loans as needed, understand the personal financial situation, and make changes to reduce debt.

- Can’t Establish a Credit History – Payday loans do not aid in establishing credit. Other lending choices, like credit cards or personal loans, assist in building credit as long as borrowers repay them.

What Are the Benefits of Payday Loans Compared To Tribal Installment Loans?

Listed below are the following benefits associated with payday loans compared to tribal installment loans:

- Easy to repay – A payday loan is easy to repay. Borrowers need to pay off the amount borrowed when the next salary arrives. There are no penalties for paying early.

- Flexible repayment period – Borrowers usually repay payday loans when they receive their next paycheck, usually after a month. However, borrowers can repay the loan at any point during the loan’s duration.

- Competitive interest rates – GreenDayOnline offers reasonable interest rates.

- No hidden charges – GreenDayOnline has no application loan fees or other hidden finance charges. Additionally, there are no prepayment charges.

- No Service Fee – No service fee for requesting a loan at GreenDayOnline.

As a leading provider of payday loans in Wisconsin, our company has established a strong presence in numerous cities nationwide. We understand the financial needs of individuals and families during times of unexpected expenses or temporary cash shortfalls. To better serve our customers, we have strategically expanded our operations to the most important cities in Wisconsin, ensuring convenient access to our reliable and efficient payday loan services. The following table highlights the key cities where our company actively engages, allowing residents to benefit from our quick and accessible financial solutions.

| Milwaukee | Madison | Green Bay |

| Kenosha | Racine | Appleton |

| Waukesha | Eau Claire | Janesville |

| Oshkosh | West Allis | La Crosse |

| Sheboygan | Wauwatosa | Fond du Lac |

What Are the Alternatives to Payday Loans That Operating Under The Wisconsin Laws?

Below are some of Wisconsin’s payday loan options operating under the state’s law, such as installment loans and options from online lenders.

- Paycheck advance

Many employers allow staff members to receive the money they earned beforehand. The employer pays the worker for the whole week if a worker has put in seven days of labor, but their next payment isn’t due for another five days. No loan is being made. It is taken out of the borrower’s next paycheck. It is crucial to have a proper repayment plan in place to ensure smooth financial management. - Borrow from friends or family

Getting a loan from family or friends is a quick and often inexpensive way to escape problems. Make sure it is a commercial arrangement that benefits both parties and is a long-term financial solution. Borrowers expect to pay considerably lower interest rates and have more than two weeks to repay a loan. Create a document that outlines the loan’s conditions. - Credit Counseling

Credit counseling organizations provide free guidance on creating a manageable monthly budget and paying off debt. They can also help you devise a sustainable repayment plan to keep your finances on track. - Debt management plans

Nonprofit credit counseling organizations offer a service to lower credit card debt via debt management programs. The debt management plans service is available for a monthly charge. Borrowers can decide whether to accept the reduced interest rate the creditor has offered the agency. A monthly payment to the agency and the agency’s price to the creditors releases funds used to pay bills and lower the borrower’s debt, working towards a long-term financial solution. - Debt Settlement

Consider debt settlement a debt-reduction alternative. Debt settlement is agreeing to pay less than what is owed, negatively impacting credit history and scores. However, it can help you establish a repayment plan that works for your situation. - Peer-to-Peer Lending

Check out the online peer-to-peer lending websites if borrowers need help locating a funding source. The interest rates are close to 35% rather than the 6% rate that people with excellent credit get. Even at 35%, they are still far lower than the 391% payday lenders offer. Assess if this option can be a viable long-term financial solution for your needs.

For Wisconsin residents looking for alternative short-term financing options, installment loans can provide another viable route. Installment loans allow repayment over a series of scheduled payments rather than requiring full repayment by the next paycheck like a traditional payday loan. To learn more about the availability and terms of installment loans in Wisconsin as an alternative to payday loans, check out our guide on Installment Loans in Wisconsin.

Is GreenDayOnline a Direct Lender for Payday Loans Operating Under The Payday Loan Statute of Limitations?

GreenDayOnline is not a direct lender for payday loans; instead, it serves as a network of lenders available to borrowers operating under the payday loan statute of limitations. Submitting a loan request enables connection to partner lenders, though it does not guarantee receipt of an offer. GreenDayOnline endeavors to secure quick loans same day for short-term loans through a simple approval process. Quickly determine eligibility for an online loan and potential approval through GreenDayOnline. The final decision on eligibility rests with the lender. If approved, direct deposit of funds is available within one business day.

Conclusion

Wisconsin newly authorized payday lending but shows commitment to consumers through a 551% APR cap – unlike lower caps in Illinois and Minnesota and complete bans in Michigan and Iowa. While higher than some neighbors, Wisconsin maintains regulated in-state borrowing options with oversight. Future reforms could incrementally lower the rate limit further, but for now, the balanced policies enable short-term credit without permitting unrestricted abuse seen previously. Consumer groups still favor lower rates but praise steps taken toward a regulatory model avoiding outright bans that eliminate access.

Payday loans are short-term unsecured loans typically used to cover emergency costs and pay the Rent or mortgage until the borrower’s next payday. They are promoted as a convenient way to get borrowers’ hands on some cash quickly, but they backfire if borrowers don’t utilize them appropriately. Payday loans with no credit check are accessible but high-risk and must be approached cautiously.

Borrowers must be at least 18 years old, a Wisconsin resident, employed, and not in bankruptcy to qualify for a payday loan in Wisconsin. Wisconsin’s annual percentage rate (APR) for a payday loan is capped at 2.75 percent. Some reasons for receiving a payday loan include being denied a loan by a bank or requiring money to cover rent or mortgage obligations. Before signing for a payday loan, weighing financing options and learning as much as possible about the loan’s terms and circumstances is important.

Frequently Asked Questions

How can I obtain payday loans in Wisconsin with bad credit or no credit history, and what are the typical requirements for approval?

You can get Wisconsin payday loans through online lenders by providing ID, proof of income, and a bank account, even with bad credit. Lenders rarely do credit checks for these small, short-term loans.

Are there reputable payday loan lenders in Wisconsin known for providing options to borrowers with poor credit, and how can I find them?

Yes, trusted Wisconsin lenders offering payday loans for poor credit found online through their websites.

What factors should I consider when evaluating payday loan offers in Wisconsin, including fees, interest rates, and repayment terms?

When reviewing Wisconsin payday loans, compare total fees, APRs, flexibility of repayment schedules, and additional terms among lenders to find the best rates.

Are there any specific state regulations or laws in Wisconsin that govern payday loans, and what should borrowers be aware of to ensure responsible borrowing?

Wisconsin caps payday loan amounts at $1500 or 35% of gross monthly income. Loans cannot exceed 90 days and renewals are limited to prevent cycles of debt.

Can you explain the process of applying for payday loans in Wisconsin and how quickly borrowers can access the funds they need, especially with bad credit or no credit check involved?

You can apply online with Wisconsin lenders and receive a fast decision. If approved, funds may be deposited as soon as the next business day, even with bad credit.