A payday online loan is a short-term loan meant to help you handle any small and unanticipated expenses, such as unexpected emergencies. Due to their short-term nature, payday loans are not supposed to be used for long-term mortgage payments. Therefore, it is advisable only to take a payday loan to cover emergencies like buying groceries, car repairs, clearing due bills, and managing unexpected expenses. GreenDay Online Loans are committed to giving you personal and online payday loans that are safe and easy to get. These loans can help you stretch your money and pay for unexpected costs.

What is the Limit On AZ Payday Loans Online For Bad Credit With No Credit Check?

Our no credit check loans near you process have been simplified compared to conventional payday loans. In AZ, federal law limits payday loans for bad credit with no credit check to $2,500 per individual for one year. However, state authorities enable each county to determine the maximum amount lenders may charge individuals. With the help of loan agreement documentation and Online lenders, you can get your loan approval within 24 hours after approval. The loan limit that will be approved will depend on the details provided by you during the application process, which will be communicated to you almost instant loan online after submitting your application. The approval process is straightforward, and you will then be expected to repay the loan on your next payday, plus the interest.

How To Responsibly Borrow Emergency Loans Near Me With Low Credit?

If you wish to borrow money responsibly, you must ensure you have no outstanding bills. Exploring different loan options and submitting a loan request is essential to find the most suitable offer. When applying for emergency loans near me with low credit, attempt to learn how much a direct lender will charge you monthly. Charges could be expressed as a percentage of your loan amount rather than fixed monthly payments. Consider the APR as well. APR stands for Annual Percentage Rate. The interest rate you will be charged for using the loan comprises the base and variable rates. The base rate changes monthly; however, the variable portion can vary. Be aware that a higher interest rate may result in you paying more. When it comes to borrowing, it is wise to compare different lenders. Find one with the lowest APRs and the most competitive rates. Additionally, ensure you have your proof of income ready, as lenders may request this information to approve your loan options.

Can I Get a Payday Advance Loan in Arizona With Very Bad Credit?

You can get a payday advance loan in Arizona with very bad credit. A payday loan in Arizona is available for residents who need money fast with no strings attached. While they may be expensive, they are also convenient and easy to apply. Most payday loan lenders offer loans to bad credit borrowers with flexible repayment terms. Nothing stops you from getting one today if you need some extra funds soon.

What Is the Application Process for a $200 Arizona Payday Loan With Guaranteed Approval?

Online applications have made applying for a $300 payday loan in Arizona quick and hassle-free. Find a reputable payday loan lender for payday loans with guaranteed approval, fill out the necessary application form, and submit it. Within a few hours or less, you should receive a decision regarding your loan approval. If approved, the funds will be deposited into your account in a short amount of time.

The application for a payday loan in Arizona is simple. The loan application process for a payday loan differs from state to state and frequently depends on where you live. However, you must normally supply personal information such as your name, address, phone number, date of birth, work status, driver’s license/state ID number, and Social Security Number. In addition, employment verification may be required to ensure that you have a stable income. Suppose you have just been rejected for a loan or plan to apply elsewhere. You should contact the lender’s customer service department and inquire about their return policy. Inquire about how much money they want reimbursed and the variety of loan products they offer. They may offer you a lower amount if they allow partial payments or need complete payback in one installment.

In addition to payday loans, Arizona residents may also consider installment loans as a short-term borrowing option. Installment loans allow you to borrow a larger amount and repay it over several scheduled payments. To learn more about installment loans and how they work in Arizona, check out our informative article on Installment Loans Arizona

Is It Legal to Get a Small Quick Cash Loan With Same Day Deposit in Arizona?

Yes, obtaining a short-term financial needs payday loan in Arizona is perfectly legal if you follow all state regulations. To apply for a fast cash loan in Arizona, you must be 18 or older, a state resident, have a source of income, and have a bank statement. Some states permit payday loans up to $500, while others prohibit all short-term loans. Before applying for a small quick cash loan type with same-day deposit, check with your local consumer protection organization.

Below are some statistics on payday loans in Arizona:

| Statistic | Value |

|---|---|

| Average interest rate | 400% |

| Average term | 14 days |

| Average loan amount | $500 |

| Default rate | 1 in 4 |

| Arizona has some of the highest interest rates on payday loans in the country. | Yes |

| Payday loans can be a risky financial product. | Yes |

| Average interest rate | Yes |

What Are Best Alternatives to a 1 Hour Payday Loan With Instant Approval From a Direct Lender?

Listed below are the best alternatives to a 1-hour payday loan with instant approval from a direct lender.

1. Credit Unions Direct Payday Lender

You can opt for a direct payday lender to avoid going through a bank. This lender offers short-term loans to those who need cash quickly, usually within a business day. Always ensure that the direct payday lender is licensed to operate in your state and has a solid reputation for avoiding falling for scams.

Credit unions are member-owned and -operated cooperatives that offer a variety of financial products and services, including low-interest loans, to their constituents at no profit. They provide various loan products, such as loan contracts, and cater to different types of loans. Credit unions typically have more accommodating loan terms than conventional lenders like banks and finance businesses. Credit unions may be more lenient with loan criteria depending on the magnitude of the loan being sought. Credit check payday loans and other forms of short-term finance may be available through some credit unions.

2. Friends or Family

When you need money fast but want to avoid paying the high-interest rates and costs connected with Traditional payday loans, turn to your friends and relatives. Instead of getting a payday loan, you should always borrow money from close friends or family first since they can offer you better terms and consider your monthly income. One advantage is that they don’t normally have official paperwork or agreements, but this typically only applies when the amount borrowed is on a smaller scale, so it won’t help if you need significantly greater sums of money quickly.

3. Banks

Instead of relying on payday loans, see if you can negotiate a loan from your regular bank if you already have a relationship with them. Some banks, rather than taking the risk of having their customers slip into payday loan debt, may offer short-term personal loans to get you through unexpected circumstances. In this case, banks should consider the number of credit inquiries on your profile and offer loans with average interest rates much lower than payday loans.

4. Apps For Personal Loans

Rather than getting into further debt with a payday lender or dealing with high-interest-rate credit cards, many apps for personal loans now allow consumers to acquire tiny short-term loans from their company until their next paycheck. To further alleviate the burden of high-interest alternatives like credit cards and payday loans, apps like DailyPay and MoneyLion enable workers to receive instant cash advances from the company, promoting easier access to cash between paychecks. Employers can provide employees access to cash through these advances using apps without the high transaction expenses typically associated with traditional payroll advances (which involve collecting earnings statements or researching employment history and pay stubs).

5. Charities

Charities such as churches and other nonprofits aid the poor because they know how difficult it is to cope financially in times of crisis and how crucial it is to develop creative solutions that don’t compromise safety. Financial assistance in the form of small grants may be available from some organizations in some areas to help people get through difficult times until their next salary arrives. Charities often prioritize individuals who cannot meet ends, so these initiatives could be a good alternative to expensive short-term loans. One option could be a payday cash advance, but having a valid checking account and staying on top of your loan balance is important to avoid potential problems. Always practice active checking of your financial situation to make informed decisions.

What Is the Repayment Period of a $100-$500 Payday Loan Approved Immediately?

A $100-$500 payday loan approved immediately has a repayment period from two weeks to twelve months. Generally, the longer the payback time, the greater the APR. The debt is deemed paid off as long as you make monthly payments. However, if your balance surpasses one-fifth of your salary for 60 consecutive days, your lender may be forced to bring a lawsuit against you. This proceeding will almost certainly end in a foreclosure judgment.

What Are the Requirements For $300 Payday Installment Loans?

You must submit a loan request form to qualify for instant approval on a payday loan fo $300 or any other desired amount. Once the lender receives your request, they will review it and approve the loan if you meet their criteria. The process is designed to be quick and easy, ensuring you can cover any unexpected medical expenses or other financial needs without delay. Listed below are the payday loan requirements.

- A Stable Source of Income. You must show that you can repay the loan with regular and reliable revenue. Having a job or receiving regular governmental benefits like Social Security or disability is one way to do this. In addition, achieving a high Acceptance Rate can improve your chances of obtaining loan funding.

- Valid ID. You must provide valid photo identification, such as a driver’s license, passport, or state ID card.

- Bank Account. Most payday lenders require an active bank account to receive deposit funds and make payments when they become due. This is essential for business day funding to take place.

- Age Requirement. Most payday lenders require borrowers to be at least 18 to obtain a loan.

- Debt-to-Income Ratio. Most loan providers will look at your debt-to-income ratio before they agree to your terms (DTI). This is calculated by adding all monthly cash inflows and subtracting the amount that must be set aside to satisfy monthly debt payments. When the DTI is over 43%, certain lenders may not provide you with a loan or offer additional offers.

- Credit Score. Certain lenders will check your credit before giving you a payday loan, but this varies from service to service and is only sometimes a prerequisite to approval (even if you have horrible credit or no credit history).

- Contact Information. Many payday lenders will also require your contact information to ask you any more questions or check up on your references before granting your loan.

What Are the Things to Consider Before Taking Out a Payday Loan From Various Places?

Below are the things to consider before applying for a payday loan from various places. Make sure to evaluate the possibility of obtaining additional loans if needed, the availability of an extended payment plan to manage repayments, the ease of acquiring convenient loans as an alternative, and the option to receive funds through direct deposit.

- Interest Rate: Before taking out a payday loan, you must consider the interest rate that your loan will have. Payday loans typically have high-interest rates, making it difficult for borrowers to repay quickly. Ensure you understand how much interest you will be charged on the amount of money you borrow so that you don’t end up in a situation where you cannot make payments on time.

- Repayment Schemes: Be aware of any repayment schemes offered by lenders and avoid any terms or contracts that put you at risk of extra charges or being unable to pay back on time. It’s important to know your rights regarding payday loans and the different repayment options available before signing any contract with a lender.

- Eligibility Requirements: Check with potential lenders about their eligibility requirements for a payday loan, as every lender may have slightly different criteria. Factors such as income and credit score can often come into play, so determine if any minimum criteria are needed before applying for a loan.

- Fees & Charges: When looking for the best payday loan deal, it is important to check the charges for repaying the loan late or defaulting on repayments to know what financial penalties could apply should these situations arise.

- Repayment Duration: The duration of the repayment plan is something else that should be considered carefully before deciding whether or not to take out a payday loan – longer repayment durations may seem attractive. Still, they could mean more interest over time with higher monthly payments than short-term loans offer, so plan and work out which suits your circumstances best.

- Alternative Options: If possible, look into other options such as borrowing from family or friends, bank overdrafts, credit unions, small personal loans, or credit cards before choosing a payday loan, as these may offer better rates and terms than many lenders do when it comes to short-term borrowing needs.

- Loan Amounts: Finally, bear in mind the actual amounts that can be borrowed via payday loans – these can vary greatly depending on your income and current financial situation – so make sure to check how much money would be available before taking out a loan for it to cover your immediate needs without causing further problems further down the line.

In the dynamic landscape of Arizona, our company has established a strong presence in several key cities, providing reliable and accessible payday loan services to meet the diverse financial needs of individuals. With a commitment to exceptional customer service and a deep understanding of the local market, we have become a trusted partner for those seeking timely financial assistance. From the bustling urban centers to the charming suburban communities, we have strategically expanded our operations to ensure our services are readily available to residents throughout the state. Below, you will find a comprehensive list of the most significant cities in Arizona where our company is actively operating, offering quick and convenient payday loan solutions.

| Phoenix | Tucson | Mesa |

| Chandler | Gilbert | Glendale |

| Scottsdale | Peoria | Tempe |

| Surprise | Buckeye | Goodyear |

| Yuma | Avondale | Queen Creek |

Conclusion

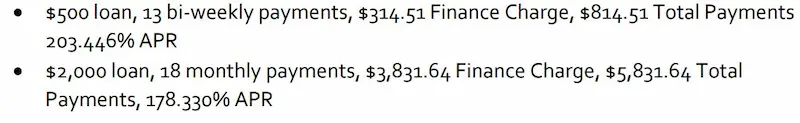

Arizona allows payday lending under statutes permitting higher costs than many states but with some restrictions on consecutive loans designed to protect consumers. Loan costs average over 200% APR statewide. Arizona’s regulations contrast with neighboring California‘s complete ban on payday loans within its borders. However Utah also authorizes high-cost payday lending showing a range of approaches across the region. Consumer advocates continue pushing for lower rate caps while industry groups argue against additional limits on access.

Payday loans are a short-term alternative for consumers needing help paying unanticipated costs. However, weigh the hefty interest rates and costs before opting for one of these loans. Before asking for a loan, a responsible borrower will shop around for the best interest rate, fully comprehend the APR, and have paid off any existing debts. Arizona has a yearly cap on payday loan debt of $2,500 per borrower, though this cap varies by county.

Payday loans in Arizona are available to those with poor credit, but other options can have cheaper rates and fees. These include personal loans from a bank or credit union, credit cards, borrowing from family or friends, and community organizations. Payday loans in Arizona are easily accessible and only demand basic personal information like name, address, phone number, date of birth, employment status, and social security number. As long as you abide by the state’s rules, short-term payday loans are permitted in Arizona.

Frequently Asked Questions

Are payday loans in Arizona available without a credit check?

Yes, most payday lenders in Arizona do not perform credit checks or require good credit for approval. They rely on income, ID, and a bank account to determine eligibility.

How can I get a same-day deposit payday loan in Arizona?

Look for lenders offering instant funding or same-day deposits to get a payday loan deposited into your Arizona bank account the same day you apply if approved early enough in the day.

What are the eligibility criteria for payday loans in Arizona?

The basic eligibility for payday loans in Arizona includes being 18+ years old, having a government-issued ID, proof of income, an active checking account, and contact information.

What are the maximum loan amounts and interest rates for payday loans in Arizona?

Arizona caps payday loan amounts at $500 for first loans and limits rates to no more than 36% APR. Repeat loans can be up to $500 with rates up to 204% APR.

Are there any alternatives to payday loans in Arizona for emergency financial needs?

Alternatives to payday loans in Arizona include pawn shop loans, credit union payday alternative loans, getting an advance from your employer, borrowing from family or friends, or seeking assistance from a nonprofit.