New Mexico Online Payday Loans – Obtain Small Loans With No Credit Checks & Same Day Deposit

Online payday loans with no credit checks and same-day deposit are small-scale, short-term loans due when the borrower’s next paycheck arrives. They range from $100 to $1,000. A payday loan helps people bridge the gap until they receive their upcoming payments. Payday loan lenders offer these loans, which are beneficial when someone in New Mexico needs extra funds to cover unforeseen medical costs. Credit check payday loans enable borrowers to get the necessary money for crises like health procedures without worrying about their credit score.

SUMMARY

- Payday loans in New Mexico are small-scale, short-term unsecured loans ranging from $100 to $1,000 to help bridge the gap until the borrower’s next paycheck.

- With simple qualifications, borrowers can apply for payday loans in physical stores or through online lenders.

- A payday loan is unsecured and requires the borrower to repay the loan plus interest when their next salary arrives.

- Requirements for a payday loan in New Mexico include a valid ID, Social Security number, monthly income, employment verification, and financial accounts or assets.

- Online payday loans are convenient and can be approved fast pay loans online quickly, but they come with a high-interest rate and potential hidden fees.

- The online application process for a payday loan in New Mexico involves submitting a loan request form, with the lender reviewing the details and presenting a loan agreement.

What is Payday Loan For Bad Credit Near Me in NM?

Payday loans for bad credit near me in New Mexico are short-term loans for bad credit, usually for amounts between $100 and $1,500. People typically use them for emergency expenses or bridging financial gaps when other loan options (like traditional bank loans) aren’t available. Payday loans charge high fees and interest rates, so they should be used as a last resort only by borrowers with bad credit.

Payday loans in New Mexico are generally short-term and only intended for use until the borrower’s next paycheck. Payday loans supply easy access to money for unforeseen costs or as a stopgap between pay periods. Consumers can apply for payday loans in a physical store or an online outlet, with some qualifications being simple compared to other loans. When searching for a payday loan in New Mexico, you must browse all available choices and fully grasp the terms and conditions. Comparing fees and interest rates from different lenders ensures the best deal.

New Mexico residents looking for more flexible repayment options may want to consider installment loans as well. Installment loans allow borrowers to repay over multiple scheduled payments, rather than the single lump sum payment required by payday loans. To learn more about the benefits and requirements of installment loans in New Mexico, check out our guide on Installment Loans New Mexico.

How Do Instant Payday Loans With Guaranteed Approval Work?

An instant payday loan with guaranteed approval is an unsecured, short-term loan of up to $1,000. The borrower pledges to return the loan plus interest when the next salary arrives. Borrowers must only borrow the needed amount and know their monthly income. Borrowers must be cautious while taking out loans.

What Are The Legal Requirements For $200 Payday Emergency Loans Approved Immediately?

Below are the requirements to qualify for a payday emergency loan for $200 or any other desired amount approved immediately.

- Valid identification: Borrowers must provide a valid driver’s license or state ID card as identification. The card must be recent and have a current address and a clear photo. Borrowers must bring or upload a birth certificate, Social Security card, and proof of citizenship.

- Social Security Number: The borrower must provide their nine-digit Social Security Number when applying for a loan. Lenders can access credit and background information related to the borrower with the SSN.

- Monthly income and employment verification: Borrowers must provide their payment details and work information, including their employment history, to be verified when applying for a payday loan application.

- Financial accounts and assets: A checking or online banking account provides borrowers with routing and account numbers.

- Credit history: While applying for a payday loan, lenders assess the borrower’s credit history to determine the likelihood of repayment.

Are Online Loans With Easy Approval A Good Option?

Yes, online loans with easy approval are a good option for people who need more time to visit a lender’s office. It is easy to apply, and borrowers get approval as soon as possible. A borrower gets payday loans by submitting complete requirements through an online form. The borrower receives money on the same day if the loan application is approved. Submitting an online loan application form with all the required data takes only 2-3 minutes to submit an online loan application form with all the required data. GreenDayOnline works best for borrowers, and bad credit loans are not an issue for short-term loans. Payday loans in New Mexico are an excellent option for clients who need extra cash fast. A borrower must provide proof of employment, source of income, and contact information.

What Are the Advantages and Disadvantages of Approved Payday Loans?

Listed below are the advantages of approved payday loans.

- Instant Approval: Approval is typically granted quickly when borrowers obtain a payday loan. Borrowers are approved on the same day if the borrower’s credentials meet the lender’s criteria. Bad credit borrowers are often eligible for Installment Loans and can choose to work with payday lenders.

- Easy Application Process: Submitting a loan request form quickly and easily is the way to start the online loan no credit check application process. No collateral or credit check is necessary after the form goes through the lender’s site. This process applies to both Installment Loans and payday loans.

- No Hidden Fees: Payday loans have no hidden fees but a high-interest rate – usually between 300 and 400 percent APR. The borrower must repay the full loan plus any charges the lender imposes. Installment Loans can offer lower rates in comparison, making them a better alternative for some borrowers.

- Low-Interest Rates: Payday loans often come with high-interest rates, but scouring the market yields more affordable options. Lenders reduce their interest rate if borrowers agree to repay the loan beforehand. Searching for better rates is particularly important when looking for Installment Loans since the repayment period is longer.

- Flexible Repayment Options: Most lenders enable auto payments, automatically deducting borrowers’ monthly dues, reducing the risk of missed payments. This convenience is available for both payday loans and Installment Loans.

- Short-Term Loans: Payday loans generally have a short-term duration and require complete payment and extra charges after a certain time. Extending the time by rolling over the balance is possible with the lender’s consent if a borrower cannot pay it off. Conversely, Installment Loans offer longer repayment periods, providing more flexibility for borrowers.

Listed below are the disadvantages of payday loans.

- Predators are suspected: It has been suggested that payday loan providers take advantage of those most vulnerable. However, customers need assistance with expenses like rent, insurance, and groceries until their paycheck arrives. Consequently, rather than relying on lenders for help, individuals must look for other sources of support.

- The cost is high: Payday loans are pricey. For each $100 borrowed, borrowers are charged anywhere from $10 to $30. The APR rate for these loans is usually high – between 300 and 400%.

- Borrowers Can’t Establish a Credit History: Payday loans are helpful when it comes to creating a credit record. On the other hand, credit cards or personal loans help develop credit if repaid on time.

What Is the Online Application Process for a $300 Payday Loan in New Mexico?

Applying for a $300 payday loan in New Mexico is the initial step, which requires submitting the loan request form, which contains details such as the borrower’s name, address, contact information, and financial information. Once done, the lender reviews the details to decide whether to approve the loan. The lender presents a loan agreement outlining the loan terms to the borrower, which includes repayment arrangements. The contract is signed by both parties before repayment with interest takes place when the next paycheck arrives.

Can I Get Payday Installment Loans With a Low Credit Rating?

Yes, a payday installment loan is possible even with a poor credit score, so long as specific terms and conditions are satisfied. Lenders mainly consider income when determining eligibility for a loan. They assess debt amount and recent debt settlement. Demonstrating the ability to make loan payments is necessary for approval.

Does Getting a Payday Loan From Online Companies Raise Borrower’s Credit Score?

Yes, an individual’s credit rating improves by acquiring a payday loan from online companies since it indicates that payments are likely to be made on schedule. Normally, some lenders forward repayments for payday loans to the credit bureaus. You must fully repay the loan and interest according to the timeline for the borrower’s credit score to increase. Those who pay late or miss payments damage their credit scores.

How Do In-Store Payday Loans Work Per The NM Laws?

In-store payday loans provide a small amount for a short period, often until the next salary check per the NM laws. It is necessary to visit a payday loan store in person and present some form of identification, proof of income, and evidence that the borrower possesses a valid bank account. After giving the information, one has to fill out an application and write the lender either a postdated check or allow them to withdraw the loan amount plus costs from their account on a predetermined date.

The borrower receives cash, or the funds are transferred into the borrower’s bank account if authorized for the loan. Borrower’s next paycheck must accomplish the entire amount required to repay with any additional fees/interest. It’s essential to reflect upon all potential charges and risks of taking out payday loans.

Who Is Eligible to Request a Payday Loan at GreenDayOnline?

Anyone can request a payday loan at GreenDayOnline, especially those who need extra cash for emergencies. The loan and associated interest are repayable on the borrower’s next paycheck. Eligible borrowers able to repay their loan on time can request a payday loan from GreenDayOnline.

In our commitment to providing accessible financial solutions, we have established a strong presence across various cities in the beautiful state of New Mexico. With a focus on meeting the urgent monetary needs of individuals, our company has strategically expanded its operations to key urban centers. This table showcases the most important cities where we are actively engaged, ensuring that residents can conveniently access our reliable payday loan services. Whether you’re in need of quick financial assistance or seeking a trustworthy lending partner, we are dedicated to serving you in these vital New Mexican cities. Take a look at the table below to discover the locations where our company is ready to help you navigate financial challenges swiftly and efficiently.

| Albuquerque | Las Cruces | Rio Rancho |

| Santa Fe | Roswell | Farmington |

| Hobbs | Clovis | Alamogordo |

What Types of Online Loans Can I Get in New Mexico?

Listed below are the different types of online payday loans in New Mexico:

- Cash advance loan: Banks and credit unions typically offer cash advances to users with no additional fees. A cash advance loan allows the borrower to pay extra without penalty, but proof of income is necessary to qualify.

- Check advance loan: Check advances give people quick access to money when using checks for daily expenses. A check and identification are necessary for approval. Paying only part of the amount when due leads to penalties and fees from the lender.

- Unsecured personal loan: Unsecured personal loans provide borrowers access to money without requiring collateral. The lender and borrower’s circumstances determine the repayment period.

- Payday loan: A payday loan is a small, short-term loan of up to $1000 in the borrower’s checking account soon after approval and must be paid back when the borrower receives the next paycheck.

Here are some statistics on Payday Loans in New Mexico:

| Statistic | Value |

|---|---|

| Average Payday Loan Amount | $500 |

| Average Payday Loan APR | 591% |

| Average Payday Loan Term | 2 weeks |

| Percentage of Payday Loan Borrowers Who Roll Over Loans | 20% |

| Payday Loan Debt as a Major Problem | Yes |

| Number of Alternative Lending Options Available | Many |

Is GreenDayOnline a Direct Lender for $100-$500 Payday Loans?

No, GreenDayOnline is not a payday loans direct lender for $100-$500 payday loans itself. Instead, it functions as a network of lenders to specific states. GreenDayOnline’s online loan procedure takes minutes and helps define if borrowers meet the conditions to get a loan through GreenDayOnline. The lender evaluates whether or not the borrower meets all criteria; The borrower receives the funds on the next business day if approved. Applying for a loan does not ensure approval; it only enables GreenDayOnline to ask lending partners if they can provide a financial product.

Conclusion

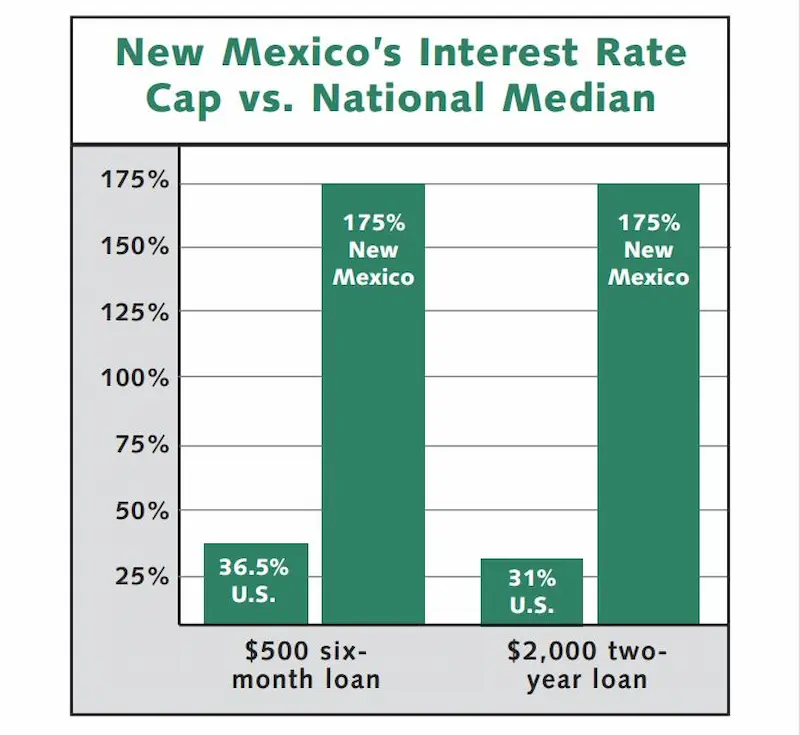

New Mexico enacted thoughtful payday lending reforms to deter debt traps through rate caps – not lobbying bans argued for by some advocates. At 175% APR costs are high but now regulated, avoiding previous unrestricted 1,000% APR abuse. Going forward New Mexico can lower rates further but already progressed protecting consumers from worst exploitation while maintaining access. New laws foster transparency and oversight exceeding Texas, Oklahoma, Arizona, Utah, and Colorado which have higher or no caps. Reform groups cite New Mexico’s approach as a model to expand upon through continued legislative improvements versus total bans. Industry groups still argue the rate cap could be raised without harming consumers.

Payday loans in New Mexico are short-term, small-scale loans that help borrowers bridge the gap between pay periods for their short-term financial needs. Payday loans range from $100 to $1,000 and are available through physical stores or online outlets. To qualify for a payday loan in New Mexico, borrowers must provide.

- Valid identification.

- Their Social Security Number.

- Proof of income and employment.

- Financial account information.

Online loans are the best option as they offer easy application, instant approval, and no hidden fees. However, payday loans come with high-interest rates, and borrowers need to be cautious when taking out these loans and compare fees and competitive rates from different lenders to get the best deal possible.

Frequently Asked Questions

How can I apply for online payday loans in New Mexico with no credit checks, and what is the typical process for receiving funds on the same day?

You can apply for online payday loans in New Mexico by submitting personal information through lenders’ sites. If approved, funds are often deposited directly into bank accounts via ACH transfers the same or next day.

What are the eligibility criteria for obtaining online payday loans in New Mexico, and are there any options for borrowers with poor or no credit history?

Online payday lenders in New Mexico generally require only proof of income, a bank account, ID, and to be over 18. Bad credit is usually not a barrier, making these accessible for borrowers with poor credit.

Are there reputable online payday loan providers in New Mexico that offer favorable terms and competitive rates for borrowers in need of quick cash?

Yes, there are some top online payday lenders in New Mexico known for competitive rates, flexible terms, and timely funding options.

What should borrowers be aware of in terms of fees, interest rates, and repayment terms when considering online payday loans in New Mexico?

Payday loans in NM can have high interest rates and fees. Borrowers should research total costs, repayment terms, and have a plan to repay on time to avoid renewals and mounting debt.

Are there any specific state regulations or laws in New Mexico that govern online payday loans, and how can borrowers ensure they are making informed decisions when applying for such loans?

New Mexico caps payday loan amounts at 25% of gross monthly income or $500, whichever is less. Loans must be for 120-130 days. Knowing the laws can help borrowers make informed decisions.