Washington State is a great place to reside because of its sunny beaches and comfortable climate. Each city has a distinct history, culture, and customs. Due to the high cost of living, some individuals need help to make ends meet. Many people have difficulty paying their rent, mortgage, and utility bills. Payday loans help you get by in a pinch. Because of the regulations, payday loans are a smart solution to handle difficulties. Online payday lenders in Washington are provided to anyone needing instant cash. These statistics help borrowers make the best choice possible.

What are Small Payday Lenders For Bad Credit With No Credit Check in WA State?

Small payday lenders for bad credit with no credit check in WA are reputable financial institutions that offer various loan offers and specialize in short-term loan assistance. They cater to individuals needing quick financial support, like a loan request for emergency expenses, car repairs, or medical bills. These lenders work with different types of loan options, ensuring every borrower finds a solution tailored to their needs. With a swift application process, instant approval, and an easy payday loan application, many people in Washington State have successfully overcome financial hurdles thanks to these reputable lenders.

What is a direct lender? Direct lenders are businesses or individuals who provide short-term loans. These loans must be repaid in full, including interest and fees, within a short period. Direct payday lenders handle all small payday loans in Washington. Repaying the loan ahead of its due date is an excellent way to avoid getting into trouble and dealing with an unexpected expense. Some lending firms sell customer information, which can impact your credit profile. These include credit card numbers, email addresses, and phone numbers. It is a well-known fact that some rogue lenders do that.

The loan application process is straightforward, and the quick loan approval process ensures timely access to funds. Washington’s direct lenders prevent third parties from interfering with the process, ensuring access to emergency cash. Washington’s direct internet payday lenders do not authorize third parties to interfere in the process, making it easier to obtain quick payday loans. All information is sent between direct lenders and customers, making the payday loan online experience seamless.

Online Services For Washington’s Easy Payday Loans With Guaranteed Approval & Same say Deposit

There are various online services for Washington’s easy payday loans with guaranteed approval and same day deposit. Washington payday loans provide several other perks, such as quick cash advance and instant approval decisions. These online short-term cash advances are also available in the growing online lending market. Borrowers aren’t required to visit a store or queue to apply for payday loans online. They can fill out the loan application form. Complete the loan application form, and you will only spend time figuring out how to complete the online application. Borrowers can apply for Washington online payday loans using a step-by-step procedure. Once approved, they enjoy an emergency loan approval rate and get the cash within one business day funding. It ensures access to cash is quick and efficient.

The service is well-known for its quick approval times. After completing the application form, borrowers have to wait for a response. You will be the one to sign the loan agreement. We will transfer the loan proceeds to your bank account within one business day. You may also like to investigate payday loans with no credit check. Individuals with a bad credit history or a bad credit score are having difficulty getting loans from other lenders. Regardless of your credit score, payday loan platforms may be an amazing alternative for loans for people with substandard credit history. Payday lenders do not check credit report scores with the major credit bureaus. Direct lenders examine borrowers’ employment histories and regular income to determine their ability to repay a loan advance. Loans for persons with poor credit scores need timely payment.

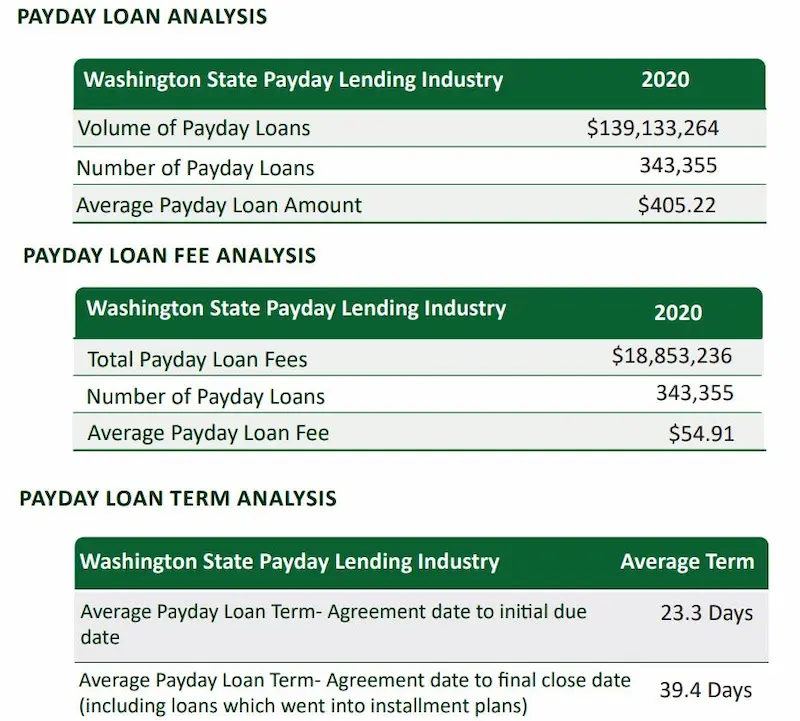

Statistics For 1 Hour Payday Loans That Accept Anyone In Washington State

In Washington, 1-hour payday loans that accept anyone have a maximum loan limit of $1000 and a maximum loan term of 31 days. A $100 payday loan is the smallest amount you can borrow. Borrowers must repay within seven days to one month. Assume that a borrower obtains a 14-day $100 loan. A borrower cannot apply for multiple cash loans at once. Additionally, rollovers are illegal. Finance costs range from 16.11 and 419 percent. The maximum financing cost in Washington is 10% plus a 5% verification fee.

Personal loan customers should be aware that they have a 24-hour cooling-off period before canceling. The client can explain why they do not want the loan. Bad credit borrowers and legal residents sometimes need help to repay their debts on the due date. Payday loans are accessible with a two-month grace period and can be an option for payday loans for cash-strapped borrowers.

One advantage of payday loans is the minimum credit score requirement, which means that even borrowers with a low credit score can potentially get approved. Before applying for a cash advance loan, borrowers are advised to have a regular source of income to increase the chances of approval and to be able to afford the flexible repayment terms.

Here are some statistics on Payday Loans Washington

| Statistic | Value |

|---|---|

| Average Payday Loan Amount | $500 |

| Average Payday Loan APR | 195% |

| Average Payday Loan Term | 14 days |

| Percentage of Payday Loan Borrowers Who Roll Over Loans | 15% |

| Payday Loan Debt as a Problem | Yes |

| Number of Alternative Lending Options Available | Many |

Washington residents looking for more flexible repayment options may want to consider installment loans as well. Our online lending platform offers installment loans in Washington that allow borrowers to pay back the loan amount in multiple payments over time. Installment loans provide another viable borrowing alternative with competitive rates and terms.

$100-$500 Payday Loans in Washington are Now Available Near Me

Borrowers may submit application applications for Washington state $100-$500 payday loans online if they want a quick loan. Kindly complete the form to determine if the lender will accept the application. Suppose borrowers don’t like an installment plan’s finance charge rates or loan terms. They are free to decline the offer. Payday loans near me in Washington are the ideal alternative if you need money immediately, with the quickest approval process. With a range of loans to choose from, borrowers can find a suitable loan product for their needs.

As a leading provider of payday loans in Washington, we take pride in our extensive reach across the state. Our commitment to serving individuals in need of short-term financial assistance has allowed us to establish a strong presence in several key cities throughout Washington. Whether you reside in the bustling urban centers or the quieter suburban neighborhoods, our services are readily accessible. We understand the urgency of financial challenges, and our dedicated team is ready to assist you with quick and convenient payday loan solutions. Below is a table highlighting the most important cities where our company is actively engaged in helping individuals meet their financial needs.

| Seattle | Spokane | Tacoma |

| Vancouver | Bellevue | Kent |

| Everett | Spokane Valley | Renton |

| Yakima | Federal Way | Bellingham |

| Kirkland | Kennewick | Auburn |

Are the easiest payday loans legal in Washington, DC?

The easiest payday loans are legal in Washington, DC, offering access to credit through a network of lenders. Borrowers must understand that they are subject to certain regulations. Payday lenders in Washington, DC, must be licensed and provide competitive rates. The Washington Department of Financial Institutions (DFI) regulates payday lending.

What Are The Prerequisites For The Best Payday Loans in Washington DC?

The best payday loan transactions have minimal requirements, allowing you to make an informed decision.

- Residents of Washington state must be eligible to vote legally.

- The smallest age requirement is 18 years.

- Physical address.

- Your Social Security Number

- To open a current checking account with a bank.

- Source of income, like minimum income. It must be a steady income.

- Having a working phone number and a valid email address is critical.

- Flexible Loans and instant cash advances are available through instant payday loan companies

- Bad credit loans options to cater to those with less than perfect credit history

- A dedicated customer service team to assist with any queries regarding the loan application or repayment

What if I am unable to make the payment on my $300 loan by the due date?

If you cannot make the payment for the $300 loan by the due date, it is essential to contact your lender’s customer service team. They may be able to help you work out a better repayment plan or discuss other options to manage your personal finance.

Suppose a borrower cannot make a small-dollar loan payment by the due date. They must contact the online lender as soon as possible to work out an alternative payment plan. Some lenders offer a wide range of solutions and a painless lending process to make it easier to repay. Depending on the lender’s policies, some borrowers extend the loan repayment plan for an extra fee. Some prefer to negotiate a new payment schedule using different forms of funding. Borrowers must remember that they pay more if they cannot make a payday loan on time. For instance, lenders might charge them additional fees and interest charges. These additional charges make it more difficult to pay off the Fastest loan. So it’s important to avoid this situation by aiming for the quickest emergency loan approval.

Types of emergency loans and lenders provide straightforward services and excellent customer service to help borrowers navigate repayment challenges. They help negotiate a solution that allows the borrower to repay it easily. Some lenders even take borrowers to court to try to recover the money. In such a case, borrowers must consider seeking legal advice. An attorney helps them understand their rights and options.

What is the difference between payday loans and title loans that follow the WA laws?

Payday loans and title loans that follow the WA laws are short-term, high-interest loans. They aim to provide borrowers with quick cash in emergencies. However, there are some key differences between the two types of loans.

Payday loans are unsecured loans issued by small lending institutions or online lenders. They are based on the borrower’s income and employment history and have a term of 14 to 18 days. Some go up to 31 days. To apply for an 18-day payday loan, borrowers must provide proof of income, a current pay stub, and a bank statement. The lender reviews the borrower’s information. Once approved, they provide the loan funds. This process offers a relatively quick experience for applicants. However, it’s essential to know the cost of loans, as they can contribute to a heavy debt.

An important aspect to consider is the income gap between paychecks, which could lead to the need for these short-term loans. Furthermore, having a bank checking could be a way to help avoid the emergency loan impact on your financial situation. Exploring other possibilities, like lines of credit before opting for payday or title loans, is also essential.

Title loans, also known as auto title loans, are secured loans. Lenders issue them using a borrower’s vehicle as collateral. Suppose the borrower cannot repay the loan. The lender has the right to take possession of the vehicle. Title loans have a longer term than the lenders marketplaces for salary loans, usually 30 days. To apply for a title loan, borrowers must provide the lender with a clear title for their vehicle, income proof, and address. The lender reviews the borrower’s information, including their income ratio, and, if approved, provides the auto loan funds.

One main difference between the two loans is that payday loans are unsecured, and title loans are secured. Additionally, small-dollar loans have shorter terms and higher interest rates. Borrowers must know that they may lose their vehicle if they miss a payment or default on a title loan. Borrowers must review the payment activity, the prepayment penalties, and the insufficient funds fees along with the terms and conditions of the loan before accepting it. Soft credit checks and a smooth experience for applicants might also vary between lenders during the application process.

Benefits of $200 small loans obtained from payday loan places

The following are the benefits of $200 small loans obtained from payday loan places.

- Pros – Small Payday Loans. Payday loans in Walla Walla provide borrowers with quick cash. They help them address emergency expenses or unexpected financial needs. They are approved and funded quickly, usually within 24 hours.

- Credit builder. Some payday loans are a good option for borrowers with bad credit or no credit history. Few lenders help borrowers build credit by allowing them to prove their ability to repay a loan on time. Once done, they report repayments to the major credit bureaus. It can also aid in reducing credit card debts.

- Financial issues. Payday loans help borrowers address financial issues. These include unexpected medical expenses, car repairs, or other urgent needs such as student loans or tribal loans.

- Credit reserve. Payday loans provide borrowers with a reserve of credit that they access in an emergency. Thus they provide peace of mind and a sense of financial security. Using a well-known lender marketplace, borrowers can find loans with a repayment period of 90-180 days to better suit their needs.

- Accessibility. In today’s digital world, borrowers can easily apply for Pros – Small Payday Loans through their mobile phone, making the process more convenient and quicker.

Small-dollar loans are still high-interest, high-risk loan options despite the potential benefits. Borrowers must use them cautiously due to the cost of the loan. They must review the terms and conditions of the loan and the cost of the loan before accepting it. A combination of credit score assessment, reading valuable articles and informative articles can help borrowers make informed decisions. Using tools like a personal loan calculator can also be beneficial in understanding the loan repayment structure. It’s essential to consider alternatives, like converting debts to business loans, to find the best fitting solution for one’s financial situation.

Conclusion

The State of Washington bans licensed payday lending but allows lower-cost installment loans at about 36% APR maximum. Advocates praise the state for promoting affordable credit access without permitting debt trap products. With careful oversight Washington closed payday lending loopholes unlike Idaho and Oregon which reformers argue allow abusive rates exceeding 100-200% APR still. Outright prohibitions favor consumer defenses against exploitation even at the cost of restraining some options reform groups maintain need stronger guardrails.

Frequently Asked Questions

How do online payday loans work in Washington (WA)?

Online payday loans in Washington involve borrowing up to $700 for up to 45 days. Approval is fast based on income, with funds deposited electronically as soon as the next business day.

What are the eligibility requirements for obtaining a payday loan with bad credit in Washington?

Requirements include being 18+, employed, having an active checking account, steady income of at least $1,000 per month, and providing personal identification details.

Are there any legal regulations or restrictions on payday loans in Washington state?

Yes, Washington caps payday loan amounts at $700 or 30% of gross monthly income, whichever is less. The maximum fees are 15% of the loan up to $90, and interest is limited to 15%.

What is the typical interest rate and repayment terms for online payday loans in Washington?

A typical APR is 390% for a 2-week loan. Loan terms range from 8-31 days, with payment owed in full out of the next paycheck via electronic withdrawal.

What alternatives to payday loans are available for people with bad credit in Washington?

Alternatives include tribal loans, credit union loans, borrowing from friends/family, credit counseling, debt management plans, and installment loans.