If you’re like most Americans, you’ve found yourself in a scenario where a little additional cash would help a lot. Emergency expenses can pop up, shaking your financial situation.

We’ve all been caught off guard by unexpected auto repairs, medical expenditures, school expenses, or home maintenance. These unexpected expenses aren’t inexpensive and can be quite stressful.

You may wonder how you’ll afford these fees or get the quick money loans or lenders you require if you have little money saved or access to funds.

Consider various options and loan providers to obtain emergency funds if this is your situation.

From online lenders to storefront choices, various methods exist to receive the fast cash you need in today’s environment. An online lending platform like GreendayOnline offers a convenient way to find loans when you need them the most. Suppose you need money right now and require extra cash to cover your emergency expenses. In that case, you can take loans from a friend or relative, work overtime, or begin working a side job.

Consider a payday or quick loan if other choices are available. Whereas these lenders may be a wonderful way to receive the cash you need quickly, certain factors must be remembered before taking out an immediate loan. It’s crucial to consider aspects like the repayment period, type of loan, and eligibility requirements.

How Can GreenDayOnline Help?

GreenDayOnline is here to help you understand cash advances and instant cash loans, including how they work, what to look out for when applying for one online or in-store, and the benefits of instant funding. We can also guide you toward reputable payday lenders that offer suitable options for your needs.

Continue reading to see how GreenDayOnline can assist you, regardless of your credit rating or financial position, even if you have a poor credit score.

What Is A Quick Cash Loan, And How Does It Work?

The first step on your trip is determining what constitutes a “fast cash loan.” This broad term can refer to various lending products and lenders, such as an online payday lender. Understanding these loans will help you make better decisions regarding monthly payments and other repayment options.

Because each loan has its own set of terms, restrictions, and interest rates, you’ll need to be willing to do many studies to determine which of the various possibilities is ideal for you. Working with a reputable lender and exploring numerous loan options can help you make the best decision.

Most people define a cash loan as “any short-term private loan product that enables a quick application and distributes monies to the customer within a short period after approval.” Same-day loans and instant loan approval options can make this process even faster.

You may have previously used a quick cash loan but have yet to realize it because they go by various names. Nonetheless, they’re essentially entirely personal loans. There are multiple types of loans and personal loan lenders, such as banks, credit unions, and other financial institutions.

Borrowers who want to spend money for personal reasons instead of business use these loans.

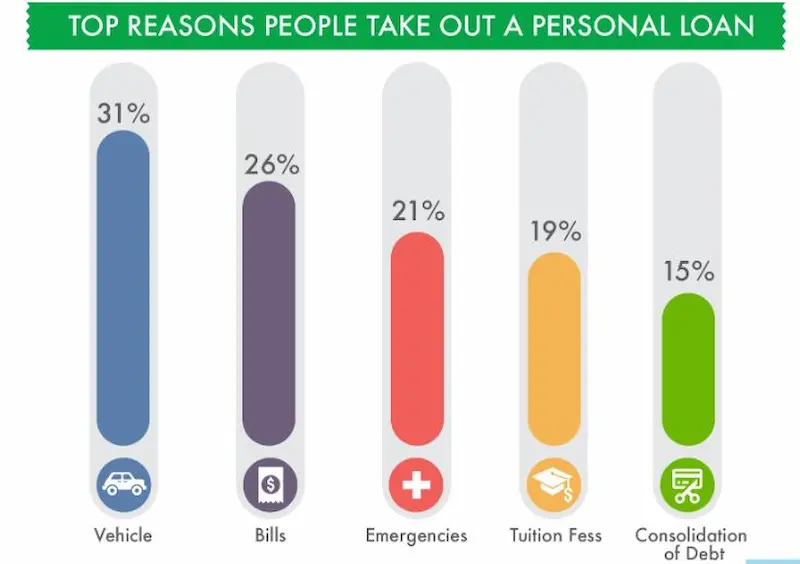

What Are Personal Loans Used For?

- Vehicle maintenance

- Repairs to the house and appliances

- The cost of sending your child to school

- Healthcare costs, including medical expenses

- Personal purchases of a significant amount

- The price of a funeral

- Costs of relocation

- Other unexpected costs

Quick cash loans are frequently short-term and have a short repayment time. The loan request process is simple, and with options like Same-day funding, you can quickly get the money you need.

The repayment time can range from a week or two to many months, depending on the sort of fast cash loans you select and the loan amount. These loans often come with flexible repayment terms to suit your needs.

It is only one of the reasons why they’re commonly employed by those who need a quick cash advance since they’re in a financial bind. An alternative loan option, like a quick cash loan, can provide quick funding.

Where to Get a Quick Payday Loan?

Requesting a fast cash loan is comparable to applying for other typical bank financial products. However, the online payday loan application process simplifies everything.

You must first fill out an online form. Many quick money providers have made the procedure even faster by now accepting online applications.

Check the lender’s website to see if you could apply for a loan online while researching. Many online loans provide quick and simple loan applications, allowing you to be authorized and receive your funds quickly.

For many borrowers needing cash quickly, getting a loan online is the favored approach due to competitive interest rates and an extensive network of lenders.

StoreFront Locations

If the lender doesn’t have an online application, you’ll have to complete an application form at a real shop location, which can be time-consuming compared to online traditional lenders.

Find a reliable lender that protects your confidentiality and offers an online application, such as Greendayonline, if you want to avoid long lines and paperwork. They also provide services like same-day approval and minimum eligibility requirements.

You’ll have to supply much personal financial data no matter what form you fill out. When lenders don’t ask for enough information, it may be a sign that they profit more when you miss a payment on your loan agreement.

What Will Direct Lenders Look At?

The lender will analyze your application and determine whether they can grant you a payday loan after you’ve submitted it, even for those with a bad credit history or poor credit history. Numerous elements go into determining if you will be accepted.

Lenders will likely assess your employment status, current active bank account details, credit history, and loan amount; a credit check is unnecessary in some situations. It is the case for both traditional banks and alternative lenders.

What Happens If I Have Bad Credit?

You may only be approved if you have a good credit score due to many debts from credit and debit cards or other loans, influencing your credit rating. The lenders may be concerned that you won’t be able to pay it back. Providing proof of income could strengthen your application.

You can normally reapply after a specified period if turned down for a loan. However, until your financial status changes, you’re unlikely to get authorized by another lender, especially a traditional bank.

If authorized for a fast cash loan from an active bank or alternative lender, you must enter into a loan contract that outlines all of the conditions and circumstances, as well as the rates and costs. Read this carefully so you know what you’re getting yourself into.

It’s best to take out loans online if you’re certain you’ll be able to repay them, ensuring you have a regular income.

How Will The Loan Be Deposited?

The lenders, often called loan companies, will provide you with the loan money once you get approval. Many lenders now send payments via wire transfer via direct deposit because obtaining funds from lenders is the quickest option.

You can use the money for any personal needs or bills you want after you have it, but remember that it’s crucial to make payments on time to maintain a good credit score.

The next step is to make loan payments on the agreed-upon repayment dates outlined in the loan terms. The contract ends once you’ve paid off the debt in full, and your source of income is not burdened by additional debt.

What You Should Know About Payday Loans

Payday loan providers offer quick cash loans made in the form of payday loans. They are available in various shapes and sizes. Whether it’s an online or in-person loan, they all have rates, terms, and conditions.

It’s critical to understand their differences and complexities to receive the finest loan type for a particular scenario and consider factors such as annual percentage rates and loan decisions.

What Are The Most Common Type Of Quick Cash Loans?

Below are some statistics about quick cash loans:

| Statistic | Value |

|---|---|

| Average payday loan | 500 |

| The average borrower takes out | 400 |

| The average borrower takes out | 10 |

| Average borrower pays | 520 |

Payday Loans

Payday loan online services are popular for individuals seeking a steady source of quick cash. Payday Loans are short-term loans that allow you to borrow money. A payday loan is a small-dollar loan used for short-term financial needs.

A payday loan is a small loan used for short-term financial needs, often dealing with loan proceeds and funds. It’s a line of credit, meaning the lender won’t ask for any collateral and will instead rely on the borrower’s pledge to repay the loan. When applying for a loan, ensure you review and understand the loan documents provided by the lender.

Payday loans are often for low amounts, ranging from a few hundred to several thousand dollars. They can have incredibly high-interest rates depending on the lender, and they’re mainly for consumers with a subprime (poor) credit score, necessitating a credit check during the application procedure. The minimum credit score requirement varies among the dozens of lenders offering payday loans.

Remember that different sorts of credit checks can harm your credit score. This fast loan could do more harm than good to your finances. Finding a lender that provides lines of credit could be a better alternative for those with less-than-perfect credit. Limited loan amounts and the option for next-day funding might appeal to some, but beware of potential pitfalls. Complete your application in minutes and carefully evaluate your options.

Title Loans

A title loan is another quick cash loan for short-term financial demands. These loans differ from payday loans because they do not require the applicant to provide credit information. Still, they demand the borrower to provide their vehicle title as security if they cannot repay the loan. This type of loan might be more suitable for bad-credit borrowers who lack access to credit personal loans.

The amount of cash you can get depends on the vehicle’s worth. However, you need help to repay the loan repayment. In that case, the creditor can confiscate and sell your vehicle to recuperate its losses.

Personal Installment Loans

These unsecured loans provide an option to borrowers who would otherwise be limited to payday and title loans due to a low credit score. They are especially beneficial for bad credit customers needing help securing traditional loans.

Personal installment loans allow borrowers to borrow more money, with loan sizes allowing for a larger loan (up to several thousand dollars). These loans also offer a flexible repayment term, lasting 24 months or more.

Personal installment loans typically have lower interest rates than payday loans. They come with attractive loan offers and the possibility of maximum loan size to cater to various needs. It is a fantastic place to start if you’re looking for a less expensive personal loan than a payday one.

They are short-term loans that are often safer and cheaper than payday loans. The nice part is that most of these lenders are available online.

Why Should You Use GreenDayOnline For Your Short-Term Cash Needs?

Our personal installment loans meet your specific financial circumstances and provide you with cash quickly. We offer maximum loan amounts and minimum options to cater to your needs.

We respect your privacy and provide an entirely online service, including a fast and easy application, bank deposit into your account, and simple online payments. It ensures a smooth funding process and funding for people in various situations.

No need to leave the convenience of your home with GreenDayOnline, which has the ideal financing solution for you, whether you need to pay bills, fix your automobile, or stretch your money till your next payment. We process loans on time to avoid any late payments.

Introducing the table below, we proudly present the American states where our company offers quick loans online. At GreenDayOnline, we understand the importance of providing accessible and efficient financial solutions to individuals and businesses in need. Our extensive reach and commitment to customer satisfaction have established a presence in multiple states nationwide. Whether you need a quick loan for personal or business purposes, rest assured that our services are available to support you in these select states. Please refer to the table to discover if your state is among those where we are actively operating.

| Alabama | Alaska | Arizona | Arkansas |

| California | Colorado | Connecticut | Delaware |

| District Of Columbia | Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana | Iowa |

| Kansas | Kentucky | Louisiana | Maine |

| Maryland | Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana | Nebraska |

| Nevada | New Hampshire | New Jersey | New Mexico |

| New York | North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania | Rhode Island |

| South Carolina | South Dakota | Tennessee | Texas |

| Utah | Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

Apply for a GreenDayOnline personal installment loan today to get back on track with your money and establish a regular source of funds when needed.

Conclusion

In conclusion, when faced with unexpected expenses and in need of emergency funds, it is important to explore various options and loan providers. Online lending platforms like GreendayOnline offer a convenient way to find loans quickly. However, factors such as repayment period, loan type, and eligibility requirements should be carefully considered before taking out a loan. GreenDayOnline can assist in understanding cash advances and instant cash loans, regardless of credit rating or financial position. Quick cash loans, including payday loans, title loans, and personal installment loans, can be used for various purposes, such as vehicle maintenance, home repairs, education expenses, healthcare costs, and more. Choosing a reputable lender, understanding the loan terms, and making timely payments are essential to maintain a good credit score. GreenDayOnline offers a reliable and secure online application process, competitive interest rates, and flexible repayment terms, making it a suitable option for short-term cash needs.

Frequently Asked Questions

What are the key benefits of applying for quick loans online?

The key benefits of applying for quick loans online include instant approval decisions, fast access to funds, flexible spending, and minimal eligibility requirements compared to traditional loans. However, high fees and interest rates can make repayment challenging.

How does the instant approval process for fast cash loans work?

The instant approval process for fast cash loans uses automated underwriting systems to quickly analyze an applicant’s basic eligibility information and approve loans within minutes, often without a credit check. Applicants receive loan decisions in real-time.

What are the typical eligibility requirements for online quick loans?

Typical eligibility requirements for online quick loans include being 18+ years old, having an active bank account, proof of income, and contact information. Credit checks are often not required. Loan amounts and terms vary by lender.

Are there any potential risks or drawbacks associated with fast cash loans?

Potential risks and drawbacks of fast cash loans include very high interest rates, aggressive repayment terms, insufficient loan regulation, and risk of falling into debt traps if unable to repay quickly. Borrowers should read terms closely.

Can you explain the difference between traditional bank loans and quick loans available online?

Traditional bank loans require extensive applications, credit checks, collateral, and longer approval times, whereas quick online loans have minimal eligibility requirements, instant approvals, and money deposited quickly but have much higher rates.