Payday Loans in Michigan Online Cash Advances Near Me for Bad Credit With No Credit Check

In Michigan, payday loans or cash advances near me for bad credit with no credit check offer quick cash to borrowers in need. They are due on the borrower’s next payday and have high-interest rates and fees. The borrower must have a stable source of income and a valid checking account to be eligible.

The loan application process is completed online or in person. Payday loans provide quick cash for emergencies, such as emergency expenses or a payday cash advance. However, they lead to a debt cycle for borrowers who need more time to repay the loan. Additionally, high-interest rates and fees significantly increase loan costs. Everyone knows what it’s like to be in desperate need of cash.

Requiring money payday loans fast and without questions, even those with proof of income find themselves in an urgent situation. Borrowers get payday loans in Michigan quickly and easily using GreenDayOnline’s simple forms. The company also offers quick approval for online loan applications and personal loans. Let’s find out what payday loans are. There are many definitions of payday loans.

Payday loans are regulated differently in each state. In most cases, they are loans that lenders offer for a short period (until the next paycheck). Cash borrowers receive varies between $100 and $1,500, which can provide those extra funds needed in a bind, depending on the state. There are two options for obtaining them; online and through a storefront payday lender.

Why do people need payday loans in Michigan (MI)

Payday easy online loans are very popular today. Despite all the negative and positive opinions, quick online loans for bad credit score are still a great option for budget management. A constant cash crunch makes it more difficult to manage a budget than a temporary, unplanned need for extra money. The best part about short-term loans? They help borrowers solve both of these problems simultaneously.

Their bank did not give them a loan with guaranteed approval and same day deposit

No one is fully prepared for financial disaster. Getting a bank loan or modifying a mortgage loan is difficult. Banks do not offer quick loans with guaranteed approval and same-day deposit. It takes a lot of time to obtain a loan from traditional lenders. Payday loans help in such situations. They are easy to qualify for compared to conventional bank loans. It takes a few minutes to approve that loan. Borrowers get the cash within one business day once approved. However, they must beware of the typical payday loan rates. They are higher than bank loan interest rates. An online lender can be a faster alternative for those with a bad credit score.

It is difficult to pay rent, utilities, bills, or groceries without payday lending in MI

A reliable online lender offering easy payday loans can be a lifesaver. Payday lending in MI helps cover essential expenses like rent, utilities, bills, or groceries until your next paycheck arrives. Just remember to carefully research any online lender carefully you’re considering and ensure you understand the terms and conditions of the payday loan they offer.

A staggering 70% of Americans use small cash advances for everyday needs or to meet consumer expenses. Such expenses include utility bills, groceries, rent, credit card payments, and costly credit cards. These borrowers have a constant cash shortage and must borrow money to pay their bills.

Paying credit card debts with their interest rates

Credit card companies have processes to collect debts and make payments, including their interest rates. Some call people five times daily, sending threatening letters and harassing them until they pay the debt. GreenDayOnline helps borrowers fed up with collectors calling them five times daily and sending threatening letters until they pay the debt. A cash advance helps cover the fee.

The best and legit payday lenders are better than borrowing from family and friends

Sometimes people turn to their families for financial help. The best and most legit payday lenders in Michigan help borrowers with their financial problems without asking their families.

You want to immediately pay off a debt per its repayment plan

Missing to immediately pay off a debt per its repayment plan leads to severe financial consequences. Borrowers face significant penalties and even lose some of their possessions depending on their agreement with other lenders if they fail to make payments. It is crucial to ensure you can repay your loan on time to avoid these issues.

What Are The Benefits Of $200 Payday Advance Loans With No Denial From Direct Lenders Only

Below are the benefits of choosing GreenDayOnline loans for your $200 cash advance loans with no denial from direct lenders only. One major advantage is the quick access to loan funds when you need them the most.

- Simple and quick forms: The company has a simple form that borrowers complete quickly. When every second counts, it is not a good idea to waste time filling out a complicated loan application. The easy application process makes it possible to apply in just two minutes and receive quick cash along with the advantage of instant funding.

- Rapid approval and instant funding: The company approves almost instantly. Borrowers are certain to get the funds deposited into their bank account within one working day. Once the loan agreement is signed and the transaction initiated, lenders transfer the cash to the borrower’s account within 24 hours. Unfortunately, lenders cannot transfer funds immediately after applying, but with instant funding, the process is faster than ever.

- Apply on the go: There are no more questions like “Where do I find the best payday loan stores near me?” Apply online for Michigan payday loans from anywhere. Borrowers only need a smartphone or computer that has internet access. If the application is approved, the company transfers funds to the customer’s account, and instant funding ensures a speedy process.

- Transparent agreement: Transparency in all transactions and agreements is the strength of GreenDayOnline. Borrowers are certain that every cent they repay is accurate. They must fill out a GreenDayOnline application if their budget is too tight to buy groceries. Those who have been in an accident that caused them to need a repair bill get help. The company takes care of the borrower’s money problems. There are no credit checks and no meaningless questions. With instant funding, clients can trust a fast and transparent experience.

In the bustling landscape of Michigan’s financial services, our company stands at the forefront, providing accessible and reliable payday loan solutions. With a focus on serving the diverse needs of individuals in the state, we have established a strong presence in key cities across Michigan. Our commitment to responsible lending and customer-centric approach has enabled us to become a trusted partner for those seeking short-term financial assistance. The table below highlights the most important cities where our company is actively engaged, offering our services to help bridge financial gaps and empower individuals in their times of need.

| Detroit | Grand Rapids | Warren |

| Sterling Heights | Ann Arbor | Lansing |

| Dearborn | Livonia | Troy |

| Westland | Farmington Hills | Flint |

| Wyoming | Rochester Hills | Southfield |

Michigan Emergency Loans With Instant Approval: Costs and Laws

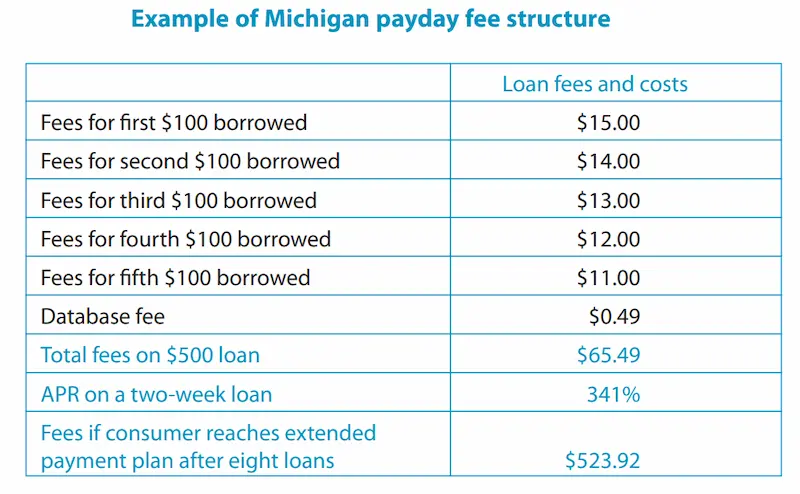

Borrowers must expect to pay these costs when they apply for any loan amount from a good direct lender in Michigan to get approval within 1 hour

- Finance charges: Payday lenders charge up to $15 for every $100 borrowed.

Annual Percentage Rate. Maximum APR. The maximum annual percentage rate for a $100 loan of 14 days is 309%. Those who need more significant amounts must consider installment loans. - Acquisition charges: A legit acquisition fee is one-tenth the payday loan amount if the borrowed cash advance loan is between $30 to $10. The acquisition service fee does not exceed $10 if the borrower’s loan exceeds $100. The Michiganders for fair lending

- Maximum loan term: Small-dollar loans in Michigan (MI) is taken for a repayment term of 4 weeks.

For Michigan residents needing larger loan amounts or more time to repay than traditional payday loans allow, installment loans can provide an alternative solution. Our Installment Loans Michigan page provides further details on how these regulated loans with longer terms and scheduled payments can suit some borrowers’ needs.

How To Apply For a $300 Payday Loan In MI

It’s easy to get a $300 payday loan in Michigan through GreenDayOnline. However, borrowers must be aware of some conditions. To make the process more convenient, consider completing an ONLINE APPLICATION for a speedy and secure experience.

- At least 18 years of age. It is illegal to lend money to anyone under 18 in the USA.

- Michigan residents must apply for a payday loan. To qualify for a Michigan payday loan, they must confirm their legal residency in Michigan. The success of getting a loan is almost certain after that.

- Bad credit is not an issue, but they must have a steady source of regular income and make at least 1000 monthly payment.

- Borrowers must have a valid email address and a phone number to get instant approval.

- Lastly, if in bankruptcy, borrowers cannot get a loan.

They only need personal details, including social security number, name, address, and the required amount. Once they have received the information, they contact borrowers to confirm the terms and conditions, including the loan contract. A small cash advance may be useful and convenient when faced with an emergency. The type of loan and title loan solve serious financial problems. Considering your credit history , it is wise to only apply for a few personal loans from the same company, considering your credit history. Borrowers end up losing their financial stability. Borrowers must be careful when obtaining bad credit loans, as it may lead to an endless cycle of debt if they fail to repay their previous loans.

Where do MI residents Obtain $100-$500 Tribal Payday Loans?

In the Great Lake State, many residents occasionally need a quick financial boost. One enticing option is through obtaining a tribal payday loan. For our Michigan residents, there are numerous accessible platforms. A noteworthy option is online providers. Online payday loan providers offer quick service, with approvals usually occurring within 24 hours. An effortless process entails filling out an application form with the required financial details to land you that much-needed $100-$500 loan.

What are the payday loan laws in Michigan?

The Deferred Presentment Service Transactions Act (DPSSTA) regulates payday lending in Michigan. The law limits the amount borrowed and the fees lenders charge for payday loans. The maximum loan amount is $600, and the maximum fee charged is 15% of the loan amount. They must have a minimum fee of $15 and a maximum fee of $75. The Michigan League for Public Policy and Michiganders for Fair Lending have advocated further restrictions on payday lending, such as minimum loan term requirements and regulating credit scores. Incorporating these credit scores and minimum loan term measures can help protect vulnerable consumers from risky financial situations. They prevent predatory loans and ensure that borrowers are less likely to get trapped in a cycle of debt.

In 2020, a ballot was proposed to the Michigan Secretary of State to cap the annual interest rate on payday loans at 36%. However, it still needs to be approved for the ballot. Additionally, some communities of color in Michigan have been disproportionately affected by predatory lending practices. Thus advocates have called for measures to address the issue. The Michigan League for Public Policy has recommended that the state increase funding for financial education and counseling programs, ensure access to cash for those in need, and enforce laws and regulations to protect consumers from predatory lending practices while also promoting improved access to cash options for individuals in these communities.

Here are some statistics on Payday Loans in Michigan:

| Statistic | Value |

|---|---|

| Legal Status | Legal |

| Number of Lenders | Over 100 |

| Average Interest Rate | 360% APR |

| Average Repayment Term | 14 days |

| Total Amount Taken Out Annually | $100 million |

| Risks | High interest rates, short repayment terms, risk of default |

| Alternatives | Personal loans, credit cards, government assistance programs |

Conclusion

Michigan prohibits licensed payday lending unlike more permissive Indiana, Ohio, and Wisconsin. But residents retain access to lower-cost online installment loans and credit union payday alternatives. By banning storefront debt traps, Michigan protects consumers while maintaining regulated online options around 100-200% APR. Consumer advocates praise the state’s prudent approach prioritizing affordability over unfettered high-cost access. But borrowers avoid riskier unregulated channels through lawful online lending Michigan encourages.

Frequently Asked Questions

How can I apply for payday loans in Michigan online, and where can I find cash advance lenders located near me for quick access to funds?

You can apply for Michigan payday loans online through lenders like Check ‘n Go, Advance America, and Approved Cash. Enter your zip code on lenders’ websites to find locations nearby.

What are the eligibility criteria for obtaining payday loans in Michigan, and are there specific options for borrowers with varying credit histories?

Michigan lenders generally require ID, income verification, a personal check, and a bank account. There are no credit requirements, making these accessible for all credit profiles.

Are there recommended reputable online payday loan providers in Michigan known for offering competitive rates and terms, and how can I ensure a secure and transparent lending experience?

Yes, there are reputable Michigan payday lenders that offer competitive rates, secure applications, and clear fee disclosures.

What factors should borrowers consider when evaluating online payday loan offers in Michigan, including fees, interest rates, and repayment terms?

When reviewing Michigan payday loans, compare origination fees, APRs, repayment timelines, and loan amounts across lenders to get the best deal.

Are there any specific state regulations or laws in Michigan that govern payday loans, and what precautions should borrowers take to avoid potential scams while seeking short-term financial assistance?

Michigan caps payday loan rates at 15% APR. Borrowers should check licenses, read terms carefully, and avoid unusual upfront fees when selecting a lender.