Online Payday Loans In Oregon for Bad Credit With No Credit Check and Same-Day Deposit

An Oregon Payday Loan for bad credit with no credit check and same-day approval is a suitable solution for short-term financial needs, usually encompassing a modest Loan amount due on the borrower’s upcoming pay date. Admittedly, these loans carry high-interest rates, a profound reason for their significance in covering unexpected bumps such as unexpected expenses or for riding out financially lean phases. However, borrowers must adopt a careful attitude toward these loans. Their high fees can easily snowball into a formidable debt if not repaid promptly, despite the pure convenience they afford.

SUMMARY

- An Oregon Payday Loan is an online loan that offers a short-term resolution to unexpected expenses, despite their high-interest rates.

- In Oregon, the Loan amount for payday loans is capped at a maximum of $50,000, allowing borrowers thoroughly flexible repayment terms of 60 days or less. The yearly interest rate remains restricted to 36%, with a maximum origination fee of $30.

- Same-day payday loans in Oregon extend rapid financial relief, an ideal solution for a sudden financial emergency, under flexible repayment terms extending up to one month.

- Applying for an Oregon Payday Loan demands a few requirements: valid identification, social security number, proof of income, and a financial account.

- The diverse online loans available in Oregon incorporate options like cash advances, check advances, unsecured personal loans, and payday loans.

- The merits of taking out an Oregon Payday Loan include an instant approval decision, a straightforward application procedure, see-through fees, adjustable repayment options, and swift short-term monetary solutions. On the downside, the potential drawbacks involve high expenditure, a focus on financially susceptible individuals, and the risk of overwhelming debt if prompt repayment is delayed.

What Are Small Payday Loans Near Me With Guaranteed Approval in OR?

These loans present an excellent approval rate, providing a viable resource in a sudden financial emergency or when met with unexpected expenses. Small payday loans with guaranteed approval near me, particularly Oregon Payday Loans, allow consumers to receive significant loan amounts of up to $50,000 for a short period. These high-interest short-term loans demand repayment within sixty days or less and disbursement within thirty-one days. Understanding the eligibility requirements, including proof of a steady monthly income, is crucial.

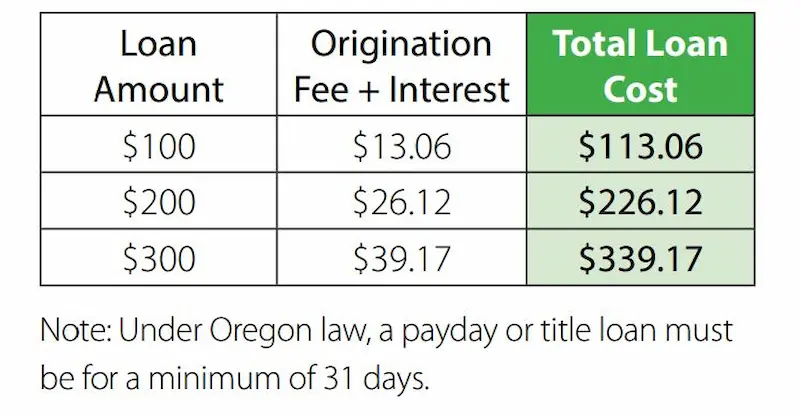

In Oregon, the payday loans legal framework restricts lenders from setting an annual interest rate exceeding 36%, barring the one-time origination fee. They are also not permitted to charge more than a single origination fee of either $10 per each $100 lent or a fee that does not exceed $30 concerning the total duration of the loan, including all renewal extensions, or levy any supplementary fees or interest.

What Is a Same-Day Payday Loan Approved Immediately By The Best Online Companies?

Same-Day Payday Loans approved immediately by the best online companies, commonly called payday advances, are designed to provide a rapid source of financial relief. These quick payday loan services permit customers to borrow money the same day, repayable within up to one month with added interest.

What are the Requirements For Instant $300 Payday Loans Per The OR Laws?

Below are the Eligibility Criteria for instant $300 payday loans per the OR laws.

- Valid identification: Comprises a valid driver’s license or a state-issued identification card. Most online lenders need a recently issued ID with a current address and a clear photograph.

- Social Security Number: The applicant must provide a nine-digit number. Lenders can access accurate credit and background information with the Social Security Number.

- Income and employment verification: Applicants must provide information about their employment and income source.

- Financial accounts and assets: It’s necessary to have an active checking or online banking account, which will facilitate routing and account numbers. Borrowers must also submit a bank statement from an active bank account.

How Can I Obtain $100-$500 Rapid Cash Through GreenDayOnline’d Payday Loans?

At GreenDayOnline, obtaining $100-$500 rapid cash is possible through an online loan application form. They operate as a direct payday lender, which enables an expedited process to get an Oregon Payday Loan.

For a payday loan from GreenDayOnline, an individual must complete the online form, which asks for personal details such as name, address, contact info, and financial information. This comprehensive data assists the company in making a well-informed lending decision. Once the form is submitted, applicants must wait for GreenDayOnline’s approval. They meticulously review the provided information to decide if they deem it fit to accept.

The next course of action involves receiving a copy of the loan agreement. It encompasses all the essential terms, including the loan payment schedule, carefully drafted to meet your needs. Once this is finalized, applicants must sign this agreement and proceed with an upfront payment. Subsequent payments must then follow as stated in the agreement with the lender. The entire process, from application submission to receiving approval, can even lead to same-day funding in some instances.

What Types of $200 Loans Can I Get Through Payday Lending in Oregon?

Below detailed are the different types of $200 payday loans available through payday lending in Oregon:

- Payday cash advance loan: This product, provided by banks or credit unions, does not incur fees and often requires proof of income for approval. It’s an excellent help for covering unexpected expenses without overdraft charges.

- Check advance loan: Check advances are short-term loans accessible with a paycheck. Borrowers require proper identification and can face extra penalties or fees if the loan isn’t repaid in its entirety on time.

- Unsecured personal loan: Unsecured personal loans can be obtained without requiring collateral. The repayment plans for these loans are diverse, depending on the provider and individual’s needs.

- Payday loan: Payday loans are short-term loans ranging from $100-$1000, which must be paid back upon the borrower receiving their next paycheck. These often have a minimum loan term attached.

Oregonians looking for additional options beyond payday loans may want to consider installment loans as well. Installment loans allow borrowers to access larger loan amounts with longer repayment terms. To learn more about the benefits and eligibility requirements for installment loans in Oregon, check out our helpful guide on Installment Loans Oregon.

What Are the Advantages and Disadvantages of a Payday Loan Online Or by Phone?

Outlined below are the Advantages of payday loans online or by phone.

- Instant Approval with Online Lending: Applying for a payday loan, also known as Payday lending, typically results in instant approval. Many online lenders provide same-day acceptances if the borrowers meet the qualifications. In case of a bad credit score, borrowers are often still accommodated.

- Easy Application Process with an Online Loan Request Form: Submitting an online loan request form on the lender’s website is an effortless and straightforward process when applying for a payday loan. There is no need to provide collateral or go through any credit check. This online application is a great way for fast, emergency cash as the funds are immediately conveyed to the borrower’s checking account when approved.

- Favorable Terms with No Hidden Fees: Payday loans only have fees that are made clear upfront. The annual percentage rate (APR) is usually between 300 and 400%, a maximum loan term the borrower must be aware of, so borrowers must repay the entire loan plus any charges imposed by the lender.

- Low-Interest Rates: Payday loans often have high-interest rates; however, borrowers find more competitive rates when comparing providers. Some lenders even reduce their interest rate if the loan is repaid before the due date.

- Flexible Repayment Options: Decide how much to borrow. Many providers offer automatic payment options to make sure to receive monthly payments.

- Short-Term Loans: Payday loans typically provide a short-term solution and must be repaid in full after two weeks, plus any fees the lender charge. If borrowers cannot pay the loan fully, the balance is rolled over to another date with the lender’s approval.

Listed below are the disadvantages of payday loans.

- Predators are suspected: Often, it is believed that payday lenders, especially those with less-than-stellar reputations, target individuals who are most financially vulnerable. Customers seeking payday loan services are typically in need of immediate financial aid. However, what they need are reputable lenders and reliable lenders who can assist without exploiting their financial health. Such lenders can provide aid for rent, insurance, groceries, and other essentials until the next paycheck.

- The cost can be high: Payday loans can be costly, charging fees of $10-$30 per $100 borrowed. The annual percentage rate (APR) ranges from 300-400%, making them an expensive option depending on the lender. That’s why exploring other funding options and direct lenders is important before going for payday loans.

- Online Request Forms for Ease and Security: Payday loan lenders sometimes need borrowers’ bank account information to approve the loan. Online payday loan vendors typically offer an online request form to obtain necessary information securely. It’s crucial to be vigilant when sharing banking details, particularly when accessing loan websites, as people with malicious intentions may exploit this information.

- Debt Cycle Traps and Their Solutions: Employing payday loans periodically is deemed acceptable. However, chronic usage of such services can lead to a dangerous debt cycle, especially for those with poor credit histories. Having limited funds from one paycheck to another is undoubtedly nerve-racking, but payday loans should only serve as a temporary salve. It’s advisable to be prudent while utilizing such services and gain more insight into your financial health to reduce the likelihood of falling into indebtedness. The judicious use of loan funds can help navigate sudden financial needs. Simultaneously, enriching oneself with financial literacy ensures the constant need for money can be avoided.

Below is a table of statistics about payday loans online in Oregon:

| Statistic | Value |

|---|---|

| Maximum loan amount | $50,000 |

| Repayment period | 31-60 days |

| APR | 36% |

| Cooling-off period | 7 days |

| Number of payday loan borrowers (2021) | 120,000 |

| Average loan amount (2021) | $350 |

| Average APR (2021) | 399% |

| Debt trap rate (percentage of borrowers who take out multiple payday loans in a year) | 25% |

| Default rate (percentage of borrowers who fail to repay their payday loans) | 15% |

Why Is GreenDayOnline the Best Provider With The Best Payday Loan Rates in Oregon?

Listed below are the reasons why GreenDayOnline is the best provider with the best payday loan rates in Oregon.

- Informed Decision. GreenDayOnline’s lending partners quickly reach verdicts on our patrons’ requests, much faster than conventional in-person payday loans. This enables clients who are legal residents to make informed decisions swiftly to handle their financial demands.

- Safe to Apply. Often, people new to applying for online payday loans in Oregon question the safety of the process. At GreenDayOnline, we ascertain that the borrowers’ application is safe from start to finish. Despite a bad credit history, security remains paramount in funding applications.

- Accessibility. By selecting a payday loan through our company, borrowers, whether they are permanent residents or otherwise, can access their accounts anytime, whether during the day or the night. This accessibility proves especially useful when facing an emergency expense.

- Better Rates. Finding payday loans in Oregon doesn’t need to be costly. Our lending partners at GreenDayOnline offer loans at competitive rates with no concealed charges. This especially benefits borrowers who have to manage medical bills or other unforeseen costs.

At GreenDayOnline, we take pride in our extensive network of services catering to individuals’ financial needs across Oregon. With our commitment to providing reliable and accessible solutions, we have established a strong presence in key cities throughout the state. Our expertise in payday loans and our dedication to customer satisfaction have enabled us to serve communities far and wide. Below, we present a comprehensive table highlighting the most important cities where our company operates, ensuring that residents from various regions can conveniently access our services. Discover the cities where we are active and experience our trusted financial assistance firsthand.

| Portland | Salem | Eugene |

| Gresham | Bend | Hillsboro |

| Beaverton | Medford | Springfield |

| Corvallis | Tigard | Albany |

| Lake Oswego | Grants Pass | Redmond |

Conclusion

Oregon now caps payday loan rates at 156% APR – curtailing 400% costs permitted before reforms while maintaining access for regulated short-term credit needs. Advocates praise the balanced approach avoiding a ban argued for by some reform groups. By preserving legal licensed lending options, Oregon’s guardrails protect consumers from the worst abuse without forcing people toward illegal offshore internet lenders as critics argue bans in Washington and Idaho effectively do through unintended consequences. Neighboring California, Nevada, and Idaho also regulate payday lending differently.

Taking out payday loans in Oregon is a short-lived, high-interest borrowing option with a lending cap of $50,000 and a minimum term of up to 60 days. The loan applicants should provide identification, social security number, proof of income, and employment, alongside their financial account details. The procedure of seeking a loan via GreenDayOnline encompasses filling out a loan request form, getting approval, and signing a loan agreement. Payday loans in Oregon come in various forms, such as cash advance loans, check advance loans, unsecured personal loans, and payday loans. These loans offer the benefits of prompt approval, a straightforward application process devoid of hidden charges, reasonable interest rates, adjustable repayment options, and short terms loans. However, these loans should not be viewed as a long-term financial solution due to their high expenses, the possibility of predatory lenders, and inordinately high-interest rates.

Frequently Asked Questions

Are online payday loans in Oregon accessible to individuals with bad credit?

Yes, online payday lenders in Oregon do not check credit reports or scores for loan approval, making them accessible to borrowers with bad credit.

How quickly can I receive same-day cash through online payday loans in Oregon?

Online payday lenders in Oregon can deposit approved loan amounts directly into your bank account as soon as the next business day.

What are the legal regulations surrounding payday loans in Oregon?

Oregon caps payday loan amounts at $50,000 or 25% of gross monthly income. Interest is limited to 36% APR, and fees to 10% of the loan up to $30.

What are the typical interest rates and fees associated with online payday loans in Oregon?

A typical payday loan in Oregon has an APR of around 156% plus origination fees from $15-$30 per $100 borrowed.

Are there alternatives to payday loans for people with bad credit in Oregon?

Alternatives include tribal loans, borrowing from friends/family, credit union payday alternative loans, installment loans, and credit counseling services.