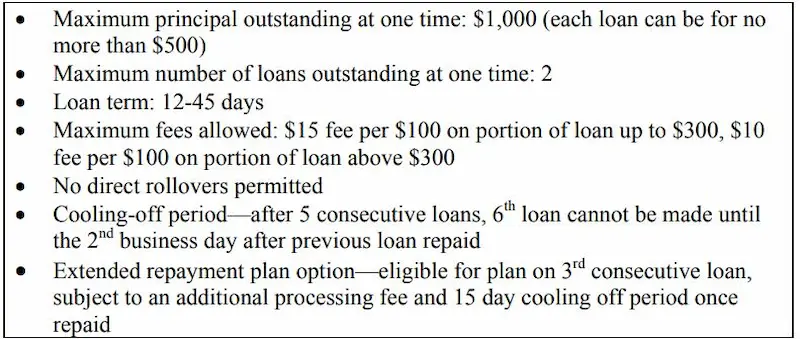

In Oklahoma, Oklahoma Payday Loans are short-term loans for a specific amount of money that borrowers need to repay on their next payday. The maximum payday loan amount in Oklahoma is $500. It is repaid at least 12 days or more than 45 days from the date the lender accepts the instrument. In addition, borrowers often have to pay a fee when they take out these loans. Online loans have made acquiring payday loans more convenient for borrowers. Payday loans typically have high-interest rates and can be hard for borrowers to pay back in full by their next paycheck. They are a long-term financial solution, and people must use them for financial emergencies only.

How Do Online Payday Loans For Bad Credit With No Credit Check Work in OK?

Oklahoma Payday loans for bad credit with no credit check are short-term, high-interest loans obtained from lenders to meet immediate financial needs. Typically, OK borrowers write a check payable to the lender for the amount they would like to borrow, plus any fees or interest. The lender then holds the check until the borrower’s next payday. On that day, the borrower must repay the loan repayment plus fees and cash interest. If unable to do so, some Oklahoma Payday Loan lenders allow an extension of payment with an added fee for extending the repayment period.

Quick loans with no credit checks can solve financial problems for people who need access to traditional banking services. Payday loans provide a way for people with a bad credit history or no credit to get money quickly to cover unexpected expenses. Because payday loans bad credit are not secured by collateral, they are usually much easier to get than other loans, and the lenders need to do a credit check. As long as you pay off the loan when it is due, you can build up your credit and get better loan options in the future.

What Are the Reasons To Obtain a Direct Lender Cash Advance Loan Near Me With Same Day Deposit?

Below are reasons people need a direct lender cash advance loan near me with a same-day deposit to cover emergency expenses.

- Unexpected Expenses. Life is full of unexpected expenses, such as medical bills or home repairs, that crop up without warning and can cause financial strain. A payday cash advance can temporarily bridge the gap until future paycheck earnings cover the expense.

- Unforeseen Emergencies. Sometimes, a payday loan could be necessary to cover sudden emergencies such as food or transportation costs when income is unavailable for the near term. An online payday loan application can make the process quick and simple.

- Bridging Cash Flow Gaps. With inconsistent income, some people rely on short-term loans to close temporary cash flow gaps when their next paycheck may not arrive soon enough. A smooth loan process can provide immediate relief during such situations.

What Are the Types of Good $200 Payday Loans With Guaranteed Approval Available in OK?

Listed below are the available $200 payday loans with guaranteed approval in Oklahoma.

- Direct Deposit Advance Loan. This type of payday loan is offered to customers who already have an open checking account with the same financial institution or credit union that offers the loan. Customers who qualify for this type of loan can receive funds from their bank electronically without applying at a physical branch. It is generally a very quick process and requires little paperwork.

- In-Store Installment Loan. For customers whose banks do not offer direct deposit advance loans, in-store installment loans are available. These require customers to visit a location to apply, and customers who qualify must be able to provide proof of identity/residency and other necessary supporting documents. After approval, the approved amount is transferred directly into the customer’s checking account.

- Online Payday Loans. Online payday loans are becoming increasingly popular and accessible as more companies move their services online, removing the need for costly physical branches or storefronts. You only need a basic internet connection and a valid ID to apply for an online payday loan. Lenders do not require a credit history check or long application forms. Simply fill out the form and submit it for review – once approved, your cash will be deposited into your designated bank account within 24 hours or sooner in some cases (depending on your chosen company). Some companies also offer an online loan application that can be approved within 24-48 hours.

- Credit Card Cash Advance. People use credit card cash advances to obtain short-term financing quickly. However, these should only be used as a last resort since they often come with high-interest rates and hefty fees/penalties if not paid back promptly as agreed upon with your lender/credit provider. With a credit card cash advance, you can withdraw cash up to your available credit limit at any ATM worldwide – although you must know all terms associated with such methods before opting for it as a solution!

- Personal Loan Through a Private Lender. Some private lenders offer personal loans, which are usually unsecured – meaning you don’t need collateral to borrow money from them through their service contract, which typically has weekly or monthly repayment plans available according to one’s qualifications & needs. This type of loan may take a bit longer than other options as they run extensive background checks regarding your financial profile & have stricter qualifiers.

- Vehicle Title Loan.

In Oklahoma, you can access Vehicle Title Loans, using your vehicle title as collateral to receive a larger upfront amount. It allows you to keep possession of your vehicle during the repayment period. However, it’s crucial to be aware that these loans typically include default provisions in the terms. Failure to repay the loan by the specified deadline may lead to potential repercussions such as vehicle repossession. Extending the deadline or refilling the loan under different arrangements may be necessary to avoid such consequences, which could result in additional costs. - Check Cashing Services. Last but not least, but certainly worth mentioning, check cashing services in Oklahoma, such as Quik Cash locations wherein individuals needing some fast money relief provided by private institutions that specialize in such transactional activities specially licensed/necessary governmental regulations while accessing related services structured primarily through third party basis publicly recorded.

What Are The Legal Requirements For $300 Payday Loans With Instant Approval From Direct Lenders Only?

Listed below are the legal requirements for $300 payday loans with instant approval from direct lenders only. You must sign a loan agreement with a lender to get started. Borrowers can do it through an online application. The application process is simple and quick, allowing you to secure your payday loan easily.

- Age Requirement. All applicants must be 18 or older to get approval for a loan in Oklahoma.

- Identification Requirements. A valid government-issued ID, such as a driver’s license or state-issued identification card, must be provided by all applicants for verification of identity.

- Residency Requirement. The borrower must be a permanent resident of Oklahoma and provide proof of residency through valid proof-of-address documentation, such as a utility bill or bank statement issued within the last 90 days.

- Income Requirements. Applicants must demonstrate their ability to repay the loan by providing recent bank statements showing that they have an income from either wages, benefits, pension agreements, or other allowable sources of funds; any kind of salary slip or certificate from an employer is also acceptable. Some lenders may perform a credit check on the applicant to assess their repayment capability before approving a loan request.

- Bank Account Requirement. A checking account registered under the borrower’s name is necessary for applying for payday loans in Oklahoma; some lenders may require additional details, including proof of account ownership and transaction history since opening it up to verify if you can indeed make regular payments from it when due on the loan’s term expiration date(s) and so they are assured they will get their money back.

- Maximum Loan and Eligibility Criteria. Lenders may have a maximum loan amount they will approve, which will likely vary based on the borrower’s financial situation and other factors. To increase the chances of approval, prospective borrowers should be aware of the lender’s specific eligibility criteria when completing their loan applications.

Here are some statistics on payday loans in Oklahoma:

| Statistic | Value |

|---|---|

| Average Payday Loan Amount | $500 |

| Average Payday Loan APR | 453% |

| Average Payday Loan Term | 14 days |

| Percentage of Payday Loan Borrowers Who Roll Over Loans | 45% |

| Payday Loan Debt as a Problem | Yes |

| Number of Alternative Lending Options Available | Many |

If you are looking for longer-term personal loan options with more flexible repayment terms than a traditional payday loan, installment loans may be a good alternative. Installment loans allow borrowers to pay back the loan amount in multiple scheduled payments over time. To learn more about installment loan requirements, maximum amounts, and providers in Oklahoma, check out our informative guide on Installment Loans in Oklahoma. This can provide helpful information on comparing your options.

Are 1 Hour Small Payday Installment Loans the Best Option for People Struggling Financially?

Yes, 1-hour payday installment loans can sound like a good idea, especially if you are struggling financially and need the cash immediately. However, payday loans generally come with high-interest rates and short repayment terms. It means borrowers may take out multiple loans to pay off the first one, creating a debt cycle they cannot escape.

People with bad credit scores have a few options for borrowing money. One of the most popular is short-term bad credit loans. These loans help those who need cash quickly and don’t have great credit. They may not be the best choice for everyone, but they can be useful in certain situations, particularly for those experiencing financial trouble. Another advantage of these loans is that they often come with a simple application form, making it easy for borrowers to apply and quickly get the money they need.

Also, lenders often target borrowers in desperate situations, leading to predatory lending practices. Before considering a payday loan, one should look into other options such as loan funds, borrowing from family or friends, credit unions, budgeting, and negotiating on past-due accounts. Online lenders can be a suitable alternative for those with less-than-perfect credit.

What Are the Advantages and Disadvantages of $100-$500 Payday Loans Approved Immediately?

$100-$500 payday loans approved immediately offer several advantages, including the ease and convenience of obtaining them, plus they do not require credit checks or collateral. They also provide quick access to needed cash in an emergency. On the other hand, payday loans can be expensive and difficult to repay due to their high-interest rates and fees. Additionally, they often require you to access your bank account, making it easy for lenders to take more money than originally agreed upon. Payday loans can also put individuals into a cycle of borrowing if they cannot keep up with the payments from month to month.

What Are the Things to Think About Before Getting a Payday Loan From an Online Company?

Consider the following before getting a payday loan from an online company:

- Loan terms: Understand the specific loan terms of the payday loan, such as interest rates, fees, and the repayment period.

- Potential lenders: Research and compare potential lenders to ensure you get the best deal and work with a reputable company.

- Hour payday advance: Determine whether an hour payday advance might be a better option for your financial needs, as it may provide faster access to funds.

- Emergency Fund. Before you consider getting a payday loan, it’s worth reflecting on whether you have any other assets or funds to fall back on that would enable you to avoid taking a loan in the first place. If you have an emergency fund to draw from, this is an ideal solution and can save you time and money solutions in the long run.

- Terms & Conditions. It is essential to fully understand the conditions of a loan before signing up for it, as payday lenders are known for having stricter terms and conditions than other types of loans. Ensure you know all the interest rates, repayment terms, and fees associated with your loan before committing to anything. It will help you find the best money solutions for your situation.

- Other Alternatives. Before opting for a payday loan, other suitable financing options may be available with better terms and conditions depending on your situation that could help you meet your financial needs. Consider researching alternatives like credit unions or short-term installment loans offering better money solutions than payday loans.

- Repayment. Payday loans usually must be paid back by your next paycheck date, so it is important to ensure it will fit into your budget if this is the case for your loan. Interest rates can also vary significantly between different lenders, so compare several lenders before settling on one option that best meets your needs and budget constraints. It will ensure you find a money solutions provider that works for you.

- Credit Score. Understand what impact a payday loan might have on your credit score before taking out a loan if this is important to you – many lenders do not report payments made towards the payday loans they offer, so they may not affect your credit rating either way. Always consider how your chosen money solutions will affect your credit in the long term.

- Potential Issues. Taking out multiple small payday loans may pose future problems if it strains your available funds. It is essential to prioritize ensuring that no unexpected charges occur after making the payment. When dealing with any debt, it is crucial to exercise caution. Over-relying on payday loans as your primary method for financial solutions should be carefully approached.

- Debt Cycle. One of the biggest issues associated with payday loans is debt cycles – where individuals keep taking out multiple short-term advances to pay off existing ones, thus creating an endless cycle of debt that can be difficult to break free from. To avoid this trap, explore other money solutions to help you manage your finances more effectively.

Is a Payday Loan With High Interest Rates a Good Option for Emergencies?

Payday loans are a bad option for emergencies since they come with high fees and high-interest rates. Depending on where you take out the loan, the annual percentage rate (APR) can be anywhere from 300% to even 1,000%. It makes it difficult to pay off the loan, creating a cycle of debt. While payday loans offer short-term relief for an emergency financial problem, there are far better options with lower interest rates and fees that could save you money in the long run. However, if all other options are not available and the payday loan is your only option, then make sure to use it wisely by borrowing what you need for now and paying it back as soon as possible.

Can I Get an Online Payday Loan With Poor Credit?

Yes, you can get an online payday loan with poor credit. Many payday loan lenders in Oklahoma City and other areas do not require a credit check as part of the application process. These lenders often provide an instant decision and an instant approval decision for borrowers, making it possible for applicants with poor credit to obtain a payday loan. However, it is essential to remember that even though you may qualify for a payday loan with poor credit, the high-interest rates and fees still apply, and you should consider other options before resorting to a payday loan.

Getting a payday loan with poor credit can take time and effort. Many lenders require a certain credit score to approve a loan. Some lenders may specialize in helping people with bad credit. Still, they typically charge very high-interest rates and fees, so the total cost of the loan is often much higher than it would be for someone with good credit. Additionally, payday lenders are generally only willing to give out small amounts of money, which could not be enough if you need funds for a larger purchase or emergency. So although it is possible to find a payday loan when you have poor credit, you may also wish to consider other financial options.

Can I Get a Payday Loan With My Phone Number if I Am Retired?

Yes, you can get a payday loan if you are retired. However, it is important to note that most lenders will require proof of income and other financial documents to approve the loan. Generally, they accept Social Security benefits, pension payments, and even retirement fund distributions as sources of income to obtain a payday loan. Therefore, it is best to speak with the lender directly by calling their phone number to find out their requirements for currently retired applicants.

Is GreenDayOnline a Direct Loan Provider Per The OK Laws?

No, GreenDayOnline is not a direct loan provider. Instead, they are a direct lender’s network, connecting borrowers with various direct lenders that offer different loan products. They offer installment loans up to $5,000 with terms of up to 60 months. Moreover, they have an easy application procedure and a fast funding process that allows you to quickly and easily receive the money you need quickly and easily.

We are delighted to share with you the key cities in Oklahoma where our company operates and provides reliable payday loan services. As a leading financial institution committed to meeting the diverse financial needs of individuals, we have established a strong presence in these communities. Whether you require immediate financial assistance or seek short-term funding solutions, our dedicated team is here. Below, you will find a comprehensive table highlighting the most important cities where our company is active, ensuring that you can conveniently access our services no matter where you are in Oklahoma.

| Oklahoma City | Tulsa | Norman |

| Broken Arrow | Edmond | Lawton |

| Moore | Midwest City | Enid |

| Stillwater | Owasso | Bartlesville |

| Muskogee | Shawnee | Bixby |

Conclusion

Oklahoma voters recently approved establishing a 200% APR cap and other meaningful protections after advocates revealed payday lenders previously exploited loose laws allowing unlimited 1,000% APR costs. The bipartisan reform balances access with regulations preventing debt traps. Consumer advocates prefer lower rates but praise progress reining in abusive products versus Kansas, Arkansas, Texas, Colorado, New Mexico, Missouri, and unrestricted tribal lending. Going forward, Oklahoma provides a model for data-driven policy reforms different states can implement to deter predatory lending through reasonable guardrails. However, industry groups argue the new rate cap goes too far.

In Oklahoma, Payday loans are short-term loans intended for emergencies only. They are typically high-interest loans obtained from lenders to meet immediate financial needs. The maximum payday loan amount in Oklahoma is $500, and borrowers must repay them on their next payday. Payday loans can be an important solution for people who don’t have access to traditional banking services. Still, they can also be difficult to repay in full by the next paycheck.

People may need a payday loan due to unexpected expenses, unforeseen emergencies, and bridging cash flow gaps. Several types of payday loans are available in Oklahoma, including direct deposit advance loans, in-store installment loans, online payday loans, and credit card cash advances. These loans can provide a way for people with bad or no credit to get money quickly. Still, it is important to know the high-interest rates and potential risks before taking one out.

Frequently Asked Questions

How can I apply for payday loans online in Oklahoma (OK) with no credit check, and is it possible to receive the funds on the same day?

You can apply on Oklahoma payday lenders’ websites by submitting personal details. If approved, you may receive same-day funding via direct deposit into your connected checking account.

What are the eligibility criteria for obtaining online payday loans in Oklahoma, and do lenders typically consider applicants with poor or no credit history?

Payday lenders in Oklahoma generally only require ID, income verification, a bank account, and to be over 18. Bad credit is usually not a barrier, making these accessible to lower credit borrowers.

Are there reputable online payday loan providers in Oklahoma known for offering competitive rates and terms, especially for borrowers in need of quick cash?

Yes, there are some top payday lenders in Oklahoma known for quick approvals, competitive rates, and receipt of funds often in as little as one business day.

What are the potential fees, interest rates, and repayment terms associated with online payday loans in Oklahoma, and how can borrowers make informed decisions to manage their finances effectively?

Payday loans in Oklahoma can have APRs over 300% and fees like origination charges. Borrowers should understand total costs and have a realistic repayment plan to avoid renewals and mounting debt.

Are there any specific state regulations or laws in Oklahoma that govern online payday loans, and what should borrowers be aware of to ensure they are dealing with legitimate lenders and making responsible financial choices?

Oklahoma limits payday loans to $500 with a minimum term of 12 days. Laws prohibit renewing loans more than twice and require lenders to offer extended payment plans before suing for defaulted debt.