New Mexico Installment Loan, an installment loan, is a type of small-dollar, short-term personal loan that allows you to pay back your money over time with interest. You can use an installment loan to consolidate credit card debt, make other payments on existing debts, or explore loan options like secured and unsecured loans. The amount of money you borrow depends on how much you want to borrow, what kind of loan you choose, what loan terms you agree to, and whether you have any collateral (such as a car) that could be used as security if you default on your loan. Online loans are becoming increasingly popular as they offer fast approval and easy access to funds.

What Are the Eligibility Requirements for an Installment Loan?

To qualify for an installment loan, you must meet specific requirements. These include satisfying certain credit score thresholds and demonstrating the ability to repay the loan according to the agreed terms. These requirements may vary depending on the installment loan type you seek.

- You must be at least 18 years old.

- It would be best if you lived in New Mexico.

- You must have a valid driver’s license.

- You must not owe more than $1,500 in total debt.

- You must provide proof of income, including bank statements showing recent deposits, W2 forms from employers, tax returns, or other documents showing your current financial situation.

- You must have access to a checking account.

- You cannot already make regular monthly payments on your debts. You must catch up before applying for an online installment loan to pay your bills.

What Are The New Mexico Installment Loans Interest Rates and Terms?

Installment loans in New Mexico range from $500.00 to $2,500.00, depending on your qualifications. Loan companies cater to various applicants, including those with bad credit loans. The interest rates and terms vary based on factors such as monthly income, loan agreement, and the applicant’s credit history. Reviewing and carefully considering loan requests and loan amounts before accepting any offers from loan companies offering online installment loans is essential.

These personal installment loans are repaid in monthly, semi-monthly, or biweekly payments over 6, 12, 18, or 24 months, depending on your chosen terms, with financial fees calculated daily. Refinances result in higher financing charges over the loan’s life. Early repayment of a loan lowers the total financing charges. Late payments result in additional finance charges. Affordable loans with flexible repayment periods can help you manage your budget during financial emergencies.

How Much Money Can I Get?

The maximum amount you can borrow using an installment loan varies by state. In New Mexico, the limit is $2,500. However, some lenders offer more significant amounts. Your lender should inform you about these limits when processing your loan applications.

What Is the Cost of an Installation Loan?

Online loan providers often offer favorable interest rates and a transparent repayment schedule that can be customized according to your financial needs. Comparing different lenders to find an affordable and suitable loan option is essential.

There are two types of finance charges associated with an installment loan: origination fees and late payment fees. Origination fees cover the cost of processing your application. They vary based on the type of loan you select and the number of installments you agree to repay. Late payment fees are charged each time you fail to make a scheduled payment. Most installment loans charge a flat fee per month for this service.

How Does an Installment Loan Work?

When you take out an installment loan, your direct lender sends you a check every few weeks or months until all your payments are complete after going through their application process, which may or may not include a credit check and might involve filling out an online form.

The amount you pay back each time is called the “principal,” and it’s what you’ll be paying off over the life of the loan. The interest rate on your loan will change as your principal changes. If you make extra payments, the principal and interest rates decrease. Suppose you miss a payment, and the principal and interest rates increase.

Installment loans are part of various financial products available to borrowers. You may also apply for a traditional bank loan instead of an installment loan. It’s important to note that the funding process might take longer than the installment loan; it usually takes a business day or more to receive your funds in the case of a bank loan.

Your lender will also send you a statement detailing the balance due on your loan. It includes the principal and any unpaid interest and finance charges. You’re responsible for repaying the entire amount owed on your loan within the specified period, including any unexpected expenses.

Can I Use My Credit Card For An Installment Loan?

Yes! Many installment loans allow you to use your credit card to fund the loan. Remember that you will incur additional interest costs and fees if you do so. If you decide to use your credit card, we recommend contacting your credit card company to see which offers best fit your needs, like title loans or Emergency Expenses.

When Should I Take Out an Installment Loan? How Do I Know Which Type of Loan Works Best For Me?

Choosing the right loan for your needs depends on several factors, such as your credit score and financial situation. Traditional loans might work well for some people, while others prefer credit check loans. Explore your personal loan options carefully, and consider the online application process for a hassle-free experience. Remember the importance of competitive interest rates when selecting a loan to ensure you get the best possible deal.

If you’re looking for a way to get out of debt fast without incurring high costs, consider taking out an installment loan instead of a payday loan. These short-term loans typically have lower rates than traditional personal loans. Plus, most installment loans don’t require collateral, so you won’t need to put anything at risk to secure the money you owe. This can be especially helpful for those with bad credit scores who may struggle with approval for other financial products like auto loans.

Installment Loans vs. Payday Loans: What is The Difference?

Installment loans are generally better than payday loans because they usually don’t carry exorbitant interest rates and often have fewer restrictions. They’re often more suitable for individuals with poor credit as they offer more affordable and low-interest rates than online payday loans. On the other hand, payday lenders are known for their high-interest rates, which can put borrowers in a cycle of debt. But there are still significant differences between them. Here’s how they compare:

Payday loans are cash advances that you must repay within two weeks. Repayments are limited to four times the original amount borrowed (plus interest).

Installment loans are structured like car financing. A set amount is paid back at regular intervals, usually monthly. Both types of loans can be used to consolidate other debts. However, installment loans may only sometimes offer the lowest rates. You should think carefully before choosing either option.

What Are the Alternatives to Installment Loans?

There are several alternatives to installment loans. Some include:

- Bad credit history loans: These loans cater to individuals with less-than-perfect credit scores. They may have higher interest rates but can help you build or repair your credit history.

- Social Security loans: If you’re receiving Social Security benefits, you may be eligible for specific loans that consider your benefit payments.

- Direct deposit loans are deposited directly into your bank account, making them more convenient than traditional loans that require physical checks.

- Active checking account loans: Lenders may offer loans to those with an active checking account, making depositing funds and collecting repayments easier.

- Cash loans: Similar to payday loans, cash loans offer a quick and easy way to borrow money. They are typically easier to obtain than traditional loans but may have higher interest rates.

- Storefront lenders: Although online lenders have become popular, local storefront lenders may still offer alternatives to installment loans. These lenders could provide face-to-face assistance and sometimes offer more personalized service.

- Flexible repayment terms loans: Some lenders may offer flexible repayment terms, allowing you to pay your loan back over an extended period or make repayments based on your income.

- Approval process: Different lenders have varying approval processes – some may offer instant approval, while others may take longer to review your application. Comparing multiple lenders can help you find the best option for your needs.

- Credit cards: You can borrow against future purchases with a credit card. Your payments go toward reducing the outstanding balance on your account. With instant approval, you can quickly access the credit you need.

- Debt consolidation: When you combine multiple smaller debts into one more significant debt, you reduce the total number of payments you must make. Debt consolidation loans can help you avoid bankruptcy by simplifying your payments and lowering your interest rates.

- Home equity line of credit: Similar to an installment loan, this type of loan allows you to tap into the equity in your home. However, unlike an installment loan, you aren’t required to repay the entire amount you borrow simultaneously. Instead, you only draw from the available funds when you want to spend more money than you currently have, which is an option that can be reported to the credit bureaus and help you build your credit.

- Personal loans: These loan products are designed to help people pay off their bills like installment loans. They differ from installment loans by requiring borrowers to repay the total amount borrowed over time rather than at regular intervals. Loan funds can be used for various purposes, and the annual percentage rate might offer favorable rates compared to other financing options. Consider utilizing online lending services for more convenience and faster approval times.

Are Installment Loans Legal in New Mexico?

Yes, installment loans are legal in New Mexico. Many lenders offer installment loans as part of their overall lending portfolio. Most online lenders like Greendayonline have licenses to operate in New Mexico. Therefore, ensure that the lender you choose is licensed to operate in your state, which will help protect you from rogue lenders who may take advantage of you.

Here are some statistics on New Mexico installment loans:

| Statistic | Value |

|---|---|

| Loan amount | $500 – $25,000 |

| Interest rate | 10% – 36% |

| Repayment period | 12 – 60 months |

| Availability | Borrowers with good to bad credit |

| Regulation | Regulated by the New Mexico Financial Institutions Division |

| Pros | Longer repayment periods than title loans, fixed interest rates, and monthly payments can be used to cover larger expenses. |

| Cons | Can be difficult to repay if you lose your job or have unexpected expenses; if you default on the loan, the lender can garnish your wages or take other legal action. |

| Tips | It can be difficult to repay if you lose your job or have unexpected expenses; if you default on the loan, the lender can garnish your wages or take other legal action. |

We are delighted to showcase the breadth of our company’s reach and presence across the beautiful state of New Mexico. As a leading provider of installment loans, we are committed to serving individuals and communities throughout the Land of Enchantment. Our services are readily available in several key cities, where our dedicated teams work tirelessly to deliver financial solutions that meet the diverse needs of our customers. With a focus on convenience, flexibility, and personalized support, we are proud to be active in the following prominent cities in New Mexico. Please refer to the table below for an overview of our active locations and their contact information.

| Albuquerque | Las Cruces | Rio Rancho |

| Santa Fe | Roswell | Farmington |

| Hobbs | Clovis | Alamogordo |

What Can I Use an Installment Loan For?

You can use an installment loan for any purpose. It doesn’t matter if it’s for paying down another bill, consolidating your debts, building an emergency fund, or even paying off student loans. Installment loans can also be an excellent option for those who need extra cash but may not qualify for loans from banks or traditional lenders. Just remember that the terms and conditions of each loan are different. So, research before you apply and consider your current income and ability to repay the loan.

In addition to installment loans, New Mexico residents may also want to consider payday loans for short-term financial assistance. While installment loans offer more extended repayment periods, payday loans can provide funds quickly with minimal paperwork. Like installment loans, reputable payday lenders operating in New Mexico must be licensed. To learn more about payday loans in New Mexico, check out our detailed guide.

How Long Does an Installment Loan Last?

Installment loans usually have a fixed term, ranging from a few months to several years. The loan duration depends on the amount borrowed, the interest rate, and the borrower’s agreement with the lender. With a network of lenders offering various repayment terms and conditions, you can choose a loan term that best fits your financial situation.

The length of an installment loan depends on the borrower’s repayment history and credit score requirement. You’ll probably get a longer term if you’ve never missed a payment and have a fair credit score. On the other hand, if you’re new to making payments, you might qualify for a shorter term. It is important to note that minimum credit scores significantly influence loan approval.

Employment verification and a steady source of income are crucial factors that lenders consider before approving a loan. Sometimes, you might be required to complete a loan request form to initiate the process.

Federal student loans can be a great option, as they usually have more flexible repayment terms than private loans. Remember that a quick loan might have higher interest rates, so always weigh your options carefully.

Conclusion

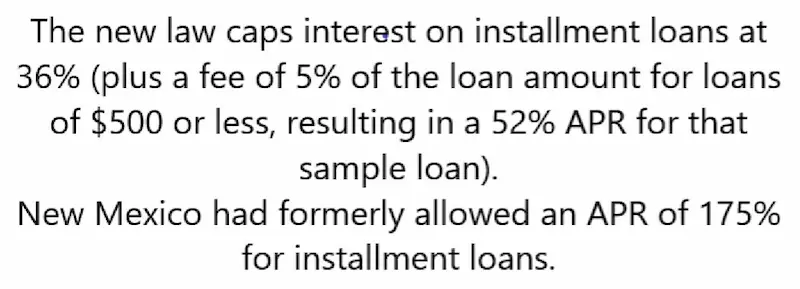

New Mexico stands out in the Mountain West region for its laws capping interest rates and costs on installment loans to help protect vulnerable borrowers. Under its statutes, rates are limited to 175% APR on principal amounts. Minimum 130 day terms are mandated so borrowers have time to repay without getting trapped in debt. Such consumer protections far exceed those available in some loosely-regulated neighboring states like Texas, Oklahoma, Colorado, Arizona, and Utah. New Mexico still enables access to credit including signature loans up to $5,000. But consumer advocacy groups praise the reforms for sparing vulnerable Hispanic, Native American, and rural low-income borrowers from predatory lenders exploiting legislative loopholes that remain open elsewhere locally.

Frequently Asked Questions

How can I find a reputable lenders in New Mexico that offer installment loans for individuals with bad credit and provide these loans without conducting credit checks?

Search online for state-licensed NM lenders advertising no credit check installment loans. Compare companies and read reviews carefully. Local credit unions may also offer options without hard credit checks.

What are the typical eligibility criteria for obtaining these installment loans in New Mexico without a credit check, especially for borrowers with poor credit histories?

Typical eligibility includes being a New Mexico resident, 18+ years old, having verifiable income, a valid ID, and an active checking account. Approval depends on income versus credit score.

Can you explain the interest rates, repayment terms, and loan amounts available for these loans in the state?

Interest rates typically range from 60% to 499% APR. Loan terms are often between 3 to 24 months. Loan amounts can be from $100 to $5,000 usually.

How does the application process for installment loans with no credit check work in New Mexico, and what documents or information should borrowers prepare?

The application process involves submitting personal information, income statements, and bank account details online or in-person. Having recent paystubs and bank statements handy can help.

Are there any specific advantages or potential considerations associated with obtaining installment loans without a credit check in New Mexico that borrowers should be aware of before applying?

Advantages include approval based on income rather than credit. Consider high interest rates and short terms that can lead to debt cycles. Avoid lenders charging excessive fees.