Alaska Installment Loans Online & Same Day

Alaska personal installment loans are short-term unsecured personal loans. It allows borrowers to repay it in smaller installments over several months or years. A common installment loan example is a $2,000 two-year loan. To apply, the borrower does not have to provide collateral, such as real estate or other assets. The lender, instead, provides funds based on the amount borrowed. Lenders consider the time the borrower takes to repay the loan.

These online installment loans help people who want to make large purchases. They are helpful when there’s a gap between income and expenses. People who need more cash to cover all the costs at once use installment loans. Banks, credit unions, finance companies, and other financial institutions offer installment loans. Some lenders even cater to borrowers with scores that may not qualify for traditional loans.

The loan application process varies by lender but typically involves providing personal and financial information. This helps the lender assess the borrower’s ability to repay the loan.

Borrowers must fill out a loan application form during the online application process. It must contain basic information about themselves and their finances. They receive an advance from the lender if approved. Most licensed lenders make direct deposits into their bank accounts.

How Does An Alaska Installment Loan Work?

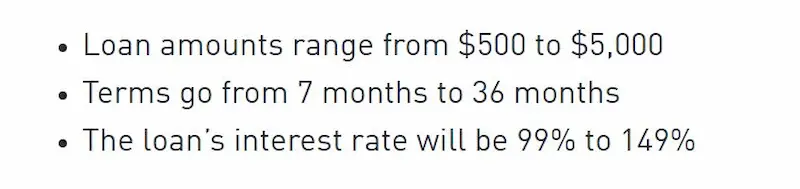

The customer applies for an Alaska installment loan through a direct lender. A direct lender is a company that provides small-dollar loans to consumers. The consumer gets approval for an Alaska installment loan through an online application. Next, they receive a pre-approved offer for a specific amount of money. It is called a “teaser rate.” It is the interest rate the customer pays while paying for their loan. The actual interest rate applied to the loan depends on the actual terms agreed upon when applying.

Customers make payments after receiving the loan offer depending on the payment plan. These payments pay off the loan’s principal balance and the loan fees. Some lenders charge origination fees. Borrowers must pay these origination fees too. The customer pays off the remaining balance owed at the end of the loan term. The customer’s loan is considered paid in full after the final payment.

Why Do People Use Alaska Installment Loans?

People use Alaska for these personal loans because they’re convenient and have flexible loan options. These loans are easy to repay because borrowers do not have to pay them all in a lump sum. Borrowers can repay them in small monthly installments within the repayment period instead. Some installment loans allow customers to borrow up to 100% of the available credit line. Borrowers don’t need a downpayment when taking out an Alaska installment loan. Borrowers get their Alaska bad credit installment loans and installment loan online without leaving home, thanks to the convenience of online applications. The entire process is online.

What Are The Types of Alaska Installment Loans?

There are two types of Alaska installment loans: secured and unsecured. Secured Alaska installment loans need security deposits. These include a car title or home equity to guarantee loan repayment. However, the unsecured Alaska installment loans don’t require collateral. Borrowers lose the money they borrowed through the installment loan if it happens. Secured Alaska installment loans tend to cost less than unsecured Alaska installment loans. But, they must ensure the vehicle is not repossessed or stolen.

Can I Get An Alaska Installment Loan With a Bad Credit Score?

An Alaska installment loan is possible, even with a bad credit score. Many lenders offer loans for borrowers with poor credit. They understand that life can throw unexpected challenges, and some might not have a perfect credit report. These loans often have higher interest rates and shorter repayment terms to balance the increased risk. Researching different loan options and comparing the costs is essential before deciding.

Yes! Many people with bad credit need help to finance more significant purchases. Most of these people have a high debt-to-income ratio. However, many options are available to those with poor credit scores. One option is an online Alaska payday loan offered by GreenDayOnline. Payday loans for customers with low credit scores are designed to cater to their needs. They are quick loans, and borrowers get the cash within one business day by filling out an online form. The loan proceeds are used for emergency expenses. However, these are high-rate loans.

Borrowers must meet specific requirements to qualify for bad credit Alaska installment loans. Bad credit lenders may require proof of income and assets. Some responsible lenders check credit scores to determine how much to lend a no-bank loan with bad credit.

How Do You Qualify for an Installment Loan?

Borrowers must determine if they’re eligible for a standard or an auto title loan to qualify for an Alaska installment loan. They should also consider their monthly income and research various loan providers for the best options.

Borrowers must prove they have enough income for regular monthly payments for standard personal loans. Borrowers can receive a decision from GreenDayOnline within 24 hours after completing the loan request form. With instant approval, borrowers can receive an email confirming their loan approval if approved.

Borrowers must complete a short form to take out an Alaska installment loan based on their car title. The lender asks borrowers to provide additional details. They include details about the vehicle’s value and the loan type amount they wish to apply for.

At GreenDayOnline, we pride ourselves on providing exceptional installment loan services throughout Alaska. With a dedicated team of professionals and a commitment to meeting our customers’ financial needs, we have established a strong presence in several prominent cities across the state. Whether you’re looking for a reliable loan provider in Anchorage, seeking convenient financial solutions in Fairbanks, or exploring opportunities in other major cities, we are here to assist you. In this article, we present a comprehensive list of the primary cities where our company is active, showcasing our extensive network and highlighting our dedication to supporting Alaskans in achieving their financial goals. Take a glance at the table below to discover the key cities we serve and the expansive reach of our services in the great state of Alaska.

| Anchorage | Fairbanks | Juneau |

| Wasilla | Sitka | Ketchikan |

Is Alaska Installment Loans Legal?

Yes. Alaska consumer installment loans are legal. Lenders must adhere to the Alaska installment loan laws. The state government regulates these loans and does not allow unlawful loans. It aims at eliminating borrowers offering high-cost loans.

Investigate the lender before applying for an Alaska online loan online. Ensure that the lender operates in Alaska legally. It helps to avoid dealing with rogue no-bank lenders who charge excessive interest rates. These exploitative lenders are known as high-rate installment lenders.

Remember that maximum loan amounts may vary among traditional lenders and other financial institutions when looking for a loan. Choose reputable lenders who follow the regulations and offer competitive loan rates.

Is There Any Down Payment Required When Borrowing Installment Loans?

The exact amount varies depending on the lender and the type of loan offered. No-bank and high-cost small loans have a minimum loan amount to be borrowed. Sometimes, there is no minimum loan amount required. But, Eligible borrowers still need to meet certain qualifications to be approved for a loan, such as a minimum credit score requirement. It depends on the loan and the lender in terms of down payments. Some online lenders need a down payment to qualify for a loan, while others do not.

The lending decision is typically made by a network of lenders that evaluate the applicant’s eligibility. Borrowers must check the terms and conditions of the actual loan offers to determine whether a down payment is needed. Some lenders need a down payment to reduce the risk of loan defaults. Others do not need a down payment to make the loan more accessible to borrowers. It’s worth noting that high-cost small loans have high-interest rates. The overall cost of the loan is quite high, even without a down payment.

What can borrowers use installment loans for?

Borrowers use installment loans for a variety of purposes. They are used to consolidate debt, pay unexpected expenses, pay credit card debt, or make home improvements. Borrowers use installment loans to pay for education, medical bills, or vacation. Borrowers must remember that installment loans are high-cost small loans. Sometimes they need to be more affordable for some borrowers. Unlawful lending practices make them easier to repay. These include charging exorbitant interest rates and fees.

Thus, borrowers must consider their financial situation and the Flexible terms of the loan before applying. Borrowers must look at other personal loan options affordable when considering installment loans. Knowing one’s minimum credit score and exploring various lending options is important. For example, suppose a credit union offers lower interest rates on a personal or home equity loan. It is a better option for someone looking to make home improvements.

Who Is a Direct Lender?

A direct lender makes personal loans directly to consumers. However, indirect lenders work with third-party companies to offer their services. Direct lenders provide quick loan approvals. Borrowers get their cash within one business day. However, they are high-cost lenders.

Listed below are factors to consider when choosing a direct lender.

- Reputation: Borrowers must consider how long the company has provided financial products and services. A steady income source can also indicate a reliable lender.

- Fees: Borrowers must consider what fees the company charges for the services.

- Rates: Borrowers must consider how quickly they are expected to repay the loan. Look for a lender with a good payment history that offers affordable financial services.

- Service: Borrowers must consider how the company provides customer support when needed. A great customer experience is essential.

Also, lenders should offer clear guidance on handling monthly bills to ensure borrowers can manage their loans effectively.

What Are the Advantages of Using an Installment Loan?

Several advantages come with using an Alaska installment loan instead of another personal finance product. Here are some examples:

- No Credit Check: An Alaska payday loan is subject to something other than traditional credit checks. They allow borrowers to borrow money regardless of their credit history. This means that even those with less-than-perfect credit or bad credit borrowers can still access the funds they need.

- Flexible Payments: Borrowers offer flexible repayment options with an Alaska installment loan. They choose between making monthly, biweekly, weekly, or daily payments. This flexibility can help borrowers maintain a positive repayment history and avoid late payments.

- Low-Interest Rates: The average Annual Percentage Rate on Alaska installment loans is approximately 5%. The annual interest rate is lower than most other types of financing available today, especially for those who might struggle with minimum score requirements.

- Quick Approval Process: Getting approved for an Alaska online loan is relatively easy. The borrowers usually get the application approved in less than 30 minutes.

Here are some statistics on Alaska Installment Loans For Bad Credit

| Statistic | Value |

|---|---|

| Average interest rate | 25% |

| Average repayment period | 36 months |

| Average fee | $35 |

| Average APR (annual percentage rate) | 30% |

| Average borrower credit score | 600 |

| Most common use | Pay for unexpected expenses, consolidate debt, make home improvements |

| Availability | Available in all 58 boroughs and census areas in Alaska |

| Maximum loan amount | $50,000 |

| Minimum credit score | Varies by lender |

| Approval process | Typically takes minutes to days |

| Funding | Funds are typically deposited directly into the borrower’s bank account within 1-2 business days |

| Risks | High interest rates, long repayment periods, high fees, default |

| Tips | Shop around, compare interest rates and fees, consider your credit score, ask about repayment options |

| Alternatives | Credit cards, personal loans, peer-to-peer lending, consolidation loans |

Do installment loans hurt your credit score?

The answer depends on how you use the loan proceeds you borrow. Spending all the borrowed funds on something that helps improve the credit rating, especially for an individual borrower. Such as, paying off debt won’t affect the credit score. Going over budget or failing to repay the loan on time negatively impacts the credit score, especially when dealing with short-term expenses.

How Do I Choose the Right Type of Personal Finance Product?

A person’s unique financial situation necessitates selecting a personal finance plan tailored to their specific requirements. When looking for extra cash or access to money, listed below are choices to remember when choosing the right personal finance product.

- The purpose of getting a personal finance loan: What to hope for when accomplishing such a purchase (savings, investment, borrowing, insurance, etc.)? Consider how a loan can help during difficult times and the loan period.

- The tolerance for risk of getting a personal finance loan: What is the risk tolerance? (Equities vs. bank accounts, for example.) Remember to consider the impact of types of credit scores.

- Time Horizon: Consider the time horizon before making any purchases. Is the product used temporarily or part of a long-term strategy? Weigh the loan period before deciding.

- Raising prices: Consider how much money is available on hand and whether or not the product is worth it. Assess the amounts of money you might need.

- Benefits and features: Check the product’s advantages and disadvantages to ensure they meet the requirements (e.g., interest rates, access to funds, etc.). Compare different types of credit scores and how they affect loan terms.

- The credibility of the provider: Checking the trustworthiness of the financial institution providing the service is smart. Look into their handling of different amounts of money and customer satisfaction.

Some borrowers need to learn the best loan for them. It is because they are sometimes unaffordable loans. They must contact the money lender for advice before signing the loan agreement. Money lenders can provide tailored guidance for people who need help with their loan choices. They offer loans to people with diverse financial. They explain the different options and give personalized advice based on their needs.

Frequently Asked Questions

How do Alaska installment loans for bad credit work?

Alaska installment loans for bad credit provide fixed loan amounts repaid with fixed monthly payments over a set repayment term.

What are the eligibility requirements for obtaining installment loans with no credit checks in Alaska?

Income verification, residency, and a personal checking account are generally needed for Alaska no credit check installment loans.

Are there any specific lenders or institutions in Alaska known for offering installment loans to individuals with bad credit?

Credit unions and online lenders like GreenDayOnline offer installment loans in Alaska specifically for borrowers with bad credit.

What is the typical repayment schedule for Alaska installment loans for bad credit?

Alaska installment loans allow 6-24 months for repayment with fixed equal monthly payments.

What are the potential advantages and disadvantages of opting for installment loans with no credit checks in Alaska?

Advantages include predictable payments, while high rates and hard credit inquiries are potential disadvantages.