Georgia Installment Loans Online for Bad Credit, an installment loan is a short-term, high-interest credit that requires you to pay back your loan over time with interest. The more you borrow, the higher your monthly payments will likely be. At Greendayonline, we provide installment loans to all borrowers who meet the qualification criteria, including those with bad credit. We specialize in online loans for bad credit consumers. We understand that a bad credit score or credit history should not prevent you from obtaining the funds you need for financial emergencies.

How Can I Apply for Online Installment Loans?

Complete our simple application form on this page to apply for online installment loans from Greendayonline. We will review your information and get back to you with instant approval within seconds. Online lenders like Greendayonline may ask for proof of income and other requirements to determine your eligibility. Once you agree to the loan terms, we will send the money into your bank account within one working day.

What Are the Loan Rate and Fee Laws and Regulations in Georgia?

The followings are the laws and regulations regarding personal installment loans and online installment loan networks in Georgia, ensuring consumer protection and fair loan approval processes for borrowers with varied credit backgrounds:

- Legal status: yes

- The minimum loan amount should be: $1,000

- The maximum loan amount is $5,000.

- The minimum term for an installment loan is 90 DAYS.

- The maximum loan term is 36 months.

- APR minimum: 6.63 percent

How Does the Georgia Installment Loan Act Protect Consumers?

The Georgia Installment Loan Act protects consumers by requiring lenders to disclose their Annual percentage rates (APR), loan fees, and other important information before accepting any consumer’s personal or financial information. The act also prohibits lenders from charging additional fees or costs after signing the initial loan agreement.

How Do Installment Loans Help Your Credit Score?

Installment loans can help improve your credit score by demonstrating responsible borrowing behavior. Lenders report your payment history to the major credit bureaus; on-time payments may positively impact your credit bureau score. Before applying for any loan, you must know your minimum credit score to get the lowest interest rate. An approved loan can help you establish or reestablish your credit, especially if you have a poor credit history. However, ensure a stable monthly income to manage repayments better. Always review your bank statements and ensure you can repay the loan without affecting your financial stability. Remember that responsibly managing lines of credit over time can significantly improve your credit score.

Installment loans help build your credit score by allowing you to make regular monthly payments instead of paying off the entire balance. It helps your overall debt load look smaller, improving your credit rating. If you have a good credit history, you may qualify for lower rates than if you have poor credit scores.

Who Is a Direct Lender?

A direct lender provides funds directly to you without going through a third party, such as a traditional bank. A direct lender typically offers better rates and terms than most banks. They do not charge hidden fees or require collateral. If you need better credit, a direct lender like Greendayonline will be your best option for an installment loan.

What Are Installment Loans No Credit Checks?

Installment loans with no credit check are alternative loans that provide emergency cash without the need for a perfect credit score. These loans consider other factors, such as your income, job stability, and outstanding debts, to determine your eligibility rather than relying solely on your credit history. This allows individuals with less-than-perfect credit to access loan funds at more competitive interest rates than traditional loans.

Credit unions and other non-bank lenders may offer these loans with faster approval times and direct deposit options, making them a valuable resource when you need funds quickly. Moreover, some lenders may perform soft credit checks instead of hard inquiries, which can prevent further damage to your credit score while applying for a loan.

At Greendayonline, our installment loan no credit check option allows you to obtain a cash advance even if you don’t have excellent credit. Our installment loan no credit check program does not rely on a traditional credit report. Instead, it uses information about your current income and expenses, employment history, and source of income, such as Social Security, to determine whether you qualify for the loan.

As a leading provider of installment loans in Georgia, our company takes pride in serving individuals and businesses across the state. We understand that financial flexibility is crucial, and that’s why we have strategically established our presence in key cities throughout Georgia. Whether you’re looking for quick access to funds or seeking a reliable financial partner, we have you covered. Below, we present a table highlighting the major cities where our company is active, demonstrating our commitment to providing convenient and accessible installment loan services across the state.

| Atlanta | Columbus | Augusta |

| Savannah | Athens | Sandy Springs |

| Roswell | Warner Robins | Johns Creek |

| Albany | Alpharetta | Marietta |

| Smyrna | Valdosta | Dunwoody |

If an installment loan does not fit your needs, explore other short-term borrowing options like payday loans. As a leading online lender in Georgia, we also offer payday loans to residents across the state. These can provide fast access to smaller amounts of cash when you need funds right away. Check out our page on Payday Loans Georgia to learn more about qualification requirements, loan amounts, and repayment terms for this alternative.

How Do You Qualify for an Installment Loan?

To qualify for an installment loan, you must demonstrate your ability to manage your finances and pay your bills on time. This includes covering any unexpected or emergency expenses that may arise during the loan term. We understand that many people face emergency costs and need quick access to funds to cover them. That’s why our loan programs are designed to support individuals who may need better credit but are responsible with their money.

If you need financial assistance that fits within your budget, consider applying for one of our installment loans to help manage your needs on a business day. By ensuring that you can make your payments on time and manage any unforeseen expenses, you’ll be able to maintain a healthy financial standing while reducing your loan balance. Plus, our installment loans are generally unsecured, so you don’t have to provide collateral to secure the loan.

If you want to take out a bad credit installment loan with guaranteed approval, you must be able to repay the loan. To qualify for an installment loan, you must demonstrate that you can earn enough money to cover your living expenses and still have some leftovers to repay. It would help if you were employed or retired to receive an installment loan. It would help if you were employed or self-employed.

When considering a loan, looking for an affordable option is crucial. Searching for loans with reasonable interest rates and appropriate loan sizes is important to fit your needs. Remember the loan payments you must make, and ensure you understand the Common types of loans available to you.

If you require a larger loan, assess your credit profile beforehand, and explore alternative borrowing options before deciding. Depending on your specific requirements, short-term loans, secured loans, and unsecured debt may also be appropriate.

Are Installment Loans Legal in Georgia?

Yes, installment loans are legal in Georgia. However, certain restrictions exist on how much money you can borrow and what types of businesses can offer them. For example, only licensed lenders can provide installment loans. In addition, installment loans can only be used to pay off debts incurred within 60 days before applying for the loan.

Here are some statistics on installment Loans in Georgia:

| Statistic | Value |

|---|---|

| Average interest rate | 38% |

| Average term | 36 months |

| Default rate | About 17% |

What Are the Advantages of Installment Loans?

The following are some of the benefits that come with using an installment loan:

- Flexibility – An installment loan lets you choose when to repay the loan over time rather than all at once. This gives you more flexibility in managing your major expenses and avoiding late payments.

- Lower Interest Rates – With an installment loan, you’ll likely get a lower interest rate than a payday loan or a credit card, making it a less-expensive option overall. This can save you money in annual costs and timely payments.

- Lenders Can Verify Income – Because your job or business secures installment loans, lenders can verify your income using tax records, payroll checks, or other documents. This can be helpful if you don’t have a Social Security Number or a regular source of income.

- Less Hassle – The application process for an installment loan is usually easier than getting a payday or title loan.

- More Options – Some installment loans let you use your paycheck to pay the principal faster, while others give you extra money to spend on groceries and utilities. Additionally, installment loans often have less stringent requirements and lower high-interest rates than other forms of credit, like credit cards.

What Is the Process of Getting Online Installment Loans?

To apply for an online installment loan from Greendayonline, follow these steps:

Step 1: Fill Out Your Application

Please fill out our simple online formal application form and submit it. We will review your application and contact you to discuss your options.

Step 2: Review Your Options

Once we’ve reviewed your application, we will send you a list of approved third-party lenders. These lenders may offer different loan amounts and payment plans with excellent loan terms. Choose one that’s right for you.

Step 3: Apply for Your Loan

After choosing a lender, complete the online application for title loans and submit it. Once we’ve received your completed application, we will approve your request and deposit funds into your bank account as a day deposit as quickly as possible.

Step 4: Pay Back Your Loan

Payments are automatically deducted from your bank account from time to time each month until the entire amount has been paid back. Please note that a service fee might be applied during the repayment period.

Conclusion

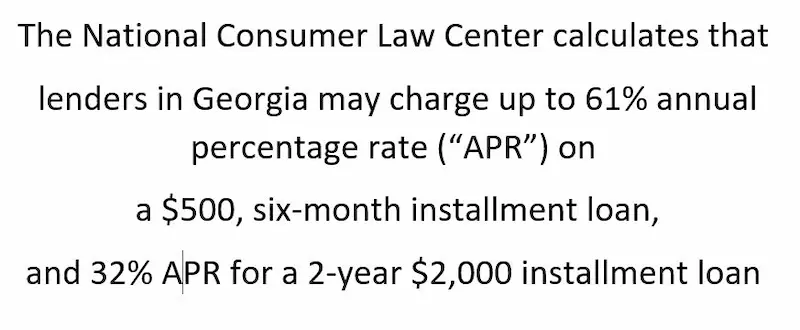

Georgia maintains moderately permissive installment lending rules compared to some neighboring states, seeking to balance access to credit with consumer protections. With a diverse workforce spanning urban and rural areas, installment loans are utilized to help Georgia borrowers smooth uneven income streams and afford critical expenses during financial hardship. Under state law, lenders can charge up to 60% APR on loans under $3,000 although average rates tend to fall between 20-50% based on credit scores. Georgia allows origination fees up to 5% of the loan amount. Some consumer advocacy groups argue Georgia should impose lower rate caps and tighter fee limits to prevent predatory lending, similar to regulations in other southern states like Florida, Alabama, Tennessee, North Carolina, and South Carolina. Industry groups counter that further reforms will restrict Georgians’ access to vital credit options.

Frequently Asked Questions

How can I qualify for an online installment loan in Georgia with bad credit and no credit check?

You’ll need proof of income over $1,200/month, Georgia ID, Social Security number, bank account access, personal references, and valuable property like a vehicle title as potential collateral to potentially qualify with no credit check.

What are the typical interest rates and repayment terms for online installment loans for bad credit in Georgia?

Interest rates are typically 25% to 35% APR with shorter 6-12 month repayment periods for Georgia installment loans for borrowers with bad credit.

What documents and information do I need to provide when applying for a bad credit installment loan online in Georgia?

You’ll need a Georgia ID, proof of income, Social Security number, bank statements, utility bill, personal references, and possibly vehicle title or other collateral assets.

Are there any specific regulations or requirements I should be aware of when seeking an online installment loan for bad credit in the state of Georgia?

Georgia has no interest rate caps on installment loans, but prohibits misleading advertising and structuring of loans to intentionally entrap borrowers.