Louisiana Installment Loans For Bad Credit With Instant Approval

Louisiana residents in need of financial assistance have the option to apply for installment loans. Lenders offer these loans to give individuals access to funds without having to repay the entire loan amount in one lump sum. Instead, they divide the repayment process into several installments, which helps people manage their monthly expenses.

Banks and traditional lenders don’t always approve applicants with bad credit, leaving them with limited options. However, online lenders offer installment loans for bad credit with instant approval. Applicants are free to submit their information online and receive immediate approval. The process is simple, and it takes just a few minutes to complete the application.

What Are Louisiana Installment Loans?

Installment personal loans are available from online lenders, banks, credit unions, and other financial institutions. The terms and interest rates of installment loans vary depending on the lender and applicant. Some lenders offer lower interest rates or more flexible terms for customers with good credit scores and a history of responsible financial decisions.

Most installment loans are typically unsecured loans. Any collateral does not back the loan, and the lender relies solely on the borrower’s creditworthiness and ability to repay the loan. The maximum loan amount a borrower can get depends on their financial situation and the lender’s criteria.

Louisiana residents looking for additional financial assistance can also consider payday loans. These short-term loans provide fast access to cash when needed until your next paycheck arrives. To learn more about payday loans and how they work in Louisiana, check out our helpful guide on Payday Loans Louisiana.

Are Installment Loans Legal in Louisiana?

Personal and payday loans are legal in Louisiana and regulated by the state’s Office of Financial Institutions. The Louisiana Installment Loan Act of 2020 regulates the maximum loan amount, interest rate, and other terms related to installment loans. It ensures borrowers are protected from unfair lending practices and can make informed decisions about their loan options, including those from payday lenders.

Borrowers in Louisiana can guarantee that their financial security is kept in check since even online direct lenders must adhere to the strict regulations in place. The laws affect 500-dollar loans to high-risk unsecured loans. Furthermore, borrowers are free to take out safe, trusted payday loans from reputable lenders to guarantee their safety from predatory lending practices, including those offering payday loan options by payday lenders.

Who Are Direct Lenders for Online Loans?

Financial institutions or companies, such as those providing payday loan services, are known as direct lenders for online loans as they provide the loans directly to the borrower, excluding the involvement of any third party. Direct lenders handle the entire loan process, from loan application to disbursal and repayment, making it convenient for borrowers to obtain a payday loan when needed.

Examples of direct lenders for online loans include banks, credit unions, peer-to-peer lending platforms, and specialized online lenders. Direct lenders have varying loan products and criteria for loan approval, including credit score requirements, income, and employment history. Borrowers obtain more favorable loan terms and a quicker and more streamlined loan process by dealing directly with the lender.

How Long Do Installment Loan Agreements Last?

Installment loans generally last from six months to five years. The loan duration is usually determined by how much money the borrower needs, their credit score, and other factors.

For instance, a borrower with a low credit score only qualifies for an installment loan of up to six months, while someone with excellent credit gets a longer term. Moreover, the loan amount plays a role in determining how long the loan lasts. For example, a borrower who takes out an installment loan of $50,000 likely qualifies for a longer term than someone who only needs $2,500.

What Are Some Things That I Should Consider Before Applying for an Installment Loan?

There are several things that borrowers must consider before applying for an installment loan online. First, they must check the loan’s APR (Annual Percentage Rate). APR is the annual cost of borrowing expressed as a percentage. For example, a 1000-dollar loan at 10% APR means paying $100 per month for a year. A $1000 loan at 17% APR implies that the total cost of borrowing would be $170 per month. Second, borrowers must consider the term of the loan.

Generally speaking, short-term loans carry lower rates than their longer-term counterparts. Third, it’s best to decide if they need a secured or unsecured personal loan. Secured loans are backed by collateral such as real estate or personal property. Any assets do not back unsecured loans.

What Are the Types of Installment Loans?

There are three main types of installment loans; fixed-rate, adjustable-rate, and hybrid. Each of these loans has its advantages and disadvantages. Short-term loans can also be classified under these types, depending on the loan agreement and interest rate structure.

- Fixed-Rate Installment Loans: Fixed-rate installment loans are the most common type of loan. Borrowers know the total cost of their monthly payments and when they are due. A fixed-rate helps borrowers manage their finances better and avoid late payments or penalties. Moreover, they are typically easier to qualify for than other types of loans.

- Adjustable-Rate Installment Loans: Adjustable-rate installment loans offer a variable interest rate that changes over time. Borrowers can get a lower initial interest rate with an adjustable-rate loan. But they need to be prepared for the possibility of higher payments in the future since the rate depends on different factors, such as the lender or the market.

- Hybrid Installment Loans: Hybrid installment loans are a mix of fixed-rate and variable-rate loans. The borrowers are free to have a fixed interest rate for a set time and switch to an adjustable rate at the end of that period. Choosing such a type of loan is suitable for borrowers who want the security of a fixed-rate loan and the flexibility of an adjustable-rate loan.

What Are the Requirements for an Installment Loan?

There are various standards that borrowers must complete to apply for an installment loan. Listed below are a few examples.

- Meeting the lender’s eligibility requirements, such as being a legal resident and owning a mobile phone.

- Completing a short online form as part of the application process, including information about the borrower’s income, work, and contact information. Applicants can do it through an online application.

- Providing proof of income from a consistent source, such as payslips or tax returns. Borrowers need to present a copy of their bank statement as proof that they can access cash.

- Having an active email address to obtain loan application confirmation and loan details through the online form or by submitting an online application.

- Accepting the loan’s payment conditions, which describe the amount they must repay and the payback timetable.

What Is the Process of Getting an Online Installment Loan?

The process of getting online installment loans is straightforward. Listed below are the steps a borrower must follow when applying for an installment loan:

- Find a reputable lender. Finding a reputable lender is the first step in getting an online installment loan. Research different lenders to compare rates, terms, and fees. Make sure to read reviews from past customers to guarantee that the cash advance provider is trustworthy and reliable.

- Apply for the loan. Borrowers must provide information about their income, employment, and contact details. The lender asks for proof of income, such as payslips or bank statements. After approving the request, the lender sends the borrower an email with the loan details, including the repayment schedule and payment conditions.

- Repaying the installment loan. Lenders provide instant approval installment loans with flexible repayment terms. Borrowers can choose to pay back the loan in a couple of months or years.

We are proud to present a comprehensive list of the most important cities where our company operates in the beautiful state of Louisiana. As a leading provider of installment loans, we have established a strong presence in these key cities to serve the financial needs of our valued customers. Whether you’re in need of quick funds for unexpected expenses or seeking a reliable source for managing your financial goals, our dedicated team is here to assist you. Below, you will find a table highlighting the major cities in Louisiana where our services are available. Take a closer look to discover how we can help you with your financial needs in these vibrant communities.

| New Orleans | Baton Rouge | Shreveport |

| Lafayette | Lake Charles | Kenner |

| Bossier City | Monroe | Alexandria |

Frequently Asked Questions

Is It Safe to Get an Online Installment Loan in Louisiana?

Yes, there are state laws that protect borrowers from predatory lending. Some of the lending laws include the Consumer Credit Act (CRA), Fair Debt Collection Practices Act (FDCPA), Truth in Lending Act (TILA), and Equal Credit Opportunity Act (ECOA). Considering your financial situation is crucial when applying for an installment loan, as you want to ensure you can handle the repayment terms.

Here are some statistics on installment loans in Louisiana:

| Statistic | Value |

|---|---|

| Loan amount | $500 to $5,000 |

| APR | Average of 360% |

| Loan term | 6 to 60 months |

| Repayment | Monthly installments |

| Fees | Origination fees, late payment fees, and prepayment penalties |

| Target audience | Borrowers with fair to bad credit |

| Pros | Quick and easy way to get cash when you need it. Don’t require a credit check and can be repaid in monthly installments. |

| Cons | High interest rates and fees. If you default on the loan, the lender can take legal action against you. |

Can I Get an Installment Loan With No Credit Check?

Yes, many online lenders offer credit check loans where they check the source of income if the applicant has a bad credit history. Borrowers are still eligible for an installment loan with a steady income. However, remember that the interest rate is higher than for borrowers with good credit.

Can I Refinance my Installment Loan?

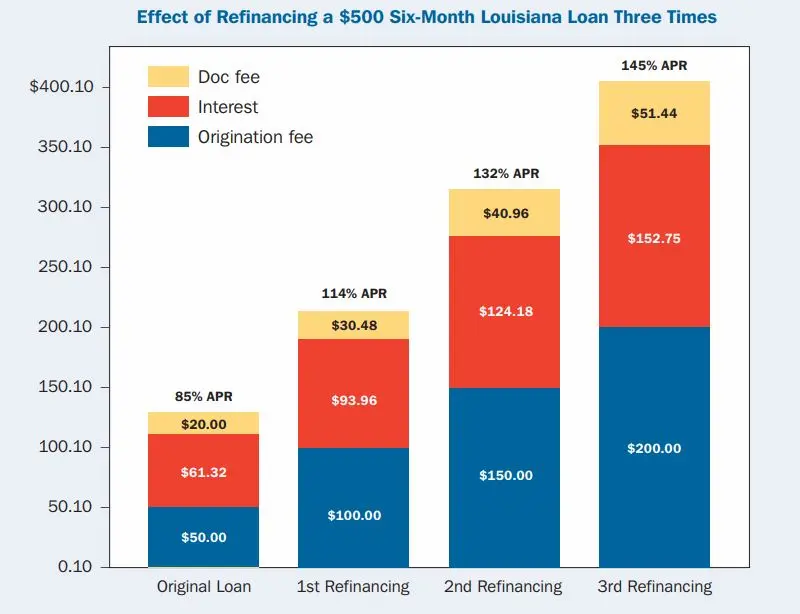

It depends on the lender and their refinancing policies. Some lenders offer refinancing options for borrowers who consistently make their monthly installments and have a good payment history. Refinancing can potentially lower your monthly payment or extend your loan term, but it’s essential to understand the new terms and conditions of the loan contract before proceeding.

Yes, it is possible to refinance an installment loan. Refinancing involves taking out a new loan to pay off an existing loan, usually with more favorable terms. However, it is important to be aware of the potential refinancing costs, such as origination fees, early repayment penalties, and other fees. Borrowers must weigh the potential benefits and costs of refinancing before deciding.

How Do I Know if My Application Was Approved?

Most lenders contact the borrower within 24 hours of receiving the application. Online lending platforms, like GreenDayOnline, provide approval within minutes. The company sends the money to the borrower’s account after finalizing the loan agreement.

Conclusion

Louisiana regulators recently enacted new restrictions on installment lending after previously allowing very high costs unlike neighboring states like Texas, Arkansas, and Mississippi which cap rates lower. Under the new Louisiana laws, interest rates are capped at 36% APR for loans under $1,750. Minimum 12 month terms are also mandated so borrowers have more time to repay – unlike some states permitting single payment loans. The reforms aim to reduce consumer hardship and curtail access to predatory credit products that previously trapped Louisiana borrowers in debt cycles according to advocacy groups. Industry associations argue the regulations have limited consumers’ credit options. The impacts are still being analyzed as borrowers and lenders adjust. Further reforms may be upcoming.

Louisiana residents can apply for installment loans, which lenders offer to provide individuals access to funds with a payback process divided into several partial payments. Online lenders offer installment loans for bad credit with instant approval. But it’s best to get installment loans from reputable lenders to avoid paying additional or hidden charges. GreenDayOnline connects borrowers to trusted lenders in Louisiana. The company provides a safe and secure platform for borrowers to get installment loans with no credit check.