Kansas Installment Loans for Bad Credit

Installment loans in Kansas are repaid over some time, often between a few months and a few years, in equal monthly installments. Installment loans are available from several different sources for borrowers in Kansas, including traditional banks, credit unions, and online loan providers.

These loans have many potential applications, including debt consolidation, funding major purchases, and meeting emergency costs. However, before committing to an installment loan, it is essential to consider the loan’s terms and circumstances, such as the interest rate, payback time, and any fees or penalties.

Main Points:

- Available for borrowers with bad credit loans or poor credit scores

- Can help improve one’s financial situation by consolidating debts or funding necessary expenses

- It’s crucial to review your credit report to understand your current financial standing before applying

- May have higher interest rates than traditional loans due to increased risk for lenders

- Wide range of loan products to choose from, including emergency loans for urgent needs

- Installment loans are a type of loan where the borrower repays the loan amount over a specified period with equal payments. Unsecured loans are sometimes offered, which don’t require collateral.

- These loans are available from traditional banks, credit unions, and online lenders. They can be used as short-term loan options or for borrowers with poor credit histories.

- The steps to get an online installment loan are as follows; fill out an online application process, receive approval, review loan terms, agree to terms, receive loan funds in a bank account, and enjoy a new cash advance.

- Late payments on installment loans result in fees and penalties, negatively impacting a borrower’s credit score. Some lenders may still offer credit check loans even to borrowers with less-than-perfect credit.

- The borrower must be 18 or older, have a valid SSN, live in Kansas, have a steady source of income or proof of income, not owe any debt to another financial institution, and provide proof of employment to qualify for an installment loan in Kansas.

- Refinancing a payment plan loan saves borrowers money by having more favorable conditions like a lower interest rate or a longer payback time.

- The Kansas Department of Revenue regulates payday lending in Kansas and sets specific regulations, including licensing requirements and interest rate limits. This ensures that borrowers are protected even with unsecured loans and lenders operating transparently.

What Are Installment Loans?

‘Traditional lenders like banks, credit unions, and internet moneylenders provide installment loans to pay for a major purchase or to cover unexpected expenses. Installment loans are repaid by the borrower over a certain time, often between several months and many years, and cover the loan’s principal and interest. Installment loans are available from various sources, and each has different requirements.

Steps for Getting Online Installment Loans?

- Step 1: Fill out our simple online form.

- Step 2: Receive the approval decision in just a few seconds. This quick application process makes it convenient for borrowers who need fast financial assistance.

- Step 3: Review the loan terms and conditions. You’ll find that most lenders accommodate bad credit scores and provide options for those with less-than-perfect credit histories.

- Step 4: Agree to the loan terms and send us your information.

- Step 5: Receive the funds deposited into your bank account within 24 hours. This timely financial help is perfect for those facing emergency expenses.

- Step 6: Enjoy the new cash advance, knowing you’ve made a smart choice with online payday loans.

How Long Does It Take to Get an Installment Loan Approval?

The approval process for installment loans is generally quick and can take a few minutes to a few hours, depending on your chosen lender. With online payday loans, you can expect a rapid response and often same-day approval. This makes them an ideal option for borrowers who need immediate access to funds for unexpected expenses or other urgent financial needs.

The approval process varies from direct lenders to direct lenders. Most online lenders offer competitive interest rates and take less than 30 minutes to approve the loan application. However, some lenders need up to two business days to complete the loan process. Lenders require borrowers to have a valid email address and agree on the loan terms before sending the money into their accounts. The money is deposited into the account the next business day after signing the loan agreement, ensuring instant approval.

What Happens if My Application Gets Denied?

Applicants are rejected for various reasons, including but not limited to insufficient credentials, insufficient documentation, or failure to fulfill stated requirements. They have determined that the applicant does not meet their requirements for membership or participation when an organization or institution declines the application, which may be due to financial hardships. Contact the appropriate authorities to determine why the application was refused and how to improve the chances and increase approval rates.

How Borrowers Pay off Online Installment Loans?

Depending on the lender’s conditions and borrowers’ preferences, borrowers can pay off personal installment loans through various methods.

Borrowers pay off the online installment loans by making regular payments via direct deposit into their checking or savings account. Lenders automatically deduct the amount owed from the account every month until the balance has been repaid. With flexible repayment terms and access to cash, these loans offer borrowers competitive rates over a period of time.

What Are the Requirements for an Installment Loan in Kansas?

Listed below are the requirements to qualify for Kansas Installment Loan.

- Be 18 years old or older.

- Have a valid Social Security number.

- Live in the state of Kansas.

- Have a steady source of income.

- Not owe any debt to another financial institution.

- Provide proof of employment.

- Consider a secured loan as one of the many types of loans available.

- Look into debt consolidation loans to manage multiple debts.

- Choose from a vast network of lenders offering various loan options.

Do Installment Loans Require a Credit Check?

GreenDayOnline only examines applicants’ limited credit history and bad credit history after granting loans. It is aware that many loan applications are denied due to mistakes in applicants’ credit records. Instead, lending partners consider the repayment capacity before deciding on the loan. Lenders tell a person how much of an installment loan to receive if one has good credit.

GreenDayOnline offers instant funding installment loans to borrowers with good repayment capacity without relying solely on credit histories. They provide comprehensive services and excellent customer service to ensure a smooth borrowing experience.

As a prominent provider of installment loans in Kansas, our company takes pride in serving numerous communities throughout the state. We understand the importance of accessibility and convenience regarding financial solutions. With that in mind, we have strategically established our presence in some of the most vital cities in Kansas.

The table below highlights the key cities where our services are readily available, ensuring residents can easily access the needed installment loans. Whether you need financial assistance or seek reliable options for managing unexpected expenses, our company is committed to supporting the financial well-being of Kansas residents in these thriving cities. Explore the table below to discover the cities where our company operates and find the closest location to you.

| Wichita | Overland Park | Kansas City |

| Olathe | Topeka | Lawrence |

| Shawnee | Lenexa | Manhattan |

| Salina | Hutchinson | Leavenworth |

| Leawood | Dodge City | Garden City |

Is it possible to refinance a payment plan loan? In What Amount Borrowers Save?

Yes, a loan on a payment plan is refinanced. Loans are refinanced when a new loan is taken from a reputable lender to pay off an old debt. Typically, the latest loan has reasonable interest rates and Flexible repayment options that are more favorable than the old one, such as a lower interest rate or a longer payback time.

The amount a borrower saves by refinancing depends on several variables, including the interest rate, loan term, and principal balance. Borrowers save money throughout the loan if the new loan has a lower interest rate. Increasing the loan’s payback term might reduce monthly payments but add to a higher interest bill over time. Borrowers might estimate their savings by comparing their present loan’s conditions and prices with viable refinancing choices.

Is an Installment Loan Right For Me?

An installment loan is right if a person wants quick access to extra cash without waiting days or weeks for a traditional personal loan. Applying for an installment loan is easy; the money is usually deposited directly into the bank account within one business day. With a wide range of lenders, borrowers can take advantage of flexible terms and a range of loan options. However, some lenders may offer limited loan amounts and charge a high Annual Percentage Rate. As a borrower, assessing the time payments and flexible repayment plans is crucial before deciding to ensure easier access to funds.

Do Installment Loans Affect Credit Scores?

Yes, getting an installment loan can hurt the credit. A loan payable in equal installments over a certain period is an installment loan. The installment loan company looks at the credit score and credit history to make a lending decision. There are a few ways in which an installment loan lowers an individual credit score.

Making all payments on time positively affects payment history, a major element in one’s credit score. However, credit scores suffer if borrowers often pay late or don’t pay. Borrowers need to be responsible for an installment loan if a person wants to keep or raise their credit score.

Sometimes, borrowers may consider other options, such as title loans, auto loans, or larger loans to meet their financial needs. However, it is essential to be aware of the possible drawbacks like limited loan term options or higher interest rates for long-term loans. For short-term financial needs, one might consider alternatives such as payday lenders or short-term payday loans.

What Are the Kansas Installment Loans Regulations?

The Kansas Department of Revenue regulates payday lending in Kansas. The department requires lenders to comply with specific regulations, including:

- The state must license lenders.

- Lenders must charge 36 percent interest per year on loans.

- Lenders cannot extend credit to anyone under 21 years old.

- Lenders cannot require customers to use a specific form of identification to obtain a loan.

Here are some statistics on Kansas Installment Loans:

| Statistic | Value |

|---|---|

| Loan amount | $500 to $5,000 |

| APR | 29.99% to 35.99% |

| Loan term | 6 to 60 months |

| Repayment | Monthly installments |

| Fees | Late payment fee of $35 |

| Target audience | Borrowers with fair to good credit |

For those seeking quick access to funds in Kansas, payday loans can also be a convenient option. As an alternative to installment loans, payday loans provide a fast way to bridge a cash shortfall until your next paycheck. You can learn more about payday lending regulations and requirements in our comprehensive guide on Payday Loans Kansas.

Are There Any Consequences for Late Payments?

Yes, fees and other penalties are associated with late payments on installment loans. Borrowers’ credit personal scores and histories must be on time with their payments. Additionally, the lender imposes late penalties and extra interest on the past due amount, which raises the loan’s overall cost.

Borrowers’ connection with the lender also suffers from overdue payments. The lender sees this as a greater risk if individuals have a history of missing or paying late fees, increasing their interest rate, or restricting their ability to borrow money in the future.

With a range of loan amounts available, installment loans can be an excellent option for borrowers. However, having an active bank account and Active checking is essential to qualify for these financial solutions.

An installment loan can be a convenient option for individuals looking for a flexible and easily manageable loan solution. Providing a range of loan amounts to suit different financial situations, installment loans offer a reliable funding source.

Conclusion

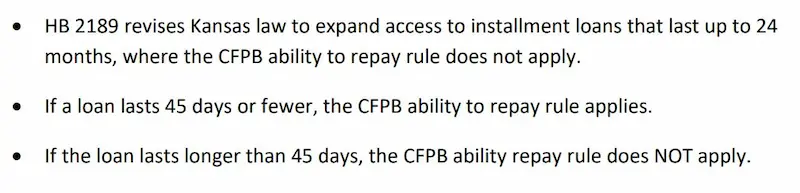

Kansas has grappled with predatory lending problems in recent years, passing reform regulations to protect consumers unlike some neighboring states with fewer defenses. High interest rates and easy access to short term, small loans sank many Kansans into debt traps according to reform advocates. In response, voters approved new laws capping rates for installment loans at 36% APR with terms between 60-120 months and limitingorigination fees to 3% of principal or $100. However some lenders are now attempting to classify their products as open-end credit to skirt rules. Kansas consumer groups caution that high costs still burden cash-strapped borrowers despite protections exceeding those in states like Nebraska, Missouri, Oklahoma, and Colorado. Meanwhile industry associations argue the new regulations restrict Kansans’ access to vital credit options.

Frequently Asked Questions

What are Kansas installment loans for bad credit, and how do they work without a credit check?

Kansas installment loans for bad credit provide fixed loan amounts repaid with fixed monthly payments over a set term without a credit check. Higher interest rates offset lending risks.

How can I apply for a Kansas installment loan if I have bad credit and want to avoid a credit check?

You can apply through online lender websites or in-person. Providing income proof, ID, Social Security number, collateral, and references can help secure a no credit check loan despite bad credit.

What are the eligibility requirements for obtaining a bad credit installment loan in Kansas?

Typical requirements are Kansas residency, steady income, valid ID, Social Security number, bank account access, personal references, and collateral like a paid-off vehicle title to help offset risk.

Are there any reputable lenders in Kansas that offer installment loans for bad credit without a credit check?

Most reputable Kansas lenders still assess credit for loan decisions. Carefully research any advertised “no credit check” offers, as legitimate bad credit installment loan options are very limited.

What factors should I consider when comparing Kansas installment loan options for individuals with poor credit?

Look at interest rates, fees, loan amounts offered, repayment terms, early payoff policies, application requirements, and lender reputation when comparing installment loans for poor credit borrowers in Kansas.