Kansas Title Loans Online for Bad Credit Direct Deposit NO Credit Check

Online title loan companies have recently gained popularity in Kansas and the United States due to their ease of accessibility and convenience. Online title loans offer borrowers the ability to apply for a loan from the comfort of their own homes and receive funding quickly through an online application process.

They seem attractive to people needing quick cash, including those with a bad credit score. Still, it is necessary to understand the potential risks involved. The following blog post explores the world of online title loans in Kansas, including how they work and what to know before taking one out. We will also discuss alternatives such as personal loans, auto title loans, and loan approval from a direct lender even with a bad credit score.

Summary

In this post, we explored online title loans as a convenient funding option for those with bad credit scores. We also mentioned options like personal loansand auto title loans and how a direct lender can play a role in loan application and approval. Consider the loan interest rate and make an informed decision before applying for any bad credit loan.

- Online title loans in Kansas use the borrower’s vehicle as collateral to borrow money, and the loan process can take just a business day or two.

- The application process is quick and easy, with lenient credit and income requirements, making them suitable for various financial institutions, including credit unions.

- Online title loans have fast approval and lower interest rates than other short-term loans but keep in mind there are different types of loans available.

- The biggest risk of online title loans is high-interest rates and fees that lead to vehicle repossession, so evaluate your payment history before committing.

- Interest rates vary depending on credit score, vehicle value, loan amount, and repayment terms, so understand the loan documents to find the best loan type for your situation.

- Borrowers must only get title loans if they plan to repay them and afford the high fees and interest rates. So, consider the repayment plan before finalizing the loan.

What Are Online Title Loans Kansas?

Online title loans in Kansas are secured loans that allow individuals to borrow money using their vehicle as collateral. The lender holds onto the car’s title until the borrower repays the loan in full. Unlike an unsecured loan, online title loans are obtained quickly and easily online, making them an attractive option for people who need fast access to cash for financial emergencies. While title loans seem simple, they have high-interest rates and fees. Please repay them to avoid losing one’s vehicle.

How To Qualify For An Online Title Loan

Online title loan lenders, also known as online lenders, provide quick and easy access to cash for borrowers in need, including loans for people with bad credit. They do not have the same strict requirements as traditional loan lenders like banks. Online title loan lenders are more lenient with credit score requirements and income verification. Filling out an online application form is quite easy. Once it is done, they use the borrower’s vehicle as collateral rather than relying solely on credit history or income. This type of loan can be a suitable option for individuals with a steady source of income and seeking lower monthly payments compared to other alternatives.

- The application process for online title loans is quick, but knowing how to qualify is still necessary to guarantee instant approval. Here’s how to qualify for an online title loan in Kansas with instant approval.

- Borrowers must have a clear title to their vehicle with no outstanding liens or loans against it. The car has to be less than ten years old and have fewer than 100,000 miles on it. Having an active checking account is also necessary for most online loans.

- Borrowers must provide the lender with proof of income and residency. Doing so helps guarantee that they have the means to repay the loan. Meeting the minimum credit score requirements may also be necessary for some credit check installment loans.

- Borrowers must start applying if they meet the basic requirements. They must provide personal information such as their name, address, phone number, and email address. Based on these details, lenders will offer different loan offers with varying rates and terms.

- Borrowers must provide details about their vehicle, including its make and model. The information helps the lender determine the value of the car and the maximum borrowing limit that they can offer.

- Approved borrowers must sign the loan agreement and provide the lender with a copy of the car title. Lenders deposit the funds into the borrower’s bank account within a few hours, granting them an instant approval experience.

Benefits Of Online Title Loans Kansas

The biggest benefit of getting a title loan is its convenience to borrowers. Borrowers can obtain title loans quickly and easily. They are unlike traditional loans requiring lengthy applications and extensive credit checks. The fast approval process and competitive rates are necessary for borrowers facing urgent financial needs, such as unexpected bills, medical bills, or Credit Card Cash Advances.

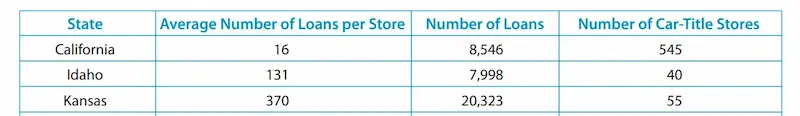

Here are some statistics on Kansas Title Loans:

| Statistic | Value |

|---|---|

| Loan amount | $500 to $35,000 |

| APR | 18% to 36% |

| Loan term | 1 to 6 months |

| Repayment | Monthly installments |

| Fees | Title loan origination fee (1-10%), late payment fee ($25-$50), prepayment penalty (1-10%) |

| Target audience | Borrowers with fair to bad credit |

Fast Approval Process

The key benefit of online title loans in Kansas is their fast approval process. A streamlined application process and minimal documentation requirements, like a bank statement, allow borrowers to receive a Same-day approval within minutes or hours of submitting their loan request. Moreover, Emergency loans like title loans can provide quick access to cash compared to other hardship options such as installment loans or credit personal loans.

Many lenders offer same-day funding options, meaning approved borrowers have cash loans in hand by the end of the day. Such speedy access to funds is a lifesaver for individuals facing unexpected expenses or temporary cash flow shortages. It is especially valuable to people who need quick funds access to address an urgent financial situation.

Low-Interest Rates and Credit Limits

Another significant benefit of online title loans in Kansas is their low-interest rates and flexible credit limits. The interest rates of title loans are lower than other short-term loans, such as traditional payday loans or cash advance loans. They have more favorable interest rates due to the collateral provided by the borrower’s vehicle. These loans can provide a maximum loan amount based on the value of the borrower’s vehicle, making them a more viable option for those needing larger funds.

Many lenders offer flexible repayment terms, allowing borrowers to customize their payments based on their needs and budget constraints. This flexibility makes it easier for individuals to consider a bad credit installment loan when looking for financial assistance. It means borrowers can access funds at a lower cost and with less financial strain compared to dealing with predatory lenders from payday loans.

When it comes to securing a quick and reliable solution for your financial needs in Kansas, our company is here to provide assistance. We take pride in our widespread presence across the state, actively serving numerous cities and communities. In this table, we present a comprehensive list of the most important cities where our company is actively engaged in offering title loans. Whether you reside in the heart of Kansas City, the scenic beauty of Wichita, or any other thriving urban center in the state, our services are readily available to support you. Take a glance at the table below to discover the key cities where our company operates, empowering individuals with accessible and flexible title loan options.

| Wichita | Overland Park | Kansas City |

| Olathe | Topeka | Lawrence |

| Shawnee | Lenexa | Manhattan |

| Salina | Hutchinson | Leavenworth |

| Leawood | Dodge City | Garden City |

Risk And Responsibilities Of An Online Title Loan With Representative Loan Examples

Before committing to an online title loan, it’s crucial to understand its risk and responsibilities, including annual percentage rates and the consequences of default. Potential borrowers should research and compare different loan providers and their representative loan examples to clearly understand costs and repayment terms. By doing so, applicants can make informed decisions and select the best loan option for their unique financial situation.

Title loans offer convenience and quick access to cash. Still, they have risks and drawbacks like other types of financial products. The biggest risks of title loans are the high-interest rates and fees title lenders charge.

The rates vary depending on several factors, including the borrower’s minimum credit score, the vehicle’s value, and the loan amount. In places like South Carolina, title loans can become very expensive, especially if the borrower cannot repay the loan on time or defaults. It leads to more fees, penalties, and even repossession of the borrower’s vehicle.

Interest Rates

The borrower’s vehicle secures the loan, reducing the lender’s risk. Title loans have lower interest rates than short-term loans, such as payday loans. But it’s necessary to note that title loans are still expensive because the interest rates vary depending on several factors, such as Annual Percentage.

While bad credit lenders may provide loans to people with lower credit scores, exploring other options, such as personal installment loans and lines of credit to avoid the high costs associated with title loans is essential. Evaluate various loan products carefully and choose the best option for your needs and financial situation.

The borrower’s credit score is the main factor affecting the interest rate of a title loan. Other factors that affect the interest rate include the value of the vehicle, the loan amount, and the repayment terms. Lenders charge borrowers with a lower credit score a higher interest rate to offset the risk. Sometimes, people consider pawnshop loans as an alternative to credit check loans, but they also come with their costs.

The average title loans have a monthly finance fee of 25%, which translates to an APR of 300%, according to Bankrate.

| Scenario | Monthly Finance Fee | APR |

|---|---|---|

| Average | 25% | 300% |

| Lower | 15% | 180% |

| Higher | 35% | 42 |

Explanation of each scenario

- Average: This scenario represents borrowers with a sufficient monthly income and a decent credit score. In this case, they will be charged a 25% monthly finance fee, which results in an APR of 300%. To avoid high finance charges, borrowers must make their payments on time.

- Lower: Borrowers with a higher credit score, stable monthly income, and a lower risk profile may qualify for a lower rate of 15% monthly finance fee or 180% APR. It still carries high finance charges compared to traditional credit check loan options. Still, it is less expensive than the average title loan.

- Higher: In cases where the borrower has a lower credit score, inconsistent income, and a higher risk profile, they might be charged a higher finance fee of 35% per month or a 420% APR. Due to the higher cost, the loan proceeds from these loans will often be used over a shorter period.

Regardless of the scenario, title loans and pawnshop loans can be costly alternatives to traditional lending options. Ensure understanding of all costs, fees, and repayment terms before committing to such loans.

- Average – The scenario represents the average title loan with a monthly finance fee of 25%, resulting in an APR of 300%.

- Lower – The scenario assumes a lower monthly finance fee of 15%, resulting in a lower APR of 180%. It is a feasible scenario for borrowers with good credit or who have established a relationship with the lender.

- Higher – The scenario assumes a higher monthly finance fee of 35%, resulting in a higher APR of 420%. It’s a scenario for borrowers with poor credit or deemed high-risk by the lender.

Loan Repayment

When considering loan repayment, it is important to explore different credit types and choose 1-year repayment term, 2-year repayment term, or 5-year repayment term options accordingly. To access better repayment options, one must submit loan request forms to reputable lending networks or bad credit providers if needed. Individuals with a limited credit historymight have to consider alternatives like credit check lenders that specialize in borrowers with various credit profiles.

Another key aspect of online title loans is loan repayment. Borrowers are responsible for repaying the loan within the agreed-upon terms and conditions, which usually involve making regular periodic payments over a set period. It is best to note that failure to make timely time payments results in severe consequences, such as extra fees and penalties or even repossession of the borrower’s vehicle. Listed below are the common repayment methods for an online title loan.

When managing utility bills and other expenses, some people may turn to a traditional bank for assistance. However, online title loans are an alternative option for those needing a consistent income source or an excellent credit score. It’s important to note that there may be application fees associated with online title loans, and borrowers should be prepared for higher interest rates due to a higher income ratio. Despite these factors, online cash advances can be a viable solution for quick financial relief.

- Lump-sum payment – The borrower repays the entire loan amount, including the principal and interest, in one payment at the end of the loan term. It is the most common repayment method for title loans.

- Installment payments – The borrower repays the loan in several smaller payments over a set period. Each payment consists of both principal and interest. It makes repayment more manageable for borrowers who cannot afford a lump sum payment.

- Automatic payments – Certain legit lenders offer the option to set up automatic payments, deducting the repayment amount from the borrower’s bank account on a schedule. It helps guarantee that payments are made on time and reduce the risk of late fees and penalties.

Borrowers from West Virginia to Kansas City must assess their ability to repay the loan before signing up for an online title loan. Borrowers must communicate with their lenders if they encounter any financial difficulties affecting their ability to make timely payments. With various types of expenses, finding favorable terms that work for your situation is crucial.

Whether in the District of Columbia seeking instant cash advances or considering pawn shop loans as a Source of emergency cash, understanding various repayment options helps borrowers make informed decisions.

Conclusion

Historically Kansas maintained very permissive title lending laws compared to Midwestern states, with no limits on interest rates or rollovers. But reforms were enacted in 2021 to restrict rates and prohibit repeated renewals. Neighboring Missouri also recently capped interest rates after previously having no restrictions. Oklahoma continues to have minimal title lending regulations compared to Kansas’s new rules. Nebraska prohibits rollovers but has looser rate caps. Meanwhile, Colorado, to the west, has its own regulatory framework that contrasts with Kansas’s approaches. Given the changing regulatory dynamics around title and installment lending in bordering states, Kansas’s newly tightened approach reflects a policy shift toward greater consumer protections compared to past years and some neighbors.

Online title loans are popular in Kansas and the US for their convenience but have high-interest rates, fees, and the risk of losing the vehicle. Borrowers need a clear vehicle title, proof of income and residency, and personal information to qualify. Instant cash advance loans provided by a direct loan lender are an excellent source of cash for emergencies. Online title loans offer fast approval and low interest rates, but examining the risks and responsibilities is necessary before taking one out. Having a valid bank account and providing additional documents might be required for some lenders. Instant funding is a major benefit, and typically, borrowers can expect the funds to be available the day after approval.

Frequently Asked Questions

How do online title loans in Kansas work for individuals with bad credit, and can you truly get direct deposit without a credit check?

Kansas prohibits online title lending so there are no legitimate direct deposit title loans available without credit checks in the state. Any such offers likely violate KA laws and should be avoided.

What are the interest rates and repayment terms typically associated with online title loans in Kansas when no credit check is involved?

Online title lending is illegal in Kansas, so there are no legal interest rates or terms available from lenders claiming to offer these loans without credit checks in the state currently.

Are there specific regulations or laws in Kansas that govern online title loans, especially those related to direct deposit and credit checks?

Kansas laws prohibit online title lending, including any provisions claiming direct deposit without credit checks. All lending must comply with state regulations like rate caps, licensing, and borrower protections.

What should borrowers look for to ensure they are dealing with a reputable online lender when applying for a title loan in Kansas without credit checks?

Online title lending without credit checks is illegal in Kansas, so any lender promoting such loans is not legitimate or following regulations. Consumers should avoid them entirely and report violations.

What are the tips on managing the repayment of online title loans in Kansas, especially for those with bad credit, to avoid potential financial challenges and pitfalls?

Online title loans are prohibited in Kansas, so consumers should not attempt to take out or repay any such claimed loans. Seeking legal in-state lending alternatives is advisable.