District of Columbia auto title loans, We’ve all been in a situation when we’re running short on cash, a bill is due, and we can’t come up with the funds to pay it. If we’ve used up all of our available credit, don’t have the time to qualify for a traditional bank loan, or don’t know anybody who can lend us the money, it may seem we have no other option than to default on our debt. This is especially true for a bad credit borrower facing a financial emergency.

Auto title loans are now available in the District of Columbia, provided by a reliable title loan lender. Online lenders have simplified the loan application process and offer same-day approval.

Regarding an auto title loan, things are different. Applicants must go through an extra step in the loan application process and meet a separate set of requirements, including working with a title loan lender. They must also agree to a unique repayment mechanism and be aware of the repercussions if the loan is not paid back, such as the vehicle being repossessed. One key advantage of auto title loans is that they often come with competitive interest rates.

GET ONLINE AUTO TITLE LOANS IN THE DISTRICT OF COLUMBIA

Every one of us faces financial challenges from time to time, such as unexpected expenses, emergencies, or even just needing access to cash for everyday needs. This could include buying groceries, urgent medical treatment, and urgent purchases. Everything else must be done before your paycheck. It is easy to handle your challenges if you own an auto title. Apply for a Title Loan in the District of Columbia and get quick cash!

WHAT IS A TITLE LOAN IN THE DISTRICT OF COLUMBIA?

Title Loan is a type of financing that allows even those with bad credit scores to apply for and obtain credit. This type of secured loan doesn’t require an extensive credit history or proof of income. Since the title of your car as collateral to secure the loan, it is essential that you have to be the sole owner of the vehicle. When you are due to repay the loan, you’ll need to take the title from your car to the lender and get it back once the loan is paid in full. This makes it great for addressing short-term expenses.

The loan is very popular because it comes with affordable interest. In addition, Title lenders typically don’t require a regular credit check, which means you could get the Title Loan even with bad credit!

HOW TO GET A TITLE LOAN IN THE DISTRICT OF COLUMBIA?

If you’re a District of Columbia resident, you can apply for and receive the Title Loan, even if your credit score is poor. Be aware that it is highly recommended to study the eligibility requirements of the qualified lenders and the regulations of the state where you reside before applying. This will ensure a smooth loan process and help you identify the best borrowing option for your needs.

Make sure that you have an official title to your name. You can obtain the Title Loan in the District of Columbia.

HOW CAN I GET A TITLE LOAN IN THE DISTRICT OF COLUMBIA WITH BAD CREDIT?

One key step to getting a Title Loan with bad credit in the District of Columbia is finding legit lenders that cater to various credit types. These lenders often have a more lenient approval process and may not have stringent requirements for traditional credit checks. Additionally, many lenders now offer an online application process to make it more convenient for potentially qualified borrowers to access the loan.

As you are aware, it is true that the Title Loan in the District of Columbia is a loan product that is secured and the title to your vehicle as collateral. Because lenders are secured by collateral, they have the assurance that you’ll repay the loan promptly. Therefore they don’t focus on your credit profile or minimum credit score. In addition, most District of Columbia lenders do not require a credit check, as the most crucial factor is monthly income.

AM I ELIGIBLE TO APPLY FOR DISTRICT OF COLUMBIA TITLE LOANS ONLINE?

To determine whether you qualify to get the Title Loan in the District of Columbia, it is necessary to study the requirements of the chosen lender. There may be differences. However, the basic needs stay the same. Most lenders offer same-day funding and require you to complete a loan request form. They will likely ask for information about your monthly payments and the desired repayment period. You may be eligible for a short-term loan with better terms and lower interest rates if you meet their criteria.

- You must be a US citizen or an official resident at least 18 or older.

- You should have a month-to-month source of income, including direct deposit.

- You must have proof of your identity, like a passport, driver’s license, or a government-issued ID, and provide recent bank statements.

- Maintain an active bank account for smooth loan processing.

- Enter your social security number to verify your employment history.

- Give contact information, like email and phone numbers, to receive loan offers and updates about types of loans.

Important! To be eligible for a loan in the District of Columbia, you should also submit the following documentation for your vehicle: Original title to the vehicle with sole ownership, evidence of residency in line with the title’s name, and car insurance certificate. Government-issued identification matches the name on the label and the most current registration for your vehicle. Please allow a few business days for processing.

HOW DO TITLE LOANS IN THE DISTRICT OF COLUMBIA WORK?

To begin, go to your chosen lender’s website and complete an easy online application giving information about yourself. Once you have submitted your application, the lender will contact you. You’ll need to take your vehicle to the nearest Title Lender location in the District of Columbia. Experts will evaluate your car and pay close attention to the following aspects: model, brand year, mileage condition, cost, and many more.

After an expert has evaluated your car, The lender will offer you the maximum loan amount based on your vehicle’s value. If you’re happy with the amount, you can agree to a loan agreement, which may include terms regarding how the loan proceeds will be used, and the time you can borrow the loan money. Then, you can transfer the title to the lender. After that, you’ll receive the cash, often through business day funding.

By choosing one of the reputable lending networks, you can access a range of loan options, making it more likely for you to find the best source for an auto title loan. In some cases, these lenders may also offer online cash advances as an alternative source of cash advances.

CAN I GET A TITLE LOAN IN THE DISTRICT OF COLUMBIA COMPLETELY ONLINE?

Many District of Columbia lenders provide completely online loans. These lenders often have a network of lenders and provide competitive rates to their borrowers. You’ll have to complete the online form and provide recent photos of your vehicle for the lender to determine the condition of your car. If the requested loan is approved, you will receive the loan amount transferred directly to your account at the bank.

HOW MUCH DOES A TITLE LOAN IN THE DISTRICT OF COLUMBIA COST?

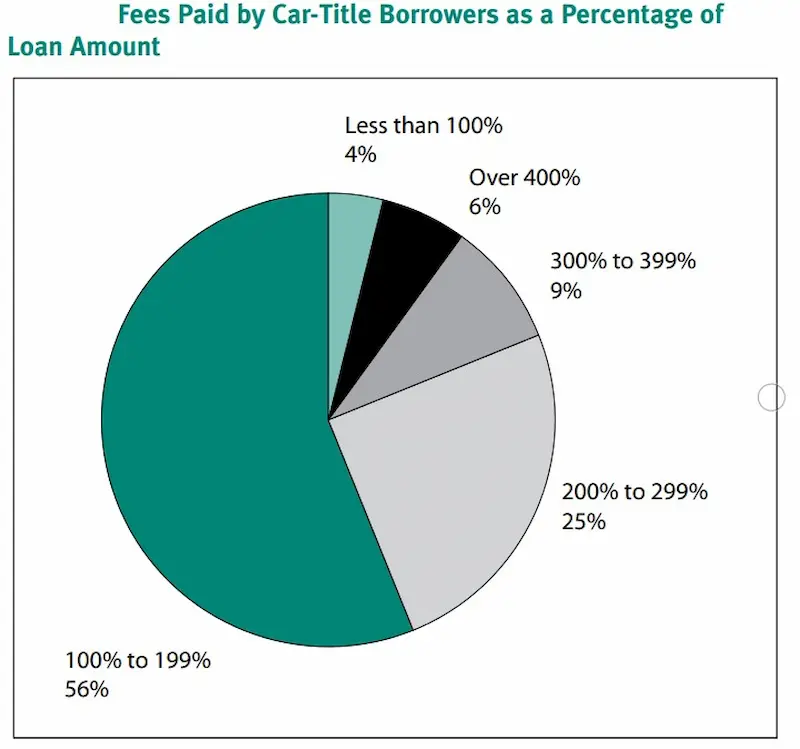

The cost of a Title Loan in the District of Columbia may vary according to the lender, your income, and numerous other variables. The Title Loans is a monthly cost of 25 percent (about 300 percent APRs). So, make sure you can repay this Title Loan in the District of Columbia when you apply for the loan. Many lenders offer flexible repayment plans and set a maximum borrowing limit based on your financial profile.

WHEN IS A GOOD IDEA TO APPLY FOR A DISTRICT OF COLUMBIA TITLE LOAN?

Applying for a District of Columbia Title Loan can be a good idea when you need a cash loan and have exhausted other options with traditional financial institutions. These loans can help you bridge the gap between paychecks or provide funds for unexpected expenses. Most lenders will perform a soft credit check before approving your application to ensure you meet applicable state laws and regulations.

Because Title Loans are short-duration and may be expensive, it’s essential to understand when to apply. Of course, taking a risk with your vehicle is not advised when you need cash to purchase a new lawn mower or celebrate your birthday. This loan is best suited to urgent situations. What is the best time to consider an unsecured Title Loan a good idea?

This loan is an excellent alternative if friends and relatives cannot aid you in getting the amount before payday. Additionally, Title Loan is ideal for those in a situation of emergency and need cash to pay for their costs in the District of Columbia. In addition, this loan might be beneficial if you have a negative or bad payment history and banks will not approve you. Installment loans with flexible repayment terms or even flexible repayment options can be viable for those struggling with late payments. These loans have more favorable rates and can help in building emergency funds.

Here are some statistics on District of Columbia auto title loans:

| Statistic | Value |

|---|---|

| Number of lenders | Over 20 |

| Average loan amount | $2,500 |

| Average interest rate | 25% |

| Average term | 12 months |

| Percentage of District of Columbia residents with auto title loans | About 1 in 50 |

THE BEST ALTERNATIVES TO DISTRICT OF COLUMBIA TITLE LOANS:

Some alternatives to Title Loans in the District of Columbia include loans that report to the credit bureaus, which can help improve your credit score over time. Such loans can benefit those with poor credit history and enable them to access financial products with better terms in the future.

Sometimes you’ll need cash immediately to cover urgent costs. If you have a low credit rating, obtaining some money from a bank or conventional lending institutions might be challenging. They need a combination of credit scores to ensure you’re a trustworthy borrower likely to repay the loan quickly. The good news is that the District of Columbia direct lenders know this and can assist with any need, regardless of their credit rating. These platforms offer loans like instant cash advances and title loans with generous borrowing limits.

Benefits of Washington DC Title Loans

Anyone with a car may get a title loan, one of the common loans available for individuals with a low credit score. These title loans typically come with a 1-year repayment term and a grace period for borrowers to ensure they make all their payments on time. An essential advantage of these loans is that even people with poor credit can get approval from a loan officer. While newer and more costly automobiles can enable you to get more money from a title loan, even older cars or vehicles with many kilometers may still provide you with some cash.

A title loan might be a lifesaver for someone struggling to make ends meet while also having bad credit. Whether you’re having trouble paying your bills, you’re about to lose your home, or you need a little more cash to get you through to your next paycheck, a title loan in DC may save the day.

You may spend the money you get from a title loan any way you choose. Title loan companies are interested in something other than helping you buy a house or an education; they want to ensure you get the money you need. They provide many loan options, including boat and motorcycle title loans.

What Are the Title Loan Interest Rates in the District of Columbia?

Some lenders charge as low as 52% yearly, while others charge 200-300% yearly. The interest rate on a vehicle title loan varies from state to state and lender to lender. The interest rate on this form of loan is substantial. Each lender will offer the interest rate information in their loan term agreements. It is essential to find an excellent source of information to make an informed decision. Also, consider factors like credit limit, income ratio, and loan extension fees.

How Long Does It Take for a Title Loan to Be Approved in the District of Columbia?

Thanks to the lender’s extensive network, title loans in the District of Columbia can be approved quickly, often within hours or the same day. To speed up the process, ensure you have a valid bank account and meet all requirements.

With the convenience of your mobile phone, you can make timely payments and avoid any additional finance charges. You’ll have the money in your account as little as 15-30 minutes later. In most cases, payments are sent within 24 to 48 hours. By maintaining good credit personal habits, you can benefit from the day cash advances and enjoy the flexibility of extended repayment options. Remember to check your account occasionally to avoid additional finance charges and maintain easy access to funds.

Frequently Asked Questions

How can I apply for a District of Columbia title loan online with no credit check?

You can apply for a DC title loan online through lender websites. Fill out a short application with personal and vehicle details for instant approval without a credit check.

What are the eligibility requirements for instant approval of title loans in the District of Columbia?

You need to own a vehicle free of other liens, have proper ID and documentation, and meet lender minimum income requirements for instant approval of a DC title loan.

Are there any limitations on the amount I can borrow with a title loan in D.C.?

Yes, lenders typically limit title loan amounts to 25-50% of your vehicle’s value in D.C., up to a maximum of a few thousand dollars based on regulations.

What happens if I default on a title loan in the District of Columbia?

If you default on a DC title loan, the lender can repossess your vehicle and sell it to recover the loan balance. You are still responsible for any remaining debt.

Are there alternatives to title loans for people with poor credit in D.C.?

Alternatives include asking family/friends for help, credit counseling, debt management plans, personal loans from credit unions, and other short-term options like payday loans.