If you consider applying for one, you may wonder if a vehicle title loan will affect your credit rating. This question may concern you because you’ve decided to obtain a pink slip loan, as title loan borrowers often have a bad credit score.

What effect does a title loan have on my credit?

Yes, title loans can impact your credit score. Your credit score will improve if you pay your monthly installments on time, making credit score resource pages valuable tools for monitoring your progress.

If you make your monthly payments on the due date, a title loan can have a positive impact of title loans on your credit score.

How can title loans affect your credit?

Your credit score will be affected if you default. It would be best if you had better credit and needed help to afford to make it worse.

It’s okay; we know exactly what you are going through. For almost ten years, thousands of customers have faced a similar problem with maintaining their credit while repaying a vehicle title loan.

If title loans affect your credit, then the answer is yes. However, it can have a positive or negative effect.

If you are considering getting a title loan, there are some important things to understand. Title loans use your vehicle as collateral: if you don’t repay the loan, the title loan company will take your car. This can be a great way to access much-needed funds quickly, but it’s with risks. Auto title loan companies and lenders often cater to credit applicants with lower credit scores, making this option more accessible.

Title Loan and My Credit

No Credit Title loans are the only personal loan that those with less-than-perfect credit can still get. You can use credit cards to pay bills.

Title lenders, like close-title loan lenders, can do this because their loan approval and amount are based entirely on your current street equity value and ability to repay the loan each month.

Many people attempt to improve their credit scores, but all creditors reject them. They may consider alternatives to title loans if they need a better credit history.

We want to help those individuals improve their credit scores to provide a bright future for their families and themselves, even if they need a bad credit title loan.

Did the title loan affect my credit score? It does. A title loan can help you improve your credit score, but it’s essential to understand its impact on credit history.

How can title loans affect your credit?

This resource article will explain how auto title loans can impact your credit score for the better and the worse and the application process behind them. Loan progress.

We believe in transparency and customer support for lenders, and we’ll also discuss alternatives to title loans for those not interested in this type of loan.

It is important not to take finances lightly, as even small decisions can greatly impact your financial future.

Are Title Loans Available for Credit?

Continue reading to find out how an auto title loan can affect your credit score and whether it might be a good option for you.

If you want to apply for a car title loan, please complete our online application. After submitting your application, you will receive a response from one of our customer representatives.

Are Average Title Loans Good for Your Credit Score?

Title loans only sometimes check your credit. It all depends on where you live and what state you are in. Some partners will approve a loan with no credit check. However, most partners will verify your credit. One of the benefits of title loans is that they can be obtained even with a Credit Score Bad.

How Title Loans Can Help Your Credit Score

Your payment history makes up 35% of your credit score.

The benefits of title loans can influence your financial situation positively if managed properly. Your credit utilization is thirty percent. 15% refers to the length of credit history, while credit mix and new credit accounts make up 10%.

The greatest impact on your credit score will be if you get a title loan and student loans.

Unsecured loans can affect credit scores more than those with secured loans. But, secured loans, which are based upon collateral like Car Title Loans, still have the potential to impact your credit score significantly. Proper loan management can help boost your credit score as you maintain regular payments, making it more appealing to credit reporting agencies.

Title loans can affect your credit.

Understanding your financial situation can play a huge role in determining whether an average title loan is a good decision. Ensure that you are well-prepared to keep up with the payments, understand the terms and conditions, and use this type of loan to enhance your credit score.

Title loans can improve your credit score, but they also have the potential to damage it. Your credit score will improve if you pay all your monthly bills on time, including your 15-day or 30-day car title loan payments.

Your credit score will be affected if you default on your payments or are late. Your credit score will be improved if you pay your monthly title loan payments on time, especially for those with excellent credit scores.

Title loans can improve your score.

Your payment history will improve if you refinance or pay off your title loan each month on the terms agreed to by the lender at the loan’s beginning. Choosing the right loan term can also help you meet the payment deadlines.

Your credit score will improve automatically as you pay off the 15-day or 30-day car title loans.

A collateral loan can help you build a better credit score if you manage your budget and payments well.

Title loans can damage your credit score.

Like any loan or credit line you take out, if you fail to make your payments on time or default on the loan, your credit score will drop, and your credit report will be less favorable to other lenders. This applies to both 15-day car title loans and 30-day car title loans.

You don’t need to worry if you keep up with your payments and don’t default on your title loans. Credit bureaus play a crucial role in determining your credit rate and eligibility on credit history when applying for a loan.

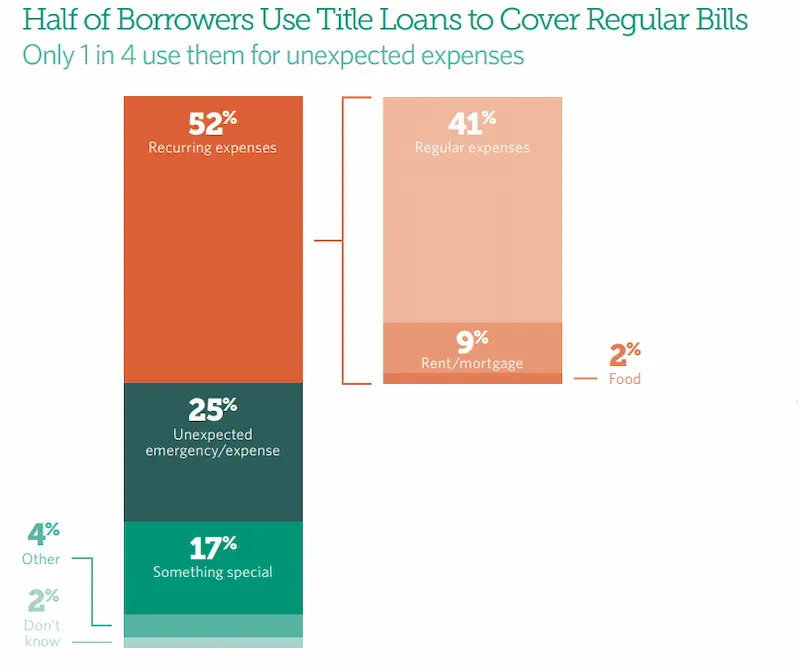

Below are statistics about title loans and the way they affect your credit:

| Feature | Title Loans | Traditional Loans |

|---|---|---|

| Interest rate | Typically 25% | Typically 5-15% |

| Repayment period | Typically 36 months | Typically 12-60 months |

| Total amount paid | Typically $1,500 in interest over the life of the loan | Typically $500-1,000 in interest over the life of the loan |

| Impact on credit score | Can lower your credit score by 50-100 points | May have a small impact on your credit score |

Apply Now for Your Title Loan

You can call us at any time if you have any questions. Our customer service representatives can answer any questions or assist you with problems, such as finding the right loan option or providing a credit report resource.

Most of us don’t know what a title loan is, so here’s the inside scoop: A title loan is a special type that doesn’t require credit checks, employment verification, or income verification. All you need is to be at least 18 years old, have a driver’s license, and have qualifying proof of residency. Title loans can put extra cash in your hands when needed.

To improve your credit, fill out the online application. We would love to work with your company.

You now know how title loans can affect your credit and how you can improve it with a title loan. Contact information is necessary for the approval of your loan.

We will lend you a title loan when other banks won’t. Also, avail of our credit card loan. Our title loans will improve your credit score if you repay your monthly on time. Remember that major credit bureaus monitor your credit activities, and every credit agency has its criteria for scoring. Explore different forms of credit and build a positive credit history with the right balance. Remember, your credit score is essential for your financial future; managing it well will help you in the long run. Make the right choices and stay in good standing with the major credit bureaus and every credit agency you engage with.

Frequently Asked Questions

How do title loans impact your credit score?

Title loans usually don’t require a credit check or directly impact your credit score. However, defaulting can allow the lender to repossess your car, indirectly hurting your credit.

Can I get a title loan without a credit check?

Yes, most title loan lenders do not check your credit when approving loans, instead assessing your car’s value as collateral, so you can get a loan without a credit check.

What are the consequences of defaulting on a title loan for my credit?

Defaulting allows the lender to repossess your vehicle, which can show as a repossession on your credit report and significantly hurt your credit score.

Do title loan lenders report to credit bureaus?

No, title loan lenders typically do not report your loan details or payment history to the major credit bureaus.

Are there alternative loan options that won’t negatively affect my credit?

Alternatives like credit union personal loans, payday loans, and borrowing from family/friends allow you to avoid credit checks and potential damage from defaults.