Auto Title Loans in Chicago (IL) Bad Credit & No Credit Checks

Borrowers can easily obtain funds by handing over their vehicle title to the lender. Auto title loan lenders in Chicago, IL, are secured loans that allow borrowers to use their vehicle title as collateral. Individuals with bad credit title loans or no credit history often seek these loans as they do not require a credit check.

The no-credit check auto title loans are convenient for those needing fast cash, as the entire title loan process is typically short and straightforward. Approval time is obtained in as little as 24 hours, as lenders transfer funds quickly.

One of the best solutions for short-term financial problems is Chicago title and personal loans. However, there are things that borrowers must know before applying.

What is a Chicago Title Loan?

A Chicago title loan is a type of loan called a secured loan that uses the borrower’s vehicle as collateral. The title loan provider places a lien on the vehicle and holds onto the title until the borrower repays the loan. The borrower is free to use the money from the loan to cover any emergency expenses or other financial needs. To qualify for a title loan, the borrower must own a reliable vehicle outright.

Loan Type: Title loans are more relaxed than traditional ones. The lenders don’t check credit scores or ask for any documents. Applicants only need to present a valid driver’s license, proof of residency, and vehicle title.

Moreover, online title-secured loans are a cheaper option. Borrowers can negotiate flexible monthly payments with the lender to ensure a positive experience.

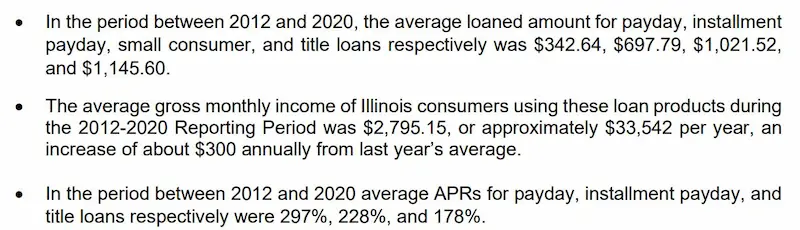

Here are some statistics on a Chicago Title Loan:

| Statistic | Value |

|---|---|

| Average APR | 300% |

| Average loan amount | $1,500 |

| Average term | 30 days |

| Default rate | 20% |

| Average borrower takes out | 10 loans per year |

Requirements for Vehicle Title Loan

The eligibility of applicants depends on the online lender. Generally, the borrower must be at least 18 years old and have a valid driving license. The borrower must own the vehicle completely and have no liens against it.

The borrower’s source of income must be sufficient to cover the monthly installments or payment periods. Applicants qualify for a title loan in Chicago in minutes if they meet the lender’s eligibility criteria.

The loan process for vehicle title loans is simple and fast, like all other online short-term loans. There are no long queues or tedious paperwork. The only thing the borrowers must do is complete an online loan application and wait for the lender to approve their loan. The process often includes providing estimates for title loans based on the vehicle’s value.

Quick Loan for Bad Credit Borrowers

Bad credit borrowers are still able to secure auto title loans. It is feasible to qualify for a loan even with a low credit score if the borrower presents proof of income.

Most lenders overlook the applicant’s credit report when giving out car title loans. Instead, they look at the borrower’s ability to repay the loan by verifying their monthly income and assessing the repayment terms.

Moreover, the borrower’s car secures the loan, which means if they fail to repay their loan, the lender is entitled to take possession of their vehicle. It provides some protection against unexpected expenses.

Why Choose GreenDayOnline To Get a Car Title Loan in Chicago, IL

GreenDayOnline is a leading title lending company in America with a strong presence in Chicago, IL. Thousands of people who need financial assistance every day trust the company.

Lenders at GreenDayOnline offer auto title loans and other cash advances at competitive rates and other financial solutions for those with poor credit scores.

Apart from that, listed below are why it’s best to choose GreenDayOnline for auto title loans.

- Quick and convenient access to funds: Auto title loans from GreenDayOnline are obtained quickly, with approval and disbursal taking place in as little as 24 hours. The application process is typically simple, making it a convenient option for those needing fast cash. You can complete an online form to start the process.

- No credit check: Auto title loans by GreenDayOnline do not require a credit check, making them a suitable option for those with bad credit or no credit history. The borrower’s vehicle title ensures that they make payments on time.

- Keep the vehicle: Borrowers can keep and continue using it during the loan period.

- Competitive interest rates: GreenDayOnline offers competitive rates, making auto title loans affordable for borrowers. It helps borrowers make some extra cash by comparing their choice of lender.

- Online application and approval: The entire application process for and obtaining an auto title loan is done online. Just fill out the online form for a quicker response. Eliminating the need for in-person visits to a loan officer, saving time and effort.

- Flexible repayment options: Repayment options for auto title loans are typically flexible, with the lender offering a range of options to suit the borrower’s financial situation. It allows borrowers to choose the best repayment plan based on their needs while considering their choice of lender.

GreenDayOnline offers the best bad credit payday loans. Borrowers with poor credit scores can get reasonable rates and payment terms regardless of their credit scores.

Conclusion

Online title loans in Chicago are an excellent option for those who have bad credit and need quick access to funds. These loans offer competitive rates, fast approval, and no penalty for early repayment. GreenDayOnline is a trusted lender with many locations throughout the city. Borrowers quickly get the money they need with the company’s easy application process and flexible payment options.

Customer service agents of GreenDayOnline are available to help if there are further questions about auto titles or other quick cash loans with no credit check.

Frequently Asked Questions

How do auto title loans work for individuals with bad credit in Chicago?

Auto title loans in Chicago rely on the borrower’s vehicle as collateral instead of their credit score. Those with bad credit can qualify if they own their vehicle outright. High interest rates apply.

Are there any credit checks involved when applying for an auto title loan in Chicago?

Most Chicago auto title lenders only require proof of income and ownership of the vehicle, with no credit checks. Some may run a soft inquiry that doesn’t impact credit score.

What are the eligibility requirements for getting an auto title loan in Chicago with bad credit?

You’ll need a vehicle with clear title, residence in Illinois, government ID, proof of income, references, and a spare set of car keys. No minimum credit score is required.

Can I still drive my vehicle if I use it as collateral for an auto title loan in Chicago?

Yes, you retain possession of the vehicle with an auto title loan in Chicago. However, failure to repay the loan means the lender can repossess your car.

What are the interest rates and fees associated with auto title loans in Chicago for borrowers with bad credit?

APRs on auto title loans in Chicago can range from 89% to 204%. There are also origination fees up to $150 and late fees. Rates are higher than traditional loans.