Installment Loans Chicago Bad Credit & Direct Lenders

Chicago Installment Loans enable the borrower to make payments over a longer period, often in monthly or biweekly installments. These loans are available via direct lenders, including financial institutions such as banks, credit unions, and Internet lenders.

Chicago is home to various financial institutions providing persons with poor credit scores access to installment loans. On the other hand, it is essential to know that loan applicants with bad credit history must pay higher interest rates and accept less attractive loan conditions. Certain financial institutions also want collateral or a cosigner to grant the loan.

The installment loan approval process also considers a person’s financial history before approving or denying an application. Banks and other lenders typically offer competitive rates and terms but may be more stringent in their requirements for approval.

When approved,loan proceeds can be used for various purposes, such as consolidating debt, making a large purchase, or paying for unexpected expenses. Understanding the lending process before committing to a personal installment loan is crucial to ensure that it meets your financial needs and that you can comfortably repay the loan over time.

Main Points:

- Installment loans allow borrowers to repay the loan in monthly or bi-weekly installments over a longer period, typically involving a fixed loan term. The loan types might vary, but adhering to the loan agreement is crucial.

- Reputable lenders, including financial institutions and online lenders, provide installment loans in Chicago, even for those with a low credit score. However, they face higher interest rates and less favorable loan conditions.

- The benefits of installment loans in Chicago include a simple online loan application procedure, convenient lending locations, and reasonable payback terms with flexible repayment terms available.

- Consider factors such as fixed interest rates, flexible repayment options, loan amounts, loan term, and lenient loan requirements when taking installment loans from a reputable lender.

- Loan repayment starts the month after receiving the funds, and payments can be made online, over the phone, or in person.

- To check eligibility for a Chicago installment loan online, the applicant must be at least 18 years old, a state resident, have a reliable source of income ($1000/month), provide contact information, have a minimum credit score, and not be a bankruptcy debtor.

- Researching and comparing different loan types and their terms help individuals maintain a good credit history and save money.

What is an Installment Loan in Chicago?

Lenders with GreenDayOnline offer financial products like installment loans for those in need. Flexible loan options allow borrowers to meet financial obligations without jeopardizing their cash flow. Unsecured installment loans are repaid in monthly installments.

GreenDayOnline application is quick, and with its online lending platform, the installment loan application process is simplified. The name, telephone number, valid email address, and proof of income are required to complete the online form. Once approved, quick funding is available within 1-2 business days.

What are the benefits of Installment Loans in Chicago?

One significant benefit of this type of loan is the funding time. With GreenDayOnline, borrowers can receive the money within just 1-2 business days, making it an ideal choice for those who need funds quickly.

- Simple application procedure: Borrowers are astounded by how simple it is to apply for a loan with GreenDayOnline. Acquire cash within hours if borrowers have a valid ID, a job that pays a living wage, an active bank account, and meet the income requirements. Lenders quickly process the request, even for online applications, and have the funds in one’s account in as little as one day. This easy process allows quick approval decisions to help borrowers manage their financial needs.

- Convenient lending locations and services: Illinois residents can apply online or in loan stores with GreenDayOnline Installment Loans because of their flexibility. Borrowers must choose the payment method, such as cash, cheque, or direct deposit. These convenient loans not only offer easy access to credit but also help borrowers cope with unexpected expenses or the need for extra cash.

- Reasonable payback terms: A monthly payback schedule gives borrowers time to prepare and verify the loan fits within their budget. It implies borrowers can pay it off before being paid again. These manageable repayment periods make it easier for borrowers to plan their monthly loan payment without the added stress of too-tight deadlines.

- Things happen rapidly. Funds must move just as quickly if a person wants to keep up. Lenders offer personal loans that fit their lifestyle, making it easier to manage unforeseen needs or expenses that may arise. To cater to these needs, GreenDayOnline also provides various options for credit cards to help borrowers stay financially secure and prepared.

What to consider in taking out Installment Loan?

Listed below are things to consider when taking out installment loans:

- Bad credit installment loan: It’s important to look for lenders who offer installment loans for individuals with bad credit. This can help you secure a loan even with a less-than-stellar credit history.

- Minimum credit score requirement: Ensure that you meet the minimum credit score requirement for the lender before applying for the loan.

- Affordable rates: Compare different lenders and look for those who offer affordable rates for their installment loans.

- Favorable terms: Search for installment loans with favorable terms, such as low fees, minimal penalties, and accessible customer support.

- Flexible repayment plans: Choose a loan that offers flexible repayment plans to avoid the risk of penalties and additional fees.

- Annual percentage rate: Pay attention to the annual percentage rate (APR), which represents the total cost of borrowing every year, including interest and fees.

- Examples of installment loans: Familiarize yourself with examples of installment loans, such as personal loans, auto loans, and mortgages. This will help you to understand better the market and what is available.

- Loan on time: Make sure you’ll be able to repay the loan on time to avoid late fees, increased interest rates, and negative impacts on your credit score.

- Long-term financial solution: Consider whether an installment loan is a suitable long-term financial solution for your situation or if other options might be more appropriate.

- Fixed interest rates are proof of fast cash loans: Most conventional loans have variable interest rates, making it difficult to budget. Bad credit scores can make the borrowing process even more challenging, but cash loans offer an alternative for those with bad credit scores.

- Cash loans are flexible, so a person must pay what they can each month: Choose a longer payback period to ensure the monthly payment budget is manageable. Shorter terms save money if borrowers want to pay off debt quickly. This flexibility improves access to funds for various financial needs.

- Longer payback durations let lenders offer more than payday loans: High loan amounts enable better budget management. Hence, applicants cover expensive items without running out of cash before their next payday. Requesting a larger loan prevents individuals from taking out several loans to cover costs. The instant approval decision smoother the loan request process.

- Short-term installment loans are easy to get: Quick cash advances are often deposited within one business day, unlike regular bank loans. It’s a great option for urgent costs. These no-denial installment loans can help borrowers with different credit histories.

- Liberal loan requirements: Any online lender issues a borrower a loan with negative credit due to looser lending standards. Despite being simple to get, free credit check installment loans need proof of repayment, like regular income. It’s a must. Remember that this flexibility may still impact your credit score, as credit bureaus will monitor the repayment history.

What is the procedure for paying back an Installment Loan?

Loan repayment begins the month after receiving and spending the money. Borrowers are required to pay both principal and interest. Lenders often accept payments made online, over the phone, or at a physical place. One consequence of overdue payments is the imposition of a late charge. A small, short-term loan can be an attractive option for those who need to stay within their credit limit and desire an instant decision on their application.

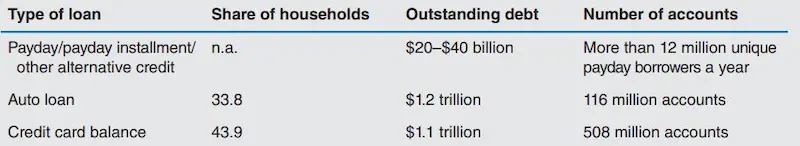

What are Payday loans in Chicago?

Payday lenders provide low-interest loans for short-term financial needs. These are quick and easy online loans for those with a steady income. The repayment term is conditional on receiving the next income. A borrower who can’t make payments seeks an extension. Online payday loans seem appealing since they do not need credit checks.

Typically, loan extensions cost more than the initial loan amount. Multiple extensions result in a considerable increase in the total amount owed. GreenDayOnline is a preferable alternative to payday loans, offering a small, short-term loan option that can be more attractive for borrowers with a limited credit limit and needing an instant decision.

How to check the eligibility for a Chicago Installment Loan Online?

Personal details, forms of credit, average borrower score, access to money, Credit Loans, monthly income, Financial Choice, minimum credit history, application form

Below are some eligibility requirements for a Chicago Installment Loan Online.

- Personal details: Applicants must provide accurate and complete personal information in the application form, including their name, address, and social security number.

- Forms of credit: Applicants must have a diverse mix of forms of credit in their credit history, such as credit cards, mortgages, and auto loans.

- Average borrower score: The average borrower score of applicants should be within the acceptable range set by the lender, which may vary depending on factors like the loan amount and term.

- Access to money: The applicant should demonstrate a stable source of access to money, such as a job, to assure lenders that they can repay the loan on time.

- Credit Loans: Prior successful experience with other Credit Loans is a positive factor in the evaluation process.

- Monthly income: Applicants must have a stable monthly income that meets the minimum requirements set by the lender.

- Financial Choice: The applicant should have a history of good Financial Choice and responsible money management.

- Minimum credit history: Prospective borrowers should possess a minimum credit history to demonstrate their creditworthiness and ability to manage credit responsibly.

Please meet these requirements before submitting your application form for a Chicago Installment Loan Online.

- The critical need is that applicant must be at least 18 years old since it is against the law in the USA to lend money to someone under that age. As a responsible lender, we consider factors such as fair credit and minimum score.

- A borrower must verify they are a state resident before applying for an installment loan. Borrowers must submit contact information to accomplish this. That guarantees loan approval. Moreover, we offer loans to people who meet our minimum income requirement of at least $1,000 per month.

- Ensure that applicants have a reliable source of income that pays at least $1,000 per month, even if negative credit isn’t a barrier. It attests to the suitability for the loan product and its interest rates. Additionally, borrowers cannot be bankrupt debtors or drowning in medical bills.

- Borrowers must provide an email address and phone number to get their application process accepted quickly. It is much more difficult to contact a person without this information. Once provided, they can expect instant funding upon approval.

- Lenders need an application such as the name, address, and social security number. Borrowers must inform the lenders how much they want to loan. GreenDayOnline also requires a request form to be filled out to facilitate a smooth process. GreenDayOnline confirms contract terms after documentation and financing clearance.

Here are some statistics on Chicago installment loans:

| Statistic | Value |

|---|---|

| Average interest rate | 30% |

| Average term | 36 months |

| Average amount | $5,000 |

| Percentage of Chicago residents who have taken out an installment loan | 15% |

Installment loans in Chicago are useful in circumstances that need to be quickly handled and are urgent. Just keep in mind that not all long-term loans provide the same advantages. Individuals need help to afford to apply for a loan they repay. Research helps people keep a good credit history and save money.

Excellent credit borrowers with a positive credit history can have access to more flexible loan offers and better interest rates. To maintain an excellent credit score, making on-time time payments and having a good payment history are essential.

One option for people trying to maintain a positive credit history is setting up an automatic payment on their loans. This prevents missed payments and ensures a timely loan repayment, further improving your credit score and options for future borrowing.

Frequently Asked Questions

What are the eligibility requirements for obtaining an installment loan in Chicago with bad credit?

Typical eligibility requirements for bad credit installment loans in Chicago include being 18+ years old, having a regular income source, an active checking account, U.S. citizenship or residency, and providing proof of identity and income. Minimum credit scores around 500-550 are often accepted. Loan amounts and terms will vary by lender.

What is the typical interest rate range for installment loans from direct lenders in Chicago for individuals with bad credit?

For bad credit borrowers, installment loan APRs from direct lenders in Chicago typically range between 20-40%. The higher your credit score, the lower the rate offered. Rates from online lenders tend to be on the lower end, around 20-29%, while rates from storefront lenders are usually higher, averaging around 35-40% APR.

Can you provide tips or advice for improving my chances of approval for a bad credit installment loan from a direct lender in Chicago?

Tips for increasing approval odds for Chicago bad credit installment loans include paying down current debts to lower your utilization, becoming an authorized user on someone else’s credit account, avoiding applying for multiple loans within a short timeframe, verifying your income and length of employment, choosing lenders that offer prequalification, and providing references or a cosigner if required and available.