Advantage Auto Loans Review | Fees & Rates

Advantage Auto Loans was created to make it easier for those with poor credit histories to apply for a poor credit auto loan. The financial institution has partnered with lending partners nationwide to help individuals find financing that suits their needs. With competitive auto loan rates and various auto loan products, this service aims to simplify the car buying process.

Main Points:

- Accessible online auto loan application for an easy and hassle-free experience.

- Wide range of financing options to accommodate different financial situations.

- Flexible credit score requirements allow people with poor credit to obtain a loan.

- Collaboration with reputable lending partners nationwide to offer the best possible loan terms.

- Advantage Auto Loans was created to make applying for a car loan easier for those with poor credit score histories.

- Advantage Auto Loans offers zero down loans for eligible applicants, accepts all credit types but prefers applicants with pre-tax income above $1,499, and matches with lending partners all over the country to provide competitive rates and various auto loan offers.

- Reports to all three main consumer credit agencies, helping borrowers establish credit if payments are made on time. This aids in improving their credit report over time.

- Qualified borrowers obtain low beginning rates for the Cons of Advantage Auto Loans, making it a go-to choice for auto loan seekers.

- The company streamlines the auto loan application process, ensuring customers can access multiple finance options easily.

- The alternatives for Advantage Auto Loans are banks, credit unions, dealer financing, peer-to-peer lending, and personal loans.

- Available with zero down loans: Advantage Auto’s partner lenders offer auto loan options without money down. It is an excellent option if applicants need more cash to pay a downpayment for a car. However, not all applicants are eligible. Read the loan offers carefully if authorized.

- Pre-tax monthly income above $1,499 is preferred: Advantage Auto Loans accepts all types of auto loans, but the platform prefers bad credit auto loan applicants with a pre-tax income of more than $1,499. Getting approved by the company’s dealers or auto loan lenders is harder if one pays less.

- There is no prequalification: Some auto loan lenders let borrowers apply for a prequalification option before they apply in full. It allows individuals to get an idea of their chances of being approved. Prequalification is not a guarantee that one is approved. However, it gives one an idea about the loan process and loan decisions to expect. Compare these to other prequalification offers. Advantage Auto Loans does not offer prequalification. Complete a loan application to get a better understanding of the terms. It results in a credit inquiry.

A more in-depth look at Advantage Auto Loans

These are other details regarding Advantage Auto Loans.

- Advantage Auto Loans accept most credit profiles. It includes applicants looking for a credit car loan after bankruptcy or repossessing a vehicle.

- Independent contractors and self-employed people get vehicle loans if they show proof of income.

- Advantage Auto considers the loan term and auto loan application services even if individuals are first car buyers.

- The platform’s lenders report to all three main credit score company agencies, which help borrowers establish credit if they make auto loan financing payments on time and responsibly. Advantage Auto links individuals with a legitimate auto loan service trade-in lender if they owe money on an automobile.

Are Advantage Auto loans right for me?

Advantage Auto loans are something one must consider if one needs better credit or a bankruptcy history. This auto loan service provider has many dealers and lenders with which it matches, so borrowers get auto loan financing every day. The auto loan resource provides advertisements for various financial products that individuals see on our site, provided by third-party businesses that compensate us. Advantage Auto works with several lenders to offer competitive interest rates, aiming to approve within minutes. The unique Auto Score feature helps determine if one is accepted. Advantage Auto is a good option if the credit score is strong, especially for those with excellent credit scores.

How to apply for a loan with Advantage Auto Loans

To apply for an Advantage Auto loan, keep track of the auto loan balance and use the online application form provided by the company.

Advantage Auto Loans requires individuals to complete their online application for an auto loan. Borrowers must use the auto loan calculator to see the possible monthly payment rates before being prequalified. Reviewing credit and checking auto loan eligibility before applying for an Advantage bad credit scores auto loan is a smart idea. Understanding the business credit score and the various loan types helps one set expectations. It is common practice for lenders to do a soft credit pull before the application process so that one becomes prequalified for a business auto loan products loan.

What are the Alternatives to Advantage Auto Loans and their customer service?

Listed below are alternatives to Advantage Auto Loans.

- Vehicle loans from credit unions: Utilize a loan from a credit union to buy a brand-new or pre-owned car, truck, motorbike, or any other kind of vehicle. Getting a car loan from a credit union usually requires being a credit union member. Need to meet particular criteria to become a member, such as residing or working in a specified region, being employed by a certain company, or being related to an existing member. Credit unions often offer auto loan refinancing and borrower loan options, allowing for more customized approval decisions.

- Vehicle loans from banks: Bank auto loans are an alternative to those offered by dealerships and credit unions. Loans for new and pre-owned vehicles, leases, and auto loan reviews for current loans are common lending products banks offer. They may also have different requirements for the lowest credit score needed for approval.

- Dealer financing. Dealer financing typically has higher accessibility of loan services compared to other options. It is available at many new and used automobile lots and is provided either by the dealership’s finance company or via agreements with local banks and credit unions.

- Peer-to-peer lending: Websites such as Lending Club and Prosper enable borrowers to connect with individual investors prepared to lend money for various reasons, including vehicle loans. Peer-to-peer lending has become more popular in recent years and presents several borrower loan options.

- Personal loans: Some internet lenders provide personal loans to finance acquiring a vehicle. Personal loans can be an alternative for those looking to bypass the traditional auto loan process, offering flexibility and potentially different approval decisions based on the borrower’s financial situation.

Advance America is a financial services company that offers quick loans and access to crucial financial resources. It offers cash advances, installment loans, and MoneyGram services. With their approval guarantee, you can make an informed decision about your finances without worrying about being turned down. This makes it one of the most productive alternatives to Advantage Auto Loans for those looking for quick financing without the hassle associated with a traditional loan.

Another advantage to Advance America is the convenience – all you need to do is apply online, provide sufficient proof of your income, and wait for your loan to be approved. Once your loan is approved, you’ll get immediate funds in as little as 24 hours. Plus, all their loans come with competitive interest rates, so you won’t have to worry about overpaying. Furthermore, Advance America also has payment plans that match your budget, so you don’t have to adjust any other aspect of your life just because of this loan.

Frequently Asked Questions

What is Advantage Auto Loans, and how does it work?

Advantage Auto Loans is an online marketplace connecting borrowers to lenders offering auto financing options, including special deals for bad credit.

Can you provide an overview of the advantages and disadvantages of Advantage Auto Loans compared to other auto loan providers?

Advantages include flexible credit options and potential discounts. Drawbacks are indirect lending model and lack of rate transparency before applying.

What are the typical interest rates and terms offered by Advantage Auto Loans?

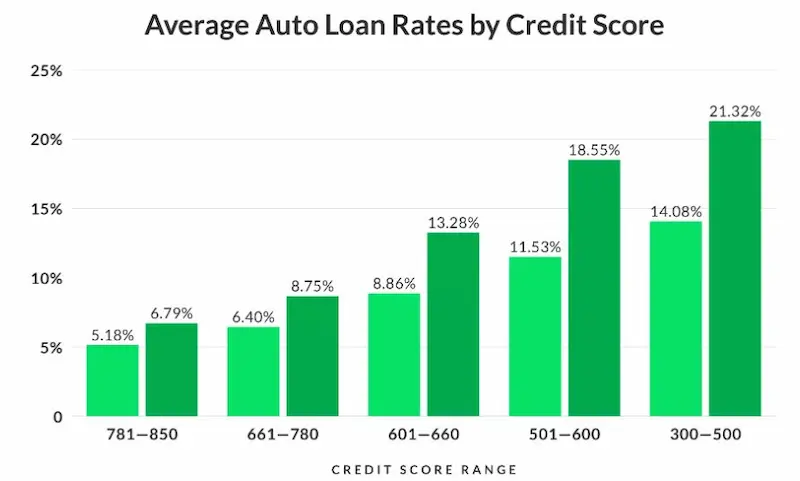

Interest rates through Advantage Auto Loans range widely from around 5% for excellent credit to over 20% for poor credit. Terms up to 84 months.

Are there any specific eligibility requirements or credit score thresholds to qualify for an auto loan with Advantage Auto Loans?

Minimum credit scores around 500-600 but requirements vary by lender. Stable monthly income and low debt-to-income ratio boost approval odds.

Have customers had positive experiences with Advantage Auto Loans? Can you share any customer reviews or testimonials?

Reviews are mixed. Some praise low rates but others report misleading terms or pressure to accept add-ons. Check complaint sites too.