Holiday Loans Online & For Bad Credit

A holiday loan is a personal loan that can be used to pay for vacation expenses. Banks, credit unions, and lenders provide these loans. They are designed to cover holiday spending and are used for personal expenses. A smart borrower must understand the differences between secured and unsecured loans. Unsecured loans don’t need collateral like a vehicle.

Credit score, income, and other factors affect the size of a loan and the interest rate. The holiday season is a wonderful time of year for many reasons. Holiday costs like gifts, parties, and travel sometimes prove too costly for the budget. However, keep the spirit. A personal holiday loan is an excellent option for borrowers needing extra holiday cash. It allows borrowers to enjoy the season while keeping their holiday budgets intact and provides financing for holiday expenses.

What are the uses of a holiday loan?

Even those with a poor credit score can apply for a holiday loan, as lenders will consider factors beyond your score when making a loan decision. One of the best features of holiday loans is the ability to submit an online application, making the entire process quick and hassle-free.

Borrowers can get their loans to buy holiday purchases for their family and friends. It helps them reduce the financial strain that gift-giving causes. Travel is another expense a holiday loan covers, making it easier to plan that dream holiday. Travel expenses include flights and accommodation. A holiday loan provides the financial cushion to travel with, helping you to create a realistic holiday budget. So many costs arise at this time of the year, making it easier for people to spend their holidays with those they love. Suppose they plan to take a vacation. Extra payments from holiday loans are helpful to pay for travel expenses, hotel stays, or joining holiday clubs. With the help of holiday loans, they’ll ease the financial burdens that the season often brings and enjoy making holiday purchases.

Why take out a loan to pay for your holidays?

It is down to planning, although the reasons vary from person to person. It is common to purchase gifts throughout the year and to start saving for the holiday season. Only some people have enough income to buy holiday gifts and travel. They must draw on their savings or take out credit card debt if they want to purchase everything in a matter of months. However, a holiday loan helps them get a lump sum of money to purchase everything, even with bad credit scores. The loan request must be sent to reputable lenders to increase the chances of credit approval and comply with the loan agreement.

The pros and cons of taking out holiday loans

It is essential to weigh the pros and cons when borrowing holiday cash. Listed below are some things to consider.

Pros

- Holidays are enjoyed with less stress and worry about money.

- The amount of credit card debt will not rise.

- Fixed and predictable monthly payments, also known as monthly repayments.

Cons

- Potential for fees

Excellent credit means better rates. However, some lenders also work with poor credit histories. Their credit history affects the interest rates. - As collateral, a car or boat could be required.

Where do borrowers obtain holiday loans?

Borrowers get holiday loans from various sources. These include credit unions, banks, and online lenders. A credit union offers more favorable loan terms. These include lower interest rates and more flexible repayment options than traditional banks. Some borrowers might also use an online form to apply for loans. Another option for borrowers needing holiday loan funds is a payday loan. Payday loans are short-term, unsecured loans typically due on the borrower’s next payday. In such cases, always choose a responsible lender.

Borrowers must first evaluate the eligibility criteria and borrowing options offered by the potential lender. Legitimate lenders should be transparent about fees, repayment terms, and other related information, ensuring borrowers make well-informed decisions.

These short-term loans are often easier to qualify for than traditional ones. They give borrowers the funds they need within one business day, providing quick cash for those who need it. They are commonly known as bad credit loans, suitable for bad credit borrowers and those with a less-than-perfect credit score. However, they have higher interest rates and fees than other loans, making them an instant decision for some but requiring caution for potential unexpected expenses. So borrowers must be careful when considering that loan option.

Another type of loan that borrowers must consider is a secured loan. A secured loan is backed by collateral, such as a car or a house. They carry a higher risk for the borrower because they lose the collateral if they default on the loan. It makes them easier to qualify for than unsecured loans, with a more straightforward application process and potentially lower rates if the borrower can provide proof of income.

We are pleased to share with you the extensive reach of our company, providing holiday loans online and catering to individuals with bad credit throughout the United States. With a commitment to helping our customers make the most of their holiday season, we have established a strong presence in several American states. Below, you will find a comprehensive table showcasing the states in which our services are currently available. Whether planning a festive getaway, hosting family gatherings, or simply spreading some holiday cheer, our company is dedicated to assisting you with convenient and accessible loan options. Please refer to the table below for a quick overview of our active states, and don’t hesitate to contact us for any further information or assistance.

| Alabama / AL | Alaska / AK | Arizona / AZ | Arkansas / AR |

| California / CA | Colorado / CO | Connecticut / CT | Delaware / DE |

| District Of Columbia / DC | Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN | Iowa / IA |

| Kansas / KS | Kentucky / KY | Louisiana / LA | Maine / ME |

| Maryland / MD | Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT | Nebraska / NE |

| Nevada / NV | New Hampshire / NH | New Jersey / NJ | New Mexico / NM |

| New York / NY | North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA | Rhode Island / RI |

| South Carolina / SC | South Dakota / SD | Tennessee / TN | Texas / TX |

| Utah / UT | Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

How long does it take to obtain a holiday loan?

The time to get a holiday loan varies depending on several factors. These include the type of loan, the loan amount, and the lender’s approval process. Generally, the larger the loan amount and the more complex the loan application, the longer it will take to get loan approval. For example, approving personal loans from a bank or credit union for a major purchase takes several days or weeks. A payday loan is approved and funded in as little as 24-48 hours. Some online lenders offer quick funding options for personal loans, such as instant approval decisions.

These give borrowers the funds they need in a few hours. Borrowers must provide the lender with personal and financial information, including details about their financial resources, even with quick funding options. Some lenders need them to go through a credit check before loan approval. The loan approval times depend on the lender’s internal policies. These include the number of loans they are processing at the time and the borrowers’ credit score, income, and employment history. By considering a range of options, borrowers can find a viable option that best suits their needs and ensures they can make their payments on time.

How to get a holiday loan

Below are some tips to help borrowers save money and find the best terms when looking for options.

- Compare offers from different lenders to compare interest rates. It helps borrowers determine if some personal loan providers have approved their loan applications.

- Only borrow what is needed. It helps borrowers lower their monthly loan payments, repayment period, and interest. Remember the regular expenses to ensure you can manage the loan.

- Make sure to meet the simple eligibility requirements before applying for a loan, as it increases the chances of approval.

- Be sure to apply for the loan before the last moment. Borrowers then take their time, search for sales, and make better shopping decisions.

- Provide all the required loan documents and ensure they meet the simple eligibility requirements.

Here are statistics on holiday loans:

| Statistic | Value |

|---|---|

| Percentage of Americans who take out a holiday loan each year | 10% |

| Average holiday loan amount | $1,000 |

| Average interest rate on a holiday loan | 30% |

| Average term of a holiday loan | 6 months |

| Percentage of holiday loans that are never repaid in full | 20% |

This year, give yourself peace of mind.

Holidays are supposed to bring joy and happiness. A holiday loan solves stress if borrowers struggle to find the necessary funds for holiday expenses. Remember to consider your regular expenses while planning the loan amount.

Frequently Asked Questions

How can I apply for holiday loans online with bad credit?

You can search for “”bad credit holiday loans”” and complete applications on lender websites. Make sure the lender is reputable before submitting an application.

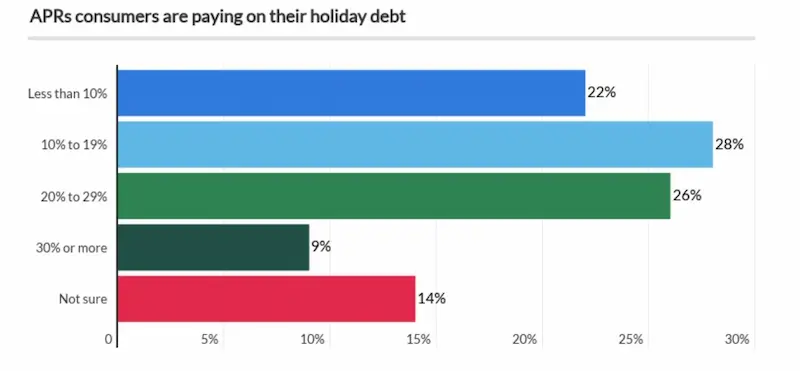

What are the typical interest rates for holiday loans for individuals with bad credit?

Expect rates from 25% to 36% APR for a holiday loan if you have bad credit. Some states cap rates at 36%, but most lenders charge higher rates.

Are there any specific eligibility requirements for getting a holiday loan with bad credit?

You’ll need steady income, government ID, Social Security number, active checking account, and proof of residency. Minimum credit scores around 500-600 may be required.

How can I improve my chances of getting approved for a holiday loan with bad credit?

Applying with a creditworthy cosigner, providing collateral, limiting recent loan requests, and taking steps to boost your credit can improve the chances.