Personal loan lenders are available to borrowers with excellent credit. Getting a personal loan can be challenging if you have a 600 credit score. However, an online title loan can be suitable for those with a bad credit score.

15 personal loans up to 600 credit scores

Many personal loan lenders lend to borrowers with good credit scores, usually between 640 and 699. For borrowers with lower credit scores, secured loans or short-term loans can be an alternative option.

Avant

4.0 ★★★★★

Avant personal loans range from $2,000 to $35,000, with two to five years repayment terms. If approved, you can get your funds the next day. The online application process makes it convenient and fast for borrowers.

Best Egg

4.2 ★★★★★

The Best Egg loan can fund many things, including home improvement and debt consolidation. You can get loans up to $50,000 or $2,000 with Best Egg. As long as you have a steady source of income, this finance company is a viable option for your financial situation.

Explore

4.5 ★★★★★

If traditional personal loans are not accessible, consider an alternative such as Explore. Explore offers flexible repayment plans for borrowers with low credit scores. They can provide you with the funds you need without the strict requirements of a payday lender.

Discover is the best excellent option for you if a longer repayment term is important. Your Discover loan can be repaid in seven business days.

Discover offers a 30-day guarantee. You can cancel your Discover loan by sending a check within the application process.

FreedomPlus

3.8 ★★★★★

FreedomPlus lets you borrow up to $50,000 over a term of two to five years through their online form. Compared to traditional loans, FreedomPlus provides excellent customer service and a faster approval process for online loans.

If 85% of the loan is used for debt repayment, you may be eligible to receive a lower interest rate. FreedomPlus may be an option if you want to consolidate high-interest debt and need financial assistance from financial institutions.

LendingClub

3.5 ★★★★★

LendingClub offers personal loans up to $40,000 and is one of the few lenders allowing cosigners for personal loans. If you have difficulty qualifying, a cosigner may help you get approved. LendingClub considers proof of income and bank statements to help borrowers with poor credit scores or a less-than-perfect credit score.

LendingPoint

3.5 ★★★★★

LendingPoint provides personal loans to borrowers with good credit. They offer several types of loans for different purposes, such as cash loans for financial emergencies and instant approval loans for urgent needs. LendingPoint may make it easier to obtain a loan if you have poor credit. LendingPoint lets you borrow as little as $2,000 up to $36,500.

LightStream

4.5 ★★★★★

LightStream is a division of SunTrust Bank and a credit union that allows you to borrow up to 0,000. Most LightStream loans are for between two to seven years. Personal loans for home improvements can be extended up to 12 years, ensuring a maximum loan term for better financial flexibility.

Marcus

4.0 ★★★★★

Marcus offers personal loans up to $40,000 with flexible repayment options. They ensure you get your loan on time and provide a helpful loan agent to assist with your queries. Your monthly payment can be deferred if you make 12 consecutive loan payments on your Marcus loan.

OneMain Financial

3.9 ★★★★★

OneMain Finance might be a good option if you don’t need to borrow a lot. Getting a loan amount between $1,500 and $20,000 is possible. If the loan amount is more significant than that, collateral might be required. They consider your monthly income and personal details to provide you with the right payment plan. OneMain Financial also offers emergency funds as part of their short-term loan solutions.

Payoff

3.9 ★★★★★

A Personal loan with a payoff may be an option to consolidate high-interest credit card debt. You can borrow up to $40,000; the loan can be repaid within five years. Payoff keeps your loan balance in check and helps configure comfortable monthly installments for you.

PenFed

4.1 ★★★★★

PenFed could be an option for you if your need is small. With terms ranging from one to five years, you can borrow as little as $600 to $ 000. PenFed takes care of your financial needs by offering tailored loan solutions and keeping track of your loan balance to ensure a stress-free experience.

PenFed loans are available for home improvement, debt consolidation, and other purposes. Complete a loan request form to start the process.

Prosperity

4.3 ★★★★★

Prosper offers loans from $2,000 up to $40,000 at a competitive rate. Investors will need to consent to finance your loan. This lending decision can take up to 14 days. It is possible that your loan will not be funded. You will need to create a new listing in this case. Keep in mind that the entire process may take some time.

SoFi

4.0 ★★★★★

SoFi offers personal loans starting at $5,000 and up to $100,000,000. It is a good option for people who need large amounts. By borrowing with SoFi, you’ll also receive member benefits such as unemployment protection. A proof of residency may be required for the application process.

Upgrade

4.5 ★★★★★

The upgrade considers Loans Legal regulations to provide more options for people seeking loans. Fill out a loan request form to begin the process and get a quick lending decision.

The upgrade can be a great choice if you need money quickly. After completing the verification, your Upgrade loan funds may be available in as little as one day if approved. You will have access to free credit monitoring and educational resources.

Start

3.9 ★★★★★

With Upstart, you can get $1,000 to $50,000. Upstart considers your education and works history to determine your eligibility. You may still be eligible, even with a low credit score or previous loans.

How to Apply for Personal Loans with 600 Credit Score

These are the steps you should follow if your goal is to get a personal loan for fair credit.

Your credit score can be checked. Lenders will check your credit scores to determine your creditworthiness. It is smart to double-check your credit report before applying for a title loan online. You can check your credit report for free at AnnualCreditReport.com.

To apply for an auto title loan or cash advance, research the title loan process and compare different lenders. Some lenders offer a day approval and an instant cash advance. Remember that this type of loan usually has a high-interest rate. After selecting a lender, apply for the loan and await approval. Once approved, you will have access to funds to meet your financial needs.

Compare vehicle title loans options and lenders. To find the best loan, compare as many title loan lenders as possible. It is important to consider the interest rate, terms, and fees. Compare lenders to find the right title loan agent for you.

Fill out the application. After you have selected the title loan companies, complete the application.

You will receive your title loan funds. The lender will ask for you to sign the loan agreement once you have been approved. A direct deposit is frequently used.

Title loan options and personal loans can take up to a week for funding. Some lenders might be able to fund your loan in as little as one day with Quick access.

Consider the time and cost of a personal loan with low interest. To estimate the cost of a loan, use our loan calculator. Keep in mind the Limited loan amounts available.

We are thrilled to share with you the comprehensive list of American states where our company actively provides online loans specifically tailored to individuals with a credit score of 600. At our company, we understand that financial situations can vary, and credit scores may not always accurately reflect one’s ability to repay a loan. With this in mind, we have expanded our services across multiple states to ensure that individuals with a 600 credit score can access the financial support they need. Please refer to the table below to see if your state is among those where we operate. We are committed to serving our customers in these regions with integrity, transparency, and a seamless online loan application process.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Below are some statistics on personal loans up to 600 credit scores:

| Feature | Value |

|---|---|

| Interest Rate | Average: 25% |

| Loan Amount | Typically: $2,000-$35,000 |

| Loan Terms | Typically: 24-60 months |

| Loan Fees | May include: origination fees, late payment fees, and prepayment penalties |

Can I get a personal loan with a 600 credit score?

You can still get a personal loan even if your credit score is 600. Loans for people with lower credit scores are available, as some lenders specialize in personal loans. Consider using a source for payday loans if you need quick access to funds.

Be aware that lenders might consider you a more risky investment if your credit score falls between 580-669.

You’ll likely pay higher interest rates than borrowers with good to excellent credit.

How can you improve your credit score?

It doesn’t matter if you have to wait for a loan. First, You can qualify for lower interest rates and longer terms by improving your credit score.

A lower interest rate could help you save money over the term of your loan.

There are many methods you can earn credit.

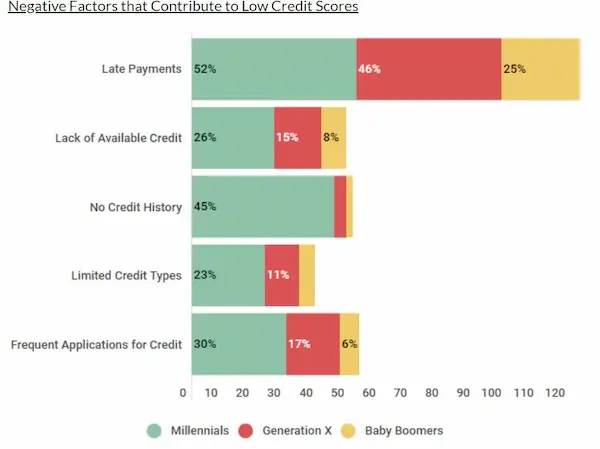

Pay your bills on time. Your payment history is a major factor in determining your credit score. Your payment history can affect your credit score. If you have made late payments in the past, it may be a good idea to pay all of your bills on time to ensure a positive loan experience.

Reduce existing debt. 30% Your credit score is determined based on your credit utilization. This is the amount of credit you have used relative to total credit. Your credit card balances might be reduced.

By improving your credit score, you can have better access to money during financial hardships and make payments on time. This will also help you avoid prepayment penalties imposed by some secured lenders. Moreover, opting for lenders that offer day funding and quick funding will make the process smoother. In addition, a wide variety of loan options is also available for those with Payday Loan Bad Credit.

Credit reports disputes. According to the Federal Trade Commission, one in five people have errors on their credit reports. Your loan terms could be reduced or denied. Examine your credit report and file dispute letters with the major credit bureaus.

- What credit score should I aim for? Those with good credit are more likely than others to be approved for loans, such as Indiana Payday Loan or a title loan funding.

- aim for 670-739 credit scores to improve your credit score. This will put you in the “good credit” category, allowing you to qualify at higher rates and terms. Utilize your mobile phone to keep track of your credit score and stay updated. With a wide range of financial options, you’ll have more choices for borrowing and saving extra money. You could acquire a vehicle equity loan in just a matter of minutes using your mobile phone, making it more efficient.

Frequently Asked Questions

Can I get a loan online with a 600 credit score and bad credit history?

Yes, many online lenders offer personal loans, small business loans, and even some mortgage products for borrowers with credit scores around 600, but interest rates will be higher than those for good credit.

What types of loans are available for people with a 600 credit score and poor credit?

Personal loans, payday alternative loans, FHA mortgages, student loan refinancing, auto loans, and secured credit cards are attainable for 600 credit scores. You’ll pay higher rates than those with good credit.

How can I improve my chances of getting approved for an online loan with a 600 credit score and bad credit?

Applying with a co-signer, providing collateral, documenting consistent income, and lowering debt burden can help overcome poor credit when seeking online loan approval.

Are there any specific requirements or documents I need to apply for an online loan with bad credit and a 600 credit score?

You’ll need government ID, proof of income, residence information, Social Security number, banking details, debt-to-income ratios, and authorization to check credit and employment.