A $100 instant loan with online application and instant approval loan deposited to a prepaid debit card is approved, and the funds are immediately deposited onto a prepaid debit card. The loan is marketed as a quick and easy way to access cash. It is a type of loan with no credit check or minimal qualifications. These loans come with high-interest rates and fees. They are targeted toward individuals with bad credit or limited access to traditional forms of credit. Borrowers must read the terms and conditions of the loan and understand the repayment schedule and any fees before applying.

Borrowers must do a few things to get an instant loan decision and approval on their loan application. People looking for instant approval must consider payday loans. These loans are designed for individuals with poor credit or no credit history. Lenders send these loans to a prepaid debit card. Most obtain these loans with poor credit scores or no credit check. After a few minutes of online application approval, they know the lender’s loan decision.

Lenders deposit the funds directly onto a prepaid debit card. The loan is issued by a lender who does not require a credit check. Thus, it makes it easier for individuals with bad credit access funds when needed. Applying for these loans is relatively straightforward. Borrowers do it online, and the application process is quick and easy through an online form. The lender requires basic information such as a borrower’s name, address, and income. The funds are deposited onto the prepaid debit card within one business day once the application is approved. The loan terms vary depending on the lender.

Generally, borrowers must repay the loan within a short period. It is normally between two and four weeks. These loans have higher interest rates than traditional ones. It is because of the higher risk the lender takes. Additionally, most of them come with extra fees. These include application fees and late loan payment fees.

Prepaid Accounts are Accepted For $100 Loans.

Prepaid accounts are a type of account that allows individuals to deposit money in advance. They use it to make purchases or withdraw cash. These accounts are often linked to a prepaid debit card payday. They are used to make purchases or withdraw cash at ATMs. Unlike traditional bank accounts, prepaid accounts do not need a credit check or a minimum balance. They are a good option for individuals with bad credit loans or limited access to credit.

Here’s how borrowers get a payday loan using debit cards. First, they must call their local payday loan shops before visiting the physical location. They then request online payday loans with debit cards. There are maps of payday loan retail locations in most areas.

Payday loan companies that accept debit cards are difficult to find. They only offer it as an extra service. However, those who do offer approved loan options are happy to have the borrower as a client and provide payday loans with Payday loan debit cards online. Payday loans are repaid once, unlike installment loans requiring monthly payments. Borrowers repay them on their next payday with flexible repayment terms.

Where Can I Find Prepaid Debit Cards Loans?

Below are things to know to find prepaid debit card loans with instant funding.

- Online prepaid card loans: Websites like GreenDayOnline offer loans to prepaid accounts with instant funding.

- Please find a local payday loan shop: Borrowers must find a website that shows a list of prepaid card loan companies in their region. Call them before going. Not all shops offer debit card loans with approved loan options.

- Open an account at a credit union: They are often very friendly and open to helping those who have lost their mark with large banks and provide Payday loan debit cards.

At GreenDayOnline, we are committed to providing swift financial solutions to individuals across the United States. With our extensive network and dedication to customer service, we are pleased to offer our $100 instant approval loan deposited to a prepaid debit card service in multiple states. We understand the importance of timely access to funds and aim to make the loan application process hassle-free. Below is a comprehensive list of the American states where our company operates. Please refer to the table to find out if your state is included, and take advantage of our convenient loan services today.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Can Lenders Make a Direct Deposit Of Payday Loans On a Prepaid Debit Card?

Yes, some financial institutions use prepaid debit cards to deposit payday loans. However, the money is loaded onto a card, not direct deposit into the borrower’s checking accounts. It is easy to find payday loan companies that accept debit cards. Borrowers must research to locate companies selling payday loans in their area. With the 5-minute loan request option, online application for an instant payday loan becomes even more convenient.

A financial safety note: A payday loan with a debit card is a short-term cash loan, also known as a short-term debt loan. Borrowers use it only for temporarily unavailable funds. It is key to a successful payday loan with a debit card transaction. Only use it if all other options have been exhausted, and when considering funding, debit cards are your primary choice.

Prepaid Card Loans: Be careful!

Prepaid account loans offer lower rates than those offered by the competition. Ensure you understand the terms and conditions of the instant payday loan online before proceeding with the application. Borrowers must read all the fine print before they sign any loan that accepts prepaid cards. Be aware of the debit card service fee and other charges. Check if there are rechargeable debit card fees.

What to look out for when applying for payday loans using a prepaid debit card?

Borrowers must remember that debit card cash advances are not the same as a prepaid debit card loan. Below are things to look for when applying for payday loans using a prepaid debit card.

- There is a service fee for debit cards: Most borrowers need to learn the cleverly crafted language used to hide costs. Additionally, borrowers should consider the form of cash they will receive, as some payday loan lenders might charge extra fees for this service.

- Rechargeable debit card: Must borrowers pay to recharge their payday loan card? No-fee debit cards are not available in this market. Borrowers must pay to recharge their cards with very few exceptions. It is why they must not transfer their card.

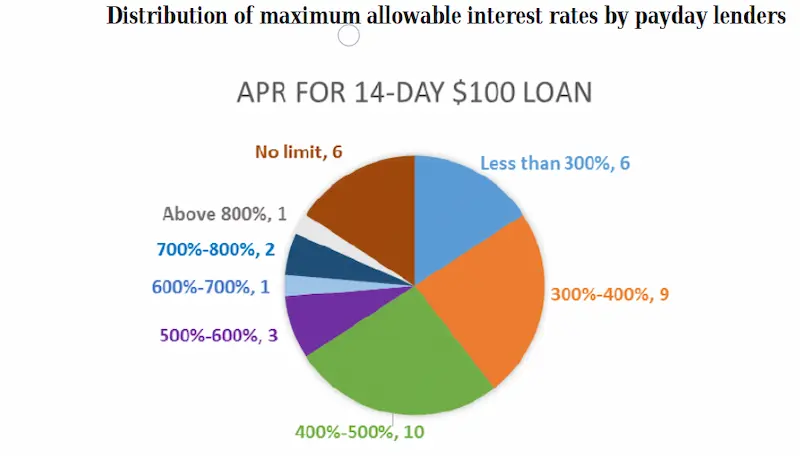

- Cost to get a debit card: Depending on where a borrower lives, the interest rate goes up to 1000% APR after fees. There are even debit card overdraft fees. Borrowers should read the loan agreement carefully to understand all associated costs and fees.

What documents do borrowers need for online payday loans with a prepaid debit card?

When applying for online payday loans with a prepaid debit card, borrowers should be prepared to provide documents that fulfill the requirements for eligibility. This usually includes proof of identity, income, and banking information. Some lenders may require additional documentation depending on their specific criteria.

All online loans accepting prepaid cards need borrowers to provide documentation. The documentation meets the “know their customers” requirements. Borrowers must provide basic information. These include their address, work history, and where they live. It is the same story at a local shop; borrowers must provide documents online for prepaid card loans.

Cash advances on prepaid cards: Can I get cash loans?

Yes, borrowers withdraw the money. However, there is a fee. They don’t have regular credit cards. It is a normal payday loan. It wires to the borrower’s prepaid card, not their checking account. It is important to be very cautious with the loan. Borrowers must only use it in an emergency after considering their monthly income and eligibility criteria in a financial emergency and while assessing their repayment capacity.

Are there other options for payday loans?

Yes, there are other options available apart from prepaid card loans. Borrowers can also choose from various instant payday loan stores that offer short-term loans with different repayment terms and interest rates. These alternative options can be helpful in financial emergencies, and borrowers should always compare the costs and terms of multiple payday loan providers to find the best option for their needs.

Yes, there are other options for payday loans. First, Pawnbrokers provide fast loans to customers without opening bank accounts. The risk of becoming indebted at a Pawnshop is lower than for other loans that do not need a bank account. These loans can also help with unexpected expense situations. Be careful that they don’t charge extra fees or interest on your expenses. Avoid them if this happens. Second, bitcoin loans are another loan option for those who do not have a bank account. Bitcoin loans are relatively new on the market and often offer instant decisions. There are a few leading Bitcoin loan companies. Third, consider opening a bank account to make it easier to obtain a loan, especially if you prefer a traditional loan. GreenDayOnline has a simple guide that helps borrowers get started.

Here are some statistics on $100 instant approval loans

| Feature | Value |

|---|---|

| Interest rate | 20% – 400% |

| APR | Varies |

| Repayment period | 3 – 12 months |

| Loan approval | Most likely |

Payday loans available for NetSpend accounts

Borrowers get cash quickly by writing a post-dated cheque for their next payday. Some choose to give an equivalent online authorization. Rapid payday loan providers make a lot of money. It is because most Americans don’t have bank accounts. Some borrowers go to their local payday lenders to get one of these cards. Many names, including NetSpend Prepaid MasterCard and Purpose Card, know these.

Making sure to handle payments on time, the success of payday lending services can be attributed to the need for quick financial solutions. With convenient online locations through which loans can be easily handled, they have become accessible to a wider range of borrowers. In addition, payday lending businesses now provide services with debit card options, catering to customers who lack traditional bank accounts.

People are now switching to a prepaid debit or card instead of a checking account. The card type is loaded with their own money and used as a credit or debit card. They must take out another type of personal loan to borrow more money after it has run out. Consumer advocacy groups like the National Consumer Law Center (NCLC) published findings. They found $15 fees for a declined payment and $25 to stop recurring charges on these short-term loans. Multiple studies have shown that such prepaid cards exploit vulnerable people. There are better ways to control spending.

Knowing the minimum credit score requirement and how different credit ratings can impact the options available is essential when considering loans. Being informed about potential lenders and their requirements will facilitate better decision-making when selecting a loan or borrowing service. Exploring various options makes finding a more affordable and reliable solution possible. One alternative is direct deposit loans for individuals with limited or no access to traditional banking services.

Comparison of overdraft fees and payday loans using a prepaid card and debit card

Overdraft is not allowed on regular cards, so no overdraft fees exist. Debit card payday loans, different from standard cards, charge overdraft fees. A person must purchase overdraft protection. They are charged a fee for more purchases with less than $20. These fees can be as high as $15. Overdraft fees are the largest single expense at NetSpend.

Simple forms and amounts of money involved in transactions can challenge some customers. Companies know that users spend too much. It is because it takes more work to keep track of all purchases on a tight budget. Multiple Payment options can help customers manage their finances better, ensuring they pay their bills on time. Overdraft fees are the largest single expense at NetSpend. It makes more than 50 million dollars annually. NetSpend customers pay almost 90% of overdraft fees.

A $300 payday loan requires the customer to pay $345 after two weeks. It is 300% interest on average. Overdrafts are subject to higher interest rates. These lead to a customer paying 500%. Borrowers must be careful when taking out instant cash loans and advances. Some get strapped for cash they authorize future deductions. Also, check the loan rate before applying for an instant cash loan. If not careful, it leads to a debt spiral that is difficult to get out of.

Payday loan regulation

Federal sponsorship aims to curb predatory lending from some direct lenders. However, traditional payday loans won’t be going anywhere. Others remain the same, while some states might progress and improve. Such a business needs to be bigger to see any significant change quickly. Payday loan companies are watching for legislative changes. They are planning to switch to longer-term loans to counter these. There is no way to prevent abuse or provide a viable alternative for the under-banked. Prepaid cards are not regulated by the Credit Card Act of 2009. These cards are not also covered by the Credit CARD Act of 2009. There is significant abuse of the medium with billions of transactions. In response, an emergency fund team has been set up to address concerns related to the minimum loan requirement, processing times, and the suitability of the credit type.

These are some good deals.

Visa, Chase, and other large financial institutions offer financial security products. They aren’t different from mainstream products, although they have yet to be transparent. They are widely accepted. Statistics show people adopt normal payday loan debit without basic or active bank accounts. Regulators keenly control this industry.

These cards are often used by the financially distressed and uninformed. Critics of regulators, sponsored by companies, claim that regulation will make it more difficult for those who need credit most to make this choice. Researchers and regulators disagree. The additional benefits and fees are often hidden in fine print or on websites. It is why we propose making all costs transparent.

A steady source of debit card cash loans can be opaque regarding their fine print. Using bulletproof glass for transactions at stores that sell cards is common practice. The contract, which is difficult to read due to its small size, is transmitted through a slot. People then sign it without having to read any minimum balance requirements. It is that way.

I Need to Borrow Money But Have Only a Prepaid Debit Card

Financial institutions wire a loan to a borrower’s debit or credit card. A friend can help them get a loan, which will be more likely to happen if it is notarized. Borrowers use their cars as collateral or borrow money from a Pawn Shop if they have valuable assets. Applying for a $100 approval loan deposited to a prepaid debit card is typically done online. The applicant must fill out an application form with their personal and financial information, such as their primary source of income. These include their name, address, income, and employment information.

Some lenders need extra information, like the applicant’s period employed or their preference for cash payments. These include their Social Security number or bank account information. The application review and approval timeline varies depending on the lender, but it is generally quick. Most lenders review the application and provide a decision within a few minutes. Suppose the application is approved. Lenders deposit the funds, essentially the original loan amount, onto the prepaid debit card within a few business days.

Prepaid Accounts Accepted For Payday Loans

Borrowers must find websites that offer loans to prepaid accounts, such as Green Day Online and Cash Central. These websites also accept time payments for added convenience.

Can You Get a Loan With a Prepaid Debit Card?

Yes, borrowers can get a loan using a prepaid debit account. However, those with Perfect credit may have better loan options available. Check out our selection of websites that offer loans to prepaid accounts.

No Bank Account is Needed

Many are known as title loans. Payday loans without a bank account are to be cautious, just like any loan company that accepts prepaid cards. Remember that having Perfect credit can be advantageous in the loan process.

How To Get Cash Advances Without Opening A Bank Account

Consider opting for timely payments to manage the repayments better. It’s simple, credit card issuers such as Cash Central offer a prepaid card payday loan. Although it can be costly and lead to a debt trap, it is possible.

How To Obtain a Loan Using a Prepaid Card

Avoid getting a loan using a prepaid card. You can try friends and co-sign for a loan with a prepaid debit card. Utilizing your Perfect credit can also help in obtaining a loan.

What are the eligibility requirements?

Listed below are the eligibility requirements.

- Source of income: A steady income source is one of these loans’ main requirements. Examples include employment income, government benefits, or other forms of regular income. The lender needs proof of income through pay stubs or bank statements.

- Valid ID: A valid ID and a mailing address are also essential. Lenders use it to verify the applicant’s identity and send the prepaid debit card to the applicant upon loan approval.

- Credit score: Credit and credit history are not considered when applying for these loans. The lender does not perform a credit check to determine the loan amount. Thus it makes it easier for individuals with bad credit or no credit history to qualify for the loan.

- Additional requirements: It’s worth mentioning that some lenders have extra requirements. These include the minimum age requirement or having a bank account. Borrowers must check with the lender before applying to ensure they meet all the eligibility requirements.

Frequently Asked Questions

How do I apply for a $100 instant approval loan deposited to a prepaid debit card?

You can apply on lender websites by submitting basic personal information, e-signing, and allowing access to the prepaid card account to deposit funds if approved.

What are the eligibility requirements for obtaining a $100 instant approval loan on a prepaid debit card?

Lenders require ID verification, income over $1,000/month, residence in an approved state, and an activated prepaid debit card registered in your name.

Are there any fees or charges associated with getting a $100 instant approval loan on a prepaid debit card?

Yes, fees like origination charges and high APR interest rates, often over 300%, as well as any prepaid card usage fees apply to these small instant approval loans.

What is the typical repayment period for a $100 instant approval loan on a prepaid debit card?

Repayment is often due within 14-30 days of receiving the funds on your prepaid debit card, via automatic withdrawal from the card.

Can I get a larger loan amount deposited to a prepaid debit card, or is $100 the maximum limit?

Most lenders cap deposits to prepaid debit cards at $100, but you may be able to qualify for up to a few hundred dollars deposited to a bank account.