Unemployed loans are a type of loan designed for individuals who are unemployed and do not have a regular source of income. They are known as no credit check loans. They do not need a credit check, so even individuals with poor credit qualify for them. Same-day payout loans allow the borrower to receive the loan funds the same day the loan is approved.

It is useful for individuals who need cash and must immediately deposit the funds into their accounts. Being unemployed and having a bad credit score is stressful when borrowers have bills to pay. Unemployed people always think of a personal loan whenever they have a financial fix. They have to ask many questions about whether it is worth it. Some lenders are ready to lend money to bad credit borrowers. They do not do a credit check. They rely on a borrower’s debt-to-income ratio.

Loans for the unemployed on benefits

For those eligible for unemployment benefits, these loans can be a lifesaver during a period of financial hardship. These loans enable borrowers to take advantage of the benefits they receive while they get back on their feet. Lenders offering these loans understand the unique challenges that unemployed people on benefits face and are more likely to approve loans for borrowers in these circumstances.

Loans for the unemployed provide financial help to individuals who do not have a regular source of income. Some benefits of these types of loans, including emergency loans, are:

- Access to cash: These loans provide individuals with access to the necessary cash. It helps them cover rent, utilities, or medical bills. An emergency loan could also be a lifesaver in urgent situations.

- No credit check: Some loans for the unemployed, such as the emergency loan, do not need a credit check. Thus, even individuals with poor credit can qualify for them.

- Fast approval: Some loans for the unemployed, including emergency loans, are approved quickly. Thus, they are useful for individuals who need cash quickly.

- Flexible repayment options: Some loans, like the emergency loan, have flexible repayment options. It becomes easier for individuals to repay the loan.

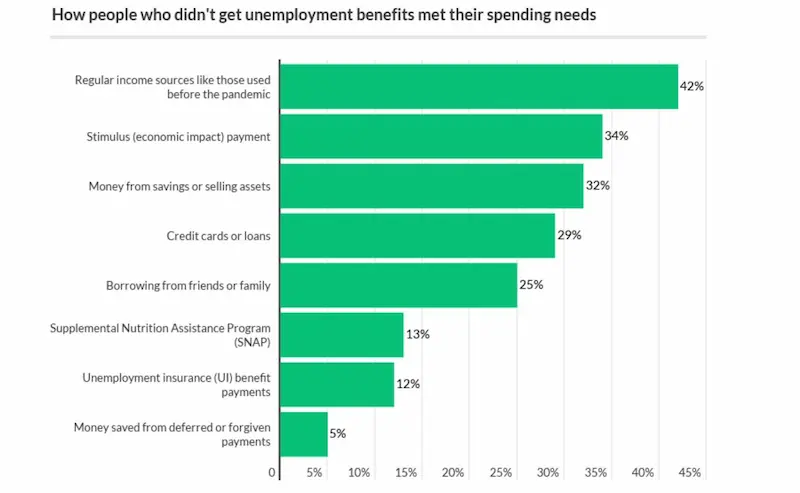

Consider alternatives such as borrowing from family or friends, credit union loans, or other types of loans, as they have lower interest rates and better terms. These loans have high-interest rates and short repayment terms. It makes them very costly in the long run. Some also need collateral, such as a car, house, or jewelry. Carefully read the terms and conditions of the loan before signing the agreement.

What to consider before getting a personal loan

Suppose a borrower is unemployed and is considering credit. There are a few things to consider first. Obtaining a personal loan has positive and negative consequences. Borrowers should be aware of these issues.

- Can borrowers pay on time?: Regardless of the debt, borrowers must ask themselves if they can make on-time payments. Late payments affect their credit score and may cost them excessive late payment fees. Suppose it is the case. The online lender collects cash via agencies, resulting in negative information about a borrower’s credit report. It means the lender reclaims the assets or takes legal action.

- Do I understand the terms and conditions of the loan?: Borrowers must understand the terms of the loan. These include interest rates, payments, taxes, fines, repayment periods, etc.

- Do I know the disadvantages?: It is good to consider how things go wrong when considering a personal loan. Here are a few points to consider; is a personal loan the best choice? What if the repayment terms need to be more affordable? Are my assets at risk? What is the total interest?

General factors are taken into account.

Each lender has a credit policy determining whether a borrower can repay a loan. It is called credit assessment. Creditors need to check several things. They include the borrower’s annual income, debt-to-GDP ratio, payment history, bad credit history, etc.

What is considered income?

Creditors still need proof of income when applying for a personal loan without employment. This proof of income is crucial, especially during a loan application process, as it assures the lender that the borrower has a steady income stream to repay the loan. However, it is more than just the employer’s income. According to the US Government, many other items are considered income.

- Alimony payments: Alimony is a court-ordered payment from one ex-spouse to another following a divorce. A financial advisor can help both parties navigate the process and provide financial advice on managing the payments.

- Invalidity benefits: These refer to financial compensation provided to those unable to work due to a disability. These benefits can come from various sources, including government programs and private insurance. Consult a financial advisor for guidance on maximizing these benefits.

- Unemployment insurance: Unemployment insurance is a government-provided program. It provides financial help to individuals out of work for no fault. Seeking financial advice on how to manage expenses during this period can be beneficial.

- Interest payments and dividends: Interest payments are made by companies to individuals invested in their bonds. Dividends are payments made by companies to shareholders as a return on their investment. A financial advisor can help you understand and manage these income sources.

- Social contributions: Social contributions refer to money paid into a government-provided social security program. Proper financial advice can help optimize your contributions and plan for retirement.

- Annuities or pensions: An annuity is a financial product that pays out a fixed or variable income stream over a certain period. A pension is a retirement plan that provides a regular income to retirees. Working with a financial advisor ensures you make informed decisions when choosing between annuities and pensions.

What sort of loans are available for unemployed borrowers?

Listed below are the loans available for unemployed borrowers, including online loans and traditional loans.

- Personal loans: Some lenders offer loans to unemployed borrowers. The terms and interest rates are less favorable for borrowers with a steady income.

- Payday loans: Payday loans are short-term, high-interest loans due on the next payday. These loans are easy to qualify for but come with high fees and interest rates and are difficult to pay back.

- Guarantor loans: A guarantor loan is where the borrower needs a person willing to guarantee the loan. The per handle for repaying the loan if the borrower cannot.

- Pawnbroker loans: Pawnbroker loans are secured loans that use personal property. These include jewelry or electronics as collateral. The loan is based on the item’s value, and borrowers get it back once they repay it.

- Title loans: A title loan is a secured loan that uses a borrower’s car as collateral. The loan is based on the car’s value, and borrowers risk losing the car if they fail to repay it.

Difference Between Guaranteed and Unsecured loans

Loans are secured for property such as a car or a house, according to the Federal Trade Commission (FTC). Unsecured loans have no bonds and are issued with no collateral against them, like a car title loan.

It helps if they consider each option when deciding whether or not loans are secured. For example, if they cannot repay a secured loan, the lender may take back their assets to make themselves whole. Creditors may consider unsecured loans riskier than secured loans, according to the Financial Consumer Protection Authority (CFPB). Unsecured loans may have higher interest rates.

Payday Advance Loans & Payday Lenders

Payday advance loans are a type of unsecured loan that payday lenders usually offer. These payday lenders provide short-term cash advances to borrowers who need financial assistance between paychecks. Since these unsecured loans may have higher interest rates and fees, making them a more costly option than secured loans.

A pay advance loan generally describes a short-term, high-cost loan due on the next payday. Loan Terms and conditions in pay advance loan differ depending on the state where borrowers live. However, payday advances have unique risks and are only sometimes available everywhere in the USA. So if borrowers are considering a loan, they must fully read the small print. Notably, loan approval from traditional lenders is a better alternative for some borrowers.

Cash advance loans

Using a credit card to withdraw money from an ATM is expensive. Some credit cards allow borrowers to obtain part of their credit line in cash. It is another high-cost, short-term loan type known as a cash advance. Cash advances can incur extra costs. The interest rate on cash advances is generally higher than on regular credit card purchases. In contrast, loan approval from traditional lenders may provide better terms and lower interest rates.

Consolidation Credit

An online application process makes it easier for borrowers to apply for a loan. Borrowers are free to consolidate or merge all debts into one loan request if borrowers want to keep up with their bills. It helps to focus on breaking down the loan into monthly payment instead of repaying it once.

According to the US government, some debt consolidation loans may require the creation of real estate as collateral. And the CFPB likes to warn consumers that debt consolidation loans do not pay off debt 100%. Sometimes, borrowers pay more if they consolidate their debts into another type of loan.

We at GreenDayOnline are committed to providing support and financial assistance to individuals who are currently unemployed and seeking loans. Understanding the challenges faced by the job market, we have extended our services across various states in the United States. Our presence in these states allows us to cater to many needy individuals, offering them a pathway toward their financial goals. Below is a comprehensive list of American states where our company is actively operating, providing accessible and reliable unemployed loans to those who require assistance.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

No Employment Verification Payday Loans For Unemployed

Personal loans that don’t require income verification permit many people to borrow money even if they do not have a job. In most cases, any credible steady income source will be sufficient to meet their requirements for unsecured loans. Access to an online application makes it convenient for potential borrowers to apply for a loan without employment verification.

Certain loans rely on collateral, not income, making them valuable (if high-risk) options for those looking for loans.

1-hour loans, no employment verification

It is not realistic to expect a loan in one hour. However, same-day loans are possible if borrowers apply online early in the business day. Some loan websites and loan-matching services can help borrowers find suitable options.

Here are some statistics on unemployed loans:

| Statistic | Value |

|---|---|

| Average interest rate | 30% |

| Average repayment period | 3 years |

| Percentage of unemployed borrowers who default on their loans | 20% |

| Percentage of unemployed borrowers who are unable to repay their loans within 3 years | 10% |

What if borrowers are not entitled to a loan?

There are still ways to start financial planning if they are unemployed and ineligible for a loan.

Reduce debt!

Some people need help paying bills, credit cards, or other loans. The CFPB recommends working directly with companies, credit unions, and lenders. They help borrowers deal with their current financial situation. Considering loan websites and loan-matching services can also guide managing debt.

Assess personal savings

Borrowers must consider all the factors if they consider logging into their retirement account first. It is time to assess personal savings if borrowers have money in a savings account or an emergency fund. However, every situation is different, so speaking with a qualified financial expert is wise.

Discover alternative sources of income

Companies online pay people to take surveys, test users, improve their content, and more. Beware of scams.

Seek more help

Some organizations help service workers, freelancers, and people cope with excess expenses. They can use charities and food banks if borrowers need immediate financial assistance feeding their families.

Frequently Asked Questions

Are there legitimate lenders that offer unemployed loans with no credit check and same-day payout?

Some online lenders market loans for the unemployed with no credit checks and fast funding, but legitimacy is questionable. Reputable mainstream lenders are unlikely to approve such risky loans. Proceed with caution.

What are the eligibility criteria for obtaining an unemployed loan with no credit check and same-day payout?

Proof of unemployment benefits, ID, bank account info, references, and collateral like a vehicle title may be required. However, meeting criteria does not guarantee approval for an unemployed loan, especially from reputable lenders.

How do I find reputable lenders that provide same-day payout loans to unemployed individuals?

Unfortunately, reputable lenders are very unlikely to offer same-day loans to unemployed borrowers due to the high risk. Legitimate options like unemployment programs, nonprofits, and government assistance may be better alternatives.

What is the typical interest rate and repayment terms for loans for unemployed people with no credit check?

Interest rates often exceed 400% APR with short 1-2 month repayment terms for unemployed loans with no credit check, making these loans extremely high risk.

Are there any alternatives to unemployed loans with no credit check for individuals in need of quick financial assistance?

Better options may include unemployment benefits, food assistance, nonprofits, payment plans, loans from family, credit counseling, or crowdfunding. Avoid unemployed loans with no credit check if possible.