Title loans have become increasingly popular in recent years, particularly to access quick cash for people with bad credit scores or poor credit history. The borrower’s vehicle secures a title loan, which serves as collateral for the loan. Florida Title Loans Online companies offer borrowers the opportunity to apply for and receive funds without ever having to leave their homes using an online application form.

Such loans seem easy to solve financial emergencies, but they have significant risks you must review before deciding. A no-credit-check title loan in Florida might be an option, but you should carefully weigh the pros and cons before deciding.

Online lenders allow borrowers to apply quickly and easily by submitting basic personal information and details about their car. Borrowers receive funds within hours or even minutes once approved. The process seems convenient, but it has serious consequences if the borrower fails to repay the loan on time or defaults entirely. Individuals exploring title loans must understand the benefits and potential drawbacks of such financing options before committing themselves financially.

Benefits Of Title Loans Florida Online

Auto title loans are viable for people who own their vehicle outright. The rise of online lending options has made it more convenient to obtain a title loan than ever before. There are several benefits to opting for title loan options in Florida online. You have an unexpected expense or need extra funds to cover bills until your next paycheck. Title loan lenders provide emergency money through online loans with competitive interest rates.

- Florida Title Loan Online provides a flexible solution for people needing fast cash with minimal hassle. It allows borrowers to apply from the comfort of their own homes without physically visiting a brick-and-mortar location.

- Many online Title lenders offer faster processing times than traditional lenders, so borrowers receive their funds in as little as 24 hours.

Below are some statistics about Title Loans Florida Online:

| Stat | Value |

|---|---|

| Maximum loan amount | $10,000 |

| Minimum loan amount | $250 |

| Typical loan term | 30 days |

| APR | 25% – 300% |

| Interest charged | Up to 25% of the loan amount per month |

| Late payment fees | Up to $35 per day |

| Repossession fees | Up to 20% of the loan amount |

| License requirements | Title loan lenders in Florida must be licensed by the Florida Department of Financial Services |

| Restrictions | Title loan lenders in Florida are limited to making loans of up to $10,000 and the APR cannot exceed 300% |

Eligibility Criteria

Applicants must be at least 18 years old and have a lien-free vehicle title to qualify for a title loan in Florida. The vehicle must have enough equity to cover the amount borrowed. Borrowers must provide proof of income, such as a pay stub or bank statement, to show they can repay the loan. Borrowers must have a valid government-issued ID and proof of residency in Florida. They must meet such requirements before applying for a title loan to increase their chances of getting approved and avoid delays in the approval process.

How To Apply For A loan application process And loan approval Online

Applying for a title loan online requires certain documents from the applicant. As title loan agents, borrowers complete the online application process by providing the lender with certain personal and financial information.

Required Documents

You must provide several documents when applying for a title loan online in Florida. First, you need proof of income, such as pay stubs or bank statements. It is so the lender assesses your ability to repay the loan, ensuring you meet the criteria for title loans. You’ll need a government-issued ID to verify your identity and age. You must surrender the vehicle’s title to the lender as collateral for the loan.

Other required documents include proof of residency (such as a utility bill) and proof of insurance on the vehicle used as collateral. Ensuring that all the documents are readily available before beginning the application process helps to expedite the process for title loans and increases your chances of instant approval.

Online Application Process

The online application process for title loans is designed for quick funding once your application is approved. You’ll typically be guided through each step, including the vehicle inspection, to ensure the vehicle’s value aligns with the loan amount requested. Borrowers can expect a smooth and efficient application process by having all the necessary documents and meeting the requirements.

Applying for a title loan online is simple and convenient as it allows you to complete the entire process from the comfort of your home.

- You’ll need to find a reputable lender who offers online applications, fill out their online form with all the requested information, and upload copies of the required documents. They may ask about your credit history as part of the approval criteria.

- The lender reviews the submitted application and makes a loan decision based on their assessment of your loan repayment ability and credit history. You must provide accurate information and verify all required documents are present when submitting your application to avoid any delays or potential denials.

Applying for a title loan online is an efficient way to secure loan funds when needed if done correctly.

Understanding The Loan Terms

Understanding the loan terms is key before signing any online title loan agreement in Florida. You must read and comprehend all the clauses, including the interest rates, monthly income requirements, approval rates, repayment schedule, and consequences of defaulting on payments. Here are four things to know when reviewing your loan terms, especially during a financial crisis.

- Interest Rates. Check the Annual Percentage Rate (APR). It reveals how much a borrower pays over one year for borrowing money. Consider your financial history before committing to any loan.

- Repayment Schedule. Review the payment terms carefully and seek clarification from your lender if anything doesn’t make sense to you. Opt for flexible repayment terms if available.

- Consequences of Defaulting. Paying your loan as agreed upon with your lender leads to the repossession of your car or truck by the lending company.

- Hidden Fees. Remember hidden fees like prepayment penalties, late payment charges, origination fees, and other miscellaneous expenses.

Taking the time to understand such factors is necessary since they have long-term effects on financial stability. Digesting through each contract section before signing enables you to make an informed decision about obtaining a title loan, especially for those with bad credit histories.

Repayment Options

Regular payment plans are a common repayment option for title loans in Florida. Extended repayment plans provide borrowers with more flexibility for repayment but have higher interest rates. Early repayment discounts allow borrowers to save on interest costs by paying off their loans before the end of the repayment period. In some cases, borrowers may receive same-day approval and access to emergency funding.

Regular Payment Plans

Borrowers applying for title loans online in Florida must choose from various repayment options. The most common choice is a regular payment plan that requires equal monthly payments until you fully repay the loan. Obtaining an Instant Cash loan from a licensed lender can be a beneficial financial option for individuals needing quick funds.

Such an option provides predictability and stability as potential borrowers budget accordingly without worrying about fluctuations in their monthly payments. Such a choice allows borrowers with less-than-perfect credit to pay off their debt systematically while building credit by making timely payments.

Title loans offer quick decisions and shorter approval times for consumers seeking emergency cash. Borrowers must afford each payment before committing to a regular payment plan when applying for title loans in Florida online. Missing even one payment results in late fees or default, which leads to extra charges and potential repossession of the vehicle used as collateral. According to the Federal Trade Commission Consumer Advice, title loans range from 25% to 50% of the vehicle’s value. Ranging from 25% to 50% of the vehicle’s value.

Extended Repayment Plans

Bad credit borrowers who apply for title loans in Florida online can choose extended repayment plans besides regular payment plans. Such a plan allows qualified borrowers to stretch out their payments over a longer period than usual, usually up to several years. This can be very helpful for those with a negative credit history.

Borrowers must carefully review their financial situation before committing to an extended repayment plan when applying for title loans in Florida online. Consider the minimum loan and maximum loan amounts available and the need for additional funding, if necessary. It seems attractive due to lower monthly payments, but note that longer repayment periods result in higher overall interest charges.

Early Repayment Discounts

Another repayment option that borrowers of title loans in Florida online encounter are the early repayment discount. Such a plan encourages borrowers to pay off their loans sooner than the agreed-upon due date by offering discounts on interest charges.

It is a great way for borrowers to save money, but they must carefully review the terms and conditions of the discount before committing. Borrowers must weigh their financial situation and goals before making a decision. Various lenders impose penalties or restrictions for early repayment, negating potential savings.

As a leading provider of title loans in Florida, our company has established a strong presence across the state, catering to individuals in need of financial assistance. We understand the importance of accessibility and convenience, which is why we have strategically chosen to operate in some of Florida’s most prominent cities. In the following table, we present an overview of the key cities where our services are available, highlighting the regions where we actively support our customers in their pursuit of quick and hassle-free title loans. Whether you reside in a bustling metropolis or a charming town, we strive to be your reliable partner, offering timely financial solutions when you need them the most. Take a closer look at the table below to discover if your city is among those where our company is actively serving its customers in Florida.

| Jacksonville | Miami | Tampa |

| Orlando | St. Petersburg | Port St. Lucie |

| Cape Coral | Hialeah | Tallahassee |

| Fort Lauderdale | Pembroke Pines | Hollywood |

| Gainesville | Miramar | Coral Springs |

Conclusion

With over 1,800 title loan storefronts statewide, Florida has one of the largest title loan industries across the U.S. However, regulations are still considerably more stringent than some of its neighboring Southern states. For example, Alabama places no limits on title loan interest rates or renewals, while Florida has set caps in both areas. Georgia, on its northern border, also recently enacted a slate of reforms adding restrictions to title lending practices. On the other end, the Carolinas have implemented some limitations yet remain looser than Florida in certain aspects. Given the major regulatory differences between Florida and other Southern states, examining title and installment lending variations in neighboring jurisdictions provides useful context on Florida’s own evolving approach.

Title Loans Florida online offer an accessible and convenient way for individuals to access immediate cash without undergoing a lengthy credit check process. The benefits of title loans include quick approval, an easy application process, and flexible repayment options.

Borrowers must meet specific eligibility requirements, including owning a car with no outstanding liens or judgments against it. Individuals must provide their personal information and vehicle details to apply for a title loan online. Once approved, the borrower gets the funds deposited directly into their account within 24-48 hours.

Understand the terms of the loan before signing up for any agreement fully. Repayment options vary depending on the lender’s policies and regulations. Various lenders allow early payment without penalty fees, while others do not. Understanding such differences is key when selecting a lender that suits one’s needs best.

Frequently Asked Questions

How can I find a reliable direct lender in Florida that offers title loans, especially if I have bad credit and need a loan with no credit check?

Search for “Florida title loans” and thoroughly vet lenders before applying. Look for Florida licensing and certification. Get loan details in writing before proceeding.

What are the typical interest rates and repayment terms associated with Florida title loans for individuals with bad credit?

Interest rates can exceed 200% APR. Loan terms are typically 30 days or one month. Extensions may be offered for an additional fee.

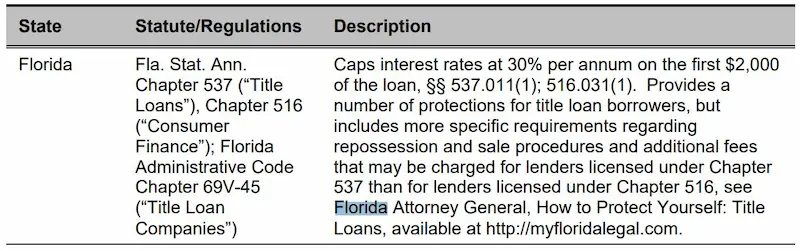

Are there any specific regulations or laws in Florida that govern title loans, including requirements for direct lenders and consumer protection measures?

Florida has no interest rate caps on title loans but does prohibit rollovers. Lenders must have a state license and disclose all fees.

What steps should I take to ensure that I’m dealing with a legitimate and reputable direct lender when applying for a title loan in Florida?

Verify active Florida licensing, check consumer complaints, get full loan details in writing beforehand, do not rely on verbal promises alone.

How to improve my chances of approval for a title loan in Florida if I have a low credit score and want to avoid credit checks?

Having steady income sources, collateral vehicle fully owned by you, and required documentation ready can help improve the chances of approval.