In recent years, online title loans have become popular for individuals needing short-term financial assistance. Tennessee is one state that has seen an increase in the availability and usage of such loans. Online title loans, also known as auto title loans or vehicle title loans, allow borrowers to use their vehicles as collateral, providing quick access to funds without requiring a credit check. This type of online loan can be an attractive option for those with less-than-perfect credit.

Online title loans are risky for people who need to be fully informed about the terms and conditions of the loan agreement despite their convenience and ease of access. Many lenders charge high-interest rates and fees, leading borrowers to enter into cycles of debt that are difficult to escape.

Before deciding, potential borrowers must carefully review all aspects of an online loan or vehicle title loan. GreenDayOnline explores the concept of online title loans in Tennessee, including their benefits and drawbacks. It provides insight into making informed decisions when seeking such financing.

Benefits Of Online Title Loans

Online title loans are becoming increasingly popular due to their numerous benefits.

- The most significant advantage is that they provide quick cash without a lengthy approval process, making them an ideal option for people needing immediate financial assistance.

- Online title loan providers offer flexible loan terms that borrowers can adjust according to their needs and repayment capabilities.

- Another benefit of such loans is that the application process is secure and straightforward, ensuring confidentiality and protection of personal information.

- Online title loans do not require collateral or thorough credit history checks, which makes them accessible to people with poor credit scores or no assets to pledge as security.

Approximately 12 million Americas use title loans annually, according to All In One Person.

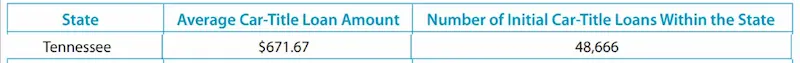

The table below contains more Tennessee title loan statistics:

| Statistic | Value |

|---|---|

| Average interest rate | 30% |

| Average term | 12 months |

| Average loan amount | $1,500 |

| Most common use | Unexpected expenses |

| Other common uses | Debt consolidation, home improvement, and car repairs |

| Risks | High interest rates, short terms, and easy to get |

| Alternatives | Personal loans, credit cards, and government assistance programs |

| State law | Title loans are regulated by the Tennessee Department of Financial Institutions. The law caps the maximum interest rate on title loans at 36% APR. |

| License requirements | Lenders must be licensed by the Tennessee Department of Financial Institutions. |

| Consumer protections | The Tennessee law includes a number of consumer protections for title loan borrowers, including: |

How To Qualify For Online Title Loans

Securing funds quickly and easily is easy with online title loans. With numerous title loan lenders available, options are abundant. To qualify for title loan funding, borrowers can consult various title loan lenders and submit an online application.

- You must have a vehicle in your name with a clear title to qualify for such auto loans.

- The loan process starts by completing an application form and providing the necessary loan documents to confirm vehicle ownership.

- Quick access to cash is available at affordable rates and customized terms once approved.

- Flexible repayment schedules allow you to repay the type of loan on time without hassle or stress.

How To Apply For Online Title Loans

Borrowers apply for an online title loan in Tennessee through a secure website, where applicants provide the necessary documentation and complete a loan request form. Gathering required loan documents for an online title loan in Tennessee includes providing evidence of valid photo identification, proof of residence and vehicle registration, and proof of income. The loan process for an online title loan in Tennessee involves a credit check and verify the applicant’s financial documents.

Gathering Required Documents

Applying for online title loans in Tennessee requires gathering the necessary documents to complete the process. You must have a vehicle inspection done and verify that all required repairs are complete because it affects the amount of money you borrow against your car’s value. Lenders conduct credit checks to determine if applicants meet their minimum credit requirements. In addition to title loans, consider opting for a personal loan or understanding other types of loans available.

You must have all the required documents, such as proof of income, identification, insurance policies, and any other relevant documentation, ready before starting the application process to increase your chances of approval. Having everything organized and prepared beforehand saves you time and potential frustration during the loan application process. Review your credit reports to ensure they accurately reflect your credit history.

Submitting Application

Applying is the next key step in applying for online title loans. Applying online allows for fast approval and a quick turnaround time. Most lenders have an easy-to-use website that guides applicants through completing the necessary forms. After submitting your Application, it is crucial to carefully review the loan contract before signing and agreeing to its terms. This will help you avoid future misunderstandings and ensure you know all the clauses within the agreement.

Lenders review the submitted Application to determine if you qualify for a short-term loan based on their criteria. Providing accurate information increases your chances of quick approval. Be prepared to promptly answer any follow-up questions from lenders to ensure timely application processing.

Loan Approval Process

The loan approval process involves lenders reviewing your Application to determine your eligibility for cash loans or unsecured loans based on their credit score requirements and other criteria. A good credit score increases your chances of being approved for cash loans with favorable terms. The time it takes to receive approval varies depending on the lender and how quickly they review your Application.

As we strive to provide exceptional financial solutions and support to our customers, we are proud to share the key cities in Tennessee where our company is actively engaged in offering Title Loans. These cities have been carefully selected based on the demand for our services and the vibrant communities we serve. With our commitment to accessibility and customer satisfaction, we have established a strong presence in these urban centers, ensuring that individuals throughout the state have convenient access to the financial assistance they need. Please refer to the table below for a comprehensive list of the major cities where we are actively operating.

| Nashville | Memphis | Knoxville |

| Chattanooga | Clarksville | Murfreesboro |

| Franklin | Johnson City | Jackson |

| Hendersonville | Smyrna | Spring Hill |

| Bartlett | Kingsport | Gallatin |

How To Repay Online Title Loans

The first step towards repaying your loan is identifying debt relief options that suit your financial situation. You must choose a repayment timeline that aligns with your income and budget, as it helps to avoid defaulting on payments.

Research different lenders’ loan rates and credit requirements before obtaining an online title loan to get a fair deal. It would be best to verify that all transactions are secure by verifying their website’s SSL certificate or checking customer reviews.

Take the repayment of online title loans seriously to maintain good credit scores and avoid legal action from the lending company. Borrowers must prioritize meeting payment deadlines and promptly communicating any difficulties in making payments with their lender to explore alternative arrangements like refinancing or restructuring the loan terms.

Alternatives To Online Title Loans

Credit Unions offer an alternative to online title loans, with lower interest rates, more flexible repayment options, and fewer fees than a traditional bank loan. Peer-to-Peer Lending is another option for people looking for an alternative to online title loans.

Bank Loans are another option for individuals seeking an alternative to online title loans. It allows individuals to borrow from a pool of lenders rather than a single bank or other financial institution. Depending on the borrower’s credit score, they offer more money, repayment options, and lower interest rates. One important document to obtain loans is your bank statement, which helps assess your financial status.

Credit Unions

Credit unions are a viable alternative to online title loans for borrowers seeking financial assistance, especially those with a bad credit score. Credit union membership offers access to various credit union services, including lower interest rates and better loan terms than traditional banks or online lenders.

They prioritize their members’ well-being over profits, so they are more willing to work with individuals with less-than-perfect credit scores. Choosing a credit union as an alternative to an online title loan helps individuals to receive the financial support they need without falling into predatory lending practices associated with high-interest rates and fees.

Peer-To-Peer Lending

For individuals looking for an alternative to title loans, installment loans through peer-to-peer lending platforms can be an excellent option. These platforms connect borrowers directly with reputable lenders without involving banks or other financial institutions, offering flexible repayment terms and potentially lower interest rates. Peer-to-peer lending can be particularly beneficial for those with poor credit, as these lenders may be more open to working with borrowers to rebuild their credit history.

Another alternative for individuals seeking financial assistance is peer-to-peer lending. Such lending involves borrowing money from individual investors rather than a traditional bank or online lender. Peer-to-peer lending platforms use credit scoring and risk management tools to assess borrowers’ creditworthiness and determine interest rates. It enables the process to be more personalized and flexible than traditional lenders. Borrowers access lower interest rates and better loan terms than online title loans. One of the factors considered is a Source of Income, as having a steady income ensures that borrowers can make their monthly payments within each business day required.

Bank Loans

Traditional banks and credit unions provide bank loans with varying interest rates and fees structure depending on the borrower’s credit score and income. Bank loans require more time to process applications but have lower interest rates and better loan terms, unlike online title loans, which offer instant approval but have high-interest rates. Applicants with a reliable Source of Income, such as a steady income, may be considered lower risk. Their capability to make monthly payments on time increases their chances of accessing better loan terms. Processing times may vary, but they usually take several business days.

Bank loans are a potential alternative to online title loans for individuals seeking financial assistance. Bank loans need to provide immediate access to funds like their alternatives. Still, they help prevent borrowers from falling into debt traps caused by predatory lending practices in the long run.

Loan Type is a significant factor to consider, knowing that the secured loans are backed by collateral such as property, while unsecured ones are not. Banks provide various options, and one should choose a suitable option, from a maximum loan amount to flexible repayment options to cover financial emergencies.

Conclusion

Title lending grew largely unrestrained in Tennessee until 2011 reforms established interest rate caps, installment payments, and renewal limits. Additional consumer protections passed in subsequent years. This contrasts with Alabama and Mississippi, which continue to lack meaningful title lending regulations. To the east, North Carolina has its own set of evolving regulations. Georgia, to the south, has been adjusting its lending laws over the years. Kentucky and Virginia impose far higher rate ceilings. Missouri, to the northwest, also represents a distinct regulatory landscape. Even Arkansas sets no maximum loan amounts. The recent implementation of tighter title lending statutes in Tennessee versus the minimal oversight in border states reflects a shifting priority given to consumer financial risks.

Online title loans provide an accessible option for individuals who require cash quickly. They offer many benefits, such as convenience and speed, but borrowers must understand the risks of obtaining such a loan. You must read about the repayment terms and potential late or missed payment penalties.

The application process is straightforward, and borrowers complete it entirely online. One must have a clear title on their vehicle and meet other eligibility requirements the lender sets to qualify for online title loans. Borrowers must carefully review their ability to repay the loan before applying. Compare different Loan Type options, including secured loans with maximum loan amounts, before deciding which is most suitable for your financial emergencies.

Please repay an online title loan to avoid the repossession of the borrower’s vehicle. Repayment options vary depending on the lender, including lump sum payments or installment plans. Therefore, you must explore all available alternatives before committing to a loan, especially in case of an unexpected expense.

Online title loans are a viable solution for qualified borrowers needing quick loan funds for unexpected emergencies but have significant risks that borrowers must fully understand before proceeding. Exploring alternative options and carefully reviewing repayment terms enables individuals to decide if such loans are right for them.

Frequently Asked Questions

How can I find a reputable direct lender in Tennessee that offers title loans, especially if I have bad credit and need a loan with no credit check?

There are no legitimate direct lenders offering title loans in Tennessee without checking credit, as this would be irresponsible lending. Those with poor credit should consult alternatives like credit unions and avoid any lender promoting “no credit check” loans.

What are the typical interest rates and repayment terms associated with title loans in Tennessee for individuals with bad credit, and do they truly not require credit checks?

Title loans in Tennessee legally require credit checks to determine rates and terms. Any lender claiming no credit checks is likely operating irresponsibly or fraudulently. Consumers should report such claims to the state regulator.

Are there any specific laws or regulations in Tennessee that govern title loans, particularly those related to direct lenders and consumer protection measures?

Tennessee caps title loan interest at 24% APR, limits loan amounts based on income, and requires licensing and credit checks by all direct lenders – promoting no credit check loans would violate regulations.

What steps should I take to ensure I’m dealing with a legitimate and trustworthy direct lender when applying for a title loan in Tennessee under these conditions?

Avoid any lenders promoting no credit check title loans, as this violates TN laws. Check license status through the state regulator and consult reviews carefully when pursuing title lending from any direct lenders.

Can you offer advice on how to navigate the process of obtaining a title loan in Tennessee with bad credit and no credit checks while making responsible financial decisions?

My advice is to avoid any title lenders claiming to offer loans without credit checks, as those violate TN laws. Instead pursue alternatives or find lenders willing to work with your specific credit situation responsibly.