Borrowers with bad credit find it challenging to get approved for loans. Lenders use credit scores to assess a borrower’s creditworthiness and ability to repay a loan. Borrowers with poor credit histories usually get a denial on their loan applications. Not getting loan request approval is frustrating for borrowers who need the money for an emergency expense or other pressing financial need. Payday loans have become a popular solution for borrowers with bad credit. The following blog post talks about how to get payday loans for bad credit borrowers.

Summary

- Payday loans are short-term loans intended to help borrowers access cash quickly, with no credit check required.

- Borrowers with bad credit are still able to get a payday loan, but it is more expensive due to higher interest rates and fees.

- It is necessary for borrowers to carefully examine the costs of a payday loan and only obtain what they afford to repay, regardless of their credit history.

- Borrowers need to assess their credit score, find the right lender, and look for the best deal for their situation before applying for a payday loan.

- The credit score has a significant impact on the interest rates and fees that a payday lender charges, so borrowers must check their credit score beforehand.

- Finding the right lender is necessary when it comes to borrowing money, particularly for borrowers with bad credit. It is best to research lenders thoroughly and compare offers to find the best fit for their needs.

- Borrowers must look for lenders that offer flexible repayment terms that fit their budget and needs and have a good reputation and positive customer reviews.

Understanding Payday Loans

A payday loan is a short-term loan due on the borrower’s next payday. Lenders designed them to help borrowers have access to cash quickly, with no credit check required. Payday loans are usually for smaller amounts, ranging from a few hundred to a few thousand dollars, and are intended to be repaid in full within a few weeks.

Borrowers are free to use them for a variety of purposes, such as unexpected expenses, bills, or emergencies. But payday loans have high-interest rates and fees, which make them an expensive borrowing option. It’s best for borrowers to understand the terms and costs associated with a payday loan and to only obtain what they afford to repay. Borrowers must explore alternative lending options, such as personal loans, credit cards, or borrowing from friends and family, before getting a payday loan.

Can Bad Credit Borrowers Get A Payday Loan?

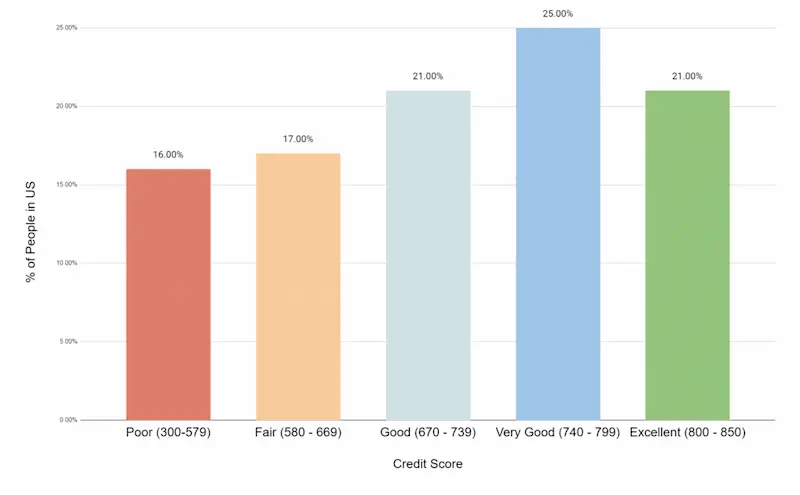

Yes, borrowers with bad credit are able to get a payday loan. Payday lenders don’t require a credit check as part of the application process, which means that borrowers with poor credit histories still get approved for a loan. But payday loans are more expensive for borrowers with bad credit, as lenders charge higher interest rates and fees to offset the perceived risk of lending to people with poor credit scores. It’s best for borrowers to carefully examine the costs of a payday loan and only obtain what they afford to repay, regardless of their credit history. Below are some statistics on bad credit:

| Statistic | Value |

|---|---|

| Percentage of Americans with bad credit | 16% |

| Average credit score in the United States | 716 |

| Interest rate on a mortgage for someone with bad credit | Typically 5% higher than the interest rate for someone with good credit |

| Interest rate on a credit card for someone with bad credit | Typically 20% or more |

How To Get Payday Loans For Bad Credit Borrowers

One advantage of payday loans is they are easy to acquire. The application process is straightforward and is completed online or in-person at a payday lending store. Borrowers are approved for a loan within minutes, and the funds are deposited into their bank account the same day or the following business day.

The convenience and speed are why payday loans have become a popular borrowing option, particularly for people who need access to cash quickly. But there are things that borrowers must do before applying. For example, they need to examine their credit score, find the right lender, and look for the best deal for their situation.

Assessing The Credit Score

A credit score is not a factor for payday loan approval, but it is still a significant aspect to assess. Payday lenders do not require a credit check or assess the borrower’s credit score, which means that borrowers with poor credit histories or no credit still get approved for a payday loan. But it does not mean that credit score is not necessary.

A borrower’s credit score has a significant impact on the interest rates and fees that a payday lender charges. Borrowers with lower credit scores are subject to higher interest rates and fees, which make the loan more expensive and more difficult to repay. Listed below are the most common methods on how to check credit scores.

- Free Annual Credit Report – People get a free copy of their credit report once a year from each of the three major credit bureaus, Equifax, Experian, and TransUnion. They are free to request their credit report online, by phone, or by mail.

- Credit Monitoring Services – Many credit monitoring services offer free credit scores and reports, and alerts for changes to the credit report.

- Credit Card Companies – Many credit card companies offer free access to credit scores as a perk to their customers. Borrowers must check with their credit card issuer to see if this is a service they offer.

- FICO Score – The FICO Score is a widely used credit score model. Borrowers are free to purchase their FICO Score directly from FICO or through one of their partners.

Finding A Lender

Finding the right lender is necessary when it comes to borrowing money, particularly for borrowers with bad credit. The right lender offers fair terms, reasonable interest rates, and flexible repayment options. The wrong lender, on the other hand, leads to high fees, unaffordable repayment terms, and a cycle of debt. Not all lenders are open to working with borrowers with poor credit histories. Others work with bad credit borrowers but charge higher interest rates and fees to offset the perceived risk. It’s best for borrowers to research lenders thoroughly and compare offers to find the best fit for their needs.

At GreenDayOnline, we understand that financial difficulties can arise unexpectedly, and traditional lending institutions may not always be accessible to everyone. We believe in providing opportunities for individuals with less-than-perfect credit histories to obtain the financial assistance they need. As part of our commitment to serving customers across the United States, we have extended our operations to several American states. Below is a comprehensive table highlighting the states where our company is actively offering safe payday loans, ensuring that residents in these regions have a viable solution even if they have bad credit. We strive to be a dependable resource, providing quick and accessible funding options to individuals in need, regardless of their credit score. Explore the table below to determine if we’re actively operating in your state.

| AL – Alabama | AK – Alaska | AZ – Arizona |

| AR – Arkansas | CA – California | CO – Colorado |

| CT – Connecticut | DE – Delaware | DC – District Of Columbia |

| FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana |

| IA – Iowa | KS – Kansas | KY – Kentucky |

| LA – Louisiana | ME – Maine | MD – Maryland |

| MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana |

| NE – Nebraska | NV – Nevada | NH – New Hampshire |

| NJ – New Jersey | NM – New Mexico | NY – New York |

| NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania |

| RI – Rhode Island | SC – South Carolina | SD – South Dakota |

| TN – Tennessee | TX – Texas | UT – Utah |

| VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Comparing Lenders

Borrowers must understand that not all payday lenders are the same. Payday loans are generally associated with high-interest rates and fees, but their terms and conditions vary widely depending on the lender. Certain payday lenders have more flexible repayment terms or offer lower interest rates, while others have more stringent eligibility requirements or charge exorbitant fees. It’s necessary for borrowers to research lenders thoroughly and compare offers to find the best fit for their needs. Listed below are the steps on how to compare and pick the right lender for a payday loan.

- Research and compare lenders. Start by researching different payday lenders and comparing their rates, fees, and terms. Look for lenders with a good reputation and positive customer reviews.

- Check for transparency. A reputable lender must be transparent about their fees and interest rates. Be sure to read the loan agreement and ask any questions before signing any agreements.

- Assess eligibility requirements. Certain lenders have more stringent eligibility requirements than others. Borrowers must check to see if they meet the lender’s requirements before applying for a loan.

- Look for flexible repayment terms. Borrowers must look for lenders that offer flexible repayment terms that fit their budget and needs. Certain lenders offer options for extending or adjusting the repayment schedule.

- Check customer service. A good lender must have responsive and helpful customer service. Look for lenders that offer customer support via phone, email, or chat.

- Evaluate loan amounts. Certain lenders offer higher loan amounts than others. Borrowers need to assess the amount they need and check if the lender is offering the loan amount.

Applying For A Payday Loan

The application process for payday loans is generally straightforward and easy, with only minor differences between online and in-person applications. Here are the steps on how to apply for bad credit payday loans.

- Research lenders. Borrowers must research different payday lenders and compare their rates, fees, and terms. They need to look for lenders with a good reputation and positive customer reviews.

- Gather the required documents. Borrowers need to provide basic personal and financial information, such as their name, address, income, and employment status. They have to provide proof of income and a valid ID.

- Complete the application. Borrowers must complete the application process online or in-person. They have to provide all required information accurately and honestly.

- Wait for approval. Borrowers must wait for the lender to approve the loan request. Certain lenders offer instant approval, while others take several days to process the application.

- Receive funds. Approved borrowers receive the funds in their bank account. Many lenders offer same-day or next-day funding, while others take longer.

Cost Of Payday Loans

Payday loans are an expensive form of borrowing, and borrowers must carefully examine the costs before applying for a loan. Listed below are the factors that affect the cost of a payday loan.

- Interest – Payday loans have high-interest rates, ranging from 300% to 400% or more, according to CNBC. The interest is charged on the principal amount of the loan and is due in full on the borrower’s next payday.

- Fees – Payday lenders charge extra fees, such as application fees, origination fees, or late payment fees. The fees add up quickly and significantly increase the cost of borrowing.

- APR – The Annual Percentage Rate (APR) is the total cost of borrowing, including interest and fees, expressed as a percentage of the loan amount. Payday loans have a high APR due to the short-term nature of the loan and the high-interest rates and fees.

| Lender | Interest Rate | Principal Amount | Due Date | Total Amount Due |

|---|---|---|---|---|

| A | 300% | $500 | Next payday | $1,500 |

| B | 400% | $1,000 | Next payday | $4,000 |

| C | 500% | $750 | Two paydays from now | $4,500 |

Explanation of scenarios:

- Lender A charges an interest rate of 300% on a payday loan of $500. The borrower is expected to repay $1,500 on their next payday.

- Lender B charges an interest rate of 400% on a payday loan of $1,000. The borrower is expected to repay $4,000 on their next payday.

- Lender C charges an interest rate of 500% on a payday loan of $750. The borrower is given two paydays to repay the loan, with a total amount due of $4,500. The scenario highlights that not all payday loans are due on the next payday, and other lenders allow for a longer repayment period at a higher interest rate.

Conclusion

Payday loans are an option for borrowers with bad credit, but they have high-interest rates and fees. It’s best to understand the terms and costs associated with payday loans and to only obtain what they affordably repaid. Borrowers must explore alternative lending options before getting a payday loan.

Borrowers must assess their credit score, find the right lender, and compare offers to get a payday loan with bad credit. Researching different lenders, checking for transparency, assessing eligibility requirements, and looking for flexible repayment terms allow borrowers to find a reputable lender that offers fair terms, reasonable interest rates, and flexible repayment options.

Frequently Asked Questions

What are the eligibility requirements for obtaining a payday loan with bad credit?

The basic eligibility requirements for a payday loan with bad credit are: legal US residency, minimum age of 18 years old, an active checking account, proof of steady income, and valid ID. Lenders may also check: debt-to-income ratio, pay frequency, length of employment, and history meeting past loan obligations. While credit scores are considered, many lenders will approve payday loans for those with low credit scores if other criteria are met.

Are there any alternatives to payday loans for people with bad credit?

Some alternatives to payday loans for people with bad credit include: borrowing from family/friends, employee cash advances, credit counseling services for negotiating payment arrangements, pawn shop short term loans, credit card cash advances, 401k loans, selling assets, seeking assistance from charities/nonprofits, and applying for bad credit personal installment loans from online lenders.

What steps can I take to improve my chances of getting approved for a payday loan despite bad credit?

Steps to increase your chances of getting approved for a payday loan with bad credit include having consistent pay stubs, direct deposit set up, a checking account in good standing, current contact information, proof of residency, references, avoiding applying for multiple loans, and being prepared to provide a valid ID, phone number, and Social Security information that aligns with the application. Also, applying in-person at a store may help more than applying online.

What should I consider when choosing a payday lender if I have a poor credit score?

When choosing a payday lender with poor credit, consider their approval likelihood, any credit score requirements, interest rates and fees, loan limits, repayment terms, penalties for nonpayment, customer service reputation, state licensure, and reporting to credit bureaus. A reputable lender that works with bad credit borrowers and reports loans can help you eventually improve your credit.

What are the potential risks and pitfalls of getting a payday loan with bad credit, and how can I avoid them?

Key risks of payday loans with bad credit include difficulty repaying which leads to rollovers and mounting fees, potential for aggressive collection tactics, bank account fees or closure if funds are insufficient, and lawsuits if chronically delinquent. Avoid these by carefully reviewing repayment capability, reading all loan terms, budgeting to ensure you can pay on time, and applying with lenders in good standing.