Title loans have become popular for people seeking financial assistance in Louisiana. Such loans allow borrowers to use their vehicles as collateral and receive cash quickly, making them an attractive option for people who need money urgently. Title loans have high-interest rates and fees, making it difficult for borrowers to repay them on time.

Individuals exploring a title loan in Louisiana to understand the risks involved and carefully weigh their options before committing to such financing. GreenDayOnline explores title loans, how they work in Louisiana, and what consumers must look out for when taking one out.

What Is A Title Loan?

A title loan is a secured loan that allows borrowers to use their vehicle as collateral. The borrower must own the vehicle outright and present its title to the lender in exchange for cash. Title loans are short-term, high-interest loans with steep fees and are risky for borrowers who need help to repay them on time.

Lenders mostly require access to the borrower’s bank account or authorization to remotely disable the vehicle if they do not make timely payments. Title loans remain popular among individuals with difficulty obtaining traditional forms of credit due to poor credit history or other financial challenges.

Potential borrowers must carefully review their options and understand all terms and conditions before obtaining a title loan. Approximately 1 percent of American adults, use automobile title loans annually, according to the Pew Charitable Trusts.

| Details | Values |

|---|---|

| Number of Americans using high-interest automobile title loans annually | More than 2 million |

| Percentage of American adults using high-interest automobile title loans annually | Approximately 1% |

| Number of states where title loans are available | 25 |

| Number of title loan stores operating in the 25 states where title loans are available | Over 8,000 |

| Type of collateral used for high-interest automobile title loans | Car title |

| Percentage of title loan branches also offering payday loans | About 50% |

What Are The Benefits Of Title Loans in Louisiana?

Title loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. There are several benefits to obtaining a title loan in Louisiana.

- First, they provide borrowers quick access to cash without going through a lengthy approval process or credit check. It is especially helpful in emergencies where funds are needed urgently.

- Secondly, title loans offer lower interest rates than short-term lending options such as payday loans.

- Lastly, borrowers have the flexibility to continue using their vehicle while repaying the loan. It means that they do not need to give up ownership or use of their car during the repayment period.

Such benefits make title loans an attractive option for individuals looking for fast and convenient Louisiana funding access.

- Quick access to cash

- Lower interest rates compared to payday loans

- Flexibility in continuing to use the vehicle during the loan repayment

- No credit check is required, making it accessible to individuals with poor credit scores

What Are The Risks Of Title Loans in Louisiana?

Title loans in Louisiana have a high-interest rate, making it difficult for borrowers to repay. A borrower who is unable to pay off the title loan promptly faces the risk of potential bankruptcy. Repossession is another potential risk associated with obtaining a title loan in Louisiana, as non-payment results in the lender reclaiming the collateral.

High-Interest Rates

The allure of quick cash is tempting but comes at a steep price for people exploring title loans in Louisiana. High-interest rates are one of the most significant risks associated with such loans. Borrowers find themselves buried under an avalanche of debt as they struggle to pay off their loans and excessive interest charges.

Lenders require borrowers to repay the borrowed amount within 30 days or face extra fees and penalties. It makes it difficult for individuals who are already struggling financially to stay afloat, let alone get ahead. You must review all options before obtaining a title loan in Louisiana, especially given the potential consequences of high-interest rates.

Repossession

Another significant risk associated with title loans in Louisiana is repossession. The lender has the right to seize and sell the vehicle used as collateral if a borrower fails to make timely payments or defaults on their loan. Lenders charge extra fees for the repossession and sale of the vehicle, adding to the already high cost of borrowing.

It devastates individuals who rely on their cars for transportation, resulting in further financial hardship. Potential borrowers must understand such a risk before borrowing a title loan and have the plan to avoid defaulting on their loan.

Potential Bankruptcy

Another significant risk associated with title loans in Louisiana is the potential for bankruptcy. High-interest rates and fees mean borrowers find it difficult to make payments on time, leading to a vicious cycle of debt. Borrowers must fill for bankruptcy as an option if their financial situation becomes dire enough.

The lender still repossesses the vehicle used as collateral even if a borrower files for bankruptcy. Lenders sometimes even challenge the bankruptcy filing and attempt to collect on the debt owed. It results in further legal battles and financial strain on already struggling individuals.

Potential borrowers must carefully review all risks associated with title loans before obtaining such a loan. Seeking alternative financing or financial counseling services provides more sustainable solutions that won’t lead to devastating consequences like repossession or bankruptcy.

How To Find The Best Title Loan For Your Needs

There are several steps to review when searching for the best title loan to fit your needs.

- Do thorough research and compare different lenders before making a decision. One way to start is by creating a table outlining the terms of each potential lender, including interest rates, repayment periods, and any extra fees. It helps you easily compare and contrast the options available to you.

- Another step to follow is to review the reputation of the lender. Look for reviews or ask for recommendations from trusted sources. You must understand all aspects of the loan agreement before signing anything, don’t hesitate to ask questions or seek clarification if necessary.

Taking such steps and being diligent in your search enables you to find a title loan that fits your specific needs and helps alleviate financial stress without causing further harm.

Tips For Managing Your Title Loan

Budgeting is a key factor when managing a title loan, as it helps you to make all payments on time. Repayment strategies such as selecting a longer loan term or making extra payments are beneficial when managing a title loan.

Budgeting

Managing your title loan is a daunting task, especially regarding budgeting. You must prioritize your expenses and allocate funds accordingly. Set realistic monthly savings goals, and track your spending habits using tools such as spreadsheets or apps.

Avoid unnecessary purchases or overspending on non-essentials, and cut back on dining out or entertainment costs until you pay off the loan. Creating a solid budget plan enables you to manage your finances effectively while repaying your title loan without sacrificing essential needs.

Repayment Strategies

A repayment strategy is key to effectively managing your title loan. A good approach is to make payments on time or even ahead of schedule if necessary, as it helps reduce the interest expenses over time. Make larger payments or pay more frequently than required to repay the loan faster and save money on interest fees.

Another effective strategy is refinancing the title loan with a lower interest rate lender to help reduce monthly payments and overall costs. Implementing such repayment strategies helps you to manage your finances better while repaying your title loan without sacrificing essential needs for yourself or your family.

Conclusion

Louisiana has a long history of allowing title lending to operate freely within the state with minimal regulations. However, some recent reforms have aimed to place new restrictions around interest rates and renewals. For instance, neighboring Texas has also sought to tighten limits on title lending in recent years. Mississippi, meanwhile, continues to impose few regulations on title loans. Alabama has no interest rate cap or renewal limits. And Arkansas sets no maximum loan amount.

Title loans in Louisiana are a popular way of borrowing money for people who need quick cash but do not have the credit score to qualify for traditional loans. Such loans work by using your vehicle as collateral, allowing you to borrow money based on its current market value.

The benefits of title loans in Louisiana include fast approval times and easy access to funds. They offer flexible repayment terms tailored to fit your individual needs. There are risks associated with title loans, including high-interest rates and the potential of repossession if you default on payments.

You must shop around and compare offers from different lenders to find the best title loan for your needs. Look for reputable companies with transparent lending practices and reasonable interest rates. You must manage your finances carefully if you decide to obtain a title loan in Louisiana.

Have a plan in place for repaying the loan on time and avoid obtaining more than you are able to afford. They provide a temporary solution for borrowers needing quick cash, but you must use them cautiously. Borrowers must know that they have both benefits and risks.

Frequently Asked Questions

How can I apply for fast cash title loans in Louisiana online without undergoing a credit check, and what are the typical approval times?

You can apply on lender sites like LoanMart and TFC Loans, providing personal/vehicle details for quick approval often within 1 business day without hard credit checks required.

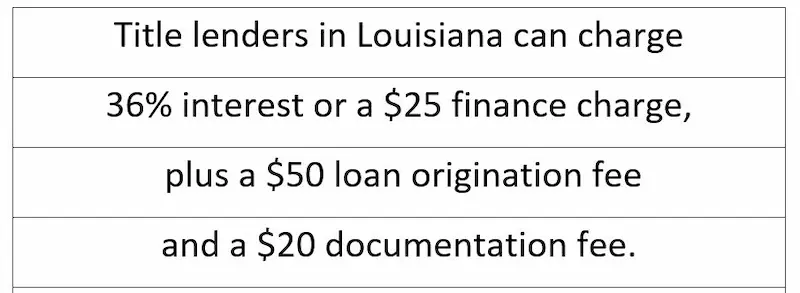

What are the interest rates and repayment terms associated with online title loans in Louisiana when no credit check is involved?

Louisiana title loans without credit checks carry interest rates starting around 25% APR with repayment terms of 30 days up to 6 months typically.

Are there any specific regulations or laws in Louisiana that govern online title loans, especially those related to no credit checks and borrower protections?

Louisiana puts limits on title loan amounts and renewals but does not have specific regulations around credit checks or requiring minimum credit standards.

How can borrowers ensure they are dealing with a legitimate online lender when applying for a title loan in Louisiana without credit checks?

Verify the lender is licensed in Louisiana, read reviews, check the BBB for complaints, look for secure website URLs, and avoid any advanced fees when applying.

What are the tips on responsible financial planning and managing the repayment of online title loans in Louisiana to avoid potential financial difficulties and pitfalls?

Tips include only borrowing what you can realistically repay, budgeting strictly, avoiding renewals/rollovers, paying down balances aggressively, and extending terms if needed.