You rely on your vehicle to get you from point A to B. You can get to your job, the grocery store, or other essential places if you have it. If your car is damaged and you need to repair it, be assured that you can get an auto repair credit, even if you don’t have enough cash to pay in advance.

A car repair loan for autos can fix a flat tire, dead battery, or other problem you may have with your vehicle to return to driving quickly. We’ve compiled this checklist of five auto repair loans suitable for people with bad credit, including auto repair financing options and emergency auto repair loan options, to take the stress out of selecting the right loan.

Best Personal loans for auto repairs

The auto repair loan, often involving credit repair, is a personal loan used to fix vehicles. They are available with varying rates and conditions, so it’s crucial to consider all options, including auto repair financing options and emergency auto repair loan options, before settling on one.

1. MoneyMutual

MoneyMutual is an internet-based marketplace that you can use to locate a wide range of auto repair loans, including emergency auto repair loans. Pick the best one for your circumstance from their lending service. All you need to fill in an online form that should take no more than five minutes to complete and then wait to be done is connected to lenders or a credit card issuer within the network.

Although MoneyMutual has a minimum income of $800, you may apply even with a poor credit score. You could be accepted for up to $2,500 and get the cash by direct deposit in less than 24 hours, perfect for emergency auto repair situations.

MoneyMutual is accessible in all states except New York and has a credit history of helping more than two million customers obtain personal loans, such as automobile repair.

2. CashUSA.com

A bigger loan offer of between $10,000 and $10,000 through CashUSA.com might be a viable option for you if your vehicle’s repair is expensive, so it is possible to pay it back on schedule and make a regular salary at or above $1,000 after tax. After completing the online application process, CashUSA.com will connect you to its short-term lenders.

Additionally, CashUSA.com offers various services on its website to help improve your financial situation. Its lenders partner with it and offer loans between 500 dollars and $10,000, with rates ranging from 5.99% to 35.99%. It is good news that you don’t need to pay a fee for your application, and you can get an answer to your loan request in a matter of minutes, even if you are a poor credit report holder.

3. CreditLoan.com

CreditLoan.com has helped match more than 750,000 borrowers with lenders that provide personal loans, which can be used for many needs, including repairs to your car. The company offers loan amounts ranging from $250 to,000, and you can receive cash directly into your bank account as soon as the next day of business. CreditLoan.com can help you find a suitable lender even if you have a bad credit history.

You can also visit CreditLoan.com to read about the lender and bank reviews, access interest rate calculators, and gain access to other critical financial sources. This can be helpful for individuals with a bad credit history looking for resources and information.

4. BadCreditLoans.com

If you have a bad credit history, Bad Credit Loans can help you connect with lenders who could aid you. The loans are available between $500 to $5,000, with rates of 5.99 percent to 35.99 percent and 3 to 60 months loan duration.

You must show proof of regular income earned from full-time or self-employment and Social Security to take out a loan with Bad Credit Loans. When one lender accepts you for an auto-repair loan, you can receive lenders’ funds on the next business day. This is a great option to secure the necessary funds for those struggling with a bad credit history.

5. PersonalLoans.com

With PersonalLoans.com, you can apply for an emergency car repair loan of up to $35,000., with monthly repayments of between three and 72 months. Although you don’t have to have a perfect credit score to get an emergency car repair loan through PersonalLoans.com, You must demonstrate financial responsibility.

You can accomplish this by showing that you do not have any recurring patterns of missed payments, debts you cannot manage, or any bankruptcy proceedings that are currently in progress or recently filed. PersonaLoans.com operates across all states and can provide you with the money you require to repair your car within one day.

Can You Finance Auto Repairs?

It’s not a secret that auto repair costs are costly. However, it’s only sometimes feasible. The American Automobile Association (AAA) research found that the average auto repair cost for autos is between $500 and $600. The organization advises car proprietors to put aside a minimum of $50 per month to pay for the unexpected costs of auto repairs.

When you’re not able to have to lie around to save for car repair financing that could be needed shortly, be aware it is possible to find. In most cases, the best way to finance your vehicle’s rehabilitation is to take auto-repair loans through an online loan provider who can approve you in moments or even hours and quickly provide you with the Loan funds you require.

Time is important for repairs to your vehicle. A loan for auto repair through an online lending network could be the best way to take it. They can often provide your Loan funds in less than 24 hours or the following business day.

If you decide to finance the repair of your vehicle with personal loans from an online lending platform, Here’s an illustration of how it could be done:

A car repair bill for your vehicle of $2,000. You get an individual loan to pay the mechanic today and repay the lender over time with regular monthly installments. If the lender has no prepayment penalties, You can pay off the auto repair loan in advance and clear the debt earlier. Before applying, check your loan eligibility to ensure a smoother process.

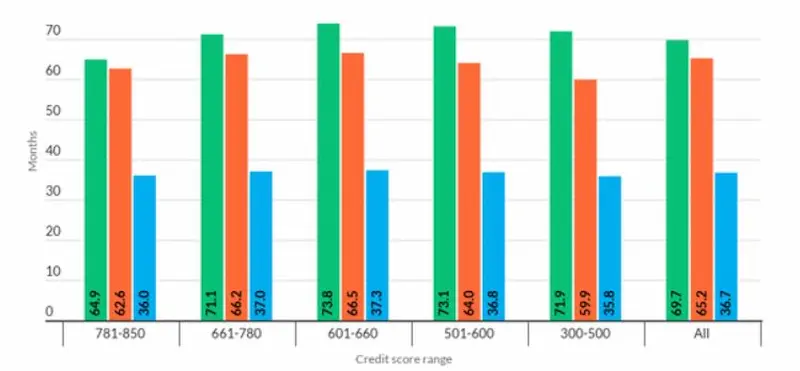

Below are statistics on Personal loans for auto repairs:

| Statistic | Value |

|---|---|

| Average personal loan amount | $3,000 |

| Average interest rate | 10% |

| Average repayment term | 3 years |

| Average credit score required | 620 |

| Approval rate | 60% |

How Do I Get My Car Repaired with no money?

Auto repair financing. It is challenging to discover that the car needs repair in the first place, particularly if you need more money to pay for everything in one go. It’s good to know that you can finance repairs to your car even if you’re in a pinch for cash. One of the most effective methods to accomplish this is conducting your study and finding online lenders who provide auto repair loans with consideration to your loan eligibility.

When you apply for auto repairs loans and get certain offers, carefully evaluate each loan’s rates for auto repair and the loan terms. Selecting the most compatible loan with your financial and lifestyle requirements is important, considering options like affordable auto repair loans if needed.

For instance, if you’re in a tight financial situation for auto repairs, there may be better options than a loan term of three months. It is possible to feel more secure having a loan with 72 months to pay it off over time.

Interest rates are an additional important factor to take into consideration. If you find two loan options for auto repairs with 72-month terms and one with lower interest rates than the other, go for the one with less interest. With a lower interest, you’ll pay less for car repairs to your vehicle and will save a significant amount of money in the long run.

Although you might not get the best interest rate when you’re not creditworthy, looking into all options is recommended. There aren’t all lenders to be equal? You may discover that one company provides better conditions or interest rates than other lenders. In this context, exploring different Repayment terms and searching for competitive auto lenders are necessary steps to finding the right loan.

Do Auto Repair Shops Offer Payment Plans?

Automobile repair firms are fully aware of the high cost of their services. Many vehicle repair shops offer consumers payment plans (or credit cards). Companies like Auto Repair Loans Now can help you find the right loan for your needs.

They usually have low or no-interest rates for the initial period, enabling you to cover your auto repair as soon as needed. Here’s an instance.

If you opt for an auto repair shop’s payment arrangement, then the repair shop might offer discounts on the auto repair. Remember that the interest rates on the payment plans for auto repair shops generally increase significantly, following the promotional low or non-interest duration, typically about six months.

For instance, the local car repair shop may offer a six-month no-interest loan. If you fail to pay for any repair in the six months, the interest rate could rise to 29.99 percent. This could make your emergency fund loans for car repair much more expensive than you initially anticipated.

Be confident that you’ll be able to pay for the repair you made to your vehicle within the specified timeframe. The car repair shop’s payment plan could be beneficial. If you require longer than the timeframe provided, you’re better off taking credit from a bank or credit union whose interest rate is the same for the whole term.

Even if you’ve got bad credit, you can obtain an auto-repair loan with a credit check at an affordable fixed rate that you can manage. Companies like Green Day Online offer fast, same-day funding to help you get your car back on the road as soon as possible.

At Green Day Online, we are committed to providing auto repair loan solutions for individuals with bad credit across the United States. Our services extend to numerous states where our company is actively operating, helping customers overcome financial challenges and get their vehicles back on the road. Below is a comprehensive list of American states where our company offers auto repair credit options, ensuring that individuals in these regions can access the necessary repairs and maintenance they need, regardless of their credit history.

| AL – Alabama | AK – Alaska | AZ – Arizona |

| AR – Arkansas | CA – California | CO – Colorado |

| CT – Connecticut | DE – Delaware | DC – District Of Columbia |

| FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana |

| IA – Iowa | KS – Kansas | KY – Kentucky |

| LA – Louisiana | ME – Maine | MD – Maryland |

| MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana |

| NE – Nebraska | NV – Nevada | NH – New Hampshire |

| NJ – New Jersey | NM – New Mexico | NY – New York |

| NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania |

| RI – Rhode Island | SC – South Carolina | SD – South Dakota |

| TN – Tennessee | TX – Texas | UT – Utah |

| VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Can I get an installment loan to fix My Car?

Another method of paying for auto repairs is with a car title loan. It’s also known as a speedy auto loan or title loan, and a title loan could be easy to obtain. However, that doesn’t mean it’s not an option.

Expect to pay high fees and even lose your car due to title loans. The typical car title loan is between 100 dollars to $5,500, which is between 25 and 50 percent of the value of your vehicle. Only fifteen or thirty days will likely have an annual percentage rate (APR) of 30% or more.

Next-day funding is something that can also be associated with car title loans. Your lender can take your car if you don’t pay the dues. Demand you pay for costly charges and the outstanding amount to return it. Loan decisions made in haste can lead to the borrower facing such situations. The positive side is that many lower-risk and cheaper options exist to get title loans.

Personal loans are beneficial because they offer credit check auto repair loans with the lowest rates and longer terms. It also means you do not have to put up your vehicle as collateral.

Have Your Car Repaired Without the Hassle

Although car repair loans are a bit frustrating, they’re not the end of the road. If you face an unexpected repair to your vehicle, you need to take a deep breath. Remember that you’ll be able to pay for it, even when you lack the money or a less-than-perfect credit score.

No matter what your credit rating is. Take out a personal loan with an online lending platform. You will get the money you require to repair your vehicle. And be back on the road quickly.

These are installment loans, which means you’ll be able to repay borrowed money over time by making regular monthly payments to the lender. You may be forced to pay interest and fees in addition to the amount borrowed, which can vary from one lender to the next.

Tags

Brighter Financial Future with Minimum Credit Score Requirement

A minimum credit score requirement plays a significant role in ensuring a brighter financial future. Utilizing tools like Credit Karma and joining credit unions can improve your credit score and pave the way for better financial opportunities.

Overcoming Challenges with Debt Consolidation

Debt consolidation can be useful for managing debt and improving your credit score range. You can gain better control over your finances by combining multiple debts into one monthly payment.

Enhancing Your Credit Line and Credit Monitoring

By being mindful of your credit score range, you can effectively enhance your credit line and maintain good standing with major credit bureaus. Regular credit monitoring, including using free online resources, can be an invaluable tool in preventing tomorrow’s bad credit score.

Borrowing Money with the Help of Credit Unions

Credit unions typically consider more than just your credit score when evaluating you for loans. Meeting the minimum credit score requirement is still important, but their approach to lending may help in borrowing money for your financial needs.

Frequently Asked Questions

What are the typical interest rates for auto repair credit for people with bad credit?

Interest rates on auto repair financing for bad credit borrowers are usually quite high, ranging from 15% to 30% APR on average, but can exceed 35% with some subprime lenders.

Are there any specific requirements or documents needed to apply for auto repair credit?

Auto repair credit applications typically require a valid driver’s license, proof of income, residence details, list of required repairs and costs, vehicle information like make, model and mileage, and contact info.

What is the maximum loan amount available for auto repairs with bad credit?

Most auto repair financing lenders will approve bad credit borrowers for $1,500 to $5,000 depending on income, collateral, and repair costs, with some specialty firms willing to finance up to $15,000.

Can I use auto repair credit at any repair shop, or are there specific participating shops I must go to?

Auto repair loans and financing are usually only valid for repairs done at partner shops with prearranged agreements, not just any shop you choose. The lender will specify eligible mechanics.