Installment loans in Denver are personal and commercial loans extended to borrowers with terms that define regular monthly payments or repayments. With each payment, the lender must pay an amount of the loan’s principal amount and interest, which can also be considered a short-term loan.

Everything You Need to Know about Installment Loans in Denver.

The loan agreement is a setup that will enable you to escape from economic difficulties without stressing about not making your next payment, even with a less-than-stellar credit history. In contrast to standard credit, installment loans in Denver, Colorado, provide flexible repayment terms and allow you to bargain for lower rates. Check it out to discover everything you need to know before starting.

The Benefits of Online Installment Loans in Denver, Colorado

You may be wondering what advantages an installment loan accords you. This is the Las Vegas due attorney’s possible to inquire about personal installment loans for bad credit in Denver, Colorado, also known as bad credit loans. So why not consider an online loan application to get started on the path to financial security?

- There is no credit checking necessary. Some financial institutions may require proof of income. Many loan providers must look at your credit score when reviewing your loan application or membership. You can get an outstanding installment loan even with a poor credit score.

- Instant approval. Unlike a traditional lender, one can find an online payday loan provider that takes less time to evaluate your application and release the loan. The application process could take just a few minutes, and the money is transferred into your account in just a few minutes. Direct lenders are a good option for faster approvals.

- Simple application process. You’ll get a simple application that doesn’t require many documents. It takes only a few minutes to complete the form online—no need to be concerned about office hours or scheduling appointments.

- Privacy and security. You can be assured that your information is kept secure and the database is protected from data breaches. Lenders use secure online portals for title and installment loans in Denver, Colorado, to safeguard your personal information.

- Secure lenders. Unlike conventional lenders, you’ll receive instant feedback when applying for an installment loan. You will know when your application is accepted, and more importantly, the funds are usually deposited quickly. This can be particularly helpful when needing extra cash to improve your financial situation.

- There are no hidden fees. You will be provided information on the amount required to pay without additional Finance Charges. The providers also offer a straightforward method, meaning you don’t need to worry about unneeded expenses that you won’t be aware of.

- Sensible plans. Installment loans offer longer terms with manageable monthly installments. An installment loan could help you pay off your debt in a crisis. Having a manageable repayment schedule will reduce the need for multiple charges. Moreover, consider exploring other personal loan options, such as title loans, to find the most suitable solution for your needs.

If you require help with your issue soon, you can generally find an established network of loan service providers in Denver. They boast an approval rate of more than 90%, meaning you are assured of assistance when you apply. Contact them for further details.

The Eligibility Requirements for Installment Loans within Denver, Colorado

Although online installment loans in Denver, Colorado, have user-friendly software, you must satisfy specific requirements to be approved. Here are the minimum conditions lenders consider to determine if you’re qualified for an installment loan.

- You must have reached the legal age for dealing in your state

- Always be a US permanent resident or a citizen

- You must be a resident of the state where the loan is made.

- You must have a qualifying source of income.

- You must have an active email address and a contact number.

- You must have a current active bank account.

- Complete an application form and provide your Social Security number.

- Unlike traditional banks, lenders may conduct a Credit Check Loan process to evaluate eligibility.

- The type of loan offered is usually an unsecured loan.

As demonstrated, as with traditional credits, you only require a little documentation. Of course, lenders have various requirements, but generally, it is all you need to begin. It doesn’t matter whether you have assets or have a bad credit history. If you can prove that you are free of these requirements, the credit union will be able to approve your loan requests and will deposit the loan funds directly into your account within just 24 hours.

How to Apply for a Guaranteed Installment Loan in Colorado?

In the end, it’s an efficient procedure. One of the advantages is that everything happens quickly, so if you’re experiencing an emergency requiring money, you’ll not be waiting for months or even days. To apply, submit a loan request form to the credit union. They will then evaluate your application and, if approved, provide you with personal credit or cash advances based on your needs.

You can complete your application in the comfort of your home and have been approved quickly. Many financial services providers, such as credit cards, debit cards, and Payday Lenders, have an online application process that includes forms you typically have to fill out. After you have provided the required information and then sent it to the lender, you will receive confirmation that tells you when the company you applied to accepted your application. They will then review it, and if they find it excellent, they can approve your quick loan or cash loan quickly.

Your payday cash advance is deposited into your account in just one day. If you use it early in the morning, it is possible to receive the cash before the end of the day. Certain companies may even send the same day, depending on the time the person could apply. You can also reach out to each of them to inquire when they speed up the process and give you the cash simultaneously. Many lenders will be willing to accept your request if made in the early stages.

How to Get Installment Loans in Denver, Colorado?

The initial step to getting an installment loan approved can be finding the appropriate lender. With so many online lenders, it can take time to determine which can offer the loan quickly and with good terms. To find reputable lenders in Denver, consider exploring the various types of loans and their Credit score requirements on our site.

If you want the best installment loan near us, we provide up-to-date information on our list of the most reliable lenders that quickly respond to your application and give you a smooth and easy way to credit the payment. Make sure to consider lenders that offer Flexible loan options, minimum loan terms, and maximum loan terms to make an educated choice. Explore the many options and then select the most suitable one for you.

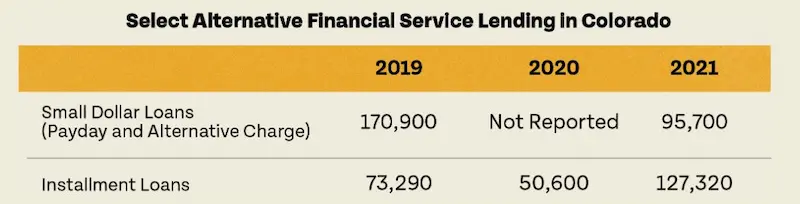

Here are some statistics on Installment Loans in Denver, Colorado

| Statistic | Value |

|---|---|

| Average interest rate | 29% APR |

| Average repayment term | 36 months |

| Average amount borrowed | $5,000 |

| Number of installment loan companies | 100+ |

For Denver residents who need fast access to cash, payday loans can also be a helpful option. Payday loans provide a similar service to installment loans, with the benefit of even quicker funding. If you’re interested in learning more about payday lending options in Denver, check out our informative guide on Payday Loans Denver.

Installment Loans in Denver, Colorado: Frequently Asked Questions

When you consider applying for an installment loan, it will likely help you find several solutions to common questions. Below are the most frequently asked questions to remember. If you have doubts, look at the details below to help you make the best decision before applying for this kind of credit score.

Am I Able to Apply to Get Multiple Installment Loans in Colorado?

Yes, you can get many internet-based installment loans in Denver, Colorado. But, it is contingent on various factors, such as your monthly income and current outstanding loan amounts. For instance, if you are paying for a mortgage, you are making auto payments and other installment loans, and you might also have credit card debt. You’ll face three installment loans if you include an unsecured installment loan. Be sure to secure an amount you can pay back within a reasonable time to avoid penalties that could be imposed on you if you have to pay more.

What Happens if I Fail in the Installment Loan?

If you fail to pay your installment loan within the agreed business day, you might face penalties, an increased annual percentage rate, and a negative impact on your credit score. It’s essential to evaluate your financial situation carefully and ensure you can handle the loan amounts before committing to installment loan agreements.

The consequences of defaulting include penalties and fees, such as increased medical bills if you have a health emergency. Your credit report will be affected the most, primarily by Late payments. If you do not clean up your credit report and maintain a perfect credit score, lenders view you as a high-risk new borrower, which means they’ll either raise your interest rates or decline the application altogether. In addition, if you have secured your loan lender correctly, you can usually seize the asset you tied to the loan, which is how Secured loans work. To avoid these issues, try to pay the loan on time and manage your Credit Situation effectively.

Can My Spouse and I Receive an Installment Loan with a Bad Credit Rating?

You can look for an installment personal loan near me to obtain bad credit. Shopping for a fair deal for your specific requirements is just a matter of shopping. Every loan company offers various conditions, considering things like the amount of income earned, Employment history, and, in some instances, credit scores. But, if you apply with a lower credit rating, you will likely be charged a higher interest rate or cost.

A Payday Loan or Installment Loan: Which Is Better?

Installment loans cover mortgages, auto loans, and other forms of personal credit. They tend to have longer durations and might be subject to credit investigation. Longer-term loans like these are often given as loans to people who can show a steady income through bank statements. Payday loans come with a shorter time frame but are subject to higher interest rates. You don’t need to fret about credit scores regarding payday loans.

Each type of loan is suited to various scenarios, meaning they can be beneficial in multiple ways. The advantage of installment loans is that you can get a more significant amount, and they usually come with manageable repayment periods. But you’re only sometimes required to repay it by the next payday (like when you take out payday loans).

Regarding credit limits and managing your monthly bills, installment loans can provide a more stable and predictable option than payday loans.

Which Installment Loans Can You Currently Have in Denver, Colorado?

If you look at the terms and conditions set by the firm, you can take out several loans at a time. Examine the terms various organizations use to determine the most appropriate for your situation. This also depends on your ability to repay the loan and your credit score. A lender will accept the application only if you have an excellent credit score, and the income will cover the entire.