How to get cash from a credit card without a cash advance?

Cash loans are high on the list of “bad credit card mistakes.” Cash advance credit cards allow you to get cash in financial trouble quickly.

It is your only way to get fast cash without a credit card. High-interest rates and fees can make cash advances expensive. Credit and cash advance limits impact the number of available funds, while your credit card balance affects your overall usage.

By joining a local credit union, avoid cash advance fees and the hefty advance interest rate.

You will need a credit card cash advance if you are really in dire need. The card does not require additional qualifications.

Low-interest cash advance credit cards

The fees associated with advance cash from credit cards are easy to understand. You can check the terms on your bank’s website or cardholder agreement to learn more. Banks do not usually charge the same fees for credit card purchases and take out a cash limit made from credit cards. Remember to consider the credit limit when assessing your options.

Large banks offer similar interest rates and cash advance fees. Top picks have attractive benefits, rewards, and low or average fees.

1. Discover it® Cash Back

Discover charges a fair cash advance fee. The key selling points of the Explore It(r) cashback are its cashback bonus categories and highly-rated U.S.-based customer service staff. For those looking to make regular purchases, the credit card statement will show a detailed record of all transactions made, helping to manage credit card debt.

2. Chase Freedom Unlimited®

More than 93,000,000 people hold Chase credit cards, so it is not surprising they are very popular. This credit card offers a cash advance alternative for those who need access to quick funds without the high fees associated with traditional cash advances. Additionally, great access to cash alternatives suits different financial needs.

3. Capital One Venture Rewards Credit Card

Cash advances are great because of their low APRs. Cardholders must pay a minimum $10 fee or 3% of the advance. With the Cash advance funds available through this card, users can take out money quickly and conveniently while benefiting from a low APR. Capital One Venture Rewards Credit Card offers the best rewards. Cardholders earn 2X miles per dollar spent. Capital One’s miles program offers many benefits, including airline flexibility and blackout-free redeems.

4. Capital One SavorOne Rewards Credit Card

Capital One SavorOne Rewards Credit Card is perfect for those who seek rewards on their regular purchases and want to monitor their credit card statement easily. With an attractive credit card debt management program and easy access to cash advance alternative options, this card is a must-have for anyone looking to earn rewards and manage their finances responsibly.

The card is free, except for a $10 cash advance fee, and you get 1% off your purchases. There are no limits or rotating categories. Foreign transaction fees and annual fees are not applicable.

5. Bank of America® Customized Cash Rewards Credit Card

Along with Citigroup and Wells Fargo Chase, Bank of America is one of America’s most well-known banks. It offers cash advance services with a competitive APR, including a cash advance rate lower than other banks on our list. Bank of America sends cardholders regular promotional emails via checks. These offers can be used to obtain cash advances at promotional rates, which can impact your purchase balance and minimum payment.

Here are some statistics about low-interest cash advance credit cards:

| Card | APR | Introductory APR period | Fees | Rewards program |

|---|---|---|---|---|

| Capital One VentureOne Rewards Credit Card | 16.24% – 26.24% variable | 0% for 15 months | $39 | 5x miles on flights booked directly with airlines or through Capital One Travel, 2x miles on hotels and rental cars booked through Capital One Travel, and 1x miles on all other purchases |

| Chase Freedom Unlimited | 15.74% – 24.49% variable | 0% for 15 months | $55 | 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on dining and drugstores, and 1% cash back on all other purchases |

| Discover it Cash Back | 14.24% – 24.24% variable | 0% for 15 months | $59 | 5% cash back on rotating categories (gas stations and wholesale clubs in Q1 2023), 2% cash back at gas stations and restaurants, and 1% cash back on all other purchases |

How do I get a cash advance on my credit card account?

Before obtaining a cash advance, you must first read your cardholder contract. The amount you can withdraw from the card will depend on your creditworthiness, reflected in your credit report.

You can apply for a cash loan using your credit card. Various cash advances are available, so choosing the right one for your needs is essential. It all depends on which issuer you use and what method you use to apply.

The credit card issuer can obtain cash advances from certain issuers by showing a photo ID and their credit card. Then, they can withdraw cash from a bank teller.

Cash transfer advances can be made with your ATM card and used for eligible purchases or during a financial emergency when you need to cover extra expenses.

Convenience checks are another way to get a cash advance transaction using your credit card. This can be used to deposit interest on cash advances into a bank account, making it a convenient cash advance choice.

Use your credit card convenience checks to pay merchants just like a regular bank cheque. Convenience checks cannot be used to pay fees or cash advances.

Your issuer may consider a cash advance to cover any transaction other than cash withdrawals, meaning these advances can help you during various financial situations.

These transactions are sometimes referred to as cash equivalent transactions. These items, such as wire transfers or money orders, can easily be converted into cash.

Cash advances are subject to credit card grace periods. Interest charges will start accruing immediately after the transaction is complete, regardless of how it was made.

It doesn’t matter how much fees are charged; issuers must disclose how they calculated them. Check your cardholder agreement to determine whether certain transactions may lead to a cash advance or an APR on the amount.

Cash Advance Options

Cash advances are great for getting quick cash and provide access to cash when needed.

Cash advances can be costly and hard to access. If access to cash is not required, it may be better to charge the purchase to your card. You can also take advantage of grace periods that lower your interest rate. This could help you save interest.

The balance must be paid within the grace period. These cards offer attractive introductory APRs, which allow you to buy new items at no interest for up to one year.

Personal loans have a lower interest rate and can often be repaid quickly. Furthermore, short-term loans can provide quick access to funds when facing urgent financial needs. A personal installment loan is a good option if you need cash fast.

An emergency fund is the best way to avoid cash advances and handle emergency expenses. Avoiding debt is easier than relying on a credit line or financial products to get you through an emergency.

Money apps like Dave can also be a helpful alternative to cash advances. With Dave, you can get a no-cost cash advance on your upcoming paycheck without paying high fees or interest rates. This can be a great option if you need cash quickly but want to avoid the extra cost and downsides of traditional cash advances.

However, it’s important to note that these cash advance apps may still charge fees or require a membership, so read the fine print before using them. Ultimately, the best way to avoid the need for cash advances or financial products is to build up your savings and emergency fund so you’re prepared for emergency expenses.

Consider your options before you apply for a cash advance.

The digitalization of society is impacting our financial lives. You might be tempted to borrow money from your credit card company to meet your financial obligations.

Cash advances can be a costly way to pay expenses, especially if you’re facing a short-term money crunch. However, with an excellent credit score, cash advances can be cost-effective and affordable for unexpected costs. The fees and interest charged will vary depending on the bank that issued the card, but those with excellent credit might secure the lowest interest rate.

If you urgently need cash, it’s important to consider all your options before turning to a credit card cash advance. While these advances may seem like a quick and easy solution to your financial problems during a certain time, they can come with high fees and a greater chance of late payments that can affect your credit score. So, searching for alternatives that provide flexible terms is crucial to avoid difficult repayments.

Instead, consider alternative options like tax refund cash advances or emergency loans in 2023. These loans can provide the funds you need to cover unexpected expenses, such as medical bills, without the high costs of credit card cash advances. However, carefully evaluate your financial situation by reviewing your monthly statement and choosing the option with the lowest rates. It’s important to consider your payment history, the scheduled payment for any loan, and the cash needed to ensure you make the best financial decision.

Frequently Asked Questions

How does the interest rate for cash advances on credit cards vary among different providers?

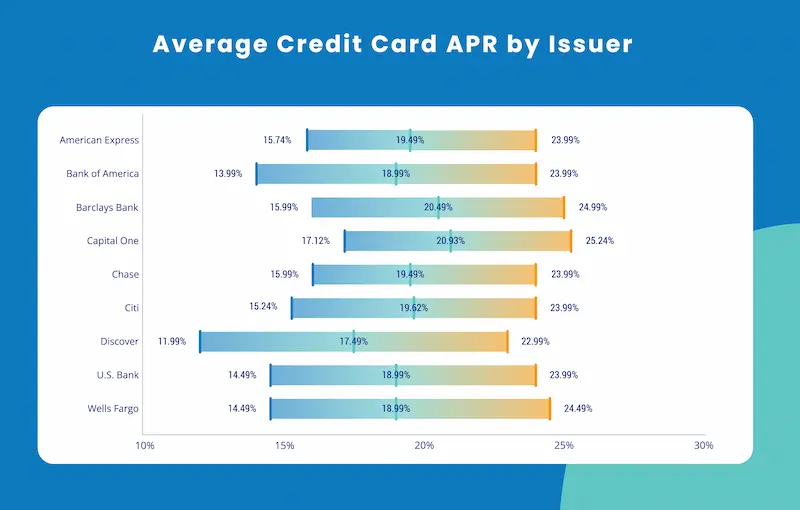

Interest rates for cash advances typically range from around 21% to 28%, with some outliers on either end. Compare closely as small differences in rates have a big impact over time.

Are there any credit cards that offer low fees or special promotions for cash advances?

Some cards offer 0% cash advance APR introductory offers for 6-12 months. There are also occasional promotional $0 fee cash advances, but fees typically run 3-5%.

What are the key factors to consider when choosing the best cash advance credit card for my financial needs?

Consider the APR, cash advance fees, credit limit, rewards potential, balance transfers, sign-up bonuses, and other benefits to select the optimal cash advance card.

Can you explain the pros and cons of using a credit card for cash advances compared to other borrowing options?

Credit cards offer convenience but have high costs. Personal loans or lines of credit are cheaper ways to borrow flexibly. Payday loans provide quick cash but at very high rates.