Credit Cards for Fair Credit are less detrimental than bad credit. However, it still needs to be at the standard of credit that most credit issuers require to allow you to use their most competitive cards. A few basic cards may not provide rewards. The aim is to use these cards responsibly to build credit over time to get higher-quality cards.

The Best Way for Students to Earn Cash-back

Discover it Cash Back for Students.

The Reasons We Decided to Pick It

This is an excellent opportunity for students with low or average credit scores to gain experience managing credit. There is no annual fee, no penalty APR, and the possibility of cash-back of up to 5 percent in various categories(up until a quarter-yearly maximum when you enroll) and 1% cash back on other eligible purchases). It’s among the best student credit cards to build a good credit report.

Pros

- Cash-back of 5% on categories of bonus that are rotating

- First-year Cash-back match

- Earn Chase Ultimate Rewards on applicable purchases

Cons

- A relatively low credit limit for some users

- Carrying a high credit card balance could negatively impact your credit score

- Payment history is crucial for improving credit over time

- The bonus cash-back rate of 5% is restricted to $1,500 per quarter of spending.

- Bonus categories must be activated each quarter

- Base low at a 1% rewards rate

Card Details

The Chase Freedom Flex offers a variety of benefits, including the option to redeem rewards for gift cards and Chase Ultimate Rewards® points. As a Credit card issuer, Chase provides additional perks such as secured cards for those looking to build credit. One significant advantage of this card is the impressive sign-up bonus available to new cardholders. The card also offers bonus cash back on drugstore purchases, making it an excellent choice for everyday spending.

- Intro Offer Unlimited Cash-back Match only available from Discover. Discover will match the cash back you’ve earned at the close of the first year so that you can turn the $50 in Cash into $100. Or turn $100 into $200. There’s no minimum or maximum reward. It’s just a dollar-for-dollar match.

- Earn a Cash-back of 5% on your everyday purchases at various locations every quarter, such as Amazon.com supermarkets and restaurants, gas stations, and more. Pay with PayPal and up to the maximum amount for each quarter when you sign up for. Additionally, earn unlimited 1.5 cash back on all other purchases in real-time, and benefit from a balance transfer credit card when needed.

Get your Credit Scorecard for free. It contains information about your FICO(r) credit score and crucial information that makes your score reported by the major credit bureaus. Earn cash-back rewards while you build the credit score that will assist you in the years following graduation. Also, use secured credit cards to build your credit responsibly. - There is no annual fee. No late fees on your first payment late. There is no APR change for late payments due to a security deposit. Upgrade to an unsecured card as soon as you’re eligible.

More than one-half million college students have Discover Cards by referring to friends’ suggestions. Refer-a-Friend: When you are the Discover it(r) student cardholder, you’ll get a statement credit every time you recommend someone and are approved. And also, enjoy eligible delivery services with your card. - Freeze It(r) off/on switch for your account, which blocks the making of new transactions, advances in Cash, and balance transfers in seconds.

- Be alerted if we locate the Social Security number on any among thousands of Dark Web sites. Activate your account at no cost.

- Discover is accepted in the United States by most credit card companies.

- Zero intros APR on purchases for six months, and then the variable purchase ongoing APR standard of 12.99% and 21.99% is in effect.

- Select “Apply Today” to view the reward details, FICO(r) Credit Score conditions and Cash-back Match(TM) information, and other details.

Best for Students Earning Money by Providing Excellent Customer Service

Discover it Student Chrome

The Reasons We Decided to Pick It

If you’re a college student trying to build credit with this Discover it(r) Chrome for students is a great place to start your credit journey. You can access an acceptable credit card rewards program and reasonable APRs without annual fees. This card can help improve your credit profile and provide a foundation for your future creditworthiness.

Pros

- No annual cost

- Earn rewards while you build credit

- Cash-back earned will be automatically matched after an account holder for the first year.

- Lower credit utilization ratio compared to other student cards

Cons

- Introduction APR offer

- The reward earning limit is set to $1,000 worth of purchases per quarter in the top category.

- In contrast to other student cards, such as Chase Sapphire Reserve or Capital One Travel.

Card Details

For those interested in business credit cards, it’s important to note that this card is specifically designed for students and may not offer the same benefits or rewards as cards aimed at business professionals.

- Intro Offer Unlimited 1.5 cash back Match only with Discover. Discover will match the cash back you’ve earned by the end of the first year, which means you can turn your Cash into $100. Or turn $100 into $200. There’s no minimum expenditure or maximum reward. It’s just a dollar-for-dollar match.

- Earn 2% cash-back in grocery stores, Gas Stations, and Restaurants on up to $1,000 worth of combined purchases every quarter. Additionally, instantly earn unlimited percent cash back on all other purchases, including retail ones.

- Earn rewards while you build the credit score that will assist you in the years following graduation. Also, download your credit score card for free that contains the details of your FICO(r) credit score, credit inquiries, and other important information that makes your score.

- No annual fees. No late fees on the initial late payments. There is no APR change for late payments. Enjoy annual statement credits with responsible usage.

- Credit card types are available: Choose the best fit for you from various options Credit One Bank and other financial institutions provide.

- Refer-a-Friend: Once you’re an official Discover it(r) student card member, you’ll be able to get a statement credit every time you recommend a person to whom you’re approved. More than half a million people received Discover Cards by referring to friends’ referrals.

- Freeze It off/on switch on your account that stops any new transactions, credit card debt advances in Cash, and a balance transfer in seconds.

- Be alerted if we locate your Social Security number on any of the thousands of Dark Web sites. You can activate your account at no cost.

- Discover is accepted across the country by the 99 percent of locations that accept credit cards, making it viable for everyday use at various outlets.

- APR intro 0% for purchases up to six months, after which the standard variable APR of 12.99% and 21.99 percent is applicable.

- Select “Apply now” to view the reward details, FICO(r) Credit Score conditions, as well as Cash-back Match(TM) information, and other details.

The Best Way to Earn Cash-back With a Fair Credit Score

Capital One QuicksilverOne Cash Rewards Credit Card

The Reasons We Decided to Pick It

The Quicksilver Cash Rewards Credit Card stands out among other popular streaming services by allowing credit cardholders to review their statements and make a monthly payment plan that suits them. An excellent option for people with less-than-perfect credit scores, this card provides an opportunity to build better credit and earn a decent unlimited 1.5 cash-back rate. You can also get an increased credit line within six months after the account opening.

Pros

- Unlimited 1.5 Cash-back rewards of 1%

- Credit scores of average applicants will be considered

- No foreign transaction fee

- Rewards don’t expire

- Compatible with major Credit card networks

Cons

- High APR

- There are no bonus categories for spending to increase rewards

- No Welcome Offer

- No intro APR offer

- No special rate on purchases

Card Details

With the Quicksilver Cash Rewards Credit Card, not only do you have the opportunity to build credit, but you also have the flexibility to manage your account efficiently. This card suits those looking to manage their credit scores and earn decent cash-back rewards efficiently.

- Earn an unlimited 1.5 percent cash back on all purchases every single day

- Earn cash rewards without joining a rotating category

- Get automatically assessed for a better credit line as short as six months

- Check your credit score through the CreditWise(r) application, which is accessible to everyone

- No fraud liability for you if your card gets stolen or lost

- There is no limit on the amount of cash back you earn. Money-back isn’t rescinded for the duration of your account.

- Ensure your credit is secure for the future by ensuring responsible card use.

- Receive personalized alerts and control your account using this app. Capital One mobile app

The Best Card for a Simple Transaction With a Fair Credit Score

Capital One Platinum Credit Card

Why We Decided It

The Chase Sapphire Preferred card is a top travel rewards credit card for those looking for excellent travel card options. In addition, this card comes with valuable features like a balance transfer fee and travel accident insurance, making it a strong choice for anyone interested in an airline credit card. Ultimately the travel cards available to consumers today provide fantastic benefits for avid travelers and those wanting to make the most of their spending.

If you have a good credit score, The Capital One Platinum Credit Card gives you a straightforward way to return on the right track. Due to the astronomically high-interest rate, it’s best to use a credit card for regular expenses and pay the total amount. Because there’s no annual credit cost and no annual fee, it’s an economical option when you pay punctually and don’t have the burden of an account balance. However, keep your credit card details secure to avoid any unwanted issues.

Pros

- No foreign transaction fees

- Fair or average credit range applicants could be considered

- Account for credit line increases could be possible within less than six months, depending mainly on your credit account history

Cons

- Very high-variable APR

- No rewards program

- No welcome bonus or introductory rate (introduction APR deal)

- A cash advance fee of 3% (min $10)

- Intro balance transfer fee may apply for an initial period

Card Details

- Pay no annual fee

- You will automatically be evaluated for a more extensive credit line as short as six months, considering a variety of credit scores.

- Insurance against fraud if your card is lost

- Make use of online banking to access your account via your phone, thanks to our mobile application

- You can check out swiftly and securely with a contactless credit card without touching a terminal and giving your card to the cashier. Hover your card before an electronic reader, then wait for confirmation, and you’re good to go.

- Pay with a check online or in the branch in your area and pay no cost, and you can choose the month’s due date which is the most suitable for your needs. Direct deposit and balance transfer cards are also available options.

- You can access your account at any time of the day, seven days a week, with financial institutions providing excellent customer service.

- Build credit by using a credit card, making timely payments, and utilizing redemption options for travel purchases whenever possible.

What Is an Acceptable Credit Score?

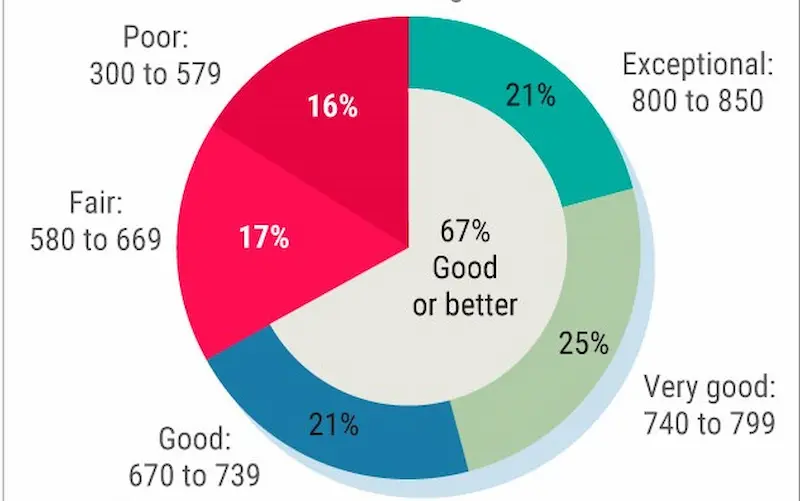

As determined by Experian, fair credit is usually described as having a FICO score between 580 and 669. Appropriate credit could be because you’ve got only a few details in your credit file or because you’ve experienced financial issues previously, which can make it challenging to cash back on eligible for most credit cards. However, it is possible to get credit card options available, particularly for students.

Methodology

To identify the top credit cards for those with fair credit scores, we looked over various credit cards offered by all the major credit issuers, including U.S. Bank. However, the trick to choosing the top cards was to narrow it down to those most likely to accept applicants with difficulties with recognition before their current situation. We also considered important factors such as the spending category, availability of Travel credit cards, and partnerships with companies like American Express Travel. Another important consideration was the applicant’s credit risk and history of on-time payments. Considering these factors, we compiled a list highlighting the best options for those with fair credit, which also features cards from U.S. Bank.

Most credit card companies declare which products are designed to be used by people with fair credit. It’s then issued comparing the card’s terms, conditions, and Benefits for details. Most of these are basic cards because they offer rewards and benefits usually sacrificed to make them accessible to those with credit problems or weak credit history.

This credit card from Discover It Credit Card for Students is a great choice to assist students with credit and manage an account on credit. Students will likely have a short credit record, should they have even. The card has a 5% cash-back reward rate on bonus categories, which changes every quarter. The Journe Student Rewards from Capital One is another excellent student option, offering a flat cash-back rate on all purchases.

The Platinum Card® from American Express could be a great fit for those interested in premium cards. Its robust Card Membership perks, such as free access to airport lounges, cater to travelers and high-spenders alike. In case of an initial application denial, you could try contacting the credit card reconsideration department to see if they can reassess your application.

Finally, when selecting a credit card, weighing the rewards against the fees is essential. For example, some cards offer significant rewards for each dollar on hotels spent, making them popular choices for frequent travelers. Consider the pros and cons before choosing any credit card, and remember to review their Benefits for details.

You can earn a 5% bonus up to $1,500 worth of quarterly purchases once activated, also known as the quarterly maximum. The bonus categories worth 5% change each calendar quarter and include popular categories like restaurants, gas stations, supermarkets, and Amazon.com. The maximum amount you can make in a year in the bonus categories that earn 5% is 300. With Chase Freedom Unlimited, you can earn a Cash-back of 1% on any other purchase, such as gas station and supermarket purchases.

So the category that is a 5% bonus could make you a massive 600 within your first year if taking the full benefit of this promotion and earn the maximum rewards on purchases. Through this promotion, you even have a chance to earn up to 5X miles.

Discover it Student Chrome

Another excellent option for students is the Discover it Chrome for Students, which includes the most popular features of Discover’s Cash and student cash back cards. Discover It Chromes for students can earn 2% back at gas stations and restaurants for up to $1,000 for quarterly purchases. It also offers unlimited 1% back anywhere else.

The card comes with a cash-back reward at the end of the first year. If you can earn the maximum cashback from gas stations and restaurant purchases in the first year, the $80 will be doubled by another $80. Besides the rewards, Discover is known for excellent customer service, with Customer Service representatives in the United States.

Capital One QuicksilverOne Cash Rewards Credit Card

Accepting the top cash-back rewards credit cards could be challenging if you have decent credit scores. However, you could qualify for the CapitalOne FastsilverOne cash rewards credit card with fair credit type, and it offers an unlimitable 1.5 percent flat-rate cash back for every purchase. The card p provides eligible customers with appropriate credit and the chance to earn high online cash rewards bonuses with every purchase without rotating categories or complicated reward programs to be concerned about.

The U.S. Bank Visa card does not charge fees for foreign transactions. It means you can use it anywhere in Canada, Mexico, or any other country accepted without any additional cost for currency conversion, which can be as low as 3 percent on the alternative credit cards. This card also allows you to earn miles on hotels, making it an excellent choice for frequent travelers.

With 1.5 percent cash back for spending $500 monthly with the card, you will receive $90 in rewards. If you pay 00 per month with the card, you’ll earn $180 annually. Although the card comes with an annual cost of $39, a spending limit of $2,600 per year will earn enough cash back to make a profit. It just takes around $217 monthly to earn enough rewards to cover the $39 annual cost. Any additional cash you earn is the profit you can put back into your pocket as long you pay the invoice in full each month. Moreover, you can explore cards like U.S. Bank Altitude, Credit CardTop Rewards, Gold Card, Citi Diamond Preferred, and Citi Simplicity, which offer better rewards and savings.

Capital One Platinum Credit Card

If you’re a creditor with a fair score and are looking for a card that is easy to use and comprehend, The Capital One Platinum Credit Card could be the right choice. The card is for those who are working on building their credit. Also, consider checking out savings accounts that offer good interest rates and look for credit cards that provide rewards for cash to maximize your savings and credit-building experience.

This credit card is easy to use and comprehend. The card’s primary focus is helping you control your money best for your financial requirements. Similar to many credit cards catering to those with low credit scores, this one doesn’t offer an option for cash back or a travel reward plan. Automatic credit line increases offer rewards for bills on time payments and could improve your credit score over the long run, possibly saving you hundreds of dollars in interest.

Anyone who has experienced issues with missed or late payments may be looking to improve their credit. This card can be a fantastic instrument to help you reach your target. If you can repay the card each month and pay on time, your credit score will slowly increase. This card can help control your cash flow and prevent fraud with each purchase. It comes with a zero annual fee and no foreign transaction fees.

Compare rates from these lenders without affecting your credit score. 100% free!

Bottom Line

It’s not easy to get approval for a reward credit card even if your credit score is decent; however, it might be easier than you believe. A suitable credit card such as the Citi Custom Cash, American Express Card, or Mission Lane Cash Back Visa could provide you with a fantastic way to pay and a wealth of advantages like a one-time $200 cash bonus or rewards in your everyday category while also providing the opportunity for you to improve your credit. Hence, you will be able to get a more lucrative card like the Blue Cash Preferred shortly. This process also helps you understand the types of credit scores and their importance in getting better financial opportunities.

What Is Fair Credit?

The definition of an acceptable credit score differs depending on the lender. Generally, you need to know a lender’s cutoff threshold for determining the difference between a good and a bad credit score. FICO, the most frequently used credit scoring system, does, however, give some useful information to assist you in establishing your score. FICO scores vary from 300 to 800, the most widely useful range. Typically, you can consider 580 to 669 a fair credit score.

Here are some statistics on earning cash back with a fair credit score:

| Statistics | Details |

|---|---|

| Average cashback reward | 1% |

| Average cash-back reward | 20% |

| Percentage of credit cards that offer cash-back rewards | Gas, groceries, and travel |

| Most popular cash-back rewards categories | $200 |

Are There Credit Card Options for Excellent or Moderate Credit That Offer Immediate Approval?

Credit cards provide instant approval for people with average or fair credit.

Many issuers, like American Airlines, American Express, Bank of America, Capital One, Chase, Citibank, Deserve, and Discover, will allow you to verify whether you’re qualified for any card. Some popular options include the Capital One SavorOne Cash Rewards Credit Card and the Capital One Venture Rewards Credit Card. This card offers valuable Membership Rewards and can be used for various purchases, including flights with American Airlines.

Remember that instant approval doesn’t mean you can utilize the card immediately, which could take anything between 5 and seven days.

Which Is the Best Credit Card to Get If I Have Fair Credit?

Only a few credit cards are the most straightforward to obtain with fair credit. The decision to approve a card is contingent on many aspects, including the credit score as just one of the minimum spending requirements. Also, there’s no ideal card, as what is right for you might not be the right option for another person. If your credit score is fair, you can get several good credit cards featured on Green Day Online’s list of top Credit cards with Fair credit.

At GreenDayOnline, we are committed to providing inclusive financial solutions to individuals across the United States. We understand that fair credit is a crucial stepping stone toward achieving financial goals and building a strong foundation for the future. As part of our mission to empower individuals with fair credit, we have expanded our operations to several states, ensuring that our credit card offerings are accessible to a wider audience. Below is a comprehensive list of the American states where our company is active, showcasing our dedication to serving customers in diverse regions. We believe everyone deserves the opportunity to access credit products to help them navigate their financial journey successfully.

| Alabama / AL | Alaska / AK | Arizona / AZ |

| Arkansas / AR | California / CA | Colorado / CO |

| Connecticut / CT | Delaware / DE | District Of Columbia / DC |

| Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN |

| Iowa / IA | Kansas / KS | Kentucky / KY |

| Louisiana / LA | Maine / ME | Maryland / MD |

| Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT |

| Nebraska / NE | Nevada / NV | New Hampshire / NH |

| New Jersey / NJ | New Mexico / NM | New York / NY |

| North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA |

| Rhode Island / RI | South Carolina / SC | South Dakota / SD |

| Tennessee / TN | Texas / TX | Utah / UT |

| Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

It is essential to look for a card that offers excellent rewards that suit your needs and preferences. The credit score that could allow you to qualify for the most favorable terms from one card issuer may need more to be eligible for the same benefits at a different bank. A prospective lender may also consider your months of purchases, bonus rewards, one-time $200 cash bonus, and payment networks when approving your application.

Finally, provide an accurate Email address when applying for a credit card. Lenders may use it to send you important notifications and updates regarding your application status and account management.

The best option for those with an average or fair credit rating is to get an account suitable for people with poor credit scores. While it’s not a 100% confirmation of approval, many issuers, such as American Express, Bank of America, Capital One, Chase, Citibank, Deserve, and Discover, can let you know to see if you’re eligible for their cards. Some issues include electronic goods retailers and software & cloud system providers offering specific cards like the Ink Business Cash and Ink Business Preferred from Chase and the Marriott Bonvoy Boundless card.

What Is the Time Frame to Build a Fair Credit History?

Whether you’re just starting from scratch or trying to raise your score, Fair Credit building is a process that takes time. You can take steps to build your credit over some time of a few months, such as making your payments on time, reducing the amount of credit you use, or making use of tools such as Experian Boost or American Express Score Goals which can provide actionable information on how you can improve your score.

There’s a precise number for the ideal length of time once late or missed payments appear on your radar. It can take several months to a few years to prove that you have improved your responsible behavior in paying. In general, anyone seeking credit on their first attempt could expect an improvement in their FICO score within six months following opening an account and making timely payments.

The credit history length is another fact you must keep the same. In the end, it takes an approximate time frame to obtain good credit. However, a fair score is achievable with a consistent payment record and good credit scores.

How to Apply for a Credit Card With Fair Credit

When applying for a credit card with fair credit, it’s essential to look for cards that offer bonus miles, airport lounge access, and special deals such as prices on thousands of prepaid hotels. You also want to consider cards with benefits like elite status and rental car insurance. By choosing a credit card that offers these generous rewards, you’ll improve your credit score and enjoy an array of benefits that cater to your everyday and travel needs.

With a fair credit history, applicants can avail of various approved cards. There won’t be a credit card with a hefty reward, a substantial welcome bonus, or any other lucrative benefits you may have heard about; however, you can get the most out of the credit card you’re using to improve your credit score.

It’s also more likely to be able to accept an account you approve, though it’s not a guarantee. Numerous issuers like American Express, Bank of America, Capital One, Chase, Citibank, Deserve, and Discover will allow you to determine whether you’re eligible for one of their cards without impacting your credit score through an inquiry.

Frequently Asked Questions

What are the top credit cards available for individuals with fair credit in January 2023?

Some of the top credit cards for fair credit in January 2023 include the Petal Visa, Capital One Platinum, Discover it Secured, Deserve EDU Mastercard, First Progress Platinum Prestige, Citi Secured, and Bank of America Customized Cash. These feature achievable approval odds, soft credit checks, low security deposits, rewards, and options to build or rebuild credit over time.

Can you recommend some credit cards specifically designed for fair credit that offer good rewards and benefits this year?

The Petal Visa, Discover it Secured, and Capital One Platinum are great options for fair credit with rewards and benefits. Petal offers 1-2% cashback with no fees. Discover matches cashback after one year. Capital One provides a credit line increase after 5 months of on-time payments. Other solid options include the Deserve EDU Mastercard which rewards good grades and the Surge Mastercard which has rotating category bonuses.

What criteria should I consider when choosing a credit card for fair credit in 2023?

Key criteria to consider for fair credit credit cards in 2023 are achieving a credit line matching your spending needs, looking for low or no annual fees, comparing interest rates, considering required security deposits and ability to recoup them, evaluating credit building capabilities, reviewing rewards structures, and checking issuer financial responsibility.

Are there any new credit card options for fair credit that have emerged as top choices for January 2023?

Yes, a few new credit cards for fair credit that are top choices in January 2023 include the Deserve EDU Mastercard for students, the Chime Credit Builder Visa which has no fees, the One Mastercard from Credit One Bank with high approval odds, and the Surge Mastercard from First Digital Bank which offers rewards for surges in monthly spending. These newer card options are worth considering.

How can I improve my chances of getting approved for one of the top credit cards for fair credit in 2023?

Ways to improve your approval chances for top fair credit cards in 2023 are reducing credit inquiries by only applying for one card at a time, keeping credit card balances low, making payments on time, becoming an authorized user on someone else’s card account, asking issuers to reconsider denials, providing income and employment details upfront, and considering secured cards that require a deposit.