A personal loan is a good funding option if you need easy cash to meet your financial needs.

What can I use a personal loan for?

You can use a personal loan for;

- Debt consolidation

- Major or minor home renovations

- Starting a small business

- Paying for tuition fees, among others

Steps to getting a personal loan

There are many lenders that offer personal loans, both online and in-store. You can apply for these loans through banks, credit unions, or alternative lenders. Most lenders allow borrowers to prequalify for the loans through their personal loan applications. Personal loan applications are quite common, and lenders follow the same process for approving the loan. Below, we have discussed important steps when applying for a personal loan.

The main requirements for personal loans

Personal identification

It can be your driver’s license, passport, or social security card.

Proof of income

It can be in the form of your bank statements, fixed tax returns, or a recent copy of your pay stub)

Employer’s information

It may be the manager’s name, company name, or phone contact.

Proof of residence

Usually in the form of utility bills, lease agreements, or home address

Eight steps to getting a personal loan

People apply for personal loans due to various reasons. It can be a medical bill, unexpected car repairs, or any other urgent financial issue. If a personal loan is a good option for your needs, here are important steps to follow when applying;

1. Run the numbers

Applying for a loan that you can’t afford to pay is something you wouldn’t want. Lenders use different criteria to determine whether you qualify for a loan. But don’t wait for the lender to do this. It is also wise to run your numbers to determine whether the loan is worth taking out. Understanding the loan applications requirements and the loan application process can help you make informed decisions.

How to run your numbers

First of all, know how much money you need at the moment. When doing this, remember that some lenders also require an origination fee. They deduct this fee from the loan amount. Ensure that what you remain with after the fee deduction is enough to cover your expenses.

The next step is to calculate the total cost of the loan. You can do this using a personal loan calculator. You can use the calculator to know how much money you will pay towards the monthly loan. Doing this may be difficult if you know the interest rate or loan term. So for a start, you can play around with numbers and explore different types of loans to find the best option.

Takeaway

Before applying, confirm whether there is an origination fee and how much it will cost you. Know how much money you will remain with after the deductions of this fee. You also should know whether you can afford the monthly loan payments.

Next step

A personal loan calculator will help determine whether you can afford the payments. Ensure to make maximum use of it.

2. Check your credit score

Usually, personal loan lenders perform a credit check. It gives them an idea of whether you are in a position to repay the debt. Some online lenders look beyond your credit score when issuing loans. For instance, they may also examine your employment history and income level. But still, these lenders may also want to know where you stand regarding your credit score.

What are the minimum credit score requirements for personal loans?

To qualify for affordable personal loans, one of the requirements is to have fair credit. Having excellent credit will increase your chances of getting a personal loan. You are also likely to get the loan at the best rates.

If you have a less-than-stellar credit score, here is what you can do;

- Get copies of your credit reports from the major credit reporting agencies. Consumers can receive these copies for free once every year. You can get these copies from the bureaus’ websites. You can also get a copy from annualcreditreport.com. It will help you understand your financial history.

- Confirm if there are any errors made. If you get a mistake in any of your credit reports, contact the agency and have the errors corrected. Please pay attention to your average borrower score, as it might be affected by these mistakes.

- If you have a bad credit score due to poor financial decisions, it is still possible to get a loan. However, expect to spend a lot of interest rates and fees accompanying the loan. The best alternative is to increase your score before you apply for the loan.

Takeaway

With a good credit score, there will be a high chance of qualifying for affordable loans. The opposite applies when you have a bad credit score. Keeping an eye on your financial history and average borrower score will help you maintain a healthy credit score.

Next step

Before you apply for a personal loan:

- Ensure that you check your credit history.

- If you have a bad credit score, take steps to improve the score first.

- Apply for the loan.

3. Consider your options

Having bad credit won’t disqualify you from getting a personal loan. But you might require a co-signer to get better rates on the loan. However, some lenders don’t allow co-signers. You might not find someone willing to cosign for you even if they did. If this happens, the best option to consider is a secured personal loan. Qualifying for this loan type is easier than the unsecured option.

So what are secured loans?

Secured loans are a type of personal loan that requires collateral. It can be your home, vehicle, savings account, or expensive jewelry. Issuing collateral increases your chances of qualifying for the loan. It also helps you get better terms on the loan. If you don’t pay the debt on time, your lender can repossess your asset and sell it to recover the money.

Where to apply for a personal loan

Banks, credit unions, and alternative lenders all offer personal loans. It is the requirements that vary among these lenders. For instance, qualifying for a bank loan is difficult if your credit score isn’t good enough.

But online lenders are different. Most of these lenders specialize in offering bad credit loans. Credit unions, on the other hand, offer payday loan alternatives. These are cheaper than normal payday loans.

Takeaway

Sometimes, you may require a personal loan but do not meet the qualification requirements. In this case, having a co-signer can increase your chances of getting approved.

Next step

If you feel that the lender won’t accept your application, don’t despair. You might still qualify for a loan with bad credit. But your interest rate, in this case, will be higher. It’s essential to consider a range of loan options and consult prospective borrowers to make an informed decision. You can also request your friend or family member to be your co-signer.

4. Choose the best loan for your needs

The next step is determining the best loan option depending on your needs. There are some loan options that you can use for specific needs. Some of these loans include auto loans and mortgages. But there are also loan types that don’t have any restrictions regarding usage. It’s also helpful to learn from the experiences of prospective borrowers to make the best choice.

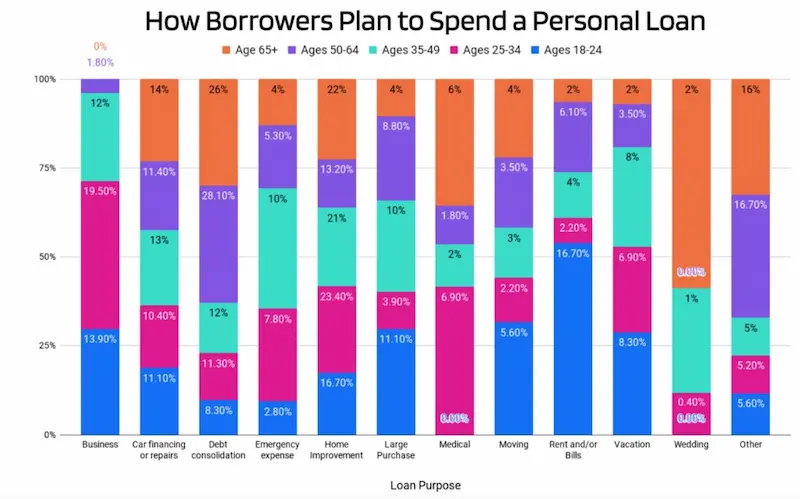

It is important to ensure that you work with a lender that can lend you money without any restrictions on usage. You can use a personal loan for different purposes. The main ones include;

Debt consolidation

Most people who apply for personal loans use the money for debt consolidation. It involves applying for a new loan to pay off your debts. With debt consolidation, you will only make one payment every month. The interest rate is also likely to reduce.

Credit card refinancing

Some companies offer loans to consumers who want to reduce their credit card debts. What these companies offer are personal loans. Why? Because personal loans have a lower interest rate than credit cards. They can be a good loan option to pay off your credit card debts and have enough time to repay them.

Home Improvement

Home improvement loans are a good option for large renovation projects. The loans are a perfect alternative to a home equity loan that requires your home as security. If you need additional financial assistance, considering other borrowing options is crucial.

Medical expenses

Most medical issues come unexpectedly. Personal loans can be a good option in such a case. Personal loans require fixed installments, giving you enough time to repay the loan. You can use the loan to pay your medical expenses, and if you require further financial assistance, you can explore additional borrowing options.

Emergencies

You can also apply for a personal loan for emergencies. It can be unexpected car repairs or purchasing an important home appliance. Knowing the different borrowing options available can help you make an informed decision.

Weddings

Vacations and weddings can, at times, be expensive. It is why many people go for personal loans for these expenses. You can then repay the loan over several years. It is one feature of personal loans that makes them very popular. Moreover, seeking financial assistance from various sources can help you have a memorable event.

Takeaway

Always work with a lender willing to offer a loan based on your specific needs and explore various borrowing options.

Next step

Compare potential lenders options from different lenders. Then apply for a personal loan from a lender ideal for your borrowing needs.

5. Shop around to get the best rates

Never settle for the first loan offer that comes your way. Instead, take your time and compare lender options to get the best rates. Start by comparing different lenders, followed by the loan types.

You can apply for a personal loan from a bank or an alternative lender. Credit unions also offer these loans. If you have had a long relationship with your bank, this can be the best place to start. The bank will likely approve your loan request if your account is well.

Know whether you prequalify

Most lenders will allow you to prequalify when applying for online loans. It can also be a perfect way to compare lender options without damaging your credit report. Only a soft credit check is necessary, which will not affect your credit score.

A lender might perform a credit check if they do not have a prequalification process. Usually, only a few credit inquiries done simultaneously can damage your credit score. It is best to take a few days before applying for a loan from another lender To reduce the damage of hard checks.

Takeaway

Please don’t apply for the first loan option, no matter how attractive it may be. Compare all your options and even prequalify for the loans before applying. Be mindful of each option’s loan applicants and the loan agreement terms.

Next step

Take your time to shop around and compare the different options available. Check how much interest rate and fees each of the lenders charges. It is the best way to find a personal loan with competitive rates.

Select a lender and apply for the loan.

It is now time to choose a lender offering a personal loan to meet your needs. Read the loan agreement thoroughly and ensure the lender has a fair process for evaluating loan applicants. Then start applying for the loan.

Some lenders allow you to complete and submit the formal application form online. Others need part of the application completed in one of their branches.

The information required during the application also varies depending on the lender. The main requirements include the following;

- You must be at least 18 years old.

- You must have a reliable source of income.

- You must provide your full name, contact information, and address.

- You must be a citizen or permanent resident of the United States.

You should also specify how much money you need. Before applying, you should know important things like;

- The amount of money you qualify for

- The interest rate

- The fee charges

- The loan term

Make sure to research and find qualified borrowers for a loan. Also, go through the terms and conditions of the loan. Ensure that there are no hidden charges.

Takeaway

The qualification requirements vary from one lender to another. The application will occur online when you work with an alternative lender.

Next step

Ensure that you provide all the details required by the lender. It will increase your chances of qualifying for a personal loan, especially regarding loans to people who may have difficulty securing financing.

- Gather all the necessary documents.

You should also share some documents with the lender during the application process, which is essential for loan funding approval. Some of these documents include;

- A copy of your driver’s license

- A copy of your recent pay stub

- Proof of residence

You can get details on uploading these documents on the lender’s website. Note that the sooner you provide these documents, the faster the loan processing will be.

Take away

Ensure to provide all the documents the lender requires when applying for a personal loan, as this plays a crucial role in securing loans to people with diverse financial backgrounds.

Next step

Gather important documents like your driver’s license, pay stubs, and W-2s. Then start the application process for smooth loan funding.

8. Accept the loan request/start repaying

After getting approved, you need to provide the documents required. After this, you have to sign the loan contract. Once done, you can receive the loan within one week. Online lenders take as little as one business day to approve the funds, giving you quick access to cash.

After getting the money you need, you should repay the loan sooner. You can authorize the lender to automatically deduct the money from your account as part of your monthly repayments. Some lenders offer interest rate discounts for automatic payments.

It would be best to consider how to repay the money every month. Generally, personal loans are more affordable than credit cards. But you can even save more on interest by paying the debt early. Planning your monthly repayments will make the whole process smoother.

Takeaway

Applying and qualifying for a personal loan within one or two business days is possible. It depends on how long the lender takes to review the application and approve the funds. Once approved, start finding ways to repay the debt, including effectively managing your access to cash and monthly repayments.

Next step

Come up with a workable plan to pay off the personal loan debt. Remember that paying off the debt faster can save you a lot of interest.

When securing a loan, it’s essential to have access to reliable financial resources that can cater to your specific needs. Our company takes pride in serving customers across the United States, and we are pleased to present a comprehensive list of states where our loan services are available. Whether you’re seeking financial assistance for personal endeavors, business ventures, or any other purpose, our presence extends to numerous states nationwide. The table below outlines all the American states where our company is actively engaged, providing a convenient reference as you explore the possibilities of obtaining a loan tailored to your requirements.

| Alabama – AL | Alaska – AK | Arizona – AZ |

| Arkansas – AR | California – CA | Colorado – CO |

| Connecticut – CT | Delaware – DE | District Of Columbia – DC |

| Florida – FL | Georgia – GA | Hawaii – HI |

| Idaho – ID | Illinois – IL | Indiana – IN |

| Iowa – IA | Kansas – KS | Kentucky – KY |

| Louisiana – LA | Maine – ME | Maryland – MD |

| Massachusetts – MA | Michigan – MI | Minnesota – MN |

| Mississippi – MS | Missouri – MO | Montana – MT |

| Nebraska – NE | Nevada – NV | New Hampshire – NH |

| New Jersey – NJ | New Mexico – NM | New York – NY |

| North Carolina – NC | North Dakota – ND | Ohio – OH |

| Oklahoma – OK | Oregon – OR | Pennsylvania – PA |

| Rhode Island – RI | South Carolina – SC | South Dakota – SD |

| Tennessee – TN | Texas – TX | Utah – UT |

| Vermont – VT | Virginia – VA | Washington – WA |

| West Virginia – WV | Wisconsin – WI | Wyoming – WY |

Factors affecting personal loans interest rates

Lenders have varied requirements for personal loans. However, there are several factors that every lender looks at to determine the loan rate. These include the following.

Credit score

With a good credit score, your chances of qualifying for a personal loan are high. You can even get the loan at a reduced rate compared to applicants with a bad credit score. Lenders review the applicant’s credit score to determine which interest rate to give. They consider things like late payments and whether there are loans that you defaulted on.

Debt to income ratio

It is how much money you spend to pay for loans divided by your monthly income. If your DTI ratio is low, you can comfortably repay the loan.

Loan term

Loans with a short repayment term have a lower interest rate. But when the loan term is long, the interest rate will be higher. One important factor is the cost of borrowing over the entire loan term.

Cosigner

If you are looking for a personal loan and don’t meet the income requirements, some lenders may need you to have a co-signer. Having a co-signer will increase your chances of qualifying. It also means that you will get the loan at a better rate.

In short, you are likely to get a higher rate if you;

- Have a low credit score

- Have a high debt-to-income ratio

- Do not have a co-signer

But you can qualify for the most affordable rates with a high credit score, low DTI, and a co-signer.

Can I prequalify for the loan?

Yes, some lenders allow applicants to prequalify for the loans. It will not have an impact on your credit score. Only a soft credit check is necessary in this case.

To confirm whether you prequalify, there is a questionnaire that you first have to fill out. Here, you provide details like

- Your full names

- Social Security number

- Address

- The amount you require

- The minimum score required by the lender

Annual gross income

- Why are you applying for the loan

- Preferred financing option

During prequalification, you do not need to attach any documents. The lender will only need supporting documents if the application moves forward. Depending on the lender, additional questions might be in the questionnaire.

How to speed up the process of getting a personal loan

It does not matter what you are applying for a personal loan for. You can deal with all your financial challenges by qualifying for a personal loan. If you need the money fast, here are a few steps.

Check your credit score.

It is one important step that you have to take before applying for a personal loan. You must first know your credit score, including the minimum score requirements of lenders, before starting your search. If you find any errors, have them corrected as soon as possible. It is one of the simple ways to increase your chances of approval.

Pay off your outstanding debts.

Analyzing the current financing option is essential when applying for a personal loan. Clearing outstanding debts would improve your credit score and help you get a better personal loan deal faster. Make sure you pay off your dues on time to enhance your chances of loan approval.

If you have outstanding debts, try as much as possible to pay them off before applying. But this will only work if you don’t need the money immediately. Reducing your debt burden can increase your credit score. It translates to getting a personal loan at affordable rates.

When looking for a personal loan, start with your local

Start the search from your local bank.

Bank or credit union. These institutions can approve the loan if you have a long and positive relationship with them. They also offer loans at affordable rates.

Consider an online lender.

Online lenders can approve the funds within 24 hours. These lenders also have less stringent requirements. Besides, you can get approved even with a bad credit score.

Pick the money in person.

Confirm whether the lender has branches near you. Then ask if you can collect the money in person. It will help you get the money fast.

Below are some statistics about the process of getting a personal loan:

| Statistic | Value |

|---|---|

| Time to get approved | 5-7 days |

| Interest rate | 10-20% |

| Loan amount | $10,000 |

| Most common reasons | Consolidate debt, pay for unexpected expenses, make home improvements |

| Best way to get a loan | Compare rates from multiple lenders |

Finding personal loans with the best interest rates

We now hope that you clearly understand how payday loans work. But before applying, comparing options from different lenders is always important. It is one of the best ways to get a personal loan with the lowest interest rate. It will also make it easier to find the exact type of loan you need depending on your financial needs. You can find the most competitive offers by exploring a wide range of lenders. Some lenders may even provide same-day funding for your convenience.

Frequently Asked Questions

What are the essential qualifications for getting a loan in 2024?

The key qualifications for getting approved for a loan in 2024 typically include a good credit score, steady income, low debt-to-income ratio, and legal U.S. residency or citizenship.

What types of loans are available in 2024, and how do they differ?

Common loans in 2024 include mortgages, auto loans, personal loans, student loans, business loans, and payday loans which vary in interest rates, terms, collateral requirements, and qualifications.

What are the key documents required to apply for a loan in 2024?

Key documents needed are government-issued ID, proof of income, bank account details, Social Security number, and proof of address or residency to apply for a loan in 2024.

What steps can I take to improve my credit score before applying for a loan in 2024?

Pay down balances, dispute errors, make on-time payments, lower utilization, and avoid new hard inquiries to potentially boost your credit score before applying for a 2024 loan.

What are the crucial steps in the loan application and approval process for 2024?

The key steps are pre-qualification, completing an application with required documents, underwriting review, approval decision, signing the loan agreement, and receiving the disbursed funds.