You have identical bills and the same amount of personal loans. You are constantly in charge of multiple credit cards, but your credit score fluctuates monthly.

Keeping an eye on your credit usage ratio can help you better understand your fluctuating credit score, whether your credit limits are reducing or your balances are climbing.

This article will look at aspects that could affect your credit score and also explain why your credit score has fallen without cause. Check your credit regularly.

The Importance of Your Credit Score

Lenders utilize credit scores to gauge the likelihood that you will repay the loan you take out. This is especially crucial when you are looking to purchase a house and is important in determining your rates and loan terms.

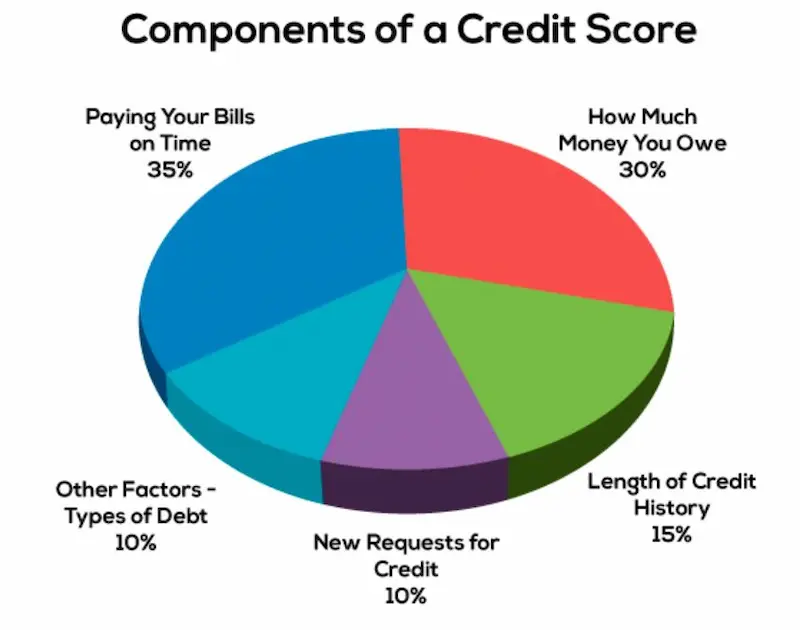

The credit report you receive using your positive payment history, the amount you have to repay, the duration of credit histories, the kind of credit you have, and the new credit accounts you have added. An increase in your score is one of those factors that have changed.

What Caused My Credit Score to Sink if Nothing Happened?

Sometimes, your score can alter due to circumstances outside your control; however, most of the time, your actions affect scores in ways that might not be apparent.

Let’s examine the factors that impact your score and some reasons for reasons why it could change when you think you’ve changed your behavior.

Your Credit Utilization Has Changed

The credit utilization ratio (CUR) is the amount you owe your credit card concerning the credit limits. It affects your score on credit, and an increase or decrease in the two could affect your credit score.

Credit Utilization Rate. The proportion of available credit on your credit cards you’re utilizing at any one time is your credit usage rate, also known as your credit ratio utilization. The greater the rate, the worse your credit score will be.

Are you paying more for your credit card recently? If yes, your credit or ratio utilization may have increased, affecting your credit score. In general, those with less than 30 percent percentage of credit usage (i.e., the amount you spend is 300 or less when your reduced credit limit is $1,000) will maintain their credit score in good health.

Find out whether your credit card provider has changed or reduced the amount you can use. Most credit card companies let you know if you qualify for a new total credit limit. However, they may modify it without your knowledge. Reducing your limit will raise your utilization credit ratio, which means your score will be reduced. When your spending habits were the same patterns, and you were able to increase the amount you can borrow would lower your credit ratio utilization, which could negatively affect your score.

Something Was Noted on Your Credit Report

Review your payments- did you miss an installment on your credit card within the past few months?

Missed payments. Late payments are usually only reported to the credit bureau 30 days late. Therefore, your score won’t affect until after the deadline. Your score can be impacted when missed payment is more extended than thirty; days late. However, delinquency refers to a loan over 30 days late and could ruin your score.

Negative marks like taxes, liens charges off foreclosures, or bankruptcies can significantly impact your good credit score and take months or weeks to show on your credit reports. If you’ve had one of these events, your score might take some time to improve. Nonetheless, seeing a Credit Score Increase is possible once these marks diminish.

Something Slipped Off Your Credit Report

Fortunately, late payments or derogatory marks will not remain on the credit report forever. The more time passes since the effect on your statement and the lower their impact, the less impact they’ll have on your score, and your score could improve over time while your behavior remains the same. Consequently, this could lead to a much-desired Credit Score Increase.

Late payments for more than 30 days are recorded in the credit report for seven years, While derogatory marks like bankruptcy could be on your credit report for as long as ten years. You can see a rapid increase in scores, especially if a new credit scoring formula is used. With time, your score will rise when the spots disappear from the credit.

There’s Been a Recent Inquiry Into Your Report

If you’ve recently applied for a credit card or loan, the company likely viewed your credit report. It’s a considered hard inquiry. It happens when a mortgage lender scrutinizes your credit score to determine whether they’d like to lend money. This can reduce your score for a short period and may be influenced by the credit scoring formula.

An Account Has Been Closed

Your credit score may be adversely affected when you make a loan or credit card payment. Your credit history will be shortened by about 10 percent of the score you get, which is determined by how old your past credit accounts are. If you’ve completed the repayment of a loan over the last couple of months, you could see your credit score dropped.

Your credit score can also be harmful due to a secured credit card. Your credit history will diminish, and the overall credit limit of your credit card account will be reduced. At the same time, your utilization rate will be affected.

You’ll likely be responsible for who authorizes a credit card to shut down. Still, credit card companies can close them without your consent. The Equal Credit Opportunity Act (ECOA) permits lenders to close an account due to inactivity, delinquency, or default without notice. If they shut down the report for reasons other than these, they must provide you with 30 days’ information before closing the account. So you could end up with an unpaid credit card you aren’t even aware of.

Do You Need to Worry About Your Credit Score Declining?

The fluctuations in your credit report are expected, and you don’t need to be concerned about minor changes! It’s recommended to review your credit report at least once each month to keep track of these changes.

It is possible to be aware of significant credit score fluctuations in your score since they may indicate that something else is going on, like when you have accounts that aren’t yours open in your name, or you’ve been the person who has been the victim of identity theft.

Things to Consider When Your Credit Score Changes

When your credit score fluctuations affect your credit score, you should ask yourself these questions:

- Did you spend more or less this month compared to the previous months? If yes, then your credit utilization ratio could have changed.

- Did you make a late payment within the last couple of months? If yes, you may have a late fee impacting your score.

- Did a late payment or an unfavorable mark from a few years ago disappear from the credit report? If yes, your credit score could be rising.

- Have you made a credit application? The inquiry could have been added to your credit report, negatively impacting your credit report.

- Have you recently completed the loan repayment or canceled a credit line? If yes, you may be affected.

- Have you experienced any credit score dings? Various factors, such as high credit card balances or inaccurate information on your credit report, could cause these.

If you look closer, You may discover an issue has occurred that could impact your credit score, but you didn’t realize it at first. The best way to track the changes to your credit score is to examine the details of your credit report monthly, so you’re informed of every change that affects your score.

How to Tell if Your Credit Score is Declining?

If you want to determine whether your credit score is declining, there are a few key indicators you can look for. First, keep an eye on your credit card and loan payments. Late or missed payments can significantly impact your credit score. Additionally, increasing the debt you owe relative to your available credit can negatively affect your score. Monitor your credit utilization ratio, which is the percentage of your available credit you are currently using. Higher utilization ratios signal financial stress and potentially lead to a lower credit score.

Another red flag to watch is the appearance of collections or delinquencies on your credit report. These negative marks can occur when accounts go into default or are sent to collections agencies. Lastly, regularly reviewing your credit report will help you identify any unauthorized accounts or fraudulent activities that could harm your creditworthiness. By staying vigilant and proactive in monitoring these signs, you can better understand whether your credit score is declining and take appropriate steps to improve it.

What Is the Most Significant Impact on Your Score on Credit?

Many factors can affect the score of your credit. Credit risk and credit history are the most significant factors. Credit scores drop due to credit risk. It can comprise 35 percent or more of the FICO score. Creditors are looking to determine whether you’ve made punctual payments to credit or loan accounts, and your payment history is usually the most reliable indicator.

Here is a table of the statistics about credit scores:

| Statistic | Value |

|---|---|

| Average credit score in US | 714 |

| Maximum credit score change in a year | 100 points |

| Most common reason for credit score change | Late payment |

| Other factors that affect credit score | Number of open accounts, amount of debt, length of credit history |

What Is Considered to Be a Lower Credit Score?

What constitutes a poor and low credit score could depend on your major credit bureaus’ scoring method.

VantageScore is a method founded on 300 to 851, where anything less than 661 is classified as “bad” and indicates a higher credit risk.

The FICO model employs a 280-850 range, with 850 being the highest possible score and “bad” scores scoring less than 670, signifying a higher credit risk. Credit scoring models.

For the most part, lenders will use your FICO® Score when deciding whether or not to approve you for a loan, taking into account the associated credit risk.

How Much Does My Credit Score Rise if a Negative Credit Item Is Eliminated or a Credit Risk Factor Is Reduced?

It’s based upon what your negative mark or derogatory mark represents, such as an unpaid bill or something different. Negative items can persist for some time, affecting your credit score for seven years, even after removal. The most important way to improve your score is to take steps to rebuild your credit reports.

Conclusion

In conclusion, monitoring and understanding your credit score is important as it fluctuates monthly. Factors such as changes in credit utilization, missed payments, negative marks on your credit report, inquiries into your report, and closed accounts can all contribute to a decline in your credit score. It is crucial to regularly check your credit report and be aware of any changes that may affect your score. By staying vigilant and proactive, you can identify and address issues impacting your credit score and take steps to improve it.

Frequently Asked Questions

What can cause a sudden drop in my credit score?

Common causes of sudden credit score drops include missed payments, maxed out cards, new hard inquiries from applications, opening several new accounts, lack of credit history, or reporting errors. A major delinquency can decrease scores over 100 points.

Are there any common misconceptions about why credit scores can decrease?

Common misconceptions are that checking your own score lowers it and that scores drop with age or income changes. In fact, credit checks by yourself and demographic factors don’t affect scores. Only changes in your credit behavior and history impact them.

How can I determine if my credit score has fallen without a clear reason?

Review your full credit reports from the three bureaus for errors, new accounts you don’t recognize, or suspicious hard inquiries you didn’t initiate. Also confirm your reported payment history is accurate. Identify any discrepancies.

What steps should I take if I notice an unexplained decrease in my credit score?

If your credit score drops unexplained, first check all three credit reports for mistakes. Dispute any errors with the bureaus. Also, monitor card statements for fraudulent activity and consider freezing your credit reports as a precaution.

Are there any external factors or errors that could lead to a credit score drop?

External factors like economic downturns or identity theft and credit report errors like incorrect balances or mixed up accounts can negatively impact credit scores through no direct fault of your own.