No Denial” Direct lender installment loans allow borrowers to borrow a predetermined sum and pay it back over time via equal monthly payments (installments) plus interest. Bad credit installment loans and installment loans bad credit are available from certain direct lenders online. Still, the interest rates are higher than those for borrowers with better credit due to their bad credit scores. Online installment loans are a convenient option for obtaining financial help; some even offer installment loans with instant approval. It’s crucial to look into and evaluate several loan choices from various lenders, considering their minimum credit score requirements and other factors, before committing to one.

Main Points:

- Bad credit installment loans are available for borrowers with a lower credit score.

- Online installment loans offer a convenient method to apply for and receive financial assistance.

- Look for lenders offering installment loans with instant approval if you need quick access to funds.

- Always compare different financial products and lenders before submitting your loan application to find the best option for your situation.

- Installment loan online – Direct lender installment loans are loans where borrowers receive funds directly from the lender without going through intermediaries. These loans are accessible online, offering convenience and flexibility.

- Installment loans are loans where borrowers with bad credit history repay the principal and interest through fixed monthly payments over a specified repayment period. They come with flexible terms to accommodate different borrowers’ needs.

- Direct lending eliminates intermediaries, resulting in a more attractive loan option with lower interest rates.

- The length of an installment loan varies but is usually several months to a few years. Longer repayment periods come with more manageable monthly payments.

- Direct lender installment loans offer convenience, flexibility, quicker approval time, and lower costs. The loan proceeds can be used for various purposes, such as financing a major purchase or consolidating debt.

- Eligibility requirements for approval for installment loans for bad credit include being of legal age, proof of income and employment, a valid checking account, a government-issued ID, and personal information.

- Alternatives for direct lender installment loans include personal loans, payday loans, title loans, installment loans, and bad credit loans. However, borrowers should carefully consider the pros and cons of each option.

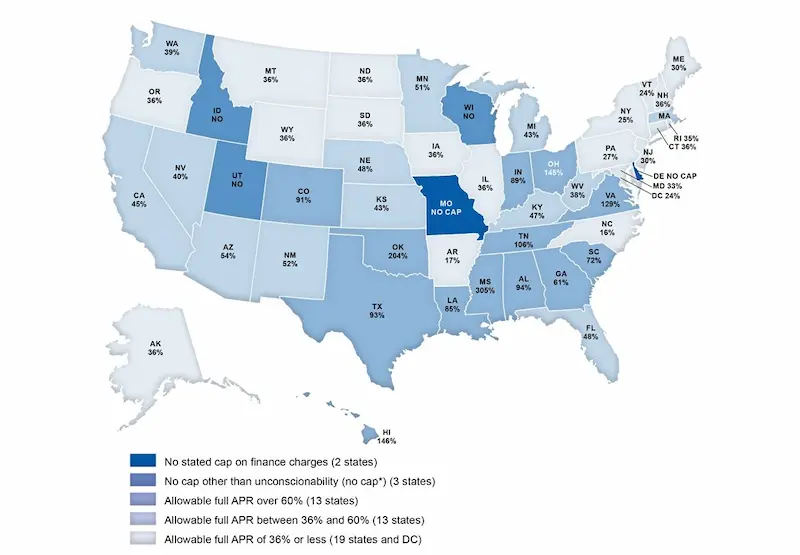

- State or federal authorities authorize licensed installment loan lenders and follow responsible lending practices. Online lenders streamline the application process, making it easier to obtain a loan. In contrast, unlicensed lenders operate speculatively and charge higher interest rates and fees.

What are online Installment loans with no credit check and no denials?

Online Installment loans with no credit check are a loan type in which the borrower pays the principal back over a certain time. The principal and interest are combined into a single monthly payment, and the payment amount is fixed. Cheap installment loans are an ideal solution for covering unexpected expenses, with the added benefit of flexible repayment terms. Debt consolidation, home improvements, and major purchases are possible uses for an installment loan. ” No denial” Installment loans are preferable to payday loans since they give borrowers more time to repay the borrowed money and generally have better eligibility criteria.

Payday loans for example in Chicago or any other US city are a type of short-term loan that typically must be repaid by the borrower’s next payday. However, installment loans are a better option for those looking to borrow money in Chicago, as they allow borrowers to repay the principal over a longer time, making repayment more manageable. Installment loans can be used for various purposes, such as debt consolidation, home improvements, and major purchases. Additionally, they offer financial assistance with a customizable repayment plan based on the borrower’s source of income.

How Do Installment Loans With Guaranteed Approval Work?

Below is the step-by-step guide on how installment loans with guaranteed approval work.

- The first step in getting a loan is filling out an application and submitting it to the lender, either online or in person. Borrowers must provide their financials, work status, and credit records in the application. This is part of the application process; many lenders accept online applications.

- Lenders provide a loan offer to the borrower outlining the loan’s specifics if the loan is authorized, such as the principal amount, interest rate, and repayment schedule. This is where loan decisions are made, and a credit check may be involved in the loan application approval process.

- The borrower signs a loan contract if they accept the loan conditions and send the money to them. This agreement will contain all the details about the types of loans and their respective terms.

- The borrower agrees to make scheduled payments to the lender regularly (usually monthly) by the conditions of the loan. These installments cover the principal and interest, creating the borrower’s payment history.

- After the last payment, the loan is paid in full, and the borrower owes no more money to the lender.

What Is Direct Lending For Bad Credit Loans & Can I Get Same Day Approval?

In direct lending for bad credit loans with same-day approval, borrowers get loan funds straight from the lender instead of going via an intermediary like a bank. P2P lending, crowdfunding, and online loans from non-banks such as internet lenders and alternative finance organizations are all direct lending.

Because they save money on intermediary fees in direct lending arrangements, lenders often provide more attractive loan conditions, such as competitive rates and flexible loan terms. Borrowers access funding that is not accessible via more conventional routes, while lenders diversify their income and even increase their returns on investment through direct lending. This form of lending also provides loans for people who may need to meet traditional bank requirements, like those with a minimum score.

How long is the duration of an installment loan from a direct lender?

The loan amount typically determines the loan term’s length, the annual percentage rates (interest rate), and the borrower’s ability to repay the loan. The duration of a high-risk installment loan varies depending on the lender and the loan amount. However, most installment loans have a repayment term of several months to a few years. With direct lending, borrowers can sometimes negotiate loan rates and repayment terms based on their needs and financial situation.

For example, personal installment loans have repayment terms ranging from 6 months to 5 years, while car loans have repayment terms that span 3 to 7 years. The exact length of the loan term depends on the lender’s policies, the borrower’s credit history, and the purpose of the loan.

What are the advantages of no credit check direct lender loans?

Some of the benefits of no credit check direct lender loans are as follows:

- Bad credit borrowers: Direct lenders may be more willing to work with borrowers with less-than-perfect credit profiles, offering them solutions for their financial needs.

- Approval rates: As direct lenders often have the flexibility to set their minimum requirements, they may offer higher approval rates than other lenders.

- Credit unions: As a loan provider, they can be more member-focused and offer their members more favorable terms and conditions.

- Financial emergencies: Direct lender installment loans can be a helpful solution for those facing financial emergencies as they typically have a faster application and approval process than traditional loans.

- Quick funding: Once an installment loan is approved, the borrower can expect to receive the funds quickly, which is particularly important during urgent financial needs.

- Quicker and more convenient than a regular bank, direct lender installment loans are sought and accepted online, offering quick cash to borrowers in need.

- Direct lenders provide additional alternatives for loan terms and repayment schedules, enabling consumers to choose a loan that works for their situation and budget.

- Direct lenders often have a quicker approval loan process and disbursement time than their counterparts that utilize intermediaries.

- Since they don’t have the same overhead expenses as brick-and-mortar banks, direct lenders might provide more affordable interest rates and fees, including reasonable interest rates.

- Direct lenders, specializing in lending and no other financial services, might provide superior customer service due to their individualized attention, specifically for loans to borrowers with a minimum credit score or bad credit rating.

- A direct lender installment loan is an option if the borrower needs better credit or help to receive a loan from a regular bank, especially for those facing financial troubles during the loan process.

At Greendayonline, we take pride in our extensive reach across the United States, offering direct lender installment loans for individuals with bad credit. Our commitment to providing accessible financial solutions has allowed us to establish a strong presence in numerous states nationwide. Whether you’re looking for flexible repayment options or a simplified application process, our services are designed to cater to your specific needs.

As a testament to our dedication, we are pleased to present the following table showcasing the American states where our company is actively operating. We believe in empowering individuals to overcome financial challenges and achieve their goals, regardless of their credit history.

| Alabama – AL | Alaska – AK | Arizona – AZ |

| Arkansas – AR | California – CA | Colorado – CO |

| Connecticut – CT | Delaware – DE | District Of Columbia – DC |

| Florida – FL | Georgia – GA | Hawaii – HI |

| Idaho – ID | Illinois – IL | Indiana – IN |

| Iowa – IA | Kansas – KS | Kentucky – KY |

| Louisiana – LA | Maine – ME | Maryland – MD |

| Massachusetts – MA | Michigan – MI | Minnesota – MN |

| Mississippi – MS | Missouri – MO | Montana – MT |

| Nebraska – NE | Nevada – NV | New Hampshire – NH |

| New Jersey – NJ | New Mexico – NM | New York – NY |

| North Carolina – NC | North Dakota – ND | Ohio – OH |

| Oklahoma – OK | Oregon – OR | Pennsylvania – PA |

| Rhode Island – RI | South Carolina – SC | South Dakota – SD |

| Tennessee – TN | Texas – TX | Utah – UT |

| Vermont – VT | Virginia – VA | Washington – WA |

| West Virginia – WV | Wisconsin – WI | Wyoming – WY |

Here are some statistics on direct lender installment loans:

| Statistic | Value |

|---|---|

| Number of lenders | Over 100 |

| Average loan amount | $5,000 |

| Average interest rate | 15% |

| Average term | 36 months |

| Percentage of borrowers with direct lender installment loans | About 1 in 10 |

What Are The Requirements to Get “Guaranteed Approval” Direct Lender Loans for Bad Credit?

The requirements to get guaranteed approval for direct lender loans for bad credit vary depending on the lender. To expedite the process, consider filling out a loan request form for quick approvals with minimal hassle. Below are the typical requirements to get approved for installment loans for bad credit.

- Be of legal age (18 or older).

- Provide proof of income and employment.

- Have a valid checking account.

- Have a valid government-issued ID.

- Provide personal information, such as name, address, phone number, email, and Social Security number.

- Expect a soft credit check as part of the lending process.

This will allow for better lending decisions and greatly increase your chances of finding a lending option suited to your needs, especially when handling short-term expenses with more favorable terms.

What are the Alternatives To Direct Lender Installment Loans?

The following lists the many kinds of monthly installment loans for bad credit that direct lenders offer. By widening your search to a broad network of lenders, you can find suitable alternatives for direct lender installment loans.

- Personal Loans: Personal loans are unsecured loans used for several objectives, such as consolidating debt, improving the house, or paying unanticipated costs. They usually offer a wide range of loan amounts and the lowest rates compared to other types of loans.

- Payday Loans: Payday loans are defined as short-term loans due on the borrower’s next payday and often have high interest rates and costs. These loans typically have shorter repayment terms and may incur a late payment fee if not paid on time.

- Title Loans: Title loans are secured by the borrower’s automobile title and are acquired quickly. Funding time for these loans is usually within one business day. However, the interest rates and costs associated with title loans are often rather expensive.

- Installment Loans: Installment loans are returned in equal monthly installments over a defined period. The interest rates and expenses associated with installment loans are often cheaper than those associated with payday loans. Borrowers can benefit from a wide range of loan amounts and repayment terms.

- Bad Credit Loans: Loans intended for borrowers with poor credit scores who have been turned down for traditional loans. These loans may have higher interest rates, but they offer a range of loan amounts to accommodate various financial needs. Lenders may have a late payment fee for delinquent borrowers, so paying on time is essential.

What Is the Difference Between Licensed and Unlicensed Lenders Offering Installment Loans?

Licensed lenders offering installment loans are financial institutions authorized by the appropriate federal or state authorities to provide installment loans. It permits and allows the bank to do business legally by all applicable laws and rules.

Unlicensed installment loan lenders follow state or federal restrictions and operate more speculatively. Borrowers pay higher interest rates and costs if they don’t follow responsible lending procedures. Predatory lending by unlicensed lenders abuses vulnerable borrowers.

Frequently Asked Questions

How can I find legitimate direct lenders offering installment loans for bad credit with no denial?

Research lenders, check BBB ratings, read online reviews, and verify state licenses to find legitimate direct lenders advertising approval for all credit types.

What are the typical eligibility requirements for bad credit installment loans from direct lenders?

You’ll need ID, proof of income, a bank account, a minimum credit score of around 500, and the ability to make monthly payments. Loan decisions are made quickly.

Are there any specific loan limits or terms associated with these loans for borrowers with bad credit?

Loan amounts usually range from $500-$5,000 with repayment terms between 3-36 months. Higher-risk borrowers may have lower limits and shorter terms.

What documentation and information do I need to provide when applying for a no-denial installment loan from a direct lender?

You’ll need to provide ID, residence information, income documentation like paystubs, listed personal references, and bank account details.

Are there any alternatives to traditional installment loans for people with bad credit?

Alternatives include secured credit cards, credit union loans, payday alternative loans, borrowing from friends/family, loan modifications, and debt management plans.