Borrowers can pay off multiple payday loans by creating a budget, prioritizing debts with high-interest rates, obtaining a debt consolidation loan, negotiating with lenders, and looking for other sources of income is helpful. Creating a budget involves identifying areas where spending is cut back and redirecting funds toward loans.

Prioritizing debts with high-interest rates while making minimum payments on others is necessary. A debt consolidation loan simplifies payments and lower interest rates, but it must work with reputable lenders. Strategizing a consolidation strategy and negotiating with lenders for payment plans or interest rate reductions is beneficial. Other income sources like part-time jobs or selling unused items generate income to pay off loans.

Understanding The Risks Of Payday Loans

Payday loans have high-interest rates and fees, which pose significant risks to borrowers. The payday loan can lead to a debt cycle if borrowers cannot repay the loan on time, negatively impacting credit scores.

Before obtaining a payday loan, borrowers must understand the terms and conditions, fees, and interest rates. Have a plan in place to repay it on time. Exploring alternative loan forms of credit and borrowing, like personal loans or credit cards, is less expensive and risky.

How To Apply For A Debt Consolidation?

Individuals must first check their credit score to apply for a consolidation loan, decide on the type of debt consolidation to pursue, shop for a consolidation option, apply for the option, use the funds to pay off existing debts and make timely payments on the consolidation option. Debt consolidation is not a solution for everyone and must address the root cause of the debt to prevent it from recurring in the future.

- Check the credit score to know it is accurate and up-to-date. Any errors or inaccuracies on credit reports affect the ability to qualify for loans. Conduct a credit check to ensure no discrepancies on your credit report before proceeding.

- Decide on the type of debt consolidation borrowers want to pursue. Several types of loans for debt consolidation include balance transfer credit cards, personal loans, home equity loans, and debt management plans.

- Shop for a consolidation option. Check with a bank or credit union, online lenders, and credit counseling agencies to find a consolidation option with lower loan interest rates than their current debts.

- Apply for the consolidation option. Provide the lender or credit counseling agency with personal and financial information, including their credit score, income, and debt-to-income ratio.

- Use the funds to pay off the existing debts. Pay off debts after consolidation approval.

- Make payments on the consolidation option. Make timely payments on the consolidation option to prevent default and further damage to credit score.

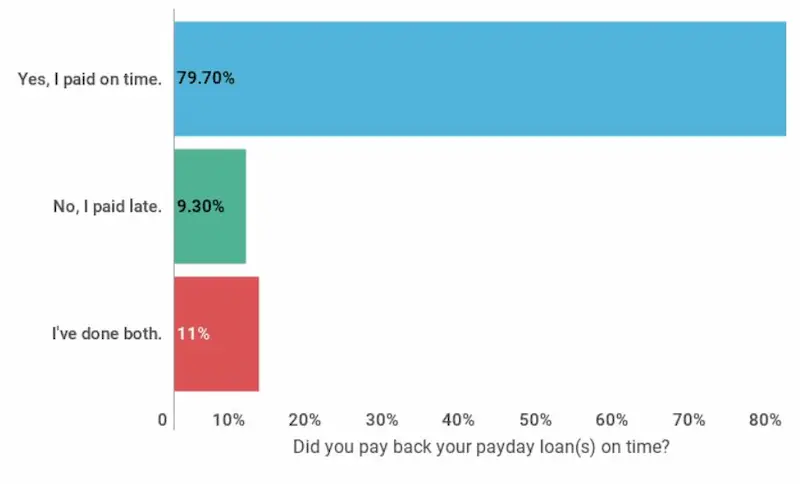

Below are statistics about How to Pay off Multiple Payday Loans:

| Statistic | Value |

|---|---|

| Average number of active payday loans per borrower | 4-5 |

| Average annual spending on interest and fees for payday loan borrowers | $520 |

| Average time to pay off a single payday loan | 2 years |

| Percentage of payday loan borrowers who pay off their loans in full within 6 months | 10% |

| Payday loans as a major source of debt for low-income families | Yes |

Payday Loan Consolidation Regulations

The table compares the interest rates and total interest paid for two scenarios of payday loans, including a short-term loan example, and two scenarios of credit card loans. Payday loans have very high-interest rates of 300% and 400% and are known for potentially leading to a debt trap. The loan amounts compared are $500 with a term of 2 weeks and $1,000 with a term of 1 month.

Credit card loans have comparatively lower APRs of 20% and 30% and a loan amount of $1,000 with a term of 1 year and $5,000 with a term of 1 year. The table shows that payday loans result in significantly higher total interest payments, highlighting the financial burden they impose on borrowers, according to Credit Summit.

| Loan Type | Interest Rate (APR) | Loan Amount | Loan Term | Total Interest Paid | |

| Payday Loan | 300% | $500 | Two weeks | $375 | |

| Payday Loan | 400% | $1,000 | One month | $1,333.33 | |

| Loan Application | Credit Card Loan | 20% | $1,000 | One year | $200 |

| Loan Application | Credit Card Loan | 30% | $5,000 | One year | $1,500 |

PAYDAY LOAN CONSOLIDATION REGULATIONS

What Are The Alternative to Payday Loans?

The alternatives to Payday Loans include loan application options for personal loans, peer-to-peer lending platforms, government assistance programs, credit unions, credit counseling services, credit card cash advances, and borrowing from family or friends.

Personal loans offer fixed interest rates and flexible repayment terms for personal expenses. Peer-to-peer lending platforms connect borrowers with individual investors who offer competitive interest rates and flexible repayment terms. Government assistance programs aim to provide financial or other aid to needy individuals or groups.

Credit unions offer lower interest rates on loans and credit cards, and credit counseling services help clients manage their finances and improve their credit. Credit card cash advances and borrowing costs from family or friends are useful alternatives to payday loans.

Personal Loans

A personal loan is an unsecured debt useful for various personal expenses, like home renovation, weddings, medical bills, or debt consolidation. They don’t need collateral. Lenders won’t seize any assets if the borrower defaults. Personal loans, also known as installment loans, have a fixed interest rate and a fixed repayment term, which vary from a few months to several years. The interest rate and the repayment term depend on the borrower’s credit score, income, and other factors. This can be especially helpful for individuals with bad credit scores who may struggle to find financing options.

Peer-to-peer Lending Platforms

Peer-to-peer lending platforms provide an alternative option for online borrowers seeking payday loans, connecting them with individual investors lending money. Its platforms offer competitive interest rates and flexible repayment terms.

Borrowers must provide information about their income, employment, and credit history to apply for a loan on a peer-to-peer lending platform. The platform uses its information to assess their creditworthiness and assigns them a credit rating.

Government Assistance

A government assistance program refers to a program or policy that a government creates to provide financial or other types of aid to individuals or groups in need. Its programs include unemployment benefits, food assistance, housing subsidies, and healthcare assistance.

Government assistance programs vary widely in scope, eligibility requirements, and the types of aid they provide, including support to fulfill financial obligations. The programs aim to help improve the living standard for economically or socially struggling individuals, ensuring they can make financial decisions more effectively and have a sufficient income to meet their basic needs. Their funds are from taxes, government debt, or other means.

Credit Unions

Credit unions are member-owned and non-profit financial institutions that offer various financial services, like savings accounts, checking accounts, loans, and credit cards. They are smaller than traditional banks and focus on serving specific communities or groups, often guiding them in making sound financial decisions and helping them manage their financial obligations with a more attainable sufficient income.

The main advantage of credit unions is that they offer lower interest rates on loans and credit cards because their primary goal is to provide financial services to their members rather than generate profits for shareholders. Credit unions are cooperative financial institutions that provide members with various services, including access to loans that borrowers repay in installments over a while.

Credit Counseling

Credit counseling is a non-profit service organizations offer to help individuals better manage their finances and improve their credit. A credit counselor works with clients to develop a budget, create a debt management plan, and provide education and resources to help clients achieve financial stability.

A counselor reviews a client’s income, expenses, debts, and credit report to identify areas where the client has to make changes to improve their financial situation during a credit counseling session. The counselor negotiates with creditors on behalf of the client to reduce interest rates, monthly payments, or waive fees and make debt payments more manageable.

Credit Card Cash Advance

A balance transfer credit card is a typical credit card that allows borrowers to transfer the balance from one or more high-interest credit cards to a new card with a lower interest rate for a promotional period. They are good options for consolidating high-interest credit card debt and reducing interest charges, but borrowers must understand the terms and conditions and any fees or limitations before applying.

Family or Friends

Borrowing money from family or friends is a useful alternative to payday loans. They offer lower or no interest rates, saving the borrower money. The advantage of borrowing from family or friends is offering more flexible repayment terms, as the lender works with the borrower to set up a repayment schedule that works for both parties. Another advantage is that borrowing from family or friends is a convenient and accessible option.

Understanding Repayment Plans

A repayment plan is a schedule or arrangement that outlines how a borrower repays a debt or loan over time. It specifies the amount of each payment, the due date, and the total time it takes to repay the debt fully. Repayment plans vary depending on the type of loan, the lender’s policies, and the borrower’s financial situation. A repayment plan helps borrowers manage their debt and make timely payments, improving their credit score and reducing the risk of default or late fees. There are two classifications of repayment plans, fixed and flexible.

- Fixed Repayment Plan – A fixed repayment plan requires borrowers to make regular fixed payments for a predetermined period of time. The payment amount remains the same throughout the repayment period, making it easy for borrowers to budget and plan their finances. Fixed repayment plans are useful for car loans, personal loans, and mortgages.

- Flexible Repayment Plan – Flexible repayment plans offer more flexibility in payment amounts and timing. Borrowers choose to make larger or smaller payments depending on their financial situation, over a period of time. Flexible repayment plans are commonly useful for student loans, where borrowers need more time to find a job.

How To Create A Repayment Plan?

Creating a repayment plan helps individuals pay off debt and achieve financial stability. Start by gathering all the debt information, prioritizing debts, setting a repayment goal, consolidating debt, negotiating with the lenders, and sticking to the plan. One option you have is to explore debt settlement programs to help reduce the amount of debt owed. Consider a consolidated loan to combine all your debts into one, making it easier to manage a single monthly payment plan. Creating a repayment plan is a step toward paying off debt and achieving financial stability. Here are steps to help individuals create a repayment plan.

- Gather all the debt load information. Start by listing all debts, including the interest rates, minimum payments, and outstanding balances.

- Prioritize debts based on interest rates and outstanding balances. Start with the debts that have the highest interest rates and work the way down the list.

- Set a repayment goal. Creating a budget to help identify areas where one cut back on spending and redirect funds toward debt repayment.

- Get debt consolidation. It involves obtaining a single loan to pay off multiple debts. It simplifies payments and lowers interest rates.

- Negotiate with the lenders. Many lenders work with borrowers experiencing financial hardship or having bad credit. Contact lenders and ask if they offer individuals an extended repayment plan or reduce their interest rates.

- Stick to the plan. Make payments on time, and avoid taking on other debt.

Seeking Professional Help

Seeking professional help is a valuable option for individuals needing assistance managing their debt. Debt counselors help individuals develop a debt management plan, negotiate with creditors, consolidate debts, and create a budget.

Financial advisors assist in developing a comprehensive financial plan, which includes retirement savings, investments, and debt management strategies. Choose reputable and qualified professionals licensed and certified in their field and review the associated fees before signing up for any services.

As a company dedicated to providing effective solutions for individuals burdened by multiple payday loans, we are proud to share the extensive reach of our services across the United States. Our commitment to assisting those facing financial challenges has led us to establish a strong presence in numerous states. To help you easily identify if our services are available in your area, we present the following table showcasing all the American states where our company is actively operating. Whether you reside in the heart of New England or the vast plains of the Midwest, we strive to offer reliable assistance in your journey to pay off multiple payday loans. Please refer to the table below to find your state and discover the resources we offer to help you regain financial stability.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Bottom Line

Payday loans cause significant financial stress due to their high-interest rates and fees, which lead to a debt cycle if borrowers cannot repay on time. Borrowers must create a budget, prioritize debts with high-interest rates, obtain debt consolidation, negotiate with lenders, and look for other sources of income to pay off multiple payday loans.

Alternatives to payday loans include personal loans, peer-to-peer lending platforms, government assistance programs, credit unions, credit counseling services, credit card cash advances, and borrowing from family or friends.

Frequently Asked Questions

What are some legal strategies for paying off multiple payday loans and getting out of the debt cycle?

Legal strategies include negotiating extended repayment plans directly with lenders, utilizing credit counseling to negotiate reduced interest rates, consolidating debts into a lower rate personal loan, filing Chapter 7 bankruptcy as a last resort to discharge loans, stopping automatic payments and payments altogether to prevent overdraft fees.

Is it possible to negotiate with payday loan lenders to reduce the interest rates and create a manageable repayment plan?

Yes, it is often possible to negotiate directly with payday lenders for reduced interest rates and a debt management plan spreading out payments over several months. Being proactive, highlighting financial hardship, providing documentation, and offering consistent monthly payments can help secure reduced terms and rates. Securing help from a credit counseling agency improves odds.

What are the consequences of defaulting on multiple payday loans, and how can I stop paying them legally?

Consequences of defaulting on multiple payday loans include damage to your credit reports and scores, constant creditor calls, potential lawsuits and wage garnishment, bank account levies, and increased difficulty obtaining loans in the future. You can legally stop payments only through bankruptcy discharge or reaching negotiated settlements.

Are there government programs or non-profit organizations that can help individuals struggling with multiple payday loans to pay them off?

Yes, there are government and non-profit programs that assist with payday loan debt such as consumer credit counseling services like Money Management International, GreenPath, InCharge Debt Solutions, and Navicore Solutions. They help negotiate debt reduction and repayment plans at little or no cost. There are also debt relief grant programs through some state governments and charities.

What steps can I take to consolidate or refinance my payday loans into a more affordable repayment plan?

Steps to consolidate payday loans include contacting each lender to negotiate payment extensions, working with a credit counseling agency to facilitate consolidation, applying for a debt management plan, taking out a lower interest personal loan to pay off the balances, using home equity or 401k loans, transferring balances to a lower APR credit card, or seeking debt settlement.