A payday lender is a type of financial institution that provides short-term loans to borrowers who are low-income earners and need quick access to cash. Payday loans are for small amounts and have a very high-interest rate. They are due on the borrower’s next payday. Payday loans are useful to cover unexpected expenses, like medical bills or car repairs.

Payday lenders target individuals with poor credit histories or who have been turned down for loans by traditional financial institutions. Other payday lenders require that borrowers provide a post-dated check as collateral for the loan, which the lender cash if the borrower fails to repay the loan on time.

What Is A Short-term Loan?

Short-term loans are a financial product that allows borrowers to access quick cash for short periods. They have different forms, but the most common types include payday and installment loans. One advantage of short-term loans is their accessibility. Borrowers apply online or in-store without extensive credit checks, making them an option for individuals with poor credit history.

Regulations And Laws Governing Payday Lending

The laws governing payday lending are designed to protect consumers from predatory lending practices and to check that lenders operate fairly and transparently. Payday lending remains a controversial industry, and there is an ongoing debate about the best way to regulate it.

Here are the general laws governing payday lending.

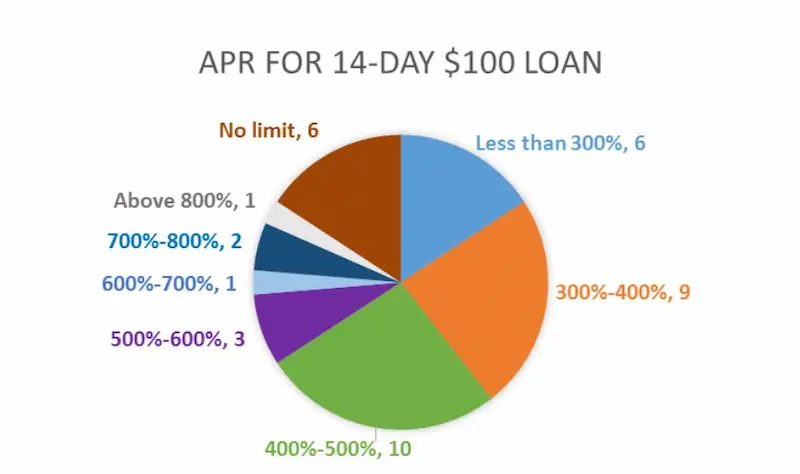

- Interest rates – Many jurisdictions have set limits on the interest rates that payday lenders charge. Its limits are expressed as an annual percentage rate (APR) and vary from state to state, ranging from 15% to over 600%. Lenders are able to charge higher rates if the state licenses them.

- Loan terms – The length of a payday loan ranges from two weeks to one month. Other jurisdictions have restrictions on the maximum loan amount, which range from a few hundred dollars to a few thousand dollars.

- Disclosure requirements – Payday lenders must disclose the loan terms, including the interest rate, fees, and repayment terms. The borrower must provide its disclosures in writing before they issue the loan.

- Renewals and rollovers – Other jurisdictions prohibit or limit the times a payday loan is renewed or rolled over. It is because borrowers who renew or rollover their loans end up paying other fees and interest, leading to a debt cycle.

- Collection practices – Payday lenders are prohibited from using harassing or abusive collection practices to collect unpaid loans. They must comply with the Fair Debt Collection Practices Act, which prohibits debt collectors from using deceptive, unfair, or abusive tactics to collect on debts.

- Licensing requirements – Payday lenders are required to be licensed by the state in which they operate. Licensing requirements vary by state but generally include minimum capital requirements, background checks, and compliance with state and federal laws.

Table of Payday Loan Interest Rates

The table compares interest rates for different forms of loans. The interest rates are compared using an Annual Percentage Rate or APR, which puts all the loans on equal terms, according to DebtHammer. The first scenario in the table compares payday loans in states with strict interest rate caps to states without interest rate caps.

The interest rates for payday loans range from 36% to over 600% APR. The second scenario in the table is car title loans, which have an average interest rate of 300% APR. Credit cards have interest rates ranging from 15% to 30% APR, as shown in the third scenario. The last scenario compares personal loans with interest rates ranging from 14% to 35% APR.

| Loan Type | Interest Rate Range | Average APR | Scenario |

| Payday loan | 36% to over 600% | Not provided | States with strict interest rate caps vs. States without interest rate caps |

| Car title loan | Not provided | 300% APR | The average interest rate for car title loans |

| Credit card | 15% to 30% | Not provided | Comparison of interest rates for different credit cards |

| Personal loan | 14% to 35% | Not provided | Comparison of interest rates for different personal loans |

What Are the Types of Short-Term Loans?

Short-term loans include payday loans, installment loans, title loans, personal lines of credit, and cash advances. Payday loans are high-interest loans due on the borrower’s next payday. Installment loans allow borrowers to repay their loans in fixed, regular payments over time. Title loans use the borrower’s vehicle as collateral to secure the loan.

Personal lines of credit allow borrowers to draw funds from a pre-approved credit limit as needed, similar to a credit card. Cash advances allow borrowers to withdraw cash against their credit card limit, but they tend to have high-interest rates and fees. Borrowers must examine their options carefully and use short-term loans responsibly to avoid accumulating debt.

Payday Loans

Payday loans are small-dollar, short-term loans payable on the borrower’s next payday. Payday loans include a straightforward application procedure requiring the borrower’s name, address, work status, and bank account data. Individuals with poor credit ratings or financial issues are targeted by marketers who promise them simple and rapid access to cash.

Installment Loans

Installment loans are a popular form of credit that allows borrowers to repay their loans in fixed, regular payments over time. They have become increasingly popular due to their accessibility and flexibility. Online lenders are making it easier than ever before for Virginians to apply for and receive installment loans without leaving the comfort of their homes.

The proliferation of online lending platforms has enabled individuals with poor or fair credit scores to obtain financing that was once difficult to access through traditional banks. Installment loan providers require less documentation and offer more flexible repayment terms than conventional financial institutions.

Title Loans

A title loan is a short-term loan that uses a borrower’s vehicle as collateral to secure the loan. The borrower provides the lender with the title to their vehicle, and in exchange, the lender provides cash. The lender assesses the vehicle’s value. The applicant applies and receives an online title loan by sending an electronic application and all required papers.

Personal Lines Of Credit

A personal line of credit loan allows borrowers to access a pre-approved credit limit as needed. It’s similar to a credit card in that the borrower borrows up to a certain amount and only pays interest on the amount borrowed.

The lender determines the credit limit based on the borrower’s creditworthiness, and the borrower uses the funds for any purpose. The borrower only pays interest on the amount borrowed and draws on the line of credit as needed, making it a useful financial tool for unexpected expenses or emergencies.

Personal lines of credit are unsecured loans, meaning they don’t require collateral but a good credit score and stable income to qualify. Personal lines of credit are unsecured loans, meaning they don’t require collateral but a good credit score and stable income to qualify. Personal lines of credit are unsecured loans, meaning they don’t require collateral but a good credit score and stable income to qualify.

Cash Advances

Cash advances are short-term loans that allow borrowers to withdraw cash against their credit card limit. Interest rates and fees associated with cash advances tend to be higher than regular credit card purchases, making them a costly way to access funds. Consumers must check personal loans or lines of credit before obtaining a cash advance to minimize debt, even in emergencies.

Pros and Cons of Payday Loans

The pros of payday loans include their quick approval and funding process, no collateral requirement, fewer requirements for borrowers, and usefulness for various purposes. The cons of payday loans include their high costs, the risk of getting caught in a debt cycle, the negative impact on credit scores, the use of aggressive collection tactics, and the varying regulations across states, making it hard to identify legitimate lenders.

Pros

Listed below are the pros of Payday Loans.

- Payday loans are approved and funded quickly, within hours, which is beneficial in emergencies.

- Other payday lenders don’t require borrowers to provide collateral like a home or car to secure the loan.

- Payday loans have fewer requirements than other types of loans. They do not require a credit check or a high credit score, making them more accessible to people with poor credit or no credit history.

- Payday loans are useful for various purposes, including paying bills, covering unexpected expenses, or bridging the gap between paychecks.

Cons

Listed below are the cons of Payday Loans.

- Payday loans have high rates and fees, making them very expensive. Its costs mount up rapidly, making it much more challenging to repay the loan if one is unable to do so on time.

- Borrowers tempt to get another payday loan if they fail to pay back the previous one on time, which leads to a debt cycle that is hard to escape.

- Other payday lenders report late payments or defaults to credit bureaus, negatively impacting credit scores.

- Other payday lenders use aggressive collection tactics, like calling one repeatedly or threatening legal action if borrowers fail to repay the loan on time.

- Payday loans are regulated state-by-state, and other states have fewer regulations than others. It makes it difficult to know if a lender operates legally and ethically.

Alternative Options to Payday Loans

Several alternative options to payday loans provide borrowers quick access to funds without high fees and interest rates. Alternatives include personal loans, credit unions, credit card cash advances, borrowing from family or friends, and side hustles.

Personal Loans

A personal loan is an unsecured loan that is useful for various purposes and is available from banks, credit unions, and online lenders. Personal loans have a fixed interest rate and repayment term, and the interest rate is based on the credit score, income, and debt-to-income ratio. The flexibility to use the funds for any purpose and the lack of collateral requirements make personal loans an attractive option for individuals who need to borrow a large amount of money.

Credit Unions

Credit unions are member-owned and non-profit financial institutions that offer various financial services, like savings accounts, checking accounts, loans, and credit cards. They are smaller than traditional banks and focus on serving specific communities or groups of people.

The main advantage of credit unions is that they offer lower interest rates on loans and credit cards because their primary goal is to provide financial services to their members rather than generate profits for shareholders. Credit unions are cooperative financial institutions that provide members with various services, including access to loans that borrowers repay in installments over a while.

Credit Card Cash Advance

A credit card cash advance is a short-term loan that borrowers obtain at an ATM or bank using their credit card. The amount that applicants borrow depends on the credit limit of the card and the available cash advance limit. Cash advances are subject to high fees and interest rates, and the interest starts accruing immediately.

There are several advantages to credit card cash advances. The advantage is that they are easily accessible, as borrowers use their credit cards to obtain the necessary cash. Another advantage is that they are useful for various purposes, like covering unexpected expenses or emergencies.

Borrowing from Family or Friends

Borrowing money from family or friends is a useful alternative to payday loans. They offer lower or no interest rates, saving the borrower money. The advantage of borrowing from family or friends is offering more flexible repayment terms, as the lender works with the borrower to set up a repayment schedule that works for both parties. Another advantage is that borrowing from family or friends is a convenient and accessible option.

Side Hustles

Side hustles or part-time work refers to other sources of income outside of one’s primary job or occupation. It includes freelance work, starting a small business, selling goods or services online, or monetizing a hobby or skill. Side hustles and part-time work have become increasingly popular in recent years to supplement their income, pay off debt, save for a goal, or pursue a passion project. Other people turn their side hustles into full-time businesses.

What Are The Procedures For Applying For A Payday Loan?

The procedures for applying for a payday loan involve finding a licensed and reputable lender, gathering necessary documentation like income and employment information, filling out an application form, reviewing the loan terms, including the interest rate and repayment terms, submitting the application to the lender, and receiving the funds if approved. The specific requirements vary depending on the lender and state.

- Look for lenders licensed and reputable. Check with the state’s regulatory agency to see if the lender is licensed to operate in their state.

- Gather documentation. Provide documentation of income and employment, like pay stubs or bank statements. The borrower must provide other basic information, like their name, address, and contact information.

- Fill out the application. The next step is to fill out an application form provided by the lender after one has acquired the required paperwork. It forms and asks for information about income, expenses, and other debts.

- Review the terms of the loan before applying. Pay attention to the interest rate, fees, and repayment terms. Know all of the costs associated with the loan before accepting it.

- Apply to the lender once one has completed the application and reviewed the loan terms. Other lenders require individuals to provide other documentation or information before approving the application.

- Receive the funds once the application is approved. Lenders deposit the funds into one’s bank account within one or two business days.

Bottom Line

Short-term loans, like payday loans, are a type of financial product that offers borrowers quick cash for short periods. Payday lenders are a type of financial institution that offers short-term loans with high-interest rates and fees.

The laws governing payday lending are designed to protect consumers from predatory lending practices and examine that lenders operate fairly and transparently. Other short-term loans include installment loans, title loans, personal lines of credit, and cash advances. Each loan type has advantages and disadvantages, and borrowers must use them responsibly to avoid accumulating debt.

Frequently Asked Questions

How does a payday lender operate?

Payday lenders offer short-term, high-interest loans, typically of $500 or less, secured by the borrower’s next paycheck. Loans have very high APRs, require fees upfront, and must be repaid quickly, often by the next pay date.

What are the typical interest rates charged by payday lenders?

Payday loans typically carry interest rates of 400% APR or higher. This is significantly more expensive than rates from mainstream lenders. Combined with fees, a $500 loan can cost over $150 in fees and interest.

Are there any legal regulations governing payday lending?

Payday lending is regulated primarily by state laws. 16 states ban or strictly limit payday loans. In states allowing them, regulations may cap loan amounts, fees, renewals, and require extended repayment options.

What are the risks associated with borrowing from payday lenders?

Risks include getting caught in debt cycles of renewing loans due to inability to repay by the due date, resulting in spiraling fees and perpetual debt. Aggressive collection tactics are also common.

Can you explain the repayment process for payday loans?

Payday loans are due in full on the borrower’s next pay date, typically in 2-4 weeks. The lender will cash the check or debit the account the borrower gave them access to for repayment. If unable to repay, the loan can be renewed with additional fees.