“Make that money do the work” is the most common advice on personal finance. However, it often needs to be more obvious how to achieve it. Setting financial goals and putting your money into an interest-paying account, such as an investment account with high yields or a retirement fund.

It could also be investing in a company, real estate, or professional certifications that allow you to study further and generate residual income. Learn more about return on investment and other personal financial information.

“Make the money you earn work for you” is standard financial advice for individuals that could be considered cliché. But what exactly does it imply? What’s more, how are you going to do it?

Nearly everyone has at least one way to make money work. There’s not a single answer or a particular method to accomplish it. Here, Business Insider rounded up eight strategies to help you get going, including investing in traditional savings accounts, mutual funds, and other options.

Below are some statistics about the ways that make your money work for you:

| Statistic | Value |

|---|---|

| Percentage of Americans who say they are not saving enough for retirement | 68% |

| Average American household debt | $137,000 |

| Average American worker’s commute time | 90 hours per year |

1. Make sure you open a high-yield savings account.

Sean Gould, a wealth strategist at Waddell and Associates and a certified financial planner, shares that before sending your cash off to perform all the work, you’ll need to be able to keep an emergency fund that has around six months of your expenses that you’ll need to pay in cash. This contributes to your financial stability.

The best place to store it is an FDIC-insured high-yielding checking and bank account, which will yield more money as it has waited. A higher savings account rate can help your emergency fund grow even more.

Savings accounts generally offer an interest rate of around 0.01 percent, while a joint check account can be described as the equivalent of putting your cash in the bed. However, high-yielding checking and savings accounts have interest rates over 1 percent, 100 times more than you would otherwise. These accounts with better savings account rates are ideal for keeping your emergency fund and improving your financial habits.

They are typically accessible at Online banks.

This helps to reduce costs by avoiding mortar and brick sites. They also reduce costs by not using bricks and mortar.

2. Develop passive income streams

According to Investopedia, passive income often refers to the money earned with minimal effort.

After setting up IP, passive income streams make money even while you sleep. It sounds too fantastic to be accurate. However, feel free; it’s not an easy-to-make-money scheme. Creating any passive income will require an initial investment of time or funds but could lead to massive rewards later.

Common types of passive income are real estate investment and silent business partnerships. Real estate investing can generate rental income, an additional income source. Still, it is also possible to earn passive income through any method, from making YouTube videos to advertising affiliate marketing on your blog.

3. Could you place it in retirement accounts?

Contributions to retirement accounts, such as 401(k)s or IRAs, are investments, which means your savings are invested into the markets and can increase exponentially. By investing in assets with high rates of return, such as dividend-paying stocks, you can grow your retirement savings passively over time.

“The most important thing is to have the money from a 401(k),” says Gould. “Save as much as you can for your money to be tax-efficient and access money from the stock market. The first bucket out of your emergency fund includes the 401(k) that is up to the match [if your employer has one for you]. Don’t offer free money.”

Gould explains that you can deposit money in an IRA, considering your credit scores and working with a good financial institution.

“Another excellent tool that many people don’t consider is HSAs,” He states, referring to accounts for which those with high-deductible health insurance coverage are qualified. “If you put money aside within an HSA, which can act as part of your emergency savings, you won’t lose it, and if you face healthcare costs, you can pull the funds out without having to pay tax on it. If you reach the age of 65, it becomes the status of an IRA, and you aren’t punished for using it to pay for other expenses. You can pay Medicare costs as well as long-term care costs.”

Gould also highlights that following a long-term strategy for savings is crucial, as is learning from wealthy people who have successfully managed their finances. Look for opportunities with a high annual percentage yield to maximize your interest earnings over time.

4. Could you place it in the market?

Gould says the next step is to open investment accounts if you’ve maxed out the funds in your 401(k) or Roth IRA accounts. “The crucial thing is taking part in the market.” Investing in the stock market, individual stocks, money market accounts, and real estate investment trusts can be a good option.

Markets are nothing like trying to predict the markets. In and out of the market, profiting from favorable market conditions, and limiting losses when the market falls is a tactics that most experts discourage. One way to better manage your finances is to make minimum payments on your debts and focus on generating extra income from various sources.

Gould says worrying markets could be evened out in time, leading to an overall increase. To reap the benefits of this benefit, you should not be a part of your investment.

He also advises, “Don’t keep more than three or six months of cash. People love the ease of cash, but they’re burnt from the 2008 and 2009 recessions, but inflation will eat away at the cash you have. Being comfortable isn’t the best way to make money.”

5. Select credit cards that offer the rewards that you need.

When selecting rewards credit cards, choose the ones that offer rewards relevant to your needs and spending habits. Additionally, keep track of your credit report regularly to maintain a good credit score, which can further open up better financial opportunities and help you manage your money effectively.

Credit cards may not seem like spending money; however, choosing a card that offers credit card rewards appropriate to your needs (read airlines miles cards aren’t ideal for people who aren’t interested in traveling) is that every dollar you pay for your card will serve two purposes.

“As an expert in financial planning, we aren’t a fan of debt; however, if you have enough monthly income and stability within your budget and can pay your debt each month, excellent credit cards are available,” says Gould. In such cases, considering personal loans from credit unions can be a good alternative for managing your finances.

Paying your credit card debt each month is the only way to make your money work for you with your card. There are better options than this method if you have an outstanding credit card balance. Building your average savings and analyzing your spending category will help you develop better spending habits.

6. Join as a silent participant in a new venture

Starting your own business could be risky. If everything goes smoothly, it will be worth it. Another investment option or strategy to reap the rewards of a successful new company without the burden of getting your business up and running is to be a silent partner that invests capital but doesn’t manage any day-to-day business operations.

By incorporating the Snowball method, you can strategically pay off debts while still making investments. This way, you can use direct deposit to allocate portions of your income to different investment strategies, such as regular savings and automatic payment for any loans.

The possibility has advantages and disadvantages. You won’t be able to have any input about how the business operates or the everyday decisions employees make. However, you’ll get some of the company’s profits without working hours.

But you are still at risk of losing money if your venture fails. Direct deposit investment plans can help mitigate this risk by automatically allocating funds to different investment options, further diversifying your portfolio.

7. Invest in real estate

If history has taught us anything, housing is not a risk-free investment. However, it is a good choice if you have cash available and are comfortable with risk investing in commercial or residential real estate. You can gradually build your real estate portfolio and generate long-term wealth by using regular saving practices and setting up automatic payment options.

Real estate investments are a double-edged proposition: You can think about buying a single house that you live in as an investment. Or, you can invest in more than your house, land for sale, or homes or stores to rent. Gould says that extending your investment beyond your property “depends on the market you’re in and your desire for rental properties,” Gould says. “In most markets, it’s an option if you can manage the hassles and have enough space.”

However, in diversifying your investments, Gould says to remember that many homeowners have found real property. To be the biggest asset they have in their portfolios and warns prospective real property investors to be cautious of weighing their portfolio of theirs towards one type of asset.

8. Achieve a professional level or certificate

Achieving a professional level or investing in a certificate of deposit can be an excellent option for those looking to diversify their investments. This can provide additional financial security and pave the way for future opportunities. Remember that achieving higher education or professional development might involve heavy lifting in effort and commitment and extra tuition or training course payments. For many individuals, managing the cost of education might include repaying student loans. Consider using debt-repayment strategies like avalanches or snowflake to tackle these loans effectively. These approaches can help you eliminate your debt more rapidly, ultimately improving your financial situation and enabling you to pursue various investment opportunities more confidently.

Another way your money can benefit you is to increase your value in the job market. “If you have the time and money to spend on continuing your education, you could increase your marketability to earn more,” Gould says.

You can still sink hundreds of thousands of dollars into graduate schools. Being more attractive as a professional or employee can be as easy as attending a seminar. To boost your public speaking skills or take a class to learn Microsoft Excel.

Many free online courses exist if you want to expand your skills but need more funds.

Frequently Asked Questions

What are the eight key strategies or methods to make your money work for you effectively?

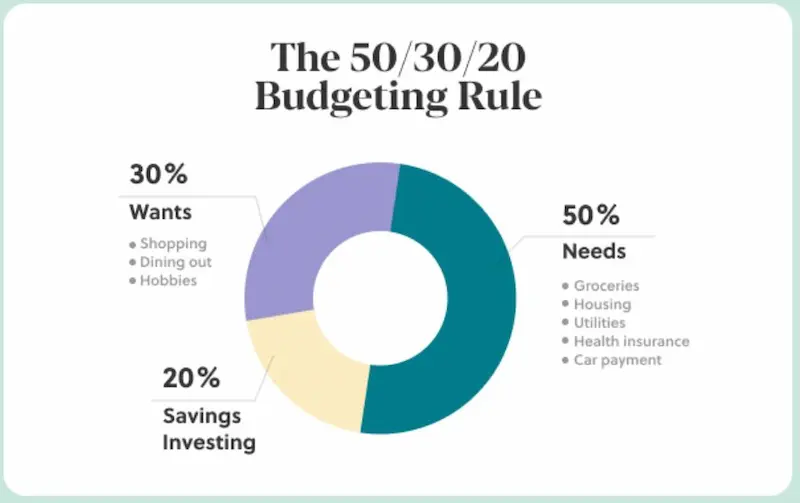

Key strategies include budgeting, saving, investing, building credit, leveraging debt beneficially, owning income-generating assets, establishing passive income streams, and controlling taxes.

Can you explain the concept of passive income and how it fits into the idea of making your money work for you?

Passive income from sources like real estate, royalties, or investments keeps earning with little ongoing effort. This allows your money to work for you with less active time commitment.

How can individuals with limited financial resources begin implementing these strategies to grow their wealth?

Those with limited means can start by budgeting, saving small amounts consistently, and investing in their education or skills to increase earning potential over time.

What are some common mistakes people make when trying to make their money work for them, and how can they avoid them?

Common mistakes include taking on bad debt, overspending, lack of budgeting, no savings cushion, and poor planning. Focusing on financial foundations helps avoid these.

Can you provide examples or case studies of individuals who successfully applied these strategies to achieve financial independence?

Many famous examples like Warren Buffett, Grant Cardone, and Suze Orman focused on saving, investing, controlling expenses, and acquiring income-generating assets to become financially independent.