When money is needed urgently, rage is typically much more evident. It does not imply that an applicant has been refused personal loans, and the credit union or bank will try to prevent abuse of credit applications.

Understanding the specific reasons for the refusal allows the applicant to change the specifics and choose a more suitable type of loan or other aspects of the loan so that it gets approved.

However, not all refusals are due to data or knowledge abuse. Incompetence on the creditor’s side in providing facts and documents causes several things to happen.

Trying to get a loan but being turned down everywhere? But why is that?

Data and documentation that is incorrect:

When you apply for a loan, the bank or other lending organization usually asks you to fill out a form with your personal information. Make sure you fill it out correctly to avoid inaccuracies in the data. During the process, credit checks may be conducted, and you might need to provide proof of income to prove your eligibility for the financial product.

In rare cases, loan approvals may be denied because the lender cannot verify the phone number. In such situations, exploring various borrowing options and ensuring all supporting documents are submitted accurately with your loan request can be crucial in obtaining approval.

Ensure that the text’s details are readily readable when photocopied by including supporting sheets. Also, double-check that your document’s specs are complete.

This prevents your application from being declined and saves you time by reducing the number of trips you make to the bank or online lender’s office.

You’re looking for a loan for an excessive amount of money:

You’ll undoubtedly request the loan amount that corresponds to your existing requirements. However, the bank and other lenders have accounting standards for determining the appropriate loan amount for you as a consumer. They might evaluate your debt-to-income ratio and provide different repayment terms.

These plans will be prepared in light of your current financial status. When facing a financial emergency, consider alternative loans that suit your needs better.

Banks may estimate the possibilities for compensating prospective debtors based on savings conditions and assets such as houses and vehicles. Ensuring you can make the monthly payment is essential, and payments should be made on a business day. It’s also important to confirm whether your chosen loan provider accepts payments through credit cards or other methods.

The bank or other payday lenders may only accept your loan application if the loan you provide is manageable compared to your readiness to pay. This is because their lending decisions are based on your income ratio and the potential for unexpected expenses.

Your remuneration does not correspond to the following terms:

Are you aware that some banks are entitled to some of the earnings from credit-worthy customers? Okay, most banks have a monthly minimum payment of at least $200. This can also entail time payments for some borrowers.

Of course, this is done to anticipate the risk of customers falling behind on their payments and to ensure their financial responsibility.

Your consistent pay demonstrates your desire to pay. So, when you apply, ensure that the wage meets the standards and that the recommended amount does not exceed your financial means. Consider personal installment loans as an alternative to traditional loan products.

These terms and conditions may differ; for example, some online lenders are more lenient with salary constraints and might allow you to apply for a loan online.

However, you must have a source of income for them to be certain you can return the loan.

Substandard Credit Payments in the Past:

If you have previously sought a loan, late payments, and a bad credit score will be the cause for the refusal of your current application. Have you gotten a copy of your credit report? Reviewing your credit report from major credit bureaus and addressing any potential credit report disputes is important.

A customer’s financial history impacts how simple it is to repay a loan and the personal loan term they receive.

The information is stored in the central bank’s Debtor Database System, which any bank may access. Your credit score requirements may not be met if you already have criminal credit obligations or outstanding debt.

Paying credit bills on time is also critical to maintaining good financial health and avoiding delays in future credit applications. Stop paying the minimum payment regularly, as this might incur high-interest rates and hurt your credit score.

What are your options?

Okay, how could you receive a loan after being turned down everywhere? Fortunately, you may always apply for a loan. In this situation, you can depend on an Internet lending business, which sometimes offers loans to individuals with lower credit scores or problematic financial histories.

There are far too many Internet lending organizations these days that offer quick loans based on easy criteria. Internet financing is more flexible and simple than a bank loan. You can pay off the loan for a short time.

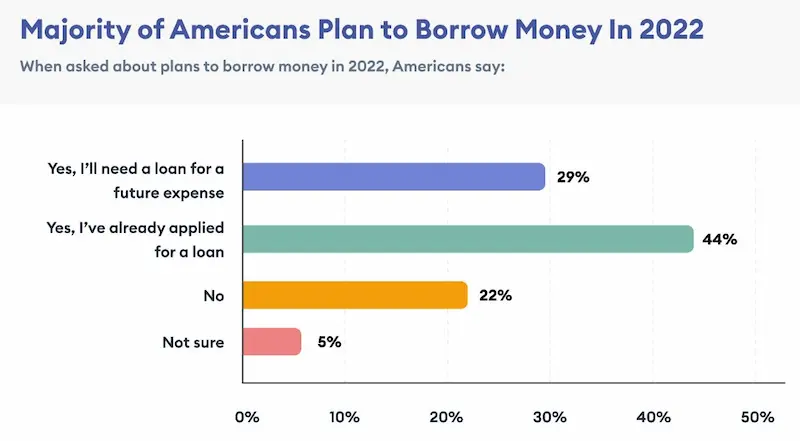

Below are some statistics on lending organizations that offer quick loans:

| Statistic | Value |

|---|---|

| Average interest rate | 36% |

| Average fee | $35 |

| Average repayment term | 36 months |

| Default rate | 20% |

| Bankruptcy rate | 10% |

You don’t have to worry about the specs in comparison. An ID card and a phone number are all you’ll need. You may also borrow money online if you need a job.

One option to consider is a federal credit union. They can offer similar benefits to these online organizations and might have easier access to cash than traditional lenders. Credit unions usually perform a soft credit check that won’t impact your credit score.

Spotloan is an online lending company in the United States. They offer short-term loans to customers in certain states, including Texas, California, Florida, and New York. If you want to apply for a loan from Spotloan, you can visit their website and check if they operate in your state.

In today’s uncertain financial landscape, many individuals need immediate financial assistance but cannot secure traditional loans. At GreenDayOnline, we understand the urgency of such situations and strive to provide alternative solutions to meet your pressing monetary needs. Our commitment to serving our customers extends across the United States, where we have established an active presence in various states. To help you quickly identify if our services are available in your area, please refer to the table below, which outlines the American states where our company operates and can assist you in promptly acquiring the funds you need.

| Alabama / AL | Alaska / AK | Arizona / AZ |

| Arkansas / AR | California / CA | Colorado / CO |

| Connecticut / CT | Delaware / DE | District Of Columbia / DC |

| Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN |

| Iowa / IA | Kansas / KS | Kentucky / KY |

| Louisiana / LA | Maine / ME | Maryland / MD |

| Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT |

| Nebraska / NE | Nevada / NV | New Hampshire / NH |

| New Jersey / NJ | New Mexico / NM | New York / NY |

| North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA |

| Rhode Island / RI | South Carolina / SC | South Dakota / SD |

| Tennessee / TN | Texas / TX | Utah / UT |

| Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

Speak with a Professional Lender:

As previously said, we all need financial assistance occasionally; this does not make you any better than the next person. It’s important to remember the basic requirements and avoid predatory lenders such as loan sharks. Consulting a financial advisor can help ensure a secure lending experience and guide you toward reputable organizations, such as a federal credit union if you’re eligible.

Life is about dealing with the unexpected, and we all know how emergency expenses like medical bills may appear out of nowhere and take you on a financial roller coaster.

At best, it means you won’t be able to make the long-awaited investment in your house or a brand-new car to keep you on track.

Worse still, something unexpected happens, such as a broken automobile or boiler in your home. Those difficulties should be addressed as soon as possible since being denied a loan might put you in a difficult position, especially if you have a poor credit score.

That is what sets specialized lenders apart from others.

They consider your credit future, and you are more than a credit score to them. If you’ve recently been rejected a loan or a loan, getting a loan may be more difficult due to a low minimum credit score.

A specialist lender is a direct loan lender that specializes in assisting potential borrowers with bad credit. Still, they may be able to assist you even if you’ve had problems in the Past. This helps break the debt cycle and improve your financial standing. As always, consult with financial experts before making any decisions.

Although other lenders may consider your situation and reject your request, we can accept your loan application for debt consolidation.

They can help you with our refused credit loans if you still need to establish enough credit invisible history to be accepted by other lenders, giving you the necessary money guidance over a period to achieve financial stability.

That gives you greater peace of mind while you work to improve your fair credit score. Your credit rating will improve if you make regular loan payments to such flexible lenders, especially during the debt consolidation process within the mentioned period.

Summary:

When asking for a loan, you always run the chance of getting turned down, particularly if you attempt to borrow money from a bank.

A bank may have a long list of requirements, and you may be turned down too many times. When you already have a choice, you won’t be sad.

In this circumstance, you will borrow any amount from an internet lending firm to achieve financial stability and follow proper money guidance.

Nonetheless, you must choose an internet financing service that guarantees a speedy process and inexpensive interest rates.

In any case, ensuring you understand all the regulations and standards is up to you.

Frequently Asked Questions

What are some alternative options for getting quick cash when I can’t qualify for a traditional loan?

Alternatives include pawn shop loans, payday alternative loans from credit unions, employer/nonprofit assistance programs, crowdfunding, and borrowing from family or friends.

How can I improve my financial situation quickly when I need money urgently and can’t secure a loan?

Options like selling assets, delivering food or rideshare, part-time jobs, credit counseling to consolidate debt, and bankruptcy may provide financial relief in the short-term.

Are there government assistance programs or grants available to help people in need of immediate financial assistance?

Programs like TANF, WIC, SNAP, and Section 8 along with local nonprofit social service grants can provide temporary financial support for qualifying individuals.

What are the risks and benefits of using payday loans or cash advances when I’m in desperate need of money?

The benefits are quick cash with minimal eligibility requirements. Risks are extremely high fees and getting caught in cycles of new loans to repay old ones.

Can you provide tips on managing financial emergencies and finding short-term financial relief when traditional lenders deny my loan application?

Tips include prioritizing needs, calling all creditors for extensions, creating a bare bones budget, selling assets, asking for help from family/friends, and seeking community resources.