You might wonder if you could borrow enough money to cover your immediate cash needs. Title loans are different from traditional loans. They use the equity or value of your car to finance the loan. But how much can I get in a title loan, and can I get a title loan without the title?

A title loan allows you to borrow only as much as your vehicle title is worth and your ability to repay it. These loans have borrowing limits. Online title loans offered by Green Day Online can help you secure a title loan of up to 000.

In certain states, the minimum loan amount that Green Day Online, a trusted title loan company, can provide is $2,000. Many loan amounts fall between the minimum and maximum amounts of money. Title loans online are specifically designed for people facing a financial emergency who need quick access to funds. They have relaxed eligibility criteria and offer quick approval, making them a popular choice for people with poor credit ratings. Fill out the online application and get the necessary funds.

Missouri title loans are a great way to get motorcycle title loans and fast cash when needed most. When you obtain a title loan, the title lender will use your car as collateral. Then they will loan you money based on your vehicle’s value and ability to repay it. The amount you can be approved for depends on various factors, such as your income and credit rating. An average title loan in Missouri can be up to $25,000, and they offer same-day approval even if you have poor credit.

What is the maximum amount you can borrow for online car title loans?

Many factors determine the answer to this question beyond what guidelines should be applied. Online car title loans are not the only option, as motorcycle title loans can also be considered.

Your ability to repay and the equity in your vehicle will determine how much you can borrow. The car is your collateral to secure your loan. Lenders offer same-day cash and favorable terms in the approval process without a high credit score requirement. Your car is the collateral used by title lenders to secure your loan.

Trucks, SUVs, Cars, and Vans

It’s not as easy as just giving a quick estimate to determine the car’s value. The value of your car depends on many factors, including make/model, condition, mileage, and age. Kelly Blue Book is a great resource for estimating the value of your vehicle.

It also considers if the vehicle has been in any collisions or has undergone a vehicle inspection. These areas have a significant impact on the value of your vehicle as well as the amount of your loan proceeds.

Model and Make

Luxury automobiles have a high price tag. BMW, Audi, and Lexus are all known for making high-end automobiles with more expensive features and better mechanics. However, luxury automobiles can be expensive when new; older models may still have a higher price tag.

You can borrow five figures if you have a luxury vehicle with a reasonable mileage that is nearing or already paid off. Online loans and convenient loans can provide a faster way to get the funds needed. Still, they may have different eligibility requirements based on your source of income, application process, and if you’re borrowing from a direct lender with competitive rates. It’s essential to consider these factors and your credit history when seeking the best loan option.

Even though older luxury vehicles with high mileage are still valuable, older vehicles will likely secure smaller loans. Each manufacturer also has different models with different prices and upgrades.

Condition

Maintaining your car’s value is important. Your car’s value will plummet if its mechanics fail. Your car’s mechanical condition could be seriously affected if you don’t change your oil regularly, rotate your tires, or bring it in for routine tune-ups.

While basic and essential repairs are inexpensive, major repairs can prove costly. Routine maintenance is crucial.

Vehicle value is affected by dents, scratches, dings, and even stained interiors.

Although a scratched bumper or paint chipping might seem like minor imperfections, they are all part of the overall vehicle’s picture. Even small flaws can affect the vehicle’s value and may indicate poor maintenance.

Mileage

In addition to the car’s condition, mileage is crucial in securing a loan. Lenders may consider factors such as repayment periods, repayment terms, Minimum credit score, and loan sizes before approving a loan. It is essential to clearly understand the loan contract to avoid any financial trouble in the future. Securing Affordable loans can help you better maintain your financial future and have easier access to money during repayment. Remember that a faster business day approval may also assist in managing your loan application effectively.

Your car’s value will be affected if your odometer is high. A higher mileage signifies wear and tear to your vehicle. You’ll find that vehicles with higher mileage are more expensive if you’re looking for used cars.

Owners who own a car with a 120,000-mile mark may need to spend more on regular maintenance to keep it in top shape. This can sometimes lead to higher medical bills if accidents occur due to poor maintenance.

Although your vehicle’s appearance and age are impeccable, a reading of 175,000 on the odometer could indicate a drop in value for both you and your title loan. Even if your vehicle has been around for a while, it will still have high mileage, affecting its value. Fortunately, there’s funding for people who need financial assistance, and online lenders can be a great resource for securing loans with flexible repayments and reasonable rates.

Regular services are important to keep your car in top shape. However, it is impossible to change the numbers on your odometer. These numbers can have a significant impact on your financial bottom line. To remedy this, you can look into options like instant funding or quick funding to manage your budget and choose the right payment option that suits your needs.

In most cases, the lender might require a proof of income and knowledge of your employment status to assess if you’re a reliable borrower.

Age

Youth is the most unfaithful lover! The same applies to cars! Manufacturers release new models every year with more features and sleeker designs.

Every year brings new, less desirable models with lower resale values. Carfax reports that a car’s value will drop by 60 percent in the first five years.

Age is just one part of the financial equation. While age can impact the car’s value, condition and mileage can also help balance and increase the value. An older car with low mileage and great condition may still be worth more than a car with higher mileage and damage.

There may be more problems with the vehicle than you realize. Certain model years are more susceptible to mechanical defects, recalls, or other value issues. Ask your loan expert for an appraisal if your car appraises lower than you expected.

Title Type

The title designation of your car can affect its value and eligibility to get a title loan. The value of your car will be greatly affected if it has a salvage title. Sometimes repairs can be made to make the vehicle safe and pass state inspections. Title loan lenders offer flexible lending options depending on factors such as proof of residency, income level, and the car’s condition. They provide Instant approval and a competitive interest rate to borrowers. Moreover, the credit limit depends on the car’s value, and some lenders cater to Customers with credit difficulties. Title loan companies usually require a direct deposit and have a high acceptance rate for borrowers who meet their requirements.

The car then gets a “branded name.” A salvage title usually indicates low value. Some salvage vehicles are not safe to drive. Although your vehicle might be worth a few hundred dollars, or even a little more, lenders won’t want to take on the risk of financing it.

It is hard to estimate the value of a salvage vehicle. Salvage titles cannot be back for auto title loans.

What about clean titles (e.g., Not salvageable) but still having the lien holder (like the original lender)? These cars can still be considered for title loans. Yes and no. Yes, and no. If your car is still in good condition, you might be eligible for a title loan with lowest rates and competitive interest rates.

You must have paid off most of your principal to qualify for a title loan. The difference between your vehicle’s value and the remaining balance on your loan is called equity. A title loan can be used to borrow more money if your equity is higher than the value of your vehicle. The entire process of obtaining a title loan involves an approval timeline, ensuring a smooth repayment process with manageable monthly repayments.

The lender may offer different repayment options and payment methods, allowing you to choose one that best suits your financial situation. Before getting a title loan, you might also be required to provide proof of insurance and have stable credit usage to ensure the lender’s confidence in your ability to repay the loan.

Here are some statistics on car title loans:

| Statistic | Value |

|---|---|

| Number of car title loans outstanding in the United States | 2 million |

| Average car title loan amount | $1,200 |

| Average interest rate on a car title loan | 300% |

| Average car title loan repayment period | 30 days |

| Percentage of car title loans that end in repossession | 20% |

What about other vehicles, such as RVs or motorcycles?

Title loans may also be available for other vehicles like RVs and motorcycles, depending on the lender’s policies and your vehicle’s eligibility. Researching and comparing lenders is essential to find the best loan terms and conditions that cater to your needs.

Not everyone needs a car, truck, van, or SUV for title loans. You may be eligible for a motorbike or recreational vehicle title loan. Both motorcycles and RVs can borrow a maximum amount for title loans. Green Day Online caps these vehicle loans at $4,000

The amount you can borrow online for car title loans is heavily influenced by your vehicle’s equity and ability to repay. Many factors can affect the value of your car. Its age will determine your automobile’s resale price, mileage, make/model, and condition. Utility bills might be required as proof of your residential address.

You cannot borrow more than the car is worth with title loan options because the vehicle is the collateral. Your vehicle’s equity will decrease once you drive it off the lot. Any outstanding loans against your vehicle will also reduce its value. Even if you have a bad credit history, title loan options can still provide you with a monthly payment plan designed as a long-term financial solution.

An extended payment plan may be available for those who need more time to repay their loan, while others may benefit from low, fixed-rate payments. Additional Services could include a Customized repayment plan tailored to your financial situation, and for an even smoother process, active checking utility bills could be a requirement for loan approval.

You will not be eligible for a title loan if your vehicle has a salvage title. These titles are considered too risky. Motorcycles and RVs have less resale value, and lenders often limit how much borrowing they can borrow.

Frequently Asked Questions

What are the eligibility criteria for a title loan in GreenDayOnline?

GreenDayOnline requires borrowers to own a paid off vehicle, be 18+, and provide proof of income and residency for title loans.

How does the interest rate on a title loan in GreenDayOnline compare to other lending options?

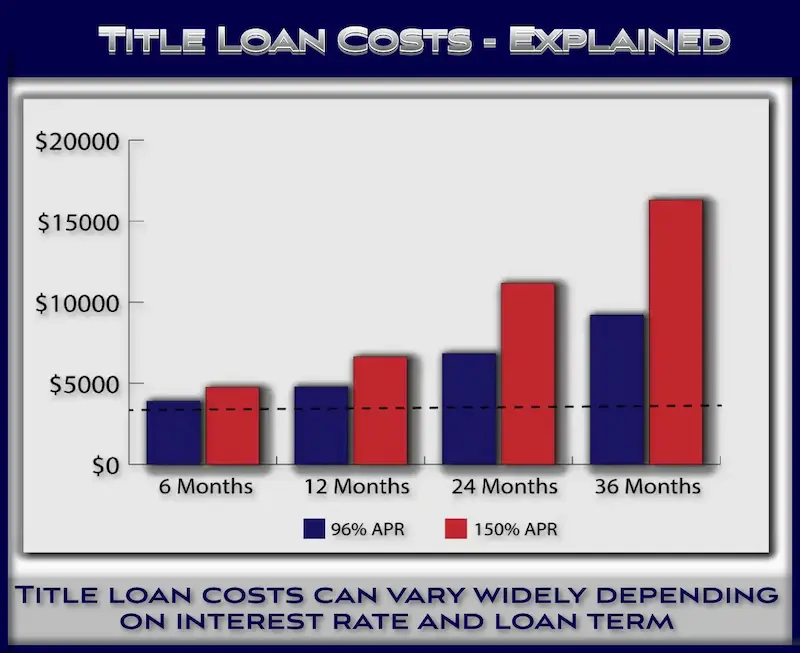

Title loan rates at GreenDayOnline are very high, averaging around 300% APR compared to 3-36% for personal loans.

What is the typical repayment period for title loans in Green Day Online?

GreenDayOnline offers title loan terms of 30 days to 2 years, with 30 days being most common.

Can I get a title loan in GreenDayOnline if I have bad credit?

Yes, GreenDayOnline approves title loans based on your car’s value, not your credit score or history.

What happens if I default on a title loan in GreenDayOnline?

Defaulting allows GreenDayOnline to repossess your car and sell it to cover their losses.